Current Report Filing (8-k)

May 15 2020 - 4:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 15, 2020

|

|

|

|

|

THE LGL GROUP, INC.

|

|

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

Delaware

|

001-00106

|

38-1799862

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

2525 Shader Road, Orlando, FL

|

32804

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (407) 298-2000

|

|

|

|

|

(Former Name or Former Address, If Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01

|

|

LGL

|

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01.Entry into a Material Definitive Agreement.

On May 12, 2020, M-Tron Industries, Inc. and Piezo Technology, Inc. (collectively, the “Borrowers”), both operating subsidiaries of The LGL Group, Inc. (the “Company”), entered into a loan agreement for a revolving line of credit with Synovus Bank, an unaffiliated entity, as the lender (“Lender”), for up to $3.5 million (the “Loan Agreement”), such amount to be used for working capital and general operations. The Loan Agreement is evidenced by a promissory note dated May 12, 2020 that matures on May 12, 2022 (the “Note”), and a corresponding security agreement (the “Security Agreement”). The Note bears interest at the London Inter-bank Offered Rate (LIBOR) 30-day rate plus 2.50%, with a floor of 0.50%. Accrued interest-only payments are due on a monthly basis until the maturity date. The Borrowers may prepay all or any portion of the loans under the Loan Agreement at any time, without fee, premium or penalty.

The Loan Agreement contains various affirmative and negative covenants that are customary for lines of credit and transactions of this type, including limitations on the incurrence of debt and liabilities by the Borrowers, as well as financial reporting requirements. The Loan Agreement also imposes certain financial covenants based on the following criteria, which are specifically defined in the Loan Agreement: (a) Debt Service Coverage Ratio; and (b) the ratio of Total Liabilities to Total Net Worth.

In the event of default, the Lender has the right to terminate its commitment to make loans pursuant to the Loan Agreement and to accelerate the payment on any unpaid principal amount of all outstanding loans and interest thereon. All loans pursuant to the Loan Agreement are secured by a continuing and unconditional first priority security interest in and to any and all property of the Borrowers.

The foregoing description of the Loan Agreement, Note, and Security Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Loan Agreement, Note, and Security Agreement, copies of which are filed as Exhibits 10.1, 10.2, and 10.3, respectively, to this Current Report on Form 8-K and incorporated herein by reference..

Item 1.02.Termination of a Material Definitive Agreement.

As previously reported in a Current Report on Form 8-K filed by the Company on April 20, 2020, Piezo Technology, Inc., M-Tron Industries, Inc., and Precise Time and Frequency LLC, all operating subsidiaries of the Company, entered into loans on April 15, 2020 with City National Bank of Florida, a national banking association, as the lender, in an aggregate principal amount of $1,907,500 pursuant to the Paycheck Protection Program under the Coronavirus Aid, Relief, and Economic Security Act. On May 14, 2020, the Company returned all amounts pursuant to such loans and such loans were thereby terminated.

Item 2.02.Results of Operations and Financial Condition.

The information contained in Item 7.01 is incorporated by reference into this Item 2.02.

Item 2.03.Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Reference is made to the disclosure under Item 1.01 above, which is hereby incorporated in this Item 2.03 by reference.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On May 15, 2020, The Company issued a press release (the “Press Release”) announcing its financial results for the three months ended March 31, 2020, and other financial information. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information furnished pursuant to this Item 7.01 of this Current Report on Form 8-K, including the exhibits hereto, shall not be considered “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any future filings by the Company under the Securities Act of 1933, as amended, or under the Exchange Act, unless the Company expressly sets forth in such future filing that such information is to be considered “filed” or incorporated by reference therein.

Item 9.01.Financial Statements and Exhibits.

(d)Exhibits

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

Loan Agreement by and among M-Tron Industries, Inc., Piezo Technology, Inc. and Synovus Bank, dated May 12, 2020.

|

|

10.2

|

Promissory Note in favor of Synovus Bank, dated May 12, 2020.

|

|

10.3

|

Security Agreement by and among M-Tron Industries, Inc., Piezo Technology, Inc. and Synovus Bank, dated May 12, 2020.

|

|

99.1

|

Press Release dated May 15, 2020.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

May 15, 2020

|

THE LGL GROUP, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ James W. Tivy

|

|

|

|

Name:

|

James W. Tivy

|

|

|

|

Title:

|

Chief Financial Officer

|

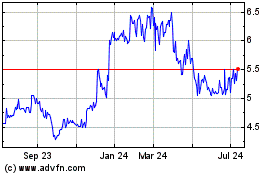

LGL (AMEX:LGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

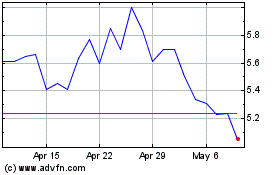

LGL (AMEX:LGL)

Historical Stock Chart

From Apr 2023 to Apr 2024