Current Report Filing (8-k)

November 26 2021 - 6:10AM

Edgar (US Regulatory)

false

0000810509

0000810509

2021-11-23

2021-11-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of Report (date of earliest event reported):

|

November 23, 2021

|

|

NAVIDEA BIOPHARMACEUTICALS, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

001-35076

|

31-1080091

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

4995 Bradenton Avenue, Suite 240, Dublin, Ohio

|

43017

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code

|

(614) 793-7500

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $.001 per share

|

|

NAVB

|

|

NYSE American

|

|

Item 5.02

|

Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

|

On November 23, 2021, Jed A. Latkin, the former Chief Executive Officer, Chief Financial Officer and Chief Operating Officer of Navidea Biopharmaceuticals, Inc. (the “Company”), signed a Separation Agreement and General Release (the “Separation Agreement”) in connection with his resignation from those positions and as a director on October 24, 2021 (the “Separation Date”). Pursuant to the Separation Agreement, among other things, the Company agreed to provide Mr. Latkin with certain separation benefits, commencing on the “Effective Date,” defined as the eighth day after Mr. Latkin signs, without revoking, the Separation Agreement. These separation benefits include continued payment of Mr. Latkin’s base salary of $490,000, less all relevant taxes and other withholdings, on the following basis: (i) for 12 months, 100% of his base salary, minus an aggregate $24,000 deducted monthly pro rata, and (ii) for 10 months following the expiration of the first 12-month period, 50% of his base salary. On the Effective Date, each of Mr. Latkin’s unvested stock options shall vest, and all of his vested stock options (covering 69,918 shares) and previously unvested options (covering 333,332 shares) may be exercised by Mr. Latkin on or before the earlier of the fifth anniversary of the Separation Date and the original expiration date. On the Effective Date, each of Mr. Latkin’s 33,333 outstanding unvested restricted stock units shall become fully vested, and all of such restricted stock units shall be settled within thirty days after the Separation Date, less applicable withholding in shares of common stock. The Company agreed to pay Mr. Latkin’s attorney fees in the amount of $24,000, and to reimburse expenses pursuant to Company policy. For purposes of assistance provided in certain litigation matters, the Company agrees to pay Mr. Latkin $250 per hour, subject to certain limitations. Mr. Latkin will also be entitled to receive, subject to his timely execution and non-revocation of the Separation Agreement, a payment equal to up to one percent of total capital raised during the twenty-two months following the Separation Date through one of two investment banking firms introduced to the Company by Mr. Latkin, less relevant taxes and withholdings and subject to certain payment terms. In addition, Mr. Latkin and the Company generally released each other from any and all claims each may have against the other.

The foregoing description of the material terms of the Separation Agreement is not complete and is qualified in its entirety by reference to the full text thereof, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

As disclosed in the notes to the financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and its Quarterly Report on Form 10-Q for the period ended September 30, 2021, the Company has been engaged in ongoing litigation with Capital Royalty Partners II L.P. (“CRG”), in its capacity as a lender and as control agent for other affiliated lenders party to the CRG Loan Agreement (collectively, the “CRG Lenders”), in the District Court of Harris County, Texas (the “Texas Court”). Currently, CRG’s pending claims against the Company in the Texas Court allege that the Company breached the Global Settlement Agreement and seeks damages, including attorney fees, from the Company.

A current lawsuit was filed by CRG in the Texas Court in April 2018. This suit seeks a declaratory judgment that CRG did not breach the Global Settlement Agreement by drawing the entire $7.1 million on the Cardinal Health 414, LLC letter of credit. CRG also alleges that the Company breached the Global Settlement Agreement by appealing the Texas Court’s judgment and by filing the suit in Franklin County, Ohio. The Company moved to dismiss CRG’s claims under the Texas Citizens’ Participation Act. The Texas Court denied the motion to dismiss. The Company filed an interlocutory appeal of the denial of its motion to dismiss. The Court of Appeals affirmed the Texas Court’s refusal to dismiss CRG’s claim on August 28, 2020. The Company has filed a petition for review with the Texas Supreme Court seeking to reverse the Texas Court’s ruling. The Texas Supreme Court denied the Company’s petition on December 18, 2020, and litigation resumed in the Texas Court on February 1, 2021. CRG filed a motion for summary judgment on its claims in the Texas Court on July 1, 2021.

On August 18, 2021, the Company filed counterclaims against CRG, asserting that CRG breached the Global Settlement Agreement and engaged in various tortious acts with respect to its recovery from the Company of amounts in excess of the amount permitted under the Global Settlement Agreement dated March 3, 2017. The Company and CRG filed motions for summary judgment in the Texas Court as to CRG’s claims against the Company and the Company’s claims against CRG in advance of a hearing which was scheduled for October 25, 2021. The Texas Court cancelled that hearing and indicated its intent to rule on the motions for summary judgment without a hearing.

On November 23, 2021, the Texas Court issued a ruling granting CRG’s motions for summary judgment and denying the Company’s motion for summary judgment. The Texas Court dismissed the Company’s counterclaims against CRG with prejudice. The Texas Court also declared that CRG had not breached the Global Settlement Agreement and that the Company had breached the Global Settlement Agreement by seeking reconsideration or appeal of the Texas Court’s initial judgment in favor of CRG or in pursuing litigation thereafter in Ohio. The Texas Court ruled that, as a result, CRG was entitled to recover its attorney fees, in an amount to be determined, from the Company. The Texas Court also ruled that the Company breached the indemnification provision of the loan agreement between CRG and the Company and that CRG was entitled to recover its attorney fees, in an amount to be determined, from the Company as a result. The Company is currently evaluating potential responses to this ruling.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Navidea Biopharmaceuticals, Inc.

|

|

|

|

|

|

|

|

|

|

Date: November 24, 2021

|

By:

|

/s/ Michael S. Rosol

|

|

|

|

Michael S. Rosol, Ph.D.

Senior Vice President and Chief Medical Officer

|

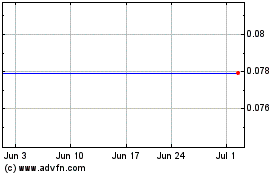

Navidea Biopharmaceuticals (AMEX:NAVB)

Historical Stock Chart

From Mar 2024 to Apr 2024

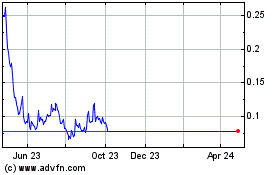

Navidea Biopharmaceuticals (AMEX:NAVB)

Historical Stock Chart

From Apr 2023 to Apr 2024