Current Report Filing (8-k)

April 01 2019 - 9:19AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of earliest event

reported:

March 29, 2019

NovaBay Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-33678

|

68-0454536

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

2000 Powell Street, Suite 1150, Emeryville, CA 94608

(Address of Principal Executive Offices) (Zip Code)

(510) 899-8800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1

.01

Entry into a Material Definitive Agreement

On March 29, 2019, NovaBay Pharmaceuticals, Inc. (the “Company”) entered into a Common Stock Purchase Agreement (the “Purchase Agreement”) with Triton Funds LP, a Delaware limited partnership (the “Investor”), pursuant to which the Company has the right to sell up to $3,000,000 of shares of common stock of the Company (the “Shares”) at a purchase price equal to 90% of the lowest trading price of the common stock of the Company for the five business days prior to the applicable closing date. The Purchase Agreement shall terminate automatically on December 31, 2019, unless earlier terminated. The Purchase Agreement also contains customary representations, warranties, and covenants by, among, and for the benefit of the parties.

The Company also entered into a Registration Rights Agreement on March 29, 2019 with the Investor, pursuant to which the Company shall register the Shares for resale by the Investor, on a registration statement, which shall be filed with the Securities and Exchange Commission not later than April 5, 2019. The Registration Rights Agreement also contains customary representations, warranties, and covenants by, among, and for the benefit of the parties.

Additionally, on March 29, 2019, the Company entered into a Letter Agreement with Triton Funds LLC (the “Recipient”), an affiliate of the Investor, pursuant to which the Company issued 150,000 shares of common stock (the “Additional Shares”) to the Recipient. The Additional Shares are also entitled to registration rights.

The Company has filed herewith as Exhibits 10.1, 10.2 and 10.3 the Common Stock Purchase Agreement, the Registration Rights Agreement and the Letter Agreement, which are incorporated herein by reference, and the foregoing descriptions of each are qualified in their entirety by reference thereto.

Item 3.02 Unregistered Sales of Equity Securities

The information set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. The Company’s offering of the Shares to the Investor and issuance of the Additional Shares to the Recipient were made without registration under the Securities Act, in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder, based on the offering or issuance of such securities to two investors, the lack of any general solicitation or advertising in connection with such offering and issuance, and the representation of such investors to the Company that they were accredited investors (as that term is defined in Rule 501(a) of Regulation D of the Act).

Item 7.01 Regulation FD Disclosure

On April 1, 2019, the Company issued a press release announcing its transaction with the Investor. The Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 7.01 of this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The furnishing of the information in this Item 7.01 of this Current Report on Form 8-K is not intended to, and does not, constitute a representation that such furnishing is required by Regulation FD or that the information contained in this Current Report on Form 8-K constitutes material investor information that is not otherwise publicly available.

The SEC encourages registrants to disclose forward-looking information so that investors can better understand the future prospects of a registrant and make informed investment decisions. This Item 7.01 of Current Report on Form 8-K and Exhibit 99.1 may contain these types of statements, which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and which involve risks, uncertainties and reflect the Company’s judgment as of the date of this Current Report on Form 8-K. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this Current Report on Form 8-K. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented within.

Item 9

.01

Financial Statements and Exhibits.

(d)

Exhibits

.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Common Stock Purchase Agreement, dated March 29, 2019, by and between the Company and Triton Funds LP

|

|

10.2

|

|

Registration Rights Agreement, dated March 29, 2019, by and between the Company and Triton Funds LP

|

|

10.3

|

|

Letter Agreement, dated March 29, 2019, by and between the Company and Triton Funds LLC

|

|

99.1

|

|

Press Release, dated April 1, 2019

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NovaBay Pharmaceuticals, Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Justin Hall

|

|

|

|

Justin Hall

|

|

|

|

Interim

President

& Chief Executive Officer and

General Counsel

|

Dated: April 1, 2019

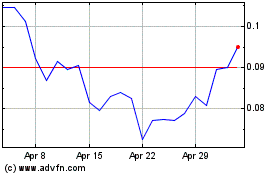

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Apr 2023 to Apr 2024