Saba’s Tender Proposal of Neuberger Berman’s High Yield Strategies Fund Passes

October 08 2019 - 2:00PM

Business Wire

62% to 38% Vote In Favor of Tender Offer

Neuberger Statement Seeks to Mislead

Shareholders

Saba Capital Management, L.P. and certain investment funds

managed by it (collectively “Saba”) today issued the following

statement regarding its campaign to effect change at the 2019

Annual Meeting of Shareholders (the “Annual Meeting”) of Neuberger

Berman High Yield Strategies Fund Inc. (“NHS” or the “Fund” or

“Neuberger”) (NYSE American: NHS).

In an attempt to mislead the public, Neuberger has declared

“resounding” support from shareholders, if

you don’t count the shareholders who voted against them.

Below are the complete and unadulterated voting results, taken

directly from the report provided to both Saba Capital and

Neuberger by the inspector of elections.

For

Against

Abstain

Terminate the Investment

Management Agreement

6,786,000

4,151,025

503,921

Tender for 100% of Shares

6,758,819

4,194,419

487,709

Saba Capital’s Nominees

Neuberger Bergman’s Nominees

Gabriel

6,210,487

Cosgrove

4,045,146

McGlade

6,210,487

McLean

4,036,627

Lipson

6,207,310

Selp

4,041,771

Saba’s proposal for the NHS board of directors to consider a

tender for 100% of the shares outstanding has passed with

overwhelming support. Saba urges the board to immediately commence

the tender and accept the will of its shareholders. Not doing so

would contradict the very corporate governance principles espoused

by Neuberger itself in their “Governance and Proxy Voting

Guidelines”.

Separately, regarding the election of directors, Boaz Weinstein,

Chief Investment Officer of Saba Capital, said, “Neuberger Berman

has deployed an entrenchment mechanism to manufacture a failed

election. This deprives shareholders of a fundamental right as

owners of an investment company.”

To be clear, Neuberger’s nominees were not elected by the Fund’s

shareholders. The Fund’s voting standard would have required

nominees to receive 9 out of 10 votes cast to be seated. This

voting standard is rarely deployed by investment companies because

it will result in the Fund falling out of compliance with the

Investment Company Act of 1940.

Boaz Weinstein continued, “We would like to express our

gratitude to all shareholders, small and large, who supported us.

It is abhorrent that Neuberger would seek to blatantly mislead

shareholders about the outcome of this important election.”

About Saba Capital

Saba Capital Management, L.P. is an Investment Adviser based in

New York. Launched in 2009, Saba currently manages assets across

three core strategies: Credit Relative Value, Tail Hedge, and

Closed-End Funds.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191008005829/en/

Investors Leah Jordan Investor Relations

+1-212-542-4614

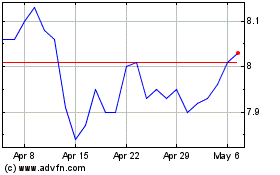

Neuberger Berman High Yi... (AMEX:NHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

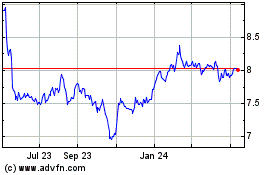

Neuberger Berman High Yi... (AMEX:NHS)

Historical Stock Chart

From Apr 2023 to Apr 2024