As filed with the Securities and Exchange Commission on March 31, 2023

Registration No. 333- 269083

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

NOVABAY PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

2834

(Primary Standard Industrial

Classification Code Number)

|

68-0454536

(I.R.S. Employer

Identification No.)

|

2000 Powell Street, Suite 1150

Emeryville, CA 94608

(510) 899-8800

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Justin M. Hall, Esq.

Chief Executive Officer and General Counsel

2000 Powell Street, Suite 1150

Emeryville, CA 94608

(510) 899-8800

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Abby E. Brown, Esq.

Squire Patton Boggs (US) LLP

2550 M Street, NW

Washington, DC 20037

(202) 457-6000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer |

☐ |

|

Accelerated Filer |

☐ |

| Non-Accelerated Filer |

☒ |

|

Smaller Reporting Company |

☒ |

| |

|

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(A) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said section 8(A), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 31, 2023

PROSPECTUS

327,860 Shares of Common Stock

This prospectus relates to the resale, from time to time, by the selling stockholders identified in the section of this prospectus entitled “Selling Stockholders” (the “Selling Stockholders”) of up to 327,860 shares (the “Shares”) of NovaBay Pharmaceuticals, Inc.’s (“us”, “we”, “our”, “NovaBay”, or the “Company”) common stock, par value $0.01 per share (the “Common Stock”), issuable upon the exercise of outstanding Common Stock warrants with a per share exercise price equal to $6.30 (the “Reprice Warrants”). The Reprice Warrants were issued to the Selling Stockholders in connection with our warrant reprice transaction of previously issued Common Stock purchase warrants held by the Selling Stockholders and other warrant holders that was completed on September 9, 2022 (the “2022 Warrant Reprice Transaction”). We are registering the resale of the Shares by the Selling Stockholders pursuant to the terms and conditions of the warrant reprice letter agreements that the Selling Stockholders each entered into with us in connection with the 2022 Warrant Reprice Transaction (the “Reprice Letter Agreements”).

Our registration of the Shares covered by this prospectus does not mean that the Selling Stockholders will offer or sell any of the Shares. The Selling Stockholders may sell all or a portion of the Shares being offered pursuant to this prospectus at the prevailing market prices at the time of sale or at negotiated prices. For additional information, see the section entitled “Selling Stockholders”.

We will not receive any proceeds from the sale of the Shares by the Selling Stockholders. However, upon any cash exercise of the Reprice Warrants by the Selling Stockholders, we will receive cash proceeds per share equal to the exercise price of the Reprice Warrants. If the Reprice Warrants are exercised in a cashless exercise, we will not receive any proceeds from the exercise of the Reprice Warrants. The Selling Stockholders will each bear all commissions and discounts, if any, attributable to their respective sales of the Shares. We will bear the costs, expenses and fees in connection with the registration of the Shares.

Our Common Stock is listed on the NYSE American under the symbol “NBY.” The last reported sale price of our Common Stock on March 30, 2023 was $1.72 per share.

You should read this prospectus, any applicable prospectus supplement and any related free writing prospectus carefully before you invest. Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risks that we have described under the caption “Risk Factors” on page 8 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023 .

TABLE OF CONTENTS

| |

Page

|

|

About this Prospectus

|

2

|

|

Prospectus Summary

|

4

|

|

Risk Factors

|

8 |

|

Special Note Regarding Forward-Looking Statements

|

9 |

|

Use of Proceeds

|

10

|

|

Market for our Common Stock

|

11

|

|

Dividend Policy

|

11

|

|

Principal Stockholders

|

12

|

|

Description of Capital Stock

|

14

|

|

Selling Stockholders

|

22

|

|

Plan of Distribution

|

26

|

|

Legal Matters

|

28

|

|

Experts

|

28

|

|

Where You Can Find More Information

|

29

|

|

Incorporation of Certain Documents by Reference

|

29

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 filed with the U.S. Securities and Exchange Commission (the “SEC”), using a “shelf” registration process. By using a shelf registration statement, the Selling Stockholders may sell up to 327,860 shares of Common Stock received upon exercise of the Reprice Warrants, from time to time in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale of the Shares by the Selling Stockholders. However, upon any cash exercise of the Reprice Warrants by the Selling Stockholders, we will receive cash proceeds per share equal to the exercise price of the Reprice Warrants. If the Reprice Warrants are exercised in a cashless exercise, we will not receive any proceeds from the exercise of the Reprice Warrants.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part, which may contain material information relating to this offering. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect to the offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information that has been incorporated by reference, including reports we file with the SEC, that are not contained in this prospectus. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the documents incorporated by reference and other additional information that we file with the SEC described in the “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” sections of this prospectus.

This prospectus includes important information about us and the securities being offered. You should rely only on this prospectus, any post-effective amendment, and any applicable prospectus supplement, and the information incorporated or deemed to be incorporated by reference in this prospectus. We have not, and the Selling Stockholders have not, authorized anyone to provide you with information that is in addition to, or different from, the information that is contained, or incorporated by reference, in this prospectus prepared by or on behalf of us or to which we have referred you. If anyone provides you with different or inconsistent information, you should not rely on it. We and the Selling Stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

The documents entered into in connection with the 2022 Warrant Reprice Transaction described herein and/or in our filings with the SEC (collectively, the “Transaction Documents”) contain representations and warranties of the parties to such agreements that may be subject to limitations, qualifications or exceptions agreed upon by the parties, and may be subject to a contractual standard of materiality that differs from the materiality standard that applies to reports and documents filed with the SEC. In particular, in your review of the representations and warranties contained in the Transaction Documents and described in the foregoing summary, it is important to bear in mind that the representations and warranties were negotiated in connection with separate transactions and with the principal purpose of allocating contractual risk between the parties in such transactions. The representations and warranties, other provisions of the Transaction Documents or any description of these provisions should not be read alone, but instead should be read only in conjunction with the information provided elsewhere in this prospectus, any post-effective amendment and any applicable prospectus supplement, as well as in the other reports, statements and filings that the Company publicly files with the SEC.

This prospectus contains market data and industry statistics and forecasts that are based on our internal estimates and independent industry publications and other sources that we believe to be reliable sources. In some cases, we do not expressly refer to the sources from which this data is derived. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our internal estimates are based upon information obtained from trade and business organizations and other contacts in the industry in which we operate, and our management’s understanding of industry conditions. While we believe our internal estimates are reliable, they has not been verified by an independent source. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. We are responsible for all of the disclosure contained in this prospectus, and we believe these industry publications and third-party research, surveys and studies are reliable. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” and elsewhere in this prospectus or otherwise incorporated by reference into this prospectus.

Unless otherwise specifically indicated, references to “prospectus” herein shall include any post-effective amendment, applicable prospectus supplement, and the information incorporation or deemed to be incorporated by reference in this prospectus. This prospectus contains summaries of certain provisions contained in some of the documents described herein or therein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

On November 15, 2022, we effected a 1-for-35 reverse stock split of our outstanding Common Stock (the “Reverse Stock Split”) as more fully described in the prospectus. Unless the context indicates or otherwise requires, all share numbers and share price data included in this prospectus have been adjusted to give effect to the Reverse Stock Split.

This prospectus includes trademarks, service marks and trade names owned by us, our subsidiary DERMAdoctor, LLC, or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus are the property of their respective owners.

Unless the context indicates otherwise in this prospectus, the terms “NovaBay,” the “Company,” “we,” “our” or “us” in this prospectus refer to NovaBay Pharmaceuticals, Inc.

PROSPECTUS SUMMARY

This summary highlights, and is qualified in its entirety by, the selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus. This summary does not contain all of the information that may be important to you or that you need to consider in making your investment decision. You should carefully read the entire prospectus, including any applicable prospectus supplement, especially the “Risk Factors” section beginning on page 8 of this prospectus and the risks under similar headings in other documents and filings that are incorporated by referenced into this prospectus, our financial statements, the exhibits to the registration statement of which this prospectus forms a part and other information incorporated by reference in this prospectus before deciding to invest in our Common Stock. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

About NovaBay

NovaBay develops and sells scientifically-created and clinically proven eyecare, skincare and wound care products.

Eyecare:

Our leading product, Avenova® Antimicrobial Lid and Lash Solution (“Avenova Spray”), is proven in laboratory testing to have broad antimicrobial properties as it removes foreign material including microorganisms and debris from the skin around the eye, including the eyelid. Avenova Spray is formulated with our proprietary, stable and pure form of hypochlorous acid and is cleared by the U.S. Food and Drug Administration for sale in the United States. Avenova Spray is available direct to consumers primarily through online distribution channels and is also often by prescription and dispensed by eyecare professionals for blepharitis and dry-eye disease. Other eyecare products offered under the Avenova eyecare brand include Novawipes by Avenova, Avenova Lubricant Eye Drops, Avenova Moist Heating Eye Compress, and the i-Chek and eyelash mirror.

Skincare:

Through our subsidiary DERMAdoctor, LLC (“DERMAdoctor”), we offer over 30 dermatologist-developed products targeting common skin concerns, ranging from aging and blemishes to dry skin, perspiration and keratosis pilaris. DERMAdoctor branded products are marketed and sold through the DERMAdoctor website, well-known traditional and digital beauty retailers, and a network of international distributors. We acquired DERMAdoctor in November 2021, and since completing this transaction we have been working to integrate and expand the DERMAdoctor business in order to achieve strategic objectives that we expected by completing this acquisition, including revenue growth, cost reductions and achieving overall profitability. We were not able to achieve these objectives in fiscal 2022, as DERMAdoctor’s product revenue declined in 2022 compared to 2021, while operating costs relating to these products remained substantially the same. We are working to achieve our overall objectives, as well as continuing to evaluate additional strategies for our Company and its business to address our capital and liquidity needs.

Wound Care:

We also manufacture and sell our proprietary form of hypochlorous acid for the wound care market with our products NeutroPhase and PhaseOne. NeutroPhase and PhaseOne are used for cleansing and irrigation as part of surgical procedures, as well as to treat certain wounds, burns, ulcers and other injuries. We currently sell our wound care products through distributors.

The Reprice Warrants and the 2022 Warrant Reprice Transaction

On September 9, 2022, we entered into Warrant Reprice Agreements with certain holders (the “2020 Participants”) of Common Stock purchase warrants that were issued as part of our prior warrant reprice transaction that closed on July 23, 2020 (the “2020 Original Warrants”) and with all of the holders (the “2021 Participants” and together with the 2020 Participants, the “Participants”) of the Common Stock purchase warrants that we issued in our private placement that was consummated on November 2, 2021 (the “2021 Original Warrants”). The Warrant Reprice Agreements provided for the 2020 Original Warrants and the 2021 Original Warrants held by Participants to be amended to reduce their respective exercise price to $0.18, or currently $6.30 reflecting the adjustment as a result of our Reverse Stock Split (the “Reduced Exercise Price”) and, in the case of the 2021 Original Warrants, extend the term of those warrants until September 11, 2028. The 2020 Original Warrants and the 2021 Original Warrants as so amended are referred to as the “2020 Amended Warrants” and the “2021 Amended Warrants”, respectively, and together, the “Amended Warrants.” The Amended Warrants became exercisable on March 9, 2023.

As part of the 2022 Warrant Reprice Transaction and pursuant to the Reprice Letter Agreements, the Selling Stockholders elected to make a cash exercise of their respective Amended Warrants, which included (i) the 2021 Participants exercising 25% of their respective 2021 Amended Warrants at the Reduced Exercise Price for a total of 9,375,000 shares of Common Stock, or 267,860 shares of Common Stock reflecting the subsequent Reverse Stock Split and (ii) a 2020 Participant exercising their 2020 Amended Warrant at the Reduced Exercise Price for 2,100,000 shares of Common Stock, or 60,000 shares of Common Stock reflecting the subsequent Reverse Stock Split (collectively, the “Initial Exercise”). The Company received $2,065,500 in aggregate gross proceeds from the Initial Exercise.

In connection with the Initial Exercise, the Company, in a private placement, issued to the Selling Stockholders the Reprice Warrants that provide for the purchase of a number of shares of Common Stock equal to 100% of the shares of Common Stock received by the Selling Stockholder in their Initial Exercise. The Reprice Warrants are currently exercisable for an aggregate of 327,860 shares of Common Stock at an exercise price equal to $6.30, which number of underlying shares and exercise price have been adjusted for the Reverse Stock Split and are subject to potential future adjustment. The Reprice Warrants will continue to be exercisable until they expire on September 11, 2028. The terms of the Reprice Warrants provide for a restriction upon exercise to the extent that, after giving effect to such exercise, the holder of the Reprice Warrant (together with the holder’s affiliates, and any other persons acting as a group together with the holder or any of the holder’s affiliates), would beneficially own in excess of 4.99% or 9.99% of outstanding Common Stock. The Reprice Warrants do not have any preemptive rights or a preference upon any liquidation, dissolution or winding-up of the Company. For additional information regarding the Reprice Warrants, see “Description of Capital Stock” in this prospectus.

In connection with the 2022 Warrant Reprice Transaction and pursuant to the terms and conditions of the Reprice Letter Agreements, we agreed to register the shares of Common Stock underlying the Reprice Warrants. Accordingly, we are registering the offer and sale of the Shares by the Selling Stockholders. We will not receive any proceeds from the sale of the Shares by the Selling Stockholders. However, upon any cash exercise of the Reprice Warrants by the Selling Stockholders, we will receive cash proceeds per share equal to the exercise price of the Reprice Warrants. If the Reprice Warrants are exercised in a cashless exercise, we will not receive any proceeds from the exercise of the Reprice Warrants. We will bear the costs, expenses and fees in connection with the registration of the Shares. The Selling Stockholders will each bear all commissions and discounts, if any, attributable to their respective sales of the Shares. For additional information, see the section entitled “Plan of Distribution”.

Recent Developments

2022 Private Placement

Concurrent with the 2022 Warrant Reprice Transaction, we entered into a private placement transaction with accredited investors (the “2022 Private Placement”) to sell, pursuant to the Securities Purchase Agreement, dated September 9, 2022 (the “2022 Securities Purchase Agreement”), units consisting of (i) 3,250 shares of Series C Non-Voting Convertible Preferred Stock, par value $0.01 per share (“Series C Preferred Stock”), convertible into an aggregate of 516,750 shares of Common Stock, (ii) a short-term Series A-1 warrant to purchase Common Stock (“Short-Term Warrants”), which are exercisable for 515,876 shares of Common Stock and (iii) a long-term Series A-2 warrant to purchase Common Stock (“Long-Term Warrants” and, together with the Short-Term Warrants, the “2022 Warrants”), which are exercisable for 515,876 shares of Common Stock. On November 18, 2022, we closed the 2022 Private Placement and received gross proceeds of $3.25 million from the sale of the Series C Preferred Stock and the 2022 Warrants.

Financial Outlook—Going Concern

In our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 31, 2023 (the “Annual Form 10-K”), we reported that based primarily on the funds available as of December 31, 2022, our existing cash and cash equivalents and cash flows generated from product sales will be sufficient to fund our existing operations and meet our planned operating expenses into at least the third quarter of 2023. We also reported that we expected that our 2023 expenses will continue to exceed our 2023 revenues, as we continue to invest in both its Avenova and DERMAdoctor commercialization efforts. Additionally, we expect to continue incurring operating losses and negative cash flows until revenues reach a level sufficient to support ongoing growth and operations. Accordingly, as reported in the Annual Form 10-K, we determined that our planned operations raise substantial doubt about our ability to continue as a going concern. In addition, we also noted that changing circumstances may cause us to expend cash significantly faster than currently anticipated, and that we may need to spend more cash than expected because of circumstances beyond our control that impact the broader economy such as periods of inflation, supply chain issues, the continuation of the COVID-19 pandemic and international conflicts. For additional information regarding our capital and liquidity situation, please read the Annual Form 10-K, as well as our other periodic reports and other filings that we make with the SEC after the date hereof, as provided in the section of this prospectus entitled “Where You Can Find More Information”.

Reverse Stock Split

To help address our need for liquidity and capital to fund our planned operations, we entered into two financing transactions on September 9, 2022, which resulted in our Company raising approximately $5.3 million of gross proceeds, as summarized in this prospectus. In connection with these transactions, effective November 15, 2022, we completed the Reverse Stock Split, a 1-for-35 reverse stock split of our Common Stock.

NYSE Notice

On October 3, 2022, the Company received a notification from the NYSE American stating that the Company is not in compliance with Section 1003(f)(v) of the NYSE American Company Guide because the Common Stock was determined by the NYSE American staff to have been selling for a low price per share for a substantial period of time. We regained compliance with the NYSE American listing requirements by effecting our Reverse Stock Split effective November 15, 2022.

Additional Information

For additional information related to and a more complete description of our business and operations, financial condition, results of operations and other important information about our Company, please refer to the reports and other filings incorporated by reference in this prospectus, including our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as described in this prospectus under the caption “Incorporation of Certain Documents by Reference”.

Company Information

NovaBay was incorporated under the laws of the State of California on January 19, 2000, as NovaCal Pharmaceuticals, Inc. It had no operations until July 1, 2002, on which date it acquired all of the operating assets of NovaCal Pharmaceuticals, LLC, a California limited liability company. In February 2007, it changed its name from NovaCal Pharmaceuticals, Inc. to NovaBay Pharmaceuticals, Inc. In June 2010, the Company changed the state in which it was incorporated and is now incorporated under the laws of the State of Delaware.

Our corporate address is 2000 Powell Street, Suite 1150, Emeryville, California 94608, and our telephone number is (510) 899-8800. Our website address is www.novabay.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of this prospectus. Our website address is included in this document as an inactive textual reference only.

RISK FACTORS

Investing in our Common Stock involves a high degree of risk. You should consider carefully the risk factors described below, and all other information and documents contained in or incorporated by reference in this prospectus (as supplemented and amended), including the risks described under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, Quarterly Reports on Form 10-Q and other filings with the SEC, including those incorporated by reference herein, before deciding whether to buy our Common Stock. The risks described in this prospectus or incorporated by reference into this prospectus are not the only ones we face, but those that we consider to be material. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations and could result in a complete loss of your investment. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of the following risks actually occur, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the market price of our Common Stock to decline, and you could lose all or part of your investment. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), including, but not limited to, statements that are based upon management’s current expectations, assumptions, estimates, projections and beliefs, including statements about the commercial progress and future financial performance of the Company. These statements relate to future events or to our future operating or financial performance and involve risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

The use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” and similar words or expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding our ability to comply with the continued listing standards of the NYSE American, the financial and business impact and effect of our recent financing transactions, and any future revenue that may result from selling the Company’s products, as well as the Company’s expected future financial results and ability to continue as a going concern. These statements involve risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in or implied by these forward-looking statements.

We discuss in greater detail many of these risks under the heading “Risk Factors” contained in this prospectus or otherwise described in our filings with the SEC, including our Annual Report on Form 10-K, in our subsequently filed Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus together with the documents we have filed with the SEC that are incorporated by reference completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

USE OF PROCEEDS

The Shares covered by this prospectus are issuable upon the exercise of the Reprice Warrants into an aggregate of 327,860 shares of Common Stock as described in “Prospectus Summary — The Reprice Warrants and the 2022 Warrant Reprice Transaction”. We will not receive any proceeds from the sale of the Shares by the Selling Stockholders. However, upon any cash exercise of the Reprice Warrants by the Selling Stockholders, we will receive cash proceeds per share equal to the exercise price of the Reprice Warrants. If the Reprice Warrants are exercised in a cashless exercise, we will not receive any proceeds from the exercise of the Reprice Warrants. We will bear the costs, expenses and fees in connection with the registration of the Shares. The Selling Stockholders will each bear all commissions and discounts, if any, attributable to their respective sales of the Shares.

MARKET FOR OUR COMMON STOCK

Market Information

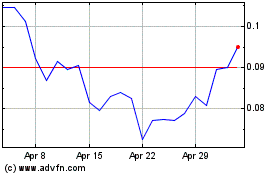

Our Common Stock is listed on the NYSE American, under the symbol “NBY.”

Holders

As of March 27, 2023, we had 2,035,444 shares of Common Stock outstanding and there were approximately 114 holders of record of our Common Stock. This figure does not reflect persons or entities that hold their stock in nominee or “street” name through various brokerage firms. We have 11,620 shares of Series B Preferred Stock that have been issued in the private placement offering that was consummated on November 2, 2021 (the “2021 Private Placement”), 2,250 shares of Series C Preferred Stock that have been issued in the 2022 Private Placement, and no other preferred stock outstanding as of the date of this prospectus.

DIVIDEND POLICY

We have not paid cash dividends on our Common Stock since our inception. We currently expect to retain earnings primarily for use in the operation and expansion of our business; therefore, we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements, restrictions under any existing indebtedness and other factors the Board of Directors deems relevant.

PRINCIPAL STOCKHOLDERS

The following table indicates information as of March 27, 2023 regarding the beneficial ownership of our Common Stock by:

| |

●

|

each person who is known by us to beneficially own more than five percent (5%) of our securities;

|

| |

●

|

our current executive officers;

|

| |

●

|

each of our directors; and

|

| |

●

|

all of our directors and executive officers as a group.

|

The percentage of shares beneficially owned is based on 2,035,444 shares of Common Stock outstanding as of March 27, 2023. Except as indicated in the footnotes to this table, and as affected by applicable community property laws, all persons listed have sole voting and investment power for all shares shown as beneficially owned by them and no shares are pledged.

|

Name and Address of Beneficial Owner (1)

|

|

Number of

Shares

Beneficially

Owned

|

|

|

Percent

of Class

|

|

|

Beneficial Owners Holding More Than 5%

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Hudson Bay Master Fund Ltd. (2)

|

|

|

225,909 |

|

|

|

9.9 |

% |

|

c/o Hudson Bay Capital Management LP

|

|

|

|

|

|

|

|

|

|

28 Havemeyer Place, 2nd Floor

|

|

|

|

|

|

|

|

|

|

Greenwich, CT 06830

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Armistice Capital, LLC (3)

|

|

|

191,826 |

|

|

|

8.6 |

% |

|

510 Madison Avenue, 7th Floor

|

|

|

|

|

|

|

|

|

|

New York, New York 10022

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Pioneer Pharma (Hong Kong) Company Ltd. (“Pioneer Hong Kong”) (4)

|

|

|

148,241 |

|

|

|

7.3 |

%

|

|

682 Castle Peak Road

|

|

|

|

|

|

|

|

|

|

Lai Chi Kok, Kowloon, Hong Kong

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Jian Ping Fu (“Mr. Fu”) (5)

|

|

|

114,286 |

|

|

|

5.6 |

%

|

|

11 Williams Road

|

|

|

|

|

|

|

|

|

|

Mt. Eliza, Melbourne VIC 3930, Australia

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

Justin M. Hall, Esq. (6)

|

|

|

16,568 |

|

|

*

|

|

|

Tommy Law (7)

|

|

|

643 |

|

|

*

|

|

|

Audrey Kunin, M.D. (8)

|

|

|

2,143 |

|

|

*

|

|

|

Jeff Kunin, M.D. (9)

|

|

|

2,143 |

|

|

*

|

|

|

Paul E. Freiman, Ph.D. (10)

|

|

|

5,181 |

|

|

*

|

|

|

Julie Garlikov (11)

|

|

|

858 |

|

|

*

|

|

|

Swan Sit (12)

|

|

|

2,288 |

|

|

*

|

|

|

Mijia (Bob) Wu, M.B.A. (13)

|

|

|

3,296 |

|

|

*

|

|

|

Yenyou (Jeff) Zheng, Ph.D. (14)

|

|

|

2,288 |

|

|

*

|

|

|

Yongxiang (Sean) Zheng (15)

|

|

|

858 |

|

|

*

|

|

|

All directors and executive officers as a group (10 persons)

|

|

|

36,266 |

|

|

|

1.8 |

%

|

|

*

|

Less than one percent (1%).

|

|

(1)

|

The address for each director and officer of NovaBay listed is c/o NovaBay Pharmaceuticals, Inc., 2000 Powell Street, Suite 1150, Emeryville, CA 94608. Number of shares beneficially owned and percent of class is calculated in accordance with SEC rules. A beneficial owner is deemed to beneficially own shares the beneficial owner has the right to acquire within 60 days of March 27, 2023. For purposes of calculating the percent of class held by a single beneficial owner, the shares that such beneficial owner has the right to acquire within 60 days of March 27, 2023are also deemed to be outstanding; however, such shares are not deemed to be outstanding for purposes of calculating the percentage ownership of any other beneficial owner.

|

|

(2)

|

Based upon information contained in Amendment No. 1 to the Schedule 13G filed by Hudson Bay Capital Management LP and Sander Gerber with the SEC on February 10, 2023, Hudson Bay Capital Management LP beneficially owned 225,909 shares of Common Stock issuable upon the exercise of certain warrants and/or conversion of shares of convertible preferred stock as of December 31, 2022, with shared voting and dispositive power of all shares and sole voting and dispositive power of no shares.

|

| |

|

|

(3)

|

Based upon information contained in the Schedule 13G filed by Armistice Capital, LLC and Steven Boyd with the SEC on February 14, 2023, Armistice Capital, LLC beneficially owned 191,826 shares of Common Stock as of December 31, 2022, with shared voting and dispositive power of all shares and sole voting and dispositive power of no shares.

|

| |

|

|

(4)

|

Based upon information contained in the Schedule 13D/A filed by Pioneer Hong Kong and China Pioneer Pharma Holdings Limited, the parent company of Pioneer Hong Kong, with the SEC on January 13, 2017, Pioneer Hong Kong beneficially owned 148,241 shares of Common Stock (as adjusted for the Reverse Stock Split) as of December 9, 2016, with shared voting and dispositive power of all shares and sole voting and dispositive power of no shares.

|

| |

|

|

(5)

|

Based upon information contained in the Schedule 13D/A filed by Mr. Fu with the SEC on August 24, 2020, Mr. Fu beneficially owned 114,286 shares of Common Stock (as adjusted for the Reverse Stock Split) as of August 1, 2020, with sole voting power over 114,286 shares, shared voting power over no shares, sole dispositive power over 114,286 shares and shared dispositive power over no shares.

|

| |

|

|

(6)

|

Consists of (i) 2,377 shares of Common Stock held directly by Mr. Hall and (ii) 14,191 shares issuable upon the exercise of outstanding options which are exercisable as of March 27, 2023 or within 60 days after such date. Does not include 14,286 performance restricted stock units granted to Mr. Hall on May 4, 2021 that will vest based on the achievement of three performance goals at the end of a three-year performance period ending December 31, 2023.

|

| |

|

|

(7)

|

Consists of 643 shares issuable upon exercise of outstanding options which are exercisable as of March 15, 2023 or within 60 days after such date.

|

| |

|

|

(8)

|

Consists of 2,143 shares issuable upon exercise of outstanding options which are exercisable as of March 27, 2023 or within 60 days after such date. Does not include 8,572 performance restricted stock units granted to Dr. Audrey Kunin on November 8, 2021 that will vest based on the achievement of three performance goals at the end of a three year performance period ending December 31, 2023.

|

| |

|

|

(9)

|

Consists of 2,143 shares issuable upon exercise of outstanding options which are held by Dr. Jeff Kunin’s spouse, Dr. Audrey Kunin, and exercisable as of March 27, 2023 or within 60 days after such date.

|

| |

|

|

(10)

|

Consists of (i) 924 shares held by the Paul Freiman and Anna Mazzuchi Freiman Trust, of which Dr. Freiman and his spouse are trustees (with sole voting power over 18 shares, shared voting power over 31 shares, sole investment power over no shares and shared investment power over 49 shares); (ii) 3,399 shares issuable upon exercise of outstanding options which are exercisable as of March 27, 2023 or within 60 days after such date; and (iii) 858 shares of Common Stock issuable upon the vesting of outstanding restricted stock units which vest within 60 days of March 27, 2023.

|

| |

|

|

(11)

|

Consists of 858 shares of Common Stock issuable upon the vesting of outstanding restricted stock units which vest within 60 days of March 27, 2023.

|

| |

|

|

(12)

|

Consists of (i) 858 shares of Common Stock held directly by Ms. Sit; (ii) 572 shares issuable upon exercise of outstanding options which are exercisable as of March 27, 2023 or within 60 days after such date; and (iii) 858 shares of Common Stock issuable upon the vesting of outstanding restricted stock units which vest within 60 days of March 27, 2023.

|

| |

|

|

(13)

|

Consists of (i) 858 shares of Common Stock held directly by Mr. Wu; (ii) 1,580 shares issuable upon exercise of outstanding options which are exercisable as of March 27, 2023 or within 60 days after such date; and (iii) 858 shares of Common Stock issuable upon the vesting of outstanding restricted stock units which vest within 60 days of March 27, 2023. As Non-Executive Director of China Pioneer, the parent company of Pioneer Hong Kong, Mr. Wu disclaims beneficial ownership of the shares of the Common Stock held by China Pioneer Pharma and Pioneer Hong Kong.

|

| |

|

|

(14)

|

Consists of (i) 858 shares of Common Stock held directly by Dr. Jeff Zheng; (ii) 572 shares issuable upon exercise of outstanding options which are exercisable as of March 27, 2023or within 60 days after such date; and (iii) 858 shares of Common Stock issuable upon the vesting of outstanding restricted stock units which vest within 60 days of March 27, 2023.

|

| |

|

|

(15)

|

Consists of 858 shares of Common Stock issuable upon the vesting of outstanding restricted stock units which vest within 60 days of March 27, 2023.

|

DESCRIPTION OF CAPITAL STOCK

Overview

Our authorized capital stock currently consists of 150,000,000 shares of Common Stock with a $0.01 par value per share, and 5,000,000 shares of preferred stock with a $0.01 par value per share. A description of material terms and provisions of the Certificate of Incorporation and our Bylaws, as amended and restated (“Bylaws”), affecting the rights of holders of the Company’s capital stock is set forth below. The description is intended as a summary, and is qualified in its entirety by reference to the Certificate of Incorporation and the Bylaws, which are available in our filings with the SEC. As of March 27, 2023, there were (i) 2,035,444 shares of Common Stock outstanding; (ii) of the 15,000 shares of the Series B Preferred Stock initially issued in the 2021 Private Placement, there are 11,620 shares of Series B Preferred Stock that have not been converted and are outstanding; and (iii) of the 3,250 shares of the Series C Preferred Stock initially issued in the 2022 Private Placement, there are 2,250 shares of Series C Preferred Stock that have not been converted and remain outstanding.

On November 15, 2022, we effected the Reverse Stock Split. The Reverse Stock Split resulted in combining every thirty-five (35) shares of Common Stock outstanding or held in treasury into one (1) share of Common Stock. The Reverse Stock Split did not reduce the number of authorized shares of Common Stock or authorized shares of preferred stock or change the par values of our Common Stock or preferred stock, both of which remain at $0.01 per share. The Company did not issue fractional shares of Common Stock and instead issued an additional whole share of Common Stock to all holders that would otherwise have received a fractional share. Except for adjustments resulting from the treatment of fractional shares, each stockholder continued to hold the same percentage of our outstanding Common Stock immediately following the Reverse Stock Split becoming effective as such stockholder held immediately prior to the Reverse Stock Split. The Series B Preferred Stock, the Reprice Warrants, the Amended Warrants, as well as other Common Stock purchase warrants, stock options, restricted stock awards and other securities entitling their holders to purchase or otherwise receive shares of Common Stock were adjusted as a result of the Reverse Stock Split as required by the terms of each security.

Common Stock

Dividend rights. Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our Common Stock are entitled to receive dividends out of funds legally available if the Board of Directors, in its discretion, determines to issue dividends and then only at the times and in the amounts that the Board of Directors may determine.

Voting rights. Each holder of Common Stock is entitled to one vote for each share of Common Stock held on all matters submitted to a vote of stockholders. Our Certificate of Incorporation does not provide for the right of stockholders to cumulate votes for the election of directors. Our Certificate of Incorporation establishes a classified Board of Directors, divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms.

No preemptive or similar rights. Our Common Stock is not entitled to preemptive rights and is not subject to conversion, redemption or sinking fund provisions. The rights, preferences and privileges of the holders of our Common Stock are subject to, and may be adversely affected by, the rights of the holders of any series of our preferred stock that NovaBay may designate and issue in the future.

Right to receive liquidation distributions. Upon our dissolution, liquidation or winding-up, the assets legally available for distribution to holders of our Common Stock are distributable ratably among the holders of our Common Stock, subject to prior satisfaction of all outstanding debt and liabilities and the preferential or pari passu rights and payment of liquidation preferences, if any, on any outstanding shares of our preferred stock, including the Series B Preferred Stock and the Series C Preferred Stock.

The rights of the holders of Common Stock are subject to, and may be adversely affected by, the rights of holders of shares of the Series B Preferred Stock and the Series C Preferred Stock, as described below, and any other preferred stock that we may designate and issue in the future.

Preferred Stock

Under the terms of the Certificate of Incorporation, the Board of Directors is authorized to issue up to 5,000,000 shares of preferred stock in one or more series without stockholder approval. Other than the Series B Preferred Stock and the Series C Preferred Stock, we do not currently have any shares of preferred stock issued and outstanding.

Our Certificate of Incorporation authorized the Board of Directors, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in each series and to fix the designation, powers, preferences and rights of the shares of each series and any of its qualifications, limitations or restrictions. The Board of Directors can also increase or decrease the number of shares of any series, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. The Board of Directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the Common Stock. The issuance of preferred stock, while providing flexibility in connection with financings, possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring, discouraging or preventing a change in control of the Company, may adversely affect the market price of our Common Stock and the voting and other rights of the holders of Common Stock, and may reduce the likelihood that stockholders will receive dividend payments and payments upon liquidation.

Series B Non-Voting Convertible Preferred Stock

On November 2, 2021, we issued 15,000 shares of the Series B Preferred Stock, all of which were convertible into shares of Common Stock at the election of the holders of the Series B Preferred Stock, subject to the beneficial ownership limitation described below. Of the 15,000 shares of Series B Preferred Stock originally issued and sold in the 2021 Private Placement, 11,620 shares of Series B Preferred Stock have not been converted and remain outstanding. In accordance with the Series B Certificate of Designation, the stated value of each share of the Series B Preferred Stock is $1,000 with a current per share conversion price of $6.30 (as adjusted for the Reverse Stock Split) into 159 shares of Common Stock, or an aggregate of 1,847,580 shares of Common Stock upon conversion of all outstanding Series B Preferred Stock. The following is a summary of the terms of the Series B Preferred Stock, which is qualified in its entirety by the Series B Certificate of Designation that was filed as Exhibit 3.1 to our Current Report on Form 8-K filed with the SEC on November 1, 2021, and which is incorporated into this prospectus by reference.

Rank

The Series B Preferred Stock ranks as to dividends or distributions of assets upon our liquidation, dissolution or winding up, whether voluntarily or involuntarily, as follows:

| |

●

|

on par with our Common Stock and our Series C Preferred Stock;

|

| |

●

|

senior to any class or series of our capital stock hereafter created specifically ranking by its terms junior to the Series B Preferred Stock; and

|

| |

●

|

junior to any class or series of our capital stock hereafter created specifically ranking by its terms senior to the Series B Preferred Stock.

|

Conversion Limitation

The Series B Preferred Stock is subject to a limitation upon conversion of the Series B Preferred Stock to the extent that, after giving effect to such conversion, the holder of such Series B Preferred Stock (together with the holder’s affiliates, and any other persons acting as a group together with the holder or any of the holder’s affiliates), would beneficially own Common Stock in excess of the Beneficial Ownership Limitation (or 4.99% or 9.99% of the outstanding Common Stock) as set forth in the Series B Certificate of Designation. Any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% of the total number of shares of Common Stock then issued and outstanding provided that such increase in percentage shall not be effective until sixty-one days after notice to us.

Liquidation Preference

In the event of our liquidation, dissolution or winding up, holders of Series B Preferred Stock are entitled to receive the same amount as a holder of Common Stock.

Voting Rights

Shares of Series B Preferred Stock generally have no voting rights, except as required by law and except that the consent of the majority of holders of the outstanding Series B Preferred Stock is required to: (i) alter or change adversely the powers, preferences or rights given to the Series B Preferred Stock or alter or amend the Series B Certificate of Designation, (ii) amend our Certificate of Incorporation or other charter documents in any manner that adversely affects any rights of the holders of Preferred Stock, (iii) increase the number of authorized shares of Preferred Stock, and (iv) enter into any agreement with respect to any of the foregoing.

Dividends

Holders of Series B Preferred Stock are entitled to receive, and we are required to pay, dividends on shares of the Series B Preferred Stock equal (on an as if converted to Common Stock basis) to and in the same form as dividends actually paid on shares of the Common Stock when, as and if such dividends are paid on shares of the Common Stock. The Series B Preferred Stock is not entitled to any other dividends.

Redemption

We are not obligated to redeem or repurchase any shares of Series B Preferred Stock. Shares of Series B Preferred Stock are not otherwise entitled to any redemption rights, or mandatory sinking fund or analogous fund provisions.

Listing

There is no established public trading market for the Series B Preferred Stock, and the Series B Preferred Stock has not been listed on any national securities exchange or trading system.

Dilution Protection

In the event we, at any time after the first date of issue of the Series B Preferred Stock and while at least one share of Series B Preferred Stock is outstanding: (i) pays a dividend or otherwise make a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock (which, for avoidance of doubt, shall not include any shares of Common Stock issued by us upon conversion of the Series B Preferred Stock or any debt securities), (ii) subdivides outstanding shares of Common Stock into a larger number of shares, (iii) combines (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares or (iv) issues by reclassification of shares of Common Stock any shares of our capital stock, then, in each case, the conversion price of the Series B Preferred Stock shall be adjusted as provided in the Series B Certificate of Designation. Any adjustment made pursuant to the Series B Certificate of Designation shall become effective immediately after the effective date of the applicable event described in subsections (i) through (iv) above. As a result of the Reverse Stock Split becoming effective at a reverse split ratio of 1-for-35 on November 15, 2022, the $0.18 conversion price of the Series B Preferred Stock immediately prior to the Reverses Stock Split automatically adjusted to a conversion price of $6.30. In addition, in the event that we or any of our subsidiaries, as applicable, at any time while the Series B Preferred Stock is outstanding sells or grants any option to purchase or sells or grants any right to reprice, or otherwise disposes of or issues (or announces any sale, grant or any option to purchase or other disposition), any Common Stock or any of our securities or any of our subsidiaries which would entitle the holder thereof to acquire at any time Common Stock at an effective price per share that is lower than the then conversion price of the Series B Preferred Stock, then the conversion price of the Series B Preferred Stock will be reduced to such lower price; this protection afforded the holder of the Series B Preferred Stock is referred to as a “full-ratchet” anti-dilution protection. This full-ratchet anti-dilution protection is subject to termination as provided in the Series B Certificate of Designation upon the earlier of: (x) our Common Stock achieving an average trading price during any 10 days during a 30-consecutive trading day period that exceeds $35.00 (such dollar amount having been adjusted to reflect the Reverse Stock Split, and which is subject to further adjustment for future stock splits, recapitalizations, stock dividends and other similar adjustments) and the trading volume during such period exceeds $500,000 per trading day; provided that the Initial Registration Statement and the registration statement registering the resale of the Common Stock underlying the warrants issued in the 2021 Private Placement both remain effective during this measurement period; or (y) 75% of the Series B Preferred Stock issued having been converted. The holders of Series B Preferred Stock do not have any preemptive rights as a result of their ownership of Series B Preferred Stock.

Fundamental Transactions

If, at any time that shares of Series B Preferred Stock were outstanding, we effected a merger, a sale of substantially all assets or engage in another type of change of control transaction, as described in the Series B Certificate of Designation and referred to as a “Fundamental Transaction”, then a holder of Series B Preferred Stock would have the right to receive, upon any subsequent conversion of a share of Series B Preferred Stock (in lieu of shares of Common Stock) for each issuable conversion share, the same kind and amount of securities, cash or property as such holder would have been entitled to receive upon the occurrence of such fundamental transaction if such holder had been, immediately prior to such fundamental transaction, the holder of Common Stock. In connection with a Fundamental Transaction, the holders of Series B Preferred Stock may instead receive in exchange for their shares of Series B Preferred Stock a security of the successor entity evidenced by a written instrument substantially similar in form and substance to the Series B Preferred Stock, which is convertible for a corresponding number of shares of capital stock of such successor entity equivalent to the shares of Common Stock upon conversion of the Series B Preferred Stock and with a conversion price consistent with the conversion price of the Series B Preferred Stock then currently in effect. If we are not the surviving entity in any such fundamental transaction, then it shall cause any successor entity to assume in writing all of the obligations of the Company under the Series B Certificate of Designation, the Securities Purchase Agreement, dated October 29, 2021 and the 2021 Registration Rights Agreement (as defined below) in accordance with the provisions of the Series B Certificate of Designation.

2021 Registration Rights Agreement

In connection with the 2021 Private Placement, we entered into a Registration Rights Agreement, dated October 29, 2022 (the “2021 Registration Rights Agreement”) with investors (the “2021 Purchasers”) that provided for the resale of the shares of Common Stock underlying the Series B Preferred Stock and the 2021 Original Warrants, which as a result of the 2022 Warrant Reprice Transaction were amended and are the 2021 Amended Warrants. Pursuant to the terms of the 2021 Registration Rights Agreement, we initially registered, on behalf of the 2021 Purchasers, the shares of Common Stock underlying the Series B Preferred Stock for resale on an initial registration statement on Form S-1 and also registered for resale on a separate registration statement on Form S-1 the shares of Common stock underlying the 2021 Original Warrants. Pursuant to the 2021 Registration Rights Agreement, we filed a third registration statement on Form S-1, on behalf of the 2021 Purchasers, that registered for resale the additional shares of Common Stock that became issuable upon conversion of the Series B Preferred Stock as a result of an anti-dilution adjustment to the conversion price that occurred as a result of the completion of the 2022 Warrant Reprice Transaction that reduced exercise prices on certain of our Common Stock purchase warrants, including the 2021 Amended Warrants and provided for the issuance of the Reprice Warrants. The 2021 Registration Rights Agreement provides for payment of liquidated damages to the 2021 Purchasers that are a party to the agreement in the event we are not able to perform our obligations with respect to registering the Common Stock. In addition, pursuant to the 2021 Registration Rights Agreement, we also agreed, among other things, to indemnify the 2021 Purchasers, their officers, directors, members, employees and agents, successors and assigns under the registration statement from certain liabilities and pay all fees and expenses (excluding any legal fees of the 2021 Purchaser(s), and any underwriting discounts and selling commissions) incident to our obligations under the 2021 Registration Rights Agreement. For additional information regarding the 2021 Registration Rights Agreement, see a copy of the 2021 Registration Rights Agreement, which was filed as Exhibit 10.1 to our Current Report on Form 8-K filed with the SEC on November 1, 2021 and which is incorporated into this prospectus by reference.

Series C Non-Voting Convertible Preferred Stock

On November 18, 2022, we closed the 2022 Private Placement and issued 3,250 shares of the Series C Preferred Stock pursuant to the terms of the 2022 Securities Purchase Agreement. At the time of issuance, all of the Series C Preferred Stock were convertible into shares of Common Stock at the election of the holders of the Series C Preferred Stock, subject to the beneficial ownership limitation described below. Of the 3,250 shares of Series C Preferred Stock originally issued and sold in the 2022 Private Placement, 2,250 of these shares remain outstanding as of the date of this prospectus. In accordance with the Series C Certificate of Designation, the stated value of each share of the Series C Preferred Stock is $1,000 with a current per share conversion price of $6.30 (as adjusted for the Reverse Stock Split) into 159 shares of Common Stock, or an aggregate of 357,750 shares of Common Stock upon conversion of all outstanding Series C Preferred Stock. The following is a summary of the terms of the Series C Preferred Stock, which is qualified in its entirety by the Series C Certificate of Designation, which was filed as Exhibit 3.2 to our Current Report on Form 8-K filed with the SEC on November 18, 2022 and which is incorporated into this prospectus by reference.

Rank

The Series C Preferred Stock ranks as to dividends or distributions of assets upon our liquidation, dissolution or winding up, whether voluntarily or involuntarily, as follows:

| |

●

|

on par with our Common Stock and our Series B Preferred Stock;

|

| |

●

|

senior to any class or series of our capital stock hereafter created specifically ranking by its terms junior to the Series C Preferred Stock; and

|

| |

●

|

junior to any class or series of our capital stock hereafter created specifically ranking by its terms senior to the Series C Preferred Stock.

|

Conversion Limitation

The Series C Preferred Stock is subject to a limitation upon conversion of the Series C Preferred Stock to the extent that, after giving effect to such conversion, the holder of such Series C Preferred Stock (together with the holder’s affiliates, and any other persons acting as a group together with the holder or any of the holder’s affiliates), would beneficially own Common Stock in excess of the Beneficial Ownership Limitation (or 4.99% or 9.99% of the outstanding Common Stock) as set forth in the Series C Certificate of Designation. Any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% of the total number of shares of Common Stock then issued and outstanding provided that such increase in percentage shall not be effective until sixty-one days after notice to us.

Liquidation Preference

In the event of our liquidation, dissolution or winding up, holders of Series C Preferred Stock are entitled to receive the same amount as a holder of Common Stock.

Voting Rights

The holders of shares of the Series C Preferred Stock generally will have no voting rights, except as required by law, and except that the consent of the majority of holders of the outstanding Series C Preferred Stock would be required to: (i) alter or change adversely the powers, preferences or rights given to the Series C Preferred Stock or alter or amend the Series C Certificate of Designation, (ii) amend the Certificate of Incorporation or other charter documents in any manner that adversely affects any rights of the holders of the Series C Preferred Stock, (iii) increase the number of authorized shares of Series C Preferred Stock, and (iv) enter into any agreement with respect to any of the foregoing.

Dividends

The Holders of the Series C Preferred Stock will be entitled to receive, and the Company will be required to pay, dividends on shares of the Series C Preferred Stock equal (on an as if converted to Common Stock basis) to and in the same form as dividends actually paid on shares of the Common Stock when, as and if such dividends are paid on shares of the Common Stock. The Series C Preferred Stock will not be entitled to any other dividends.

Dilution Protection

In the event the Company, at any time after the 2022 Private Placement Closing Date and while at least one share of Series C Preferred Stock is outstanding: (i) pays a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock (which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Company upon conversion of the Series C Preferred Stock or payment of a dividend on the Series C Preferred Stock); (ii) subdivides outstanding shares of Common Stock into a larger number of shares; (iii) combines (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares; or (iv) issues by reclassification of shares of Common Stock any shares of capital stock of the Company, then in each case the conversion price of the Series C Preferred Stock will be adjusted as provided in the Series C Certificate of Designation. Any adjustment made pursuant to the Series C Certificate of Designation will become effective immediately after the effective date of the applicable event described in subsections (i) through (iv) above. In addition, if the Company at any time while the Series C Preferred Stock is outstanding, but prior to the Ratchet Termination Date (as defined in the Series C Certificate of Designation) sells or grants any option to purchase or sells or grants any right to reprice, or otherwise disposes of or issues (or announces any sale, grant or any option to purchase or other disposition), any Common Stock or any securities of the Company or any of its subsidiaries that would entitle the holder thereof to acquire Common Stock at an effective price per share that is lower than the then conversion price of the Series C Preferred Stock, then the conversion price of the Series C Preferred Stock will be reduced to such lower price, which is referred to as a “full-ratchet” anti-dilution protection. This full-ratchet anti-dilution protection is subject to termination as provided in the Series C Certificate of Designation upon the earlier of: (a) the Common Stock achieving an average trading price of 250% of the conversion price during any 10 days during a 30-consecutive trading day period and (b) 75% of the Series C Preferred Stock issued on the original issue date has been converted. The holders of Series C Preferred Stock will not have any preemptive rights as a result of their ownership of Series C Preferred Stock.

Redemption

We are not obligated to redeem or repurchase any shares of Series C Preferred Stock. Shares of Series C Preferred Stock are not otherwise entitled to any redemption rights, or mandatory sinking fund or analogous fund provisions.

Listing

There is no established public trading market for the Series C Preferred Stock, and the Series C Preferred Stock has not been listed on any national securities exchange or trading system.

Fundamental Transactions

If, at any time that shares of Series C Preferred Stock were outstanding, we effected a merger, a sale of substantially all assets or engage in another type of change of control transaction, as described in the Series C Certificate of Designation and referred to as a “Fundamental Transaction”, then a holder of Series C Preferred Stock would have the right to receive, upon any subsequent conversion of a share of Series C Preferred Stock (in lieu of shares of Common Stock) for each issuable conversion share, the same kind and amount of securities, cash or property as such holder would have been entitled to receive upon the occurrence of such fundamental transaction if such holder had been, immediately prior to such fundamental transaction, the holder of Common Stock. In connection with a Fundamental Transaction, the holders of Series C Preferred Stock may instead receive in exchange for their shares of Series C Preferred Stock a security of the successor entity evidenced by a written instrument substantially similar in form and substance to the Series C Preferred Stock, which is convertible for a corresponding number of shares of capital stock of such successor entity equivalent to the shares of Common Stock upon conversion of the Series C Preferred Stock and with a conversion price consistent with the conversion price of the Series C Preferred Stock then currently in effect. If we are not the surviving entity in any such fundamental transaction, then it shall cause any successor entity to assume in writing all of the obligations of the Company under the Series C Certificate of Designation, the 2022 Securities Purchase Agreement, the 2022 Registration Rights Agreement (as defined below), and the 2022 Warrants in accordance with the provisions of the Series C Certificate of Designation.

2022 Registration Rights Agreement

In connection with the 2022 Private Placement, the Company entered into a Registration Rights Agreement, dated as of November 18, 2022 (the “2022 Registration Rights Agreement”) pursuant to which the Company was required to file this initial registration statement with the SEC covering the resale of the Shares being registered by this prospectus by no later than December 10, 2022, and to use best efforts to have this registration statement declared effective as promptly as possible after the filing. The 2022 Registration Rights Agreement provides for payment of liquidated damages to the Selling Stockholders, who are a party to the agreement, in the event we are not able to perform our obligations with respect to registering the Common Stock. In addition, pursuant to the 2022 Registration Rights Agreement, we also agreed, among other things, to indemnify the Selling Stockholders, their officers, directors, members, employees and agents, successors and assigns under the registration statement from certain liabilities and pay all fees and expenses (excluding any legal fees of the Selling Stockholder(s), and any underwriting discounts and selling commissions) incident to our obligations under the 2022 Registration Rights Agreement. For additional information regarding the 2022 Registration Rights Agreement, see a copy of the 2022 Registration Rights Agreement, which was filed as Exhibit 10.4 to our Current Report on Form 8-K filed with the SEC on September 13, 2022, and which is incorporated into this prospectus by reference.

Common Stock Warrants

Reprice Warrants

The Reprice Warrants were issued in the 2022 Warrant Reprice Transaction. The Reprice Warrants are exercisable into an aggregate of 327,860 shares of Common Stock at an exercise price of $6.30 per share, subject to customary anti-dilution adjustments as provided in the Reprice Warrants. The Reprice Warrants are currently exercisable on March 9, 2023 and expire on September 11, 2028. The Reprice Warrants include a provision that limits a holder’s ability to exercise their Reprice Warrant to the extent that, after giving effect to such exercise, the holder of such Reprice Warrant (together with the holder’s affiliates, and any other persons acting as a group together with the holder or any of the holder’s affiliates), would beneficially own Common Stock in excess of the Beneficial Ownership Limitation (or 4.99% or 9.99% of the outstanding Common Stock) as set forth in the Reprice Warrants. Any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% of the total number of shares of Common Stock then issued and outstanding provided that such increase in percentage shall not be effective until sixty-one days after notice to us. The Reprice Warrants do not have any preemptive rights or a preference upon any liquidation, dissolution or winding-up of the Company. For additional information about the terms of the Reprice Warrants that we issued in the 2022 Warrant Reprice Transaction, see the forms of the Reprice Warrants that were filed as Exhibits 4.3 and 4.4 to our Current Report on Form 8-K filed with the SEC on September 13, 2022, and which are incorporated into this prospectus by reference.

Other Outstanding Warrants

As of March 27, 2023, we had outstanding Common Stock purchase warrants (including the Reprice Warrants separately described above) to purchase an aggregate of 2,305,519 shares of Common Stock at a weighted average exercise price of $7.70 per share. All such outstanding Common Stock purchase warrants are currently exercisable.

Anti-Takeover Effects of Provisions of our Certificate of Incorporation and Bylaws and Delaware Law