Filed Pursuant to Rule 424(b)(5)

Registration No. 333-231178

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, nor are they soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated June 25, 2020

Preliminary Prospectus Supplement

(To the Prospectus dated May 16, 2019)

MILESTONE SCIENTIFIC INC.

Shares of Common Stock

Warrants to Purchase Shares of Common Stock

We are offering shares of our common stock, par value $0.001 per share (“common stock”) and warrants to purchase shares of our common stock (and the shares of common stock issuable from time to time upon exercise of the warrants) pursuant to this prospectus supplement and the accompanying base prospectus in a firm commitment public offering. The common stock and warrants will be sold in combination, with a warrant to purchase shares of common stock accompanying each share of common stock sold. The combined purchase price for each share of common stock and accompanying warrant is $ . The warrants may only be exercised to purchase whole shares of common stock at an exercise price of $ per share and will expire on June , 2023. The common stock and the warrants are immediately separable and will be issued separately, but must be purchased together in this offering.

Our common stock is listed on the NYSE American stock exchange under the symbol “MLSS.” On June 24, 2020, the last reported sales price of our common stock on the NYSE American was $2.40 per share. There is no established trading market for the warrants, and we do not expect a market to develop. In addition, we do not intend to list the warrants on the NYSE American, any other national securities exchange, or any other nationally recognized trading system.

Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus and all information incorporated by reference therein. These documents contain information you should consider when making your investment decision.

Investing in these securities involves significant risks. Please read “Risk Factors” on page S-6 of this prospectus supplement, on page 3 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Share and Accompanying Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discount and commissions (1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

1. In addition, we have agreed to reimburse up to $50,000 of the actual out-of-pocket fees and expenses (including legal expenses) of Maxim Group LLC (the “underwriter”) in connection with this offering. See “Underwriting” for additional information about our compensation arrangements with the underwriter.

We have granted the underwriter a 45-day option to purchase up to additional shares of common stock and/or warrants to purchase up to shares of common stock to cover over-allotments, if any.

We expect to deliver the common stock and warrants being offered pursuant to this prospectus supplement on or about June , 2020.

Sole Book Running Manager

Maxim Group LLC

Prospectus Supplement dated June , 2020

TABLE OF CONTENTS

Prospectus Supplement

|

|

Page

|

|

ABOUT THIS PROSPECTUS SUPPLEMENT

|

S-1

|

|

|

|

|

FORWARD LOOKING STATEMENTS

|

S-2

|

|

|

|

|

PROSPECTUS SUMMARY

|

S-3

|

|

|

|

|

THE OFFERING

|

S-5

|

|

|

|

|

RISK FACTORS

|

S-6

|

|

|

|

|

USE OF PROCEEDS

|

S-10

|

|

|

|

|

DILUTION

|

S-10

|

|

|

|

|

CAPITALIZATION

|

S-11

|

|

|

|

|

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

|

S-11

|

|

|

|

|

DESCRIPTION OF COMMON STOCK

|

S-11

|

|

|

|

|

DESCRIPTION OF WARRANTS

|

S-12

|

|

|

|

|

UNDERWRITING

|

S-16

|

|

|

|

|

LEGAL MATTERS

|

S-18

|

|

|

|

|

EXPERTS

|

S-19

|

|

|

|

|

INFORMATION INCORPORATED BY REFERENCE

|

S-19

|

|

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

S-19

|

TABLE OF CONTENTS

Prospectus

|

|

Page

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

1

|

|

|

|

|

FORWARD-LOOKING STATEMENTS

|

2

|

|

|

|

|

PROSPECTUS SUMMARY

|

2

|

|

|

|

|

RISK FACTORS

|

3

|

|

|

|

|

THE BUSINESS

|

3

|

|

|

|

|

USE OF PROCEEDS

|

4

|

|

|

|

|

DESCRIPTION OF COMMON STOCK WE MAY OFFER

|

4

|

|

|

|

|

DESCRIPTION OF PREFERRED STOCK AND PREFERRED STOCK WE MAY OFFER

|

5

|

|

|

|

|

DESCRIPTION OF WARRANTS WE MAY OFFER

|

7

|

|

|

|

|

DESCRIPTION OF DEBT SECURITIES WE MAY OFFER

|

8

|

|

|

|

|

DESCRIPTION OF UNITS WE MAY OFFER

|

10

|

|

|

|

|

PLAN OF DISTRIBUTION

|

11

|

|

|

|

|

LEGAL MATTERS

|

13

|

|

|

|

|

EXPERTS

|

13

|

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. This document contains two parts. The first part consists of this prospectus supplement, which provides you with specific information about this offering. The second part, the accompanying prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both parts combined.

All references in this prospectus supplement to “Milestone,” “us,” “our,” “we” or “Milestone Scientific” refer to Milestone Scientific Inc. and its consolidated subsidiaries, Wand Dental, Inc., Milestone Advanced Cosmetic Inc. and Milestone Medical Inc. and affiliate, Milestone Education LLC, unless the context otherwise indicates. Milestone Scientific is the owner of the following U.S. registered trademarks: CompuDent®; CompuMed®; CompuFlo®; the CompuFlo design®; DPS Dynamic Pressure Sensing technology®; Milestone Scientific®; the Milestone design®; SafetyWand®; STA Single Tooth Anesthesia System®; and The Wand®. References to our “common stock” refer to the common stock of Milestone Scientific Inc., and references to “warrants” are to the warrants to purchase our common stock that are being sold in this offering.

This prospectus supplement, and the information incorporated herein by reference, may add, update or change information in the accompanying prospectus and any free writing prospectuses. You should read both this prospectus supplement, the accompanying prospectus, and any free writing prospectuses together with additional information described under the heading “Where You Can Find More Information.” If there is any inconsistency between the information in this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained in or incorporated by reference to this prospectus supplement, the accompanying prospectus, and any free writing prospectuses. We have not authorized any other person to provide information different from that contained in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein, and any free writing prospectuses. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in the accompanying prospectus and this prospectus supplement is accurate as of the dates on their respective covers, regardless of time of delivery of the prospectus and this prospectus supplement or any sale of securities. Our business, financial condition, results of operations, and prospects may have changed since those dates.

All references in this prospectus supplement to our consolidated financial statements include, unless the context indicates otherwise, the related notes.

The industry and market data and other statistical information contained in this prospectus supplement, the accompanying prospectus, and the documents we incorporate by reference are based on management’s own estimates, independent publications, government publications, reports by market research firms or other published independent sources, and, in each case, management believes are reasonable. Although we believe these sources are reliable, we have not independently verified the information. None of the independent industry publications used in this prospectus supplement, the accompanying prospectus or the documents we incorporate by reference were prepared on our behalf or on behalf of any of our affiliates and none of the sources cited by us consented to the inclusion of any data from its reports, and we have not sought their consent.

We are not making an offer to sell the securities covered by this prospectus supplement in any jurisdiction in which an offer or solicitation is not permitted or in which the person making the offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

FORWARD-LOOKING STATEMENTS

Certain statements made in this prospectus supplement are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of Milestone Scientific to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. Milestone Scientific’s plans and objectives are based, in part, on assumptions involving the continued expansion of its business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Milestone Scientific. Although Milestone Scientific believes that its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate. Considering the significant uncertainties inherent in the forward-looking statements included herein, particularly in view of the substantial doubt relating to our ability to continue as a going concern, our history of operating losses that are expected to continue, requiring additional funding, which we may be unable to raise when needed (which may force us to delay, curtail or eliminate commercialization efforts of our CompuFlo® Epidural Computer Controlled Anesthesia System), the ongoing COVID-19 pandemic, the early stage operations of and relative lack of acceptance of our medical products, relying exclusively on two third parties to manufacture our products, changes in our informal manufacturing arrangements made by the manufacturers of our products and disruptions at the manufacturing facilities of our manufacturers exposes us to risks that may harm our business, raising additional funds by issuing securities or through licensing or lending arrangements may cause dilution to our existing stockholders, restrict our operations or require us to relinquish proprietary rights, if physicians do not accept or use our CompuFlo® Epidural Computer Controlled Anesthesia System our ability to generate revenue from sales will be materially impaired, exposure to the risks inherent in international sales and operations, including China, and developments by competitors may render our products or technologies obsolete or non-competitive, the inclusion of such information should not be regarded as a representation by Milestone Scientific or any other person that the objectives and plans of Milestone Scientific will be achieved. Milestone Scientific undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

PROSPECTUS SUMMARY

The information below is only a summary of more detailed information included elsewhere in or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary may not contain all the information that is important to you or that you should consider before making a decision to invest in our common stock and warrants. Please read this entire prospectus supplement and the accompanying prospectus, including the risk factors, as well as the information incorporated by reference in this prospectus supplement and the accompanying prospectus, carefully.

About Milestone Scientific

Milestone Scientific is a biomedical technology research and development company that patents, designs, develops and commercializes innovative diagnostic and therapeutic injection technologies and devices for medical, dental, cosmetic and veterinary applications. Since our inception, we have engaged in pioneering proprietary, innovative, computer-controlled injection technologies and solutions for the medical and dental markets.

We have focused our resources on redefining the worldwide standard of care for injection techniques by making the experience more comfortable for the patient by reducing the anxiety and stress of receiving injections from the healthcare provider. We believe our computer-controlled injection devices make injections precise, efficient and virtually painless. Milestone’s proprietary DPS Dynamic Pressure Sensing technology® is our technology platform that we believe will advance the development of next-generation devices. It regulates flow rate and monitoring pressure from the tip of the needle through platform extensions for local anesthesia for subcutaneous drug delivery used in various dental and medical injections. It has specific medical applications for cosmetic botulinum toxin injections, epidural space identification in regional anesthesia procedures and intra-articular joint injections.

Milestone Scientific remains focused on advancing efforts to achieve the following four primary objectives:

|

|

●

|

Establishing Milestone’s DPS Dynamic Pressure Sensing technology platform as the standard-of-care in painless and precise drug delivery, providing for the first time, objective visual and audible in-tissue pressure feedback, and continuing to expand platform applications;

|

|

|

●

|

Following obtaining successful FDA clearance of our first medical devices, Milestone Scientific is transitioning from a research and development organization to a commercially focused medical device company;

|

|

|

●

|

Expanding our global footprint of our CompuFlo Epidural System by partnering with distribution companies worldwide; and

|

|

|

●

|

Continuing the development of our proprietary cosmetic injection device for delivery of botulinum toxin (such as Botox® and Dysport®).

|

Substantial Doubt About Our Ability to Continue as a Going Concern

The report of our independent auditors on our consolidated financial statements for the period ended December 31, 2019 included an emphasis of matter paragraph indicating (and a note to our consolidated financial statements for the quarter ended March 31, 2020 stated) that there was then substantial doubt about our ability to continue as a going concern. Our auditors’ doubts are based on our recurring losses from operations in relation to the likely resources to fund such losses.

Recent Developments

In the first quarter of 2020, and through the date of this prospectus supplement, the effects of the COVID-19 pandemic have dramatically reduced our marketing capabilities at dental offices, hospitals and medical centers in the U.S. and worldwide. Marketing persons have not been able to travel to or enter potential customer facilities and generally medical institutions have curtailed introduction of new instruments and procedures at this time. The challenge presented by the COVID-19 pandemic is expected to continue through the second and into the third quarter of this year as the U.S. and the other countries of the world, begin to slowly restart normal business operations. We anticipate that our revenue for the second quarter, and possibly the third quarter, will be materially and adversely affected. At this point in time, it is too early to give an estimate of what the second or third quarter impact will be or the effect of the COVID-19 pandemic and the government and industry response may have on our fourth quarter revenue.

As discussed in our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2020, we have consumed substantial amounts of cash since inception and expect to continue to spend substantial amounts on continuing our operations. In the first four months of the fiscal year ending December 31, 2020, our rate of cash usage for current activities has increased from our average monthly rate for current activities for the same period in the prior year, and our cash usage may continue at such a rate for the remainder of 2020. The capital raised in April 2020 provides us with working capital to continue marketing our CompuFlo® Epidural device and to market our dental devices. Now that the CompuFlo® Epidural System has obtained FDA clearance in the United States (June 2017), the development costs were reduced in 2019 but the selling costs are expected to continue to increase. With the FDA clearance, subject to having sufficient capital resources, the Company is proceeding to establish distribution in the U.S. and otherwise supporting the Epidural device commercialization process.

In April 2020, the Company completed an underwritten offering of shares of its common stock and warrants to purchase shares of common stock for net proceeds of approximately $4.6 million.

In the first quarter of 2020, Milestone China and Milestone Beijing entered into a plan to merge (the “Transaction”) into Anhui Maishida Medical Technology, Co. Ltd. (“Anhui”), a company affiliated with Milestone China with some common investors. Anhui will be the surviving entity after the merger and will have Milestone China’s factory and other assets, as well as complete responsibility for sales, marketing, and distribution for the Company’s dental products in China. Upon completion of the Transaction, Milestone Scientific is expected to have an approximate 28.4% direct ownership in Anhui, and Milestone China and Milestone Beijing are expected to be dissolved, subject to the required regulatory filings in Hong Kong and China. However, due to the COVID-19 pandemic, the regulatory process for the planned merger has been suspended, since applicable government offices are closed in China and Hong Kong.

On April 28, 2020, the Company entered into a settlement with United Systems for their outstanding manufacturing costs for hand pieces and single tooth anesthesia instruments supplied to Milestone China in 2018, which were billed and shipped by United Systems and not paid by Milestone China. In the settlement, United Systems sold its accounts receivable of $370,260 to the Company. Of that amount $100,000 was paid in cash in April 2020 and the Company issued 107,082 shares for a value of $170,000, based on the per share closing price on April 23, 2020, of $1.59. The balance of $100,000 is due to be paid in cash in July 2020.

On May 18, 2020, the Company a acquired 50% interest in Advance Cosmetic Systems Inc. held by Milestone China, for $900,000, which amount is offset by the balance owed by Milestone China to the Company. Due to the offset, no cash was payable to Milestone China. Milestone China has the option to repurchase from the Company the 50% interest in Advance Cosmetic Systems, exercisable within one year from May 18, 2020, for the same price of $900,000.

Corporate Information

We were organized in August 1989 under the laws of the State of Delaware. Our principal executive office is located at 425 Eagle Rock Avenue, Roseland, New Jersey 07068. Our telephone number is (973) 535-2717. Our common stock is listed on the NYSE American stock exchange under the ticker symbol “MLSS”.

THE OFFERING

|

Issuer:

|

Milestone Scientific Inc.

|

|

|

|

|

Securities offered by us:

|

shares of our common stock and warrants to purchase up to an aggregate of shares of common stock.

|

|

|

|

|

Warrants offered by us:

|

The warrants are immediately exercisable. However, they may only be exercised to purchase a whole share of common stock. The exercise price of the warrants is $ per share. The warrants will expire on June , 2023. This prospectus supplement also relates to the offering of the shares of common stock issuable upon exercise of the warrants.

|

|

|

|

|

Public offering price:

|

$ per share of common stock and warrant.

|

|

|

|

|

Shares of common stock outstanding after the offering (1):

|

shares (assuming none of the warrants issued in this offering are exercised).

|

|

|

|

|

Over-allotment option:

|

We have granted the underwriter a 45-day option to purchase up to an additional shares of common stock and/or warrants to purchase up to shares of common stock to cover over-allotments, if any

|

|

|

|

|

Use of proceeds:

|

Any net proceeds we may receive will be used for manufacturing, marketing, sales and distribution of our CompuFlo Epidural System and development of new products and new product uses, working capital and general corporate purposes. See “Use of Proceeds.”

|

|

|

|

|

NYSE American listing:

|

Our common stock is listed on the NYSE American under the symbol "MLSS." There is no established public trading market for the warrants and a market may never develop. We do not intend to list the warrants on the NYSE American, any other national securities exchange or other nationally recognized trading system.

|

|

|

|

|

Risk factors:

|

Investing in our common stock and warrants involves a high degree of risk and purchasers of our common stock and warrants may lose their entire investment. See “Risk Factors” and the other information included and incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of risk factors you should carefully consider before deciding to invest in our securities.

|

|

|

|

1. The number of shares of our common stock to be outstanding after this offering is based on 55,472,706 shares of our common stock outstanding as of May 31, 2020. The number of shares of common stock outstanding excludes 1,287,435 shares of common stock issuable upon exercise of outstanding stock options, which have a weighted average exercise price of $1.64 per share, 613,446 shares of common stock issuable upon exercise of outstanding warrants, which have a weighted average exercise price of $.50 per share and 2,629,000 shares of common stock issuable upon exercise of outstanding warrants, which have a weighted average exercise price of $1.20 per share .

RISK FACTORS

Any investment in our common stock and warrants involves a high degree of risk. You should carefully consider the risks and uncertainties described below and all of the information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus before deciding whether to purchase our common stock and warrants, including the risk factors contained herein and in the accompanying prospectus, as well as those in our periodic reports filed with the Securities and Exchange Commission incorporated by reference in this prospectus supplement and the accompanying prospectus, including those set forth in Item 1A to our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which is incorporated herein by reference. If any of these risks actually occurs, our business, financial condition, liquidity and results of operations would suffer. The risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See the information under the heading “Forward-Looking Statements” in this prospectus supplement.

RISKS RELATING TO THIS OFFERING

Business interruptions, including any interruptions resulting from the COVID-19 pandemic, have significantly disrupted our operations and will have a material adverse impact on our business.

The ongoing COVID-19 pandemic has resulted in adverse effects to our business and operations. The widespread closure and reduced hours of dental offices, hospitals and medical facilities, rules eliminating access to their facilities for marketing purposes, and the current unwillingness of medical institutions to introduce new equipment and procedures throughout the United States and in many parts of the rest of the world have dramatically reduced our marketing abilties and sales. If we are unable to continue selling our products to dental offices, hospitals and medical institutions, our revenue and results of operations will be severely and adversely impacted.

All of our employees are located in the U.S. Because we have relatively limited personnel, the prolonged illness, incapacitation or death of any of our executive officers or key personnel would severely, negatively impact our business. In addition to our employees, we rely on (i) distributors, agents and third-party logistics providers in connection with product sales and distribution, and (ii) raw material and component suppliers in the U.S., Europe and China. Disruptions to our, or any third-party's respective operations or facilities, or if we or any of these third-parties were to shut down for any reason, including by fire, natural disaster, such as a hurricane, tornado or severe storm, power outage, systems failure, labor dispute, pandemic or other unforeseen disruption, then we or they will be prevented or delayed from effectively operating our or their businesess, respectively.

Further, the continued duration of the COVID-19 pandemic could negatively impact the manufacture, supply, distribution and sale of our products and our financial results. The extent to which the coronavirus impacts our operations or those of our third-party partners will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the pandemic, new information that may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others. Any losses or damages we incur as a result of the COVID-19 pandemic could have a material adverse effect on our financial results and our ability to conduct business as expected.

Overall, the COVID-19 pandemic has had an adverse impact on our sales efforts and sales in the first half of the year. We anticipate that our revenue for the second quarter and the third quarter will be materially and adversely affected. At this point in time, it is too early to give an estimate of the effect of the COVID-19 pandemic and the governmental and industry response may have on our fourth quarter revenue. Nonetheless, we anticipate reduced sales and revenues during the full fiscal 2020 year.

You will experience immediate dilution in the book value per share of the common stock you purchase.

Because the price per share of our common stock being offered is substantially higher than the book value per share of our common stock, you will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. Based on the per share purchase price on the cover of this prospectus supplement, you will suffer immediate and substantial dilution of $ per share in the net tangible book value of the common stock, calculated as of March 31, 2020. See “Dilution” on page S-9 for a more detailed discussion of the dilution you will incur if you purchase shares of our common stock in this offering.

There is no public market for the warrants to purchase common stock being offered in this offering.

There is no established public trading market for the warrants being sold in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the warrants on any national securities exchange or other nationally recognized trading system, including the NYSE American. Without an active market, the liquidity of the warrants will be limited.

Management has broad discretion over the use of the proceeds from this offering. We may use the proceeds of this offering in ways that do not improve our operating results or the market value of our common stock.

We intend to use the net proceeds from the sale of common stock and warrants for manufacturing, marketing, sales and distribution of our CompuFlo Epidural System and development of new products and new product uses, working capital and general corporate purposes. However, we will have broad discretion in determining the specific uses of the net proceeds from the sale of the common stock and warrants and our allocations may change in response to a variety of unanticipated events, such as differences between our expected and actual revenues from operations or availability of commercial financing opportunities, unexpected expenses or expense overruns or unanticipated opportunities requiring cash expenditures. We will also have significant flexibility as to the timing and use of the net proceeds. As a result, investors will not have the opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use the net proceeds. You will rely on the judgment of our management with only limited information about their specific intentions regarding the use of proceeds. We may spend most of the net proceeds of this offering in ways which you may not agree with. If we fail to apply these funds effectively, our business, results of operations and financial condition may be materially and adversely affected.

The offering price will be set by our Board of Directors and does not necessarily indicate the actual or market value of our common stock.

Our Board of Directors will approve the offering price and other terms of this offering after considering, among other things: the number of shares authorized in our restated certificate of incorporation, as amended (our “certificate of incorporation”); the current market price of our common stock; trading prices of our common stock over time; the volatility of our common stock; our current financial condition and the prospects for our future cash flows; the availability of and likely cost of capital of other potential sources of capital; the characteristics of interested investors and market and economic conditions at the time of the offering. The offering price is not intended to bear any relationship to the book value of our assets or our past operations, cash flows, losses, financial condition, net worth or any other established criteria used to value securities. The offering price may not be indicative of the fair value of the common stock.

Provisions of the warrants in this offering could discourage an acquisition of us by a third party.

In addition to the discussion of the provisions of our certificate of incorporation and the terms of our warrants issued in the April 2020 offering, certain provisions of the warrants to be sold in this offering could make it more difficult or expensive for a third party to acquire us. The warrants prohibit us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving entity assumes our obligations under the warrants. These and other provisions of the warrants in this offering could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to the holders of our common stock and our other outstanding securities.

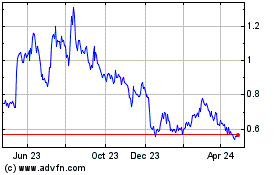

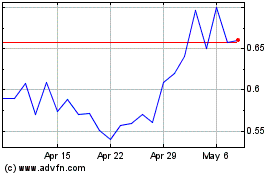

The market price of our common stock may be volatile and may fluctuate in a way that is disproportionate to our operating performance.

Our stock price may experience substantial volatility as a result of a number of factors, including:

|

|

●

|

the effects of COVID-19 on general economic conditions and on our business activities and our financial condition;

|

|

|

|

|

|

|

●

|

sales or potential sales of substantial amounts of our common stock and exercise for common stock of our outstanding warrant securities;

|

|

|

●

|

delay or failure in initiating our strategy to commercialize our CompuFlo Epidural System;

|

|

|

●

|

the success of our strategy to commercialize our CompuFlo Epidural System;

|

|

|

●

|

announcements about us or about our competitors, including clinical trial results, regulatory approvals or new product introductions that could adversely impact the market acceptance or competitive advantages of our CompuFlo Epidural System;

|

|

|

●

|

developments concerning our licensors or product manufacturers;

|

|

|

●

|

litigation and other developments relating to our patents or other proprietary rights or those of our competitors;

|

|

|

●

|

our ability to successfully develop and commercialize our products and services for the healthcare industry;

|

|

|

●

|

conditions in the medical device industry;

|

|

|

●

|

governmental regulation and legislation;

|

|

|

●

|

variations in our anticipated or actual operating results; and

|

|

|

●

|

change in securities analysts’ estimates of our performance, or our failure to meet analysts’ expectations.

|

Many of these factors are beyond our control. The stock markets in general, and the market for small, medical device companies, in particular, have historically experienced extreme price and volume fluctuations. These fluctuations often have been unrelated or disproportionate to the operating performance of these companies. These broad market and industry factors could reduce the market price of our common stock, regardless of our actual operating performance.

Sales of a substantial number of shares of our common stock, or the perception that such sales may occur, may adversely impact the price of our common stock.

Almost all of our outstanding shares of common stock, as well as a substantial number of shares of our common stock underlying outstanding warrants, are available for sale in the public market, either freely or pursuant to Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”). In addition, we have an effective S-3 registration statement on file with the SEC covering the sale by us of up to approximately $30 million of securities (less the dollar amount of securities previously sold in April 2020 and this offering), including common stock, preferred stock, debt, convertible debt, warrants and units. Sales of a substantial number of shares of our common stock, or the perception that such sales may occur, may adversely impact the price of our common stock.

If we fail to adhere to the strict listing requirements of NYSE American, we may be subject to delisting. As a result, our stock price may decline, and our common stock may be de-listed. If our stock were no longer listed on NYSE American, the liquidity of our securities likely would be impaired.

Our common stock currently trades on the NYSE American under the symbol “MLSS”. If we fail to adhere to NYSE American's strict listing criteria, including with respect to stock price, our market capitalization and stockholders’ equity, our stock may be de-listed. This could potentially impair the liquidity of our securities not only in the number of shares that could be bought and sold at a given price, which may be depressed by the relative illiquidity, but also through delays in the timing of transactions and the potential reduction in media coverage. As a result, you may find it more difficult to dispose of our common stock. Any failure at any time to meet the continuing NYSE American listing requirements could have an adverse impact on the value of and trading activity in our common stock.

While we recently regained compliance with the NYSE American listing requirements, there can be no assurance that we will be able to maintain compliance with these requirements. If we fail to adhere to these listing requirements, we may be unable to regain compliance with the exchange’s requirements, which would result in our shares being delisted from the NYSE American. If our shares were delisted, the liquidity of our shares would be severely impaired and you may lose the value of your investment.

USE OF PROCEEDS

We estimate the net proceeds from this offering will be approximately $ , after deducting estimated offering expenses payable by us. We intend to use the net proceeds from this offering, and any proceeds from the exercise of the warrants, for the manufacturing, marketing, sales and distribution of our CompuFlo Epidural System, the development of new products and new product uses, general corporate and working capital purposes.

DILUTION

If you purchase securities in this offering, your interest will be immediately and substantially diluted to the extent of the difference between the public offering price per share of our common stock and accompanying warrant, assuming $ of the public offering price is attributable to each warrant to purchase up to shares of common stock, and the as adjusted net tangible book value per share of our common stock after giving effect to this offering.

Our net tangible book value as of March 31, 2020 was approximately $118,822, or approximately $.002 per share. Net tangible book value is determined by subtracting our total liabilities from our total tangible assets, and net tangible book value per share is determined by dividing our net tangible book value by the number of outstanding shares of our common stock. After giving effect to the sale of shares of our common stock and accompanying warrants to purchase up to shares of our common stock in this offering at the public offering price of $ per share (assuming $ of the public offering price is attributable to each warrant to purchase up to _____ shares of common stock), and after deducting the underwriting discount and commissions, and estimated offering expenses payable by us, and excluding the proceeds attributable to sale of the warrants and the proceeds, if any, from the exercise of the warrants issued pursuant to this offering, our adjusted net tangible book value as of March 31, 2020 would have been approximately $ , or approximately $ per share. This represents an immediate increase in net tangible book value of approximately $ per share to our existing stockholders and an immediate dilution in net tangible book value of approximately $ per share to investors participating in this offering. The following table illustrates this calculation on a per share basis:

|

Public offering price per share of common stock, not including $ of the offering price per share attributable to each warrant for shares of common stock

|

$

|

|

Net tangible book value per share as of March 31, 2020

|

$.002

|

|

Increase in net tangible book value per share attributable to this offering

|

$

|

|

Adjusted net tangible book value per share after this offering

|

$

|

|

Amount of dilution in net tangible book value per share to new investors in this offering

|

$

|

The information above assumes that the underwriter does not exercise its over-allotment option. If the underwriter exercised its over-allotment option in full, the as-adjusted net tangible book value (not including amounts attributable to the warrants) will increase to $ per share, representing an immediate increase to existing stockholders of $ per share and an immediate dilution of $ per share to participants in this offering.

The above discussion and table are based on 49,860,201 shares of common stock outstanding as of March 31, 2020. Excluded from the above calculations are the 5,420,000 shares of common stock sold in the April 2020 public offering, the 1,262,440 shares of common stock issuable upon exercise of stock options outstanding as of March 31, 2020, which have a weighted average exercise price of $1.64 per share, the 613,446 shares of common stock issuable upon exercise of warrants outstanding as of March 31, 2020, which have a weighted average exercise price of $.50 per share, and the 2,710,000 shares of common stock issuable upon exercise of outstanding warrants issued in the April 2020 public offering, which have an exercise price of $1.20 per share.

capitalization

The following table sets forth our cash and cash equivalents and capitalization, as of March 31, 2020:

• on an actual basis; and

• on a pro forma basis, based on (i) net proceeds of $4,634,861 from the sale of common stock and warrants to acquire 0.50 of a share of common stock at a purchase price of $0.95 in an underwritten public offering consummated on April 14, 2020, and (ii) the sale of shares of common stock and warrants in this offering at an offering price of $ per share of common stock and accompanying warrant after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

You should consider this table in conjunction with “Use of Proceeds” above as well as our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the notes to those financial statements contained within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, incorporated by reference in this prospectus.

|

|

|

As of March 31, 2020

|

|

|

|

Unaudited,

Actual

|

|

|

Unaudited,

Pro forma

|

|

Cash and cash equivalents

|

|

$

|

765,975

|

|

|

$

|

|

|

Stockholders’ Equity:

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

49,893

|

|

|

|

|

|

Additional paid-in capital

|

|

|

96,553,976

|

|

|

|

|

|

Accumulated deficit

|

|

|

(95,124,512)

|

|

|

|

|

|

Treasury stock, at cost, 33,333 shares

|

|

|

(911,516)

|

|

|

|

|

|

Noncontrolling interest

|

|

|

(80,012)

|

|

|

|

|

|

Total Stockholders’ Equity

|

|

$

|

487,829

|

|

|

$

|

|

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

In this offering, we are offering shares of common stock and warrants to purchase up to _______ shares of common stock. The exercise price of the warrants is $ per share of common stock. No fractional shares will be issued. The common stock and the warrants are immediately separable and will be issued separately. This prospectus supplement also relates to the offering of the common stock issuable upon exercise of the offered warrants.

DESCRIPTION OF COMMON STOCK

The following description of our common stock is only a summary. This description is subject to, and qualified in its entirety by reference to, our certificate of incorporation and amended and restated bylaws (the “bylaws”), each of which has previously been filed with the SEC, and the Delaware General Corporation Law (“DGCL”).

Common Stock

Our authorized capital stock includes 75,000,000 shares of common stock, par value $0.001 per share. As of March 31, 2020, there were 49,893,534 shares of common stock issued, 49,860,201 shares outstanding and 33,333 shares of common stock held in the treasury. In connection with the underwritten offering consummated on April 14, 2020, we issued 5,420,000 shares of common stock, and warrants to acquire up to 2,710,000 shares of our common stock, at an exercise price of $1.20 per share, which have been reserved. The following description of the rights of the common stock do not apply to the treasury shares.

The holders of outstanding common stock are entitled to receive dividends out of assets legally available therefor at such times and in such amounts as the Board of Directors may from time to time determine. Each stockholder is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Directors are elected by plurality vote. Therefore, the holders of a majority of the common stock voted can elect all of the directors then standing for election. The common stock is not entitled to preemptive rights and is not subject to conversion. If we are liquidated or dissolved or our business is otherwise wound up, the holders of common stock would be entitled to share ratably in the distribution of all of our assets remaining available for distribution after satisfaction of all our liabilities and the payment of the liquidation preference of any outstanding preferred shares.

Authorized but Unissued Common Stock

The DGCL does not require stockholder approval for any issuance of authorized shares, except in certain limited circumstances. However, the listing requirements of the NYSE American, which apply for so long as our common stock is listed on the NYSE American, require stockholder approval of certain issuances (other than a public offering) equal to or exceeding 20% of the then outstanding voting power or then outstanding number of shares of common stock, as well as for certain issuances of stock in compensatory transactions. We will not need to obtain stockholder approval for the issuance of the common stock to be sold in this offering. These additional shares may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions. One of the effects of the existence of unissued and unreserved shares of common stock may be to enable our Board of Directors to sell shares to persons friendly to current management, for such consideration, in form and amount, as is acceptable to the Board, which issuance could render more difficult or discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of our management and possibly deprive stockholders of opportunities to sell their common stock at prices higher than prevailing market prices.

DESCRIPTION OF WARRANTS

The following summary of certain terms and provisions of the warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by the provisions of the warrant, the form of which will be filed with the SEC by us as an exhibit to a Current Report on Form 8-K in connection with this offering. Prospective investors should carefully review the terms and provisions of the form of the warrant for a complete description of the terms and conditions of the warrants.

Warrants

Duration and Exercise Price. In connection with this offering, we will issue warrants to purchase up to _____ shares of our common stock. For every share of common stock sold in this offering, we will issue a warrant to purchase _____ of a share of common stock. The warrants may only be exercised to purchase whole shares of common stock. At the Company’s election, fractional shares will be paid in cash or rounded up to the next whole share. The exercise price of the warrants is $ per share of common stock, subject to adjustments as discussed below. The exercise of the warrants may be at any time commencing upon consummation of this offering and terminating at 5:00 p.m., New York City time, on June , 202_. After the exercise period, holders of the warrants will have no further rights to purchase the common stock underlying the warrants.

Exercisability. The warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder may not exercise any portion of the warrant to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would own more than 4.99% of the outstanding shares of common stock after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding shares after exercising the holder’s warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the warrants.

Cashless Exercise. If, at the time a holder exercises its warrant, there is no effective registration statement registering, or the prospectus contained therein is not available for an issuance of the shares underlying the warrant to the holder, then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the warrant.

Fundamental Transactions. In the event of any fundamental transaction, as described in the warrants and generally including any merger with or into another entity, sale, lease, license or other disposition of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our common stock, then upon any subsequent exercise of a warrant, the holder will have the right to receive as alternative consideration, for each share of our common stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of common stock of the successor or acquiring corporation or of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of common stock for which the warrant is exercisable immediately prior to such event.

Adjustments. If we, at any time while the warrant is outstanding: (i) pay a stock dividend or otherwise make a distribution or distributions on shares of common stock or any other equity or equity equivalent securities payable in shares of common stock (not including any shares of common stock issued by us upon exercise of the warrant), (ii) subdivide outstanding shares of common stock into a larger number of shares, (iii) combine (including by way of reverse stock split) outstanding shares of common stock into a smaller number of shares, or (iv) issue by reclassification of shares of common stock any shares of our capital stock, then in each case the exercise price of the warrant and the number of shares of common stock issuable upon exercise of the warrant will be proportionately adjusted such that the aggregate exercise price will remain unchanged.

Transferability. Subject to applicable laws and the restriction on transfer set forth in the warrant, the warrants may be transferred at the option of the holder upon surrender of the warrant to us together with the appropriate instruments of transfer.

Listing. We do not intend to list the warrants on the NYSE American, any other national securities exchange or any other nationally recognized trading system.

Right as a Stockholder. Holders of the warrants will not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their warrants, with exceptions for participation in rights offerings or extraordinary distributions.

Anti-Takeover Provisions

Delaware Law

We are subject to Section 203 of the DGCL. This provision generally prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years following the date the stockholder became an interested stockholder, unless:

• prior to such date, the board of directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

• upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of voting shares outstanding those shares owned by persons who are directors and also officers and by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

• on or subsequent to such date, the business combination is approved by the board of directors and authorized at an annual meeting or special meeting of stockholders and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

Section 203 defines a business combination to include:

• any merger or consolidation involving the corporation and the interested stockholder;

• any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

• subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

• any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

• the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

In general, Section 203 defines an “interested stockholder” as any entity or person beneficially owning 15% or more of the outstanding voting stock of a corporation, or an affiliate or associate of the corporation and was the owner of 15% or more of the outstanding voting stock of a corporation at any time within three years prior to the time of determination of interested stockholder status; and any entity or person affiliated with or controlling or controlled by such entity or person.

These statutory provisions could delay or frustrate the removal of incumbent directors or a change in control of us. They could also discourage, impede, or prevent a merger, tender offer, or proxy contest, even if such event would be favorable to the interests of stockholders.

Certificate of Incorporation and Bylaw Provisions

Our certificate of incorporation and bylaws contain provisions that could have the effect of discouraging potential acquisition proposals or making a tender offer or delaying or preventing a change in control, including changes a stockholder might consider favorable. In particular, the certificate of incorporation and bylaws, as applicable, among other things:

• provide our board of directors with the ability to alter its bylaws without stockholder approval; and

• provide that vacancies on our board of directors may be filled by a majority of directors in office, although less than a quorum.

Such provisions may have the effect of discouraging a third-party from acquiring us, even if doing so would be beneficial to our stockholders. These provisions are intended to enhance the likelihood of continuity and stability in the composition of our board of directors and in the policies formulated by them, and to discourage some types of transactions that may involve an actual or threatened change in control of us. These provisions are designed to reduce our vulnerability to an unsolicited acquisition proposal and to discourage some tactics that may be used in proxy fights. We believe that the benefits of increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure our Company outweigh the disadvantages of discouraging such proposals because, among other things, negotiation of such proposals could result in an improvement of their terms. However, these provisions could have the effect of discouraging others from making tender offers for our shares that could result from actual or rumored takeover attempts. These provisions also may have the effect of preventing changes in our management.

Our certificate of incorporation provides that no director is personally liable to us or our stockholders for monetary damages for any breach of fiduciary duty by such director as a director. Nonetheless, a director is liable to the extent provided by applicable law, (i) for breach of the director’s duty of loyalty to us or our stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) pursuant to Section 174 of the DGCL (relating to unlawful payment of dividend or unlawful stock purchase or redemption) or (iv) for any transaction from which the director derived an improper personal benefit. If the DGCL

is amended to authorize the further elimination or limitation of the liability of directors, then the liability of one of our directors, in addition to the limitation on personal liability provided in our certificate of incorporation, will be limited to the fullest extent permitted by the amended DGCL. No amendment to or repeal of the relevant article of our certificate of incorporation will apply to or have any effect on the liability or alleged liability of any of our directors for or with respect to any acts or omissions of such director occurring prior to such amendment.

Our certificate of incorporation furthermore states that we shall indemnify, to the fullest extent permitted by Section 145 of the DGCL, as amended from time to time, each person that such section grants us the power to indemnify. Insofar as indemnification for liability under the Securities Act may be permitted for our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

Dividends

We have not declared or paid any cash dividends on our common stock, and we do not anticipate declaring or paying cash dividends for the foreseeable future. We are not subject to any legal restrictions respecting the payment of dividends, except that we may not pay dividends if the payment would render us insolvent. Any future determination as to the payment of cash dividends on our common stock will be at our board of directors’ discretion and will depend on our financial condition, operating results, capital requirements and other factors that our board of directors considers to be relevant. Currently, the board of directors does not intend to pay any cash dividends, but retain all funds for working capital.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock and warrants is Continental Stock Transfer & Trust Company.

UNDERWRITING

Maxim Group LLC has agreed to act as the sole underwriter and book-running manager for the offering. Subject to the terms and conditions of an underwriting agreement, dated June , 2020 between Maxim Group LLC and us (the “underwriting agreement”), the underwriter has agreed to purchase, and we have agreed to sell to it, the number of shares of common stock and warrants at the public offering price, less the underwriting discounts and commissions, as set forth on the cover page of this prospectus supplement and as indicated below:

|

Underwriter

|

|

Number of Shares

|

|

Number of Warrants

|

|

Maxim Group LLC

|

|

|

|

|

|

Total

|

|

|

|

|

The underwriting agreement provides that the obligation of the underwriter to pay for and accept delivery of the shares of common stock and warrants to purchase common stock offered by this prospectus are subject to the approval of certain legal matters by its counsel and other conditions. The underwriter is obligated to take and pay for all of the shares and warrants offered by this prospectus supplement if any such shares and warrants are taken, other than those shares and/or warrants covered by the over-allotment option described below.

Over-Allotment Option

We have granted to the underwriter an option, exercisable not later than 45 days after the effective date of the underwriting agreement, to purchase up to additional shares of common stock and/or additional warrants to purchase up to shares of common stock at the public offering price less the underwriting discounts and commissions set forth on the cover of this prospectus supplement. The underwriter may exercise this option only to cover over-allotments made in connection with this offering. We will be obligated, pursuant to the option, to sell these additional shares and/or additional warrants to the underwriter to the extent the option is exercised. If any additional shares and/or additional warrants are purchased, the underwriter will offer the additional shares and/or additional warrants on the same terms as those on which the other shares and/or warrants are being offered hereunder.

Commissions

We have agreed to pay the underwriter a cash fee equal to 7.0% of the gross proceeds in this offering. The underwriter proposes to offer the shares and accompanying warrants directly to the public at the public offering price set forth on the cover of this prospectus supplement. In addition, the underwriter may offer some of the shares and warrants to other securities dealers at such price less a concession of up to % or $ per share and accompanying warrant. After the offering to the public, the offering price and other selling terms may be changed by the underwriter without changing the proceeds we will receive from the underwriter.

The following table summarizes the public offering price, underwriting commissions and proceeds before expenses to us assuming both no exercise and full exercise of the underwriter’s option to purchase additional shares and warrants. The underwriting commissions are equal to the public offering price per share and accompanying warrant less the amount per share and accompanying warrant the underwriter pays us for the shares and accompanying warrant.

|

|

|

Per Share and Accompanying Warrant

|

|

Total Without Over-Allotment

|

|

Total With Over-Allotment

|

|

Public offering price

|

$

|

|

$

|

|

$

|

|

|

Underwriting discounts and commissions

|

$

|

|

$

|

|

$

|

|

|

Proceeds, before expenses, to us

|

$

|

|

$

|

|

$

|

|

We estimate that the total expenses of the offering, including registration, filing and listing fees, printing fees and legal and accounting expenses, but excluding underwriting discounts and commissions, will be approximately $ , all of which are payable by us.

Lock-Up Agreements

We and each of our executive officers and directors have agreed, subject to certain exceptions, not to offer, issue, sell contract to sell, encumber, grant any option for the sale of or otherwise dispose of any shares of our common stock or other securities convertible into or exercisable or exchangeable for shares of our common stock for a period of ninety (90) days after the date of this prospectus supplement without the prior written consent of Maxim Group LLC.

Price Stabilization, Short Positions and Penalty Bids

In connection with this offering, the underwriter may engage in transactions that stabilize, maintain or otherwise affect the price of our common stock. Specifically, the underwriter may over-allot in connection with this offering by selling more shares than are set forth on the cover page of this prospectus supplement. This creates a short position in our common stock for the underwriter’s own account. The short position may be either a covered short position or a naked short position. In a covered short position, the number of shares of common stock over-allotted by the underwriter is not greater than the number of shares of common stock that they may purchase in the over-allotment option. In a naked short position, the number of shares of common stock involved is greater than the number of shares of common stock in the over-allotment option. To close out a short position, the underwriter may elect to exercise all or part of the over-allotment option. The underwriter may also elect to stabilize the price of our common stock or reduce any short position by bidding for, and purchasing, common stock in the open market.

The underwriter may also impose a penalty bid. This occurs when a particular underwriter or dealer repays selling concessions allowed to it for distributing a security in this offering because the underwriter repurchases that security in stabilizing or short covering transactions.

Finally, the underwriter may bid for, and purchase, shares of our common stock in market making transactions, including “passive” market making transactions as described below.

These activities may stabilize or maintain the market price of our common stock at a price that is higher than the price that might otherwise exist in the absence of these activities. The underwriter is not required to engage in these activities, and may discontinue any of these activities at any time without notice. These transactions may be effected on the NYSE American stock exchange, in the over-the-counter market, or otherwise.

In connection with this offering, the underwriter and selling group members, if any, or their affiliates may engage in passive market making transactions in our common stock immediately prior to the commencement of sales in this offering, in accordance with Rule 103 of Regulation M under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Rule 103 generally provides that:

• a passive market maker may not effect transactions or display bids for our common stock in excess of the highest independent bid price by persons who are not passive market makers;

• net purchases by a passive market maker on each day are limited to 30% of the passive market maker’s average daily trading volume in our common stock during a specified two-month prior period or 200 shares, whichever is greater, and must be discontinued when that limit is reached; and

• passive market making bids must be identified as such.

Other Terms

In addition, we have agreed to reimburse the underwriter for all reasonable out-of-pocket expenses up to $50,000, including but not limited to reasonable legal fees, actually incurred by the underwriter in connection with the offering. In the event the offering is not consummated, we will reimburse the underwriter for all such expenses actually incurred up to $25,000.

If we elect to terminate this offering for any reason (other than for cause) even though the underwriter was prepared to proceed with the offering, if within 12 months following the termination, we complete any financing of equity, equity-linked or debt or other capital raising activity with any of the investors contacted by the underwriter, then we will be required to pay to the underwriter upon the closing of the financing the cash fee described above.

We have also granted the underwriter a right of first refusal to act as placement agent, underwriter or book runner and/or placement agent on any subsequent private or public equity and public debt offerings of our securities for a period of 12 months from the sale of common stock and warrants in this offering.

Our Relationship with the Underwriter

The underwriter and its affiliates have engaged, and may in the future engage, in investment banking transactions and other commercial dealings in the ordinary course of business with us. The underwriter has received, or may in the future receive, customary fees and commissions for these transactions.

Indemnification

We have agreed to indemnify the underwriter against certain liabilities, including liabilities under the Securities Act, and liabilities arising from breaches of representations and warranties contained in the underwriting agreement, or to contribute to payments that the underwriter may be required to make in respect of those liabilities.

Electronic Distribution

This prospectus supplement and the accompanying base prospectus may be made available in electronic format on websites or through other online services maintained by the underwriter or by an affiliate. Other than this prospectus supplement and the accompanying base prospectus, the information on the underwriter’s website and any information contained in any other website maintained by the underwriter is not part of this prospectus supplement and the accompanying base prospectus or the registration statement of which this prospectus supplement and the accompanying base prospectus forms a part, has not been approved and/or endorsed by us or the underwriter, and should not be relied upon by investors.

The foregoing does not purport to be a complete statement of the terms and conditions of the underwriting agreement. A copy of the underwriting agreement is included as an exhibit to our Current Report on Form 8-K filed with the SEC in connection with this offering and incorporated by reference into the Registration Statement of which this prospectus supplement forms a part. See “Where You Can Find More Information.”

Selling Restrictions

No action has been taken in any jurisdiction (except in the United States) that would permit a public offering of our common stock and warrants, or the possession, circulation or distribution of this prospectus supplement, the accompanying prospectus or any other material relating to us or our common stock and warrants in any jurisdiction where action for that purpose is required. Accordingly, our common stock and warrants may not be offered or sold, directly or indirectly, and none of this prospectus supplement, the accompanying prospectus or any other offering material or advertisements in connection with our common stock and warrants may be distributed or published, in or from any country or jurisdiction, except in compliance with any applicable rules and regulations of any such country or jurisdiction.

LEGAL MATTERS

The validity of the securities offered by this prospectus supplement will be passed upon for us by Golenbock Eiseman Assor Bell & Peskoe LLP, New York, New York. Harter Secrest & Emery LLP, Rochester, New York, is acting as counsel for the underwriter in connection with this offering.

EXPERTS

The consolidated financial statements incorporated in this prospectus supplement by reference to the Annual Report on Form 10-K for the year ended December 31, 2019, have been so incorporated in reliance on the report of Friedman LLP (which includes an explanatory paragraph as to the Company’s ability to continue as a going concern), an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

INFORMATION INCORPORATED BY REFERENCE

This prospectus supplement “incorporates by reference” certain information that we have filed with the SEC under the Exchange Act. This means we are disclosing important information to you by referring you to those documents. We incorporate by reference the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until the offering is terminated:

|

● Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed on March 30, 2020;

|

|

● Annual Report on Form 10-K/A for the fiscal year ended December 31, 2019, filed on April 2, 2020;

● Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, filed on May 15, 2020;

● Current Report on Form 8-K, filed on April 9, 2020;

● Current Report on Form 8-K, filed on May 5, 2020;

● Current Report on Form 8-K, filed on May 22, 2020; and

|

|

● The description of Milestone’s Common Stock contained in Exhibit 4.6 to its Annual Report on Form 10-K/A for the fiscal year ended December 31, 2019, filed on April 2, 2020, including any further amendment or report filed hereafter for the purpose of updating such description.

|

You should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone to provide you with different information. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of this document. All documents that we file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus or after the date of the registration statement of which this prospectus forms a part and prior to the termination of the offering will be deemed to be incorporated in this prospectus by reference and will be a part of this prospectus from the date of the filing of the document. Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus, except in case the information contained in such document to the extent “furnished” and not “filed” will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement that is modified or superseded will not constitute a part of this prospectus, except as modified or superseded.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement under the Securities Act that registers the securities offered hereby. The registration statement, including the exhibits and schedules attached thereto and the information incorporated by reference therein, contains additional relevant information about the securities and our Company, which we are allowed to omit from this prospectus supplement pursuant to the rules and regulations of the SEC. In addition, we file annual, quarterly and current reports and proxy statements and other information with the SEC. Our SEC filings are also available on the SEC’s website at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.milestonescientific.com. We have not incorporated by reference into this prospectus supplement the information on our website and it is not a part of this document.

PROSPECTUS

$30,000,000

MILESTONE SCIENTIFIC INC.

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

This prospectus relates to common stock, preferred stock, debt securities, warrants and units that we may sell from time to time in one or more offerings up to a total public offering price of $30,000,000 on terms to be determined at the time of sale. We will provide specific terms of these securities in supplements to this prospectus. You should read this prospectus and any supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement for those securities.