CHERRY HILL, N.J., Aug. 2 /PRNewswire-FirstCall/ -- inTEST

Corporation (NASDAQ:INTT), an independent designer, manufacturer

and marketer of semiconductor automatic test equipment (ATE)

interface solutions and temperature management products, today

announced results for the quarter ended June 30, 2006. Net revenues

for the quarter ended June 30, 2006 were $18.9 million compared to

$13.7 million reported for the first quarter of 2006. Net income

for the second quarter of 2006 was $1.9 million or $0.21 per

diluted share, compared to net income of $340,000 or $0.04 per

diluted share for the first quarter of 2006. Robert E. Matthiessen,

President and Chief Executive Officer of inTEST commented, "This

was an exceptional quarter for us as our revenue and EPS exceeded

prior guidance. Each of our three product segments came in ahead of

our expectations in both bookings and net revenues, with our

overall results demonstrating the improved leverage we have

achieved in our operating model. Bookings in the second quarter of

2006 were $20.4 million compared to $15.5 million in the first

quarter of 2006. Importantly, based on customer forecasts, we

believe the strength in the second quarter was due to larger orders

rather than orders being pulled from future quarters." Hugh T.

Regan, Jr., Treasurer and Chief Financial Officer of inTEST said,

"On an operational basis, our Company's results during the second

quarter of 2006 were very encouraging. This was our fourth

consecutive quarter of profitability which resulted in our cash and

cash equivalents increasing to $10.6 million. On July 1, 2006, we

reinstated certain employee benefits and increased salaries for

most of our domestic staff, the majority of whom had not had salary

increases in two years. These actions will increase our fixed

operating expenses by approximately $215,000 per quarter. Based on

current customer forecasts, we expect net revenues will be in the

range of $16.5 million to $17.5 million for the quarter ending

September 30, 2006, with pre- tax earnings ranging from $0.10 to

$0.15 per diluted share." Investor Conference Call / Webcast

Details inTEST will review second quarter 2006 results and discuss

management's expectations for the third quarter of 2006 and current

views of the industry today, Wednesday, August 2, 2006 at 5 p.m.

ET. The conference call will be available at http://www.intest.com/

and by telephone at (201) 689-8560 or toll free at (877) 407-0784.

A replay of the call will be available 2 hours following the call

through midnight on Wednesday, August 9, 2006 at

http://www.intest.com/ and by telephone at (201) 612-7415

(international) or (877) 660-6853 (domestic). The account number to

access the replay is 3055 and the conference ID number is 206306. A

transcript of the conference call will be filed as an exhibit to a

Current Report on Form 8-K as soon as practicable after the

conference call is completed. About inTEST Corporation inTEST

Corporation is an independent designer, manufacturer and marketer

of ATE interface solutions and temperature management products,

which are used by semiconductor manufacturers to perform final

testing of integrated circuits (ICs) and wafers. The Company's

high-performance products are designed to enable semiconductor

manufacturers to improve the speed, reliability, efficiency and

profitability of IC test processes. Specific products include

positioner and docking hardware products, temperature management

systems and customized interface solutions. The Company has

established strong relationships with semiconductor manufacturers

globally, which it supports through a network of local offices. For

more information visit http://www.intest.com/. CONTACTS: Hugh T.

Regan, Jr. Treasurer and Chief Financial Officer inTEST Corporation

856-424-6886, ext 201 David Pasquale, 646-536-7006, or Abbas Qasim,

646-536-7014 Both of The Ruth Group, http://www.theruthgroup.com/

Forward-Looking Statements: This press release includes

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements do not

convey historical information, but relate to predicted or potential

future events that are based upon management's current

expectations. These statements are subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements. In addition to

the factors mentioned in this press release, such risks and

uncertainties include, but are not limited to, changes in business

conditions and the economy, generally; changes in the demand for

semiconductors, generally; changes in the rates of, and timing of,

capital expenditures by semiconductor manufacturers; progress of

product development programs; increases in raw material and

fabrication costs associated with our products; implementation of

additional restructuring initiatives; costs associated with

compliance with Sarbanes Oxley and other risk factors set forth

from time to time in our SEC filings, including, but not limited

to, our periodic reports on Form 10-K and Form 10-Q. The Company

undertakes no obligation to update the information in this press

release to reflect events or circumstances after the date hereof or

to reflect the occurrence of anticipated or unanticipated events.

SELECTED FINANCIAL DATA (Unaudited) (In thousands, except per share

data) Condensed Consolidated Statements of Operations Data: Three

Months Ended Six Months Ended 6/30/2006 6/30/2005 3/31/2006

6/30/2006 6/30/2005 Net revenues $18,889 $12,155 $13,732 $32,621

$22,840 Gross margin 8,380 4,218 5,834 14,214 7,355 Operating

expenses: Selling expense 2,593 2,406 2,129 4,722 4,479 Engineering

and product development expense 1,159 1,532 1,289 2,448 2,936

General and administrative expense 2,303 1,973 2,101 4,404 3,978

Restructuring and other charges - 320 - - 420 Operating income

(loss) 2,325 (2,013) 315 2,640 (4,458) Other income 105 101 70 175

140 Earnings (loss) before income taxes 2,430 (1,912) 385 2,815

(4,318) Income tax expense (benefit) 488 (119) 45 533 (113) Net

earnings (loss) 1,942 (1,793) 340 2,282 (4,205) Net earnings (loss)

per share - basic $0.22 $(0.21) $0.04 $0.25 $(0.48) Weighted

average shares outstanding - basic 9,015 8,745 8,991 9,003 8,734

Net earnings (loss) per share - diluted $0.21 $(0.21) $0.04 $0.25

$(0.48) Weighted average shares outstanding - diluted 9,124 8,745

9,068 9,096 8,734 Condensed Consolidated Balance Sheets Data: As

of: 6/30/2006 3/31/2006 12/31/2005 Cash and cash equivalents

$10,552 $8,455 $7,295 Trade accounts and notes receivable, net

11,978 9,171 9,443 Inventories 6,552 6,288 6,235 Total current

assets 29,666 24,580 23,606 Net property and equipment 3,578 3,700

3,951 Total assets 36,780 31,662 30,869 Accounts payable 4,856

2,781 2,527 Accrued expenses 4,735 4,505 4,295 Total current

liabilities 10,337 7,604 7,411 Noncurrent liabilities 589 620 652

Total stockholders' equity 25,854 23,438 22,806 DATASOURCE: inTEST

Corporation CONTACT: Hugh T. Regan, Jr., Treasurer and Chief

Financial Officer, of inTEST Corporation, +1-856-424-6886, ext 201;

or David Pasquale, +1-646-536-7006, or Abbas Qasim,

+1-646-536-7014, both of The Ruth Group, for inTEST Corporation Web

site: http://www.intest.com/

Copyright

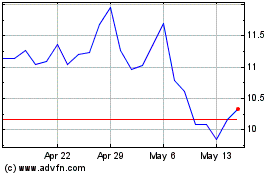

inTest (AMEX:INTT)

Historical Stock Chart

From Aug 2024 to Sep 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Sep 2023 to Sep 2024