inTEST Reports Third Quarter 2009 Results

November 04 2009 - 4:30PM

PR Newswire (US)

CHERRY HILL, N.J., Nov. 4 /PRNewswire-FirstCall/ -- inTEST

Corporation (NASDAQ:INTT), an independent designer, manufacturer

and marketer of semiconductor automatic test equipment (ATE)

interface solutions and temperature management products, today

announced results for the quarter and nine months ended September

30, 2009. Net revenues for the quarter ended September 30, 2009

were $6.0 million, compared to $4.7 million for the second quarter

of 2009. Our net loss for the third quarter of 2009 was $(278,000)

or $(0.03) per diluted share, compared to a net loss of $(2.0)

million or $(0.20) per diluted share for the second quarter of

2009. The net loss for the third quarter of 2009 included

restructuring charges of $(27,000) or $(0.00) per diluted share.

The net loss for the second quarter of 2009 included restructuring

charges of $(269,000) or $(0.03) per diluted share. The

restructuring charges recorded during the third quarter were

incurred by our Mechanical Products segment while the restructuring

charges recorded during the second quarter of 2009 were incurred by

all of our product segments. The restructuring charges during the

third quarter consist of facility closure costs for our Japanese

subsidiary while the restructuring charges during the second

quarter consisted of one-time termination benefits as a result of

the workforce reductions we implemented in all three product

segments. Robert E. Matthiessen, President and Chief Executive

Officer of inTEST commented, "We entered this quarter surmising

that the upturn in bookings we experienced at the end of the second

quarter of 2009 represented the beginnings of recovery from the

extended downturn of the semiconductor capital equipment business.

Our business results in the third quarter re-enforce our opinion

that we are seeing a broad-based gradual recovery in the automatic

test equipment market. Net revenues for the third quarter increased

29% over the second quarter while third quarter gross margin

increased 72% over the second quarter. All of our product segments

experienced quarter-over-quarter revenue growth with Mechanical

Products increasing 10%, Thermal Products 15% and Electrical

Products 390%. Bookings for the quarter ended September 30, 2009

were $7.9 million, an increase of 73% over the second quarter

bookings. The increase in business is such that we are now faced

with the challenge of production ramp-up, a challenge we heartily

embrace. Although the business outlook has become more positive, we

will proceed with great prudence monitoring operating expenses as

we increase production output." Conference Call Information There

will be a conference call with investors and analysts this evening

at 5:00 pm ET to discuss the Company's third quarter 2009 results

and management's current expectations and views of the industry.

The call may also include discussion of strategic, operating,

product initiatives or developments, or other matters relating to

the Company's current or future performance. About inTEST

Corporation inTEST Corporation is an independent designer,

manufacturer and marketer of ATE interface solutions and

temperature management products, which are used by semiconductor

manufacturers to perform final testing of integrated circuits (ICs)

and wafers. The Company's high-performance products are designed to

enable semiconductor manufacturers to improve the speed,

reliability, efficiency and profitability of IC test processes.

Specific products include positioner and docking hardware products,

temperature management systems and customized interface solutions.

The Company has established strong relationships with semiconductor

manufacturers globally, which it supports through a network of

local offices. For more information visit http://www.intest.com/.

CONTACT: Hugh T. Regan, Jr., Treasurer and Chief Financial Officer,

inTEST Corporation, 856-424-6886, ext 201. Forward-Looking

Statements: This press release includes forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements do not convey historical information, but

relate to predicted or potential future events that are based upon

management's current expectations. These statements are subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. In

addition to the factors mentioned in this press release, such risks

and uncertainties include, but are not limited to, changes in

business conditions and the economy, generally; changes in the

demand for semiconductors, generally; changes in the rates of, and

timing of, capital expenditures by semiconductor manufacturers;

progress of product development programs; increases in raw material

and fabrication costs associated with our products; implementation

of additional restructuring initiatives; costs associated with

compliance with Sarbanes Oxley and other risk factors set forth

from time to time in our SEC filings, including, but not limited

to, our periodic reports on Form 10-K and Form 10-Q. The Company

undertakes no obligation to update the information in this press

release to reflect events or circumstances after the date hereof or

to reflect the occurrence of anticipated or unanticipated events.

SELECTED FINANCIAL DATA (Unaudited) (In thousands, except per share

data) Condensed Consolidated Statements of Operations Data: Three

Months Ended Nine Months Ended 9/30/2009 9/30/2008 6/30/2009

9/30/2009 9/30/2008 Net revenues $6,009 $9,159 $4,672 $15,076

$31,960 Gross margin 2,432 2,962 1,416 4,651 11,938 Operating

expenses: Selling expense 988 1,863 1,036 3,161 6,180 Engineering

and product development expense 515 1,235 576 1,848 4,062 General

and administrative expense 1,161 1,750 1,374 4,219 6,038 Impairment

of long-lived assets - 133 - - 133 Restructuring and other charges

27 61 269 356 261 Operating loss (259) (2,080) (1,839) (4,933)

(4,736) Other income (expense) (18) 85 (121) (58) 167 Loss before

income taxes (277) (1,995) (1,960) (4,991) (4,569) Income tax

expense (benefit) 1 37 (8) (6) 146 Net loss (278) (2,032) (1,952)

(4,985) (4,715) Net loss per share - basic $(0.03) $(0.22) $(0.20)

$(0.50) $(0.51) Weighted average shares outstanding - basic 9,983

9,337 9,973 9,971 9,323 Net loss per share - diluted $(0.03)

$(0.22) $(0.20) $(0.50) $(0.51) Weighted average shares outstanding

- diluted 9,983 9,337 9,973 9,971 9,323 Condensed Consolidated

Balance Sheets Data: As of: 9/30/2009 6/30/2009 12/31/2008 Cash and

cash equivalents $3,428 $4,606 $7,137 Trade accounts and notes

receivable, net 4,169 2,884 3,758 Inventories 3,237 3,272 4,193

Total current assets 11,301 11,076 15,904 Net property and

equipment 358 423 617 Total assets 14,844 14,697 20,492 Accounts

payable 2,249 1,391 1,830 Accrued expenses 2,124 2,640 3,095 Total

current liabilities 4,504 4,198 5,224 Noncurrent liabilities 1,712

1,741 1,801 Total stockholders' equity 8,628 8,758 13,467

DATASOURCE: inTEST Corporation CONTACT: Hugh T. Regan, Jr.,

Treasurer and Chief Financial Officer, inTEST Corporation,

+1-856-424-6886, ext 201 Web Site: http://www.intest.com/

Copyright

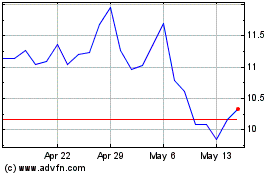

inTest (AMEX:INTT)

Historical Stock Chart

From Aug 2024 to Sep 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Sep 2023 to Sep 2024