UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

India Globalization Capital, Inc.

(Exact name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

India Globalization Capital, Inc.

10224 Falls Road, Potomac,

Maryland, 20854

ANNUAL MEETING OF STOCKHOLDERS

July 26, 2022

Dear Stockholder:

You are cordially invited to attend the 2022 Annual Stockholders’ Meeting of India Globalization Capital, Inc. (“IGC,” “we,” “us,” “our” or the “Company”), which is to be held at 10224 Falls Road, Potomac, Maryland, on September 9, 2022, at 11:00 a.m. local time. Due to the current COVID-19 outbreak and governmental restrictions of public gatherings and thinking about the wellbeing of our shareholders and employees, attendees should wear a self-provided mask that covers the nose and mouth completely at all times and practice social distancing. If you experience cold or flu-like symptoms or have been exposed to COVID-19, please stay home. If you are in attendance, you might be asked to leave the premises for the protection of the other attendees. We reserve the right to take any additional precautionary measures we deem appropriate in relation to the physical meeting and access to our premises. We may need to change the time, date or location of the Annual Meeting. If we do so, we will announce any changes in advance as required by the Securities and Exchange Commission (the “SEC”) and by any applicable state law. The Annual Meeting will commence with a discussion and voting on the matters set forth in the accompanying Notice of Annual Meeting of Stockholders followed by a report on our operations.

The Notice of Annual Meeting of Stockholders and Proxy Statement, which more fully describe the formal business to be conducted at the Annual Meeting, follows this letter. A copy of our Annual Report to Stockholders for the fiscal year ended March 31, 2022, is also enclosed. We encourage you to carefully read these materials. The notice and the accompanying proxy statement will be mailed to all stockholders by July 26, 2022.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by signing, dating, and returning your proxy card. Beneficial owners of shares held in street name should follow the instructions in the Proxy Statement for voting their shares. If you are a record holder and you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 9, 2022:

This Proxy Statement, the Notice of Annual Meeting of Stockholders, and our Annual Report to Stockholders are available at http://www.igcinc.us.

On behalf of the Board of Directors, thank you for your continued support.

Sincerely,

/s/ Richard Prins

Chairman

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

India Globalization Capital, Inc.

10224 Falls Road, Potomac,

Maryland, 20854

NOTICE OF ANNUAL MEETINGS OF STOCKHOLDERS

The Annual Meetings of Stockholders (the “Annual Meeting”) for the year ended March 31, 2022, of India Globalization Capital, Inc. (“IGC,” “we,” “us,” “our” or the “Company”) will be held at 10224 Falls Road, Potomac, Maryland, 20854, on September 9, 2022, at 11:00 a.m. local time. Voting materials, which include this Proxy Statement, the proxy card and our Annual Report for the fiscal ended March 31, 2022, are first being mailed to Stockholders of the Company on or about July 26, 2022.

Stockholders who desire to attend the Annual Meeting should indicate such planned attendance by marking the appropriate box on the enclosed proxy card. Stockholders who do not indicate attendance at the Annual Meeting by proxy will be required to present acceptable proof of stock ownership to attend the Annual Meeting. All stockholders must furnish personal photo identification for admission to the Annual Meeting.

The Company will hold the Annual Meeting for the following purposes:

|

(1)

|

To elect Mr. Ram Mukunda and Congressman James Moran to the Company’s board of directors to serve as Class C directors until the 2025 annual meeting of Stockholders and to elect Ms. Claudia Grimaldi to the Company’s board of directors to serve as a Class A director until the 2023 annual meeting of Stockholders, in each case until such directors’ respective successors shall be duly elected and qualified, or until such directors’ earlier death, resignation or removal from office;

|

|

(2)

|

To ratify the appointment of Manohar Chowdhry & Associates, as the Company’s independent registered public accounting firm for the 2023 fiscal year;

|

|

(3)

|

To approve the grant of 3,000,000 shares of common stock to be granted from time to time to the Company’s current and new employees, advisors, directors, and consultants by the board of directors, pursuant to certain metrics including performance, vesting, and incentive as set by the board of directors and or the CEO; and

|

|

(4)

|

To act upon such other matters as may properly come before the Annual Meeting, including any proposal to adjourn or postpone the Annual Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies (the “Adjournment Proposal”).

|

Your attention is directed to the Proxy Statement accompanying this Notice for a more complete description of each of the foregoing items of business.

Only holders of record of our common stock at the close of business on July 13, 2022, are entitled to notice of and to vote at the Annual Meeting and at any and all adjournments or postponements thereof.

By Order of the Board of Directors,

Richard Prins

Chairman

July 25, 2022

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

INDIA GLOBALIZATION CAPITAL, INC.

PROXY STATEMENT

The board of directors of the Company (the “Board of Directors”) is soliciting proxies for the Annual Meeting. You may revoke your proxy at any time prior to voting at the Annual Meeting by submitting a later dated proxy or by giving timely written notice of your revocation to the Secretary of the Company. Proxies properly executed and received by the Secretary prior to the Annual Meeting, and not revoked, will be voted in accordance with the terms of the proxies.

Registered stockholders holding shares of the Company’s common stock may vote by completing, signing and dating the proxy card and returning it as promptly as possible. The Company will pay all of the costs associated with this proxy solicitation. Proxies may be solicited in person or by mail, telephone, telefacsimile or other means of electronic transmission by our directors, officers and employees. We will also reimburse banks, brokerage firms, and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding soliciting materials to the beneficial owners of the Company’s common stock.

If you desire to attend the Annual Meeting, you should indicate your intent to attend in person when voting by marking the appropriate box on the enclosed proxy card. If you do not indicate attendance at the Annual Meeting on the proxy, you will be required to present acceptable proof of stock ownership to attend. All stockholders who attend the Annual Meeting must furnish personal photo identification for admission. If your shares are not registered in your own name and you plan to attend the Annual Meeting and vote your shares in person, you should contact your broker or agent in whose name your shares are registered to obtain a proxy executed in your favor and bring it to the Annual Meeting in order to vote.

VOTING RIGHTS

Our stockholders are entitled to one vote at the Annual Meeting for each share of Company common stock held of record as of July 13, 2022, the record date for the Annual Meeting. As of the close of business on the record date, there were 52,084,353 shares of common stock outstanding. A majority of the shares entitled to vote, present in person or represented by proxy, will constitute a quorum at the Annual Meeting (the “Record Date”). If your shares are held in “street name,” these proxy materials are being forwarded to you by your bank or brokerage firm (the “Record Holder”), along with a voting instruction card. As the beneficial owner, you have the right to direct the Record Holder on how to vote your shares, and the Record Holder is required to vote your shares in accordance with your instructions. If you do not give instructions to your bank or brokerage firm, it will nevertheless be entitled to vote your shares in its discretion on “routine matters.”

BROKER NON-VOTES

A “broker non-vote” occurs when a broker submits a proxy card with respect to shares held in a fiduciary capacity (typically referred to as being held in “street name”) but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters.

The election of directors in an uncontested election is deemed to be a non-routine matter. The vote to approve grants of shares of common stock from time to time to the Company’s current and new employees, advisors, directors, and consultants by the board of directors is also deemed to be a non-routine matter. Accordingly, if you hold your shares in street name, in order for your shares to be voted for the election of directors at the Annual Meeting (Proposal One), and the grant of up to 3,000,000 shares of common stock to the Company’s current and new employees, advisors, directors, and consultants by the board of directors (Proposal Three), you must provide voting instructions to your broker in accordance with the voting instruction card that you will receive from your broker. Proxies received but marked as abstentions or treated as broker non-votes will be included in the calculation of the number of shares considered to be present at the Annual Meeting for quorum purposes.

For purposes of this Annual Meeting, the Company has determined that the reappointment of its independent auditors (Proposal Two) is a routine matter under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal Two. The approval of the Adjournment Proposal (Proposal Four) requires a majority of all the votes cast at a meeting at which a quorum is present. Approval of the Adjournment Proposal is not conditioned upon the approval of any other proposals in this proxy.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

We are not aware of any matters that are to come before the Annual Meeting other than those described in this Proxy Statement; however, if other matters do properly come before the Annual Meeting, it is the intention of the persons named in the proxy card to vote such proxy in accordance with their best judgment.

SOLICITATION OF PROXIES

We will bear the cost of soliciting proxies. In addition to soliciting stockholders by mail through our employees, we will request banks, brokers, and other custodians, nominees, and fiduciaries to solicit customers for whom they hold our stock and will reimburse them for their reasonable, out-of-pocket costs. We may use the services of our officers, directors, and others to solicit proxies, personally or by telephone, without additional compensation. We have also engaged InvestorCom to solicit proxies on our behalf. We anticipate that the fees to InvestorCom will be approximately $2,750.

PROPOSAL ONE

ELECTION OF DIRECTORS

Our Board of Directors is currently divided into three classes, Class A, Class B, and Class C, with only one class of directors being elected in each year and each class serving a three-year term. At the 2022 Annual Meeting, two Class C directors and one Class A director are to be elected as members of our Board of Directors to serve until the 2025 and 2023 Annual Stockholders Meetings, respectively, and until their successors are duly elected and qualified, or until their earlier resignation, removal or death. Our Board of Directors has nominated Mr. Ram Mukunda and Congressman James Moran to serve as a Class C directors, and Ms. Claudia Grimaldi to serve as a Class A director.

The other current directors consist of one Class B director and one Class A director, who will serve until the 2024 and 2023 Annual Stockholders’ Meetings, respectively, and until their successors are duly elected and qualified.

Should any vacancy occur on the Board of Directors, the remaining directors would be able to fill such vacancy by the affirmative vote of a majority of the remaining directors in office, even if the remaining directors do not constitute a quorum. Any director elected by the Board of Directors to fill a vacancy would hold office for the remainder of the full term of the class of directors in which the vacancy occurred and until a successor is elected and qualified. If the size of the board is increased, additional directors will be apportioned among the three classes in order to make all classes as nearly equal as possible.

Set forth below is information regarding our Class C and A director nominees. Except as set forth below, there are no family relationships between any of our directors or executive officers. Each director holds his office until he or she resigns or is removed and his or her successor is elected and qualified.

|

Name

|

|

Positions

|

|

Age

|

|

|

Director Since

|

|

|

Term will Expire

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Ram Mukunda

|

|

President, Chief Executive Officer, and Director (Class C director)

|

|

63

|

|

|

2005

|

|

|

2025

|

|

|

James Moran

|

|

Director (Class C director)

|

|

77

|

|

|

2022

|

|

|

2025

|

|

|

Claudia Grimaldi

|

|

Vice-President, Principal Financial Officer, Chief Compliance Officer, and Director (Class A director)

|

|

51

|

|

|

2022

|

|

|

2023

|

|

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Ram Mukunda has served as Director of the Board, CEO and President since April 29, 2005. He is responsible for general management and over the past seven years has been largely responsible for the Company’s strategy and positioning in the medical cannabinoids industry. He has been the chief inventor and architect of all patent filings by the Company, and the thrust into R&D and medical trials, which support the Company’s desire to bring low-cost medications that address diseases and ailments that affect humankind. Prior to IGC, from January 1990 to May 2004, Mr. Mukunda served as Founder and CEO of Startec Global Communications, which he took public in 1997 on NASDAQ. Prior to Startec, he served as Strategic Planning Advisor at Intelsat, a communications satellite services provider and prior to that worked in the bond market for a boutique firm on Wall Street. Mr. Mukunda serves as an Emeritus member on the Board of Visitors at the University of Maryland, School of Engineering. From 2001 to 2003, he was a Council Member at Harvard’s Kennedy School of Government, Belfer Center of Science and International Affairs. Mr. Mukunda is the recipient of several awards including, among others, the 2013 University of Maryland’s International Alumnus of the year award, the 2001 Distinguished Engineering Alumnus Award, the 1998 Ernst & Young, LLP’s Entrepreneur of the Year Award. He holds a B.S. degree in Electrical Engineering, a B.S degree in Mathematics, and a M.S. in Engineering from the University of Maryland. Mr. Mukunda has traveled extensively, and managed companies in Europe and Asia. He has over 20 years of experience managing public companies and has acquired and integrated over 20 companies. His in-depth business experience in the medical cannabinoids industry, his knowledge of U.S. capital markets, capital structuring, international joint ventures, and broad science and engineering background make him qualified to serve as a director of our Company.

James Moran (Congressman Moran) has served on the Board as an Independent Director since January 2022. He served on Virginia’s 8th Congressional District for 24 years, where he was known as a “Problem Solver.” Throughout his tenure, he demonstrated bipartisan leadership and worked across the aisle to find common ground to resolve complex issues. He served on the Appropriation, Banking and Finance, and Budget committees. He played a leadership role in the areas of defense, health, and the environment. During his 24 years in Congress, Congressman Moran was recognized as a champion of innovative research and development in areas including healthcare and national security, environmental protection and sustainability, and international trade and fiscal responsibility. He rose to senior leadership on the Appropriations Committee enabling him to bring billions of dollars into his Northern Virginia communities of Alexandria, Arlington, and Fairfax County. Having retired after 35 years in elected office, Congressman Moran is now with a major law firm and represents international and domestic clients in the defense, technology, entertainment, and international diplomacy sectors. He also serves in leadership roles for several non-profit foundations and is also a member of the Government Blockchain Association. Congressman Moran received a master’s degree in Public Administration from the University of Pittsburgh Graduate School of Public and International Affairs and a bachelor’s in economics from the College of the Holy Cross.

Congressman Moran introduced the AUTISM Educators Act in 2012, which funded partnerships between public schools and higher education and non-profit organizations to promote teaching skills for educators working with high functioning autism students. He understands that treatment and education for conditions such as Autism and Alzheimer’s disease have the potential to positively impact millions of lives. With his extensive experience in Congress and as a policy advisor on topics including health, technology, and education, we are confident Congressman Moran will be a great asset to IGC, especially at a time when we pursue Phase 2/3 human trials on IGC- AD1 on individuals that have Alzheimer’s disease. Congressman Moran’s extensive government experience, including his sponsorship of the AUTISM Educators Act in 2012, makes him qualified to serve as a director of our Company.

Claudia Grimaldi has served on the Board of Directors since May 2022. She is also the Vice-president, PFO, and Chief Compliance Officer, is responsible for managing the accounting and finance teams in various countries and is responsible for ensuring timely and accurate statutory and regulatory compliance (SEC, FINRA, NYSE, IRS, XETRA 2, among others). She has more than ten years of experience with SEC filings, regulatory compliance, and disclosures, having held increasing responsibilities first as Manager of financial reporting and compliance from May 2011 to 2013 and then as General Manager financial reporting and compliance from 2013 to May 2018. She also serves as a Director/Manager for some of our subsidiaries. Ms. Grimaldi graduated summa cum laude from Javeriana University, a top five university in Colombia, with a Bachelor of Arts in Psychology. She holds an MBA in General Management, graduating with Highest Honors, from Meredith College, in North Carolina. She is a member of Delta Mu Delta International Honor Society. She has also completed Executive Education courses on SEC compliance, finance from UVA, and corporate governance from the Columbia Business School. In addition, she has attended the Darden School of Business Financial Management Executives program at the University of Virginia, and SEC reporting and compliance seminars. Currently she is pursuing her Directorship Certification with the National Association of Corporate Directors (“NACD”). She is also fluent in both English and Spanish. Ms. Grimaldi’s extensive financial experience and operational knowledge of the Company makes her qualified to serve as a director of our Company.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

The following sets forth information regarding our current Class A and Class B directors. Except as set forth below, there are no family relationships between any of our directors or executive officers. Each director holds office until he or she resigns or is removed and his or her successor is duly elected and qualified.

|

Name

|

|

Positions

|

|

Age

|

|

|

Director Since

|

|

|

Term will Expire

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

John Lynch

|

|

Director (Class A director)

|

|

84

|

|

|

2021

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Richard Prins

|

|

Chairman of the Board of Directors and the Audit,

Disclosure and Compensation Committees

(Class B director)

|

|

65

|

|

|

2007

|

|

|

2024

|

|

Richard Prins has been our Chairman and Audit Committee Chairman since 2012 and has served as an Independent Director since May 2007. Mr. Prins has extensive experience in private equity investing and investment banking. From March 1996 to 2008, he was the Director of Investment Banking at Ferris, Baker Watts, Incorporated (FBW). Mr. Prins served in a consulting role to RBC until January 2009. Mr. Prins currently serves on one other board, volunteers full time with a non-profit organization, Advancing Native Missions, and is a private investor. Since February 2003, he has been on the board of Amphastar Pharmaceuticals, Inc. Mr. Prins holds a B.A. degree from Colgate University and an M.B.A. from Oral Roberts University. Mr. Prins has substantial knowledge and experience with U.S. capital markets, has served on and chaired audit and compensation committees of boards, has extensive experience in finance, accounting, and internal controls over financial reporting. His knowledge of the pharmaceutical industry and experience with U.S. capital markets make him qualified to serve as a director of our Company.

John Lynch has served as an Independent Director since January 2021. He is also a member of the Audit and Compensation Committees. Mr. Lynch helped negotiate the licensing of the patent filed by the University of South Florida titled “Extreme Low Dose THC as a Therapeutic and Prophylactic Agent for Alzheimer’s Disease,” which is the basis for our Hyalolex Drops of Clarity™, available only in Puerto Rico, as well as the IGC-AD1 formulation, subject of a Phase 1 trial. Mr. Lynch has been an independent consultant since 2003, and, for the past five years, he has served IGC as an Advisor. Mr. Lynch has been instrumental in developing the intellectual property strategy for the Company. Thanks to Mr. Lynch’s strategy and support, the Company has filed eleven patents with the United States Patent & Trademark Office (USPTO) including formulations for Cannabidiol-based compositions and methods for treating pain, cachexia and eating disorders, seizures, CNS disorders, restoring energy, stuttering and Tourette syndrome (TS), and Alzheimer’s disease related symptoms. Mr. Lynch was an adjunct professor of law at Georgetown University Law Center, as well as an adjunct professor in Intellectual Property (IP) Law at the University of San Francisco School of Law. Mr. Lynch received a B.S., Chemistry, in 1960 from Fordham College and a J.D. in 1963 from Georgetown University Law Center. Mr. Lynch’s extensive experience make him qualified to serve as a director of our Company.

Vote Required and Board of Directors Recommendation

The election of the nominee for director requires a majority of the votes present at the meeting and entitled to vote, in person or by proxy. In determining whether the proposal has been approved, abstentions will be counted for purposes of determining the presence or absence of a quorum and will be counted as votes against the purpose, and broker non-votes will not be counted as votes for or against the proposal or as votes present and voting on the proposal.

Stockholders do not have the right to cumulate their votes in the election of directors. If, at the time of the Annual Meeting, the nominee should be unavailable to serve as a director, it is intended that votes will be cast, in accordance with the enclosed proxy, for such substitute nominee as may be nominated by the Board of Directors, or the Board of Directors may reduce the number of directors. The nominee has consented to being named in this Proxy Statement and to serve if elected.

The Board of Directors recommends that the stockholders vote FOR the election of the nominees set forth above. Properly executed and delivered proxies solicited by management for which no specific direction is included will be voted FOR the election of the nominees listed to serve as directors.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

PROPOSAL TWO

RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

On July 13, 2021, the Audit Committee of the Board selected Manohar Chowdhry & Associates as the Company’s independent registered public accountants for both fiscal years ending March 31, 2022 and 2023.

Manohar Chowdhry & Associates served as the Company’s independent auditors for the fiscal years ended March 31, 2019, 2020, 2021, and 2022 reviewing the Company’s financial statements. Services provided to the Company by Manohar Chowdhry & Associates for the 2021 and 2022 fiscal years are described in “Audit Information.” A representative of Manohar Chowdhry & Associates will not be present at the meeting.

Although stockholder ratification is not required by the Company’s Bylaws or otherwise, the Board of Directors is requesting that stockholders ratify the selection of Manohar Chowdhry & Associates as the Company’s independent registered public accountants to make an examination of the financial statements of the Company for the 2023 fiscal year. If stockholders do not ratify the selection of Manohar Chowdhry & Associates at the Annual Meeting, the Audit Committee will reconsider whether to retain that firm for future audits. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if it determines that such change would be in the best interests of the Company and its stockholders.

Vote Required and Board of Directors Recommendation

The ratification of the appointment of Manohar Chowdhry & Associates as the Company’s independent registered public accountants for the 2023 fiscal year will require the affirmative vote of the holders of a majority of the shares of outstanding common stock present or represented at the Annual Meeting and entitled to vote thereat. In determining whether the proposal has been approved, abstentions will be counted as votes against the proposal, and broker non-votes will not be counted as votes for or against the proposal or as votes present and voting on the proposal.

The Board of Directors recommends that you vote FOR the ratification of the appointment of Manohar Chowdhry & Associates as the Company’s independent registered public accountants for the 2023 fiscal year. Proxies solicited by management for which no specific direction is included will be voted FOR ratification of the appointment of Manohar Chowdhry & Associates.

PROPOSAL THREE

GRANT OF 3,000,000 SHARES OF COMMON STOCK

TO OUR CURRENT AND NEW OFFICERS, DIRECTORS, EMPLOYEES,

ADVISORS AND CONSULTANTS

Our Board of Directors is requesting that IGC stockholders approve a grant of 3,000,000 shares of common stock to current and new officers, directors, employees, advisors and consultants (the “Compensation Shares”).

The Compensation Committee believes that the grant of the Compensation Shares to some of its current officers, employees, directors, advisors, and consultants is important in order to align their interests with the interests of the Company and its shareholders, as well as to retain them as the Company builds its Plant and Cannabinoid business in an industry brimming with opportunity, high growth, and high relative valuations.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Among the accomplishments achieved by the Company in fiscal 2022 are the following: i) the Company completed Phase 1 of human clinical trials for its product IGC-AD1 targeting Alzheimer’s disease; ii) the Company has engaged and continues to engage more Principal Investigators and study sites to start conducting Phase 2 trial on IGC-AD1 on the second half of the current calendar year to assess it as a symptom modifying agent, specifically on agitation in dementia due to Alzheimer’s disease; iii) the Company recently acquired rights to a family of naphthalene monoimide (“NMI”) molecules. TGR-63, a lead NMI molecule, is an enzyme inhibitor that has been shown in pre-clinical trials to reduce neurotoxicity in Alzheimer’s cell lines and improve memory in an Alzheimer’s mouse model. Subject to further study, research, and development, TGR-63 could give the Company a potential disease modifying agent and help expand the Company’s pursuit of a drug that can potentially treat or modify Alzheimer’s; and (iv) on June 7, 2022, the USPTO issued a patent (#11,351,152) to the Company titled “Method and Composition for Treating Seizures Disorders.” The patent relates to compositions and methods for treating multiple types of seizure disorders and epilepsy in humans and animals using a combination of cannabidiol (CBD) with other compounds. Subject to further research and study, the combination is intended to reduce side effects caused by hydantoin anticonvulsant drugs such as phenobarbital, by reducing the dosing of anticonvulsant drugs in humans, dogs, and cats.

The Board of Directors will determine, subject to vesting, the award of the Compensation Shares among its current officers, employees, directors, advisors, and consultants based on the Compensation Committee’s recommendation and depending on specific factors like individual’s contribution to the Company’s business advancement and creation of intellectual property, NYSE/SEC/IRS compliance, business strategy, overhead and expenses control/savings and management of daily operations, amongst others. As of the date of this Proxy Statement, IGC has no contractual agreement to issue to any of its current officers, employees, directors, advisors, and consultants any shares of the issued and outstanding shares of the common stock of IGC. As of the date of this Proxy Statement, the Compensation Committee has not made a determination of the amount of Compensation Shares to be awarded to current officers, employees, directors, advisors, and consultants and the amount to be used in the future to recruit specialists. The NYSE American rules require IGC stockholders’ approval prior to the issuance of the Compensation Shares.

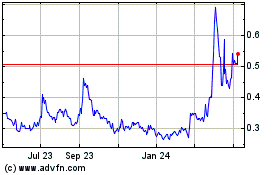

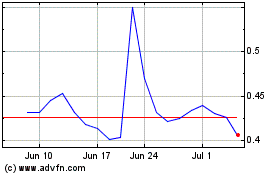

At the Record Date, 606,309 shares of the Company’s Common Stock remained available for future grants under the Company’s existing equity plan. On the Record Date, the closing price of our Common Stock was $0.51 per share. On the Record Date, directors and executive officers, including the Named Executive Officers, and approximately 20 employees and consultants of the Company were eligible to participate in the receipt of the Compensation Shares.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table shows (in thousands), as of July 13, 2022, information regarding outstanding awards available under our compensation plans (including individual compensation arrangements) under which our equity securities may be delivered.

|

Plan category

|

|

(a)

Number of

securities to be

issued upon

exercise of

outstanding

options,

warrants and

rights (1)

(in thousands)

|

|

|

(b)

Weighted-

average exercise

price of

outstanding

options,

warrants and

rights

|

|

|

(c)

Number of

securities

available for

future

issuance

(excluding

shares in

column (a)(1)

(in thousands)

|

|

|

Equity compensation plans approved by security holders:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 Omnibus Incentive Plan (1)

|

|

|

1,640

|

|

|

$

|

0.43

|

|

|

|

379

|

|

|

Special Grant (2)

|

|

|

5,431

|

|

|

$

|

1.16

|

|

|

|

227

|

|

(1) Consists of our 2018 Omnibus Incentive Plans, as approved by our stockholders on November 8, 2017. See Note 14, “Stock-Based Compensation” of the Notes to the Consolidated Financial Statements included in our Annual Reports on Form 10-K filed with the SEC on June 22, 2022.

(2) Consists of a total of 8 million shares of common stock from three special grants approved by our stockholders on January 7, 2020, on January 11, 2021, and on October 15, 2021.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Vote Required for Special Grant of Shares

The approval of the grant of Compensation Shares will require the affirmative vote of the holders of a majority of the shares of common stock present or represented at the Annual Meeting and entitled to vote thereat. In determining whether the proposal has been approved, abstentions will be counted as votes against the proposal, and broker non-votes will not be counted as votes for or against the proposal or as votes present and voting on the proposal.

The Board of Directors recommends that you vote FOR the grant of Proxies solicited by management for which no specific direction is included will be voted FOR the grant of The Compensation Shares.

PROPOSAL FOUR

THE ADJOURNMENT PROPOSAL

If, at the Annual Meeting of stockholders on September 9, 2022, the number of shares of the Company’s common stock present or represented and voting in favor of adoption or rejection of the proposals is insufficient to adopt such proposals under the applicable rules and regulations, the Company’s Executive Chairman intends to move to adjourn the Annual Meeting in order to enable our Board of Directors to solicit additional proxies.

In this Proposal Four, we are asking you to authorize Ram Mukunda or Richard Prins to vote in favor of an adjournment of the Annual Meeting to another time and place for the purpose of soliciting additional proxies. If the stockholders approve the Adjournment Proposal, we could adjourn the Annual Meeting, and any adjourned session of the Annual Meeting, and use the additional time to solicit additional proxies, including the solicitation of proxies from stockholders that have previously submitted proxies. Among other things, approval of the Adjournment Proposal could mean that, even if we had received proxies representing a sufficient number of votes against some of the proposals, we could adjourn the Annual Meeting without a vote on that particular proposal and seek to convince the holders of those shares to change their votes to votes in favor of adoption of such proposal.

If our stockholders do not approve the Adjournment Proposal, our Board of Directors may not be able to adjourn the Meeting to a later date in the event there are not sufficient votes at the time of the Meeting.

Vote Required and Board Recommendation

The Adjournment Proposal, if a quorum is present, requires the affirmative vote of a majority of the votes, which could be cast by holders of all shares of stock entitled to vote thereon, which are present in person or by proxy at the Annual Meeting. In the absence of a quorum, the stockholders present, by majority vote, may adjourn the Meeting. Broker non-votes will have no effect on the outcome of the vote on the Adjournment Proposal.

Our Board of Directors recommends that you vote FOR the Adjournment Proposal. Proxies solicited by management for which no specific direction is included will be voted FOR the Adjournment Proposal.

SECURITY OWNERSHIP OF BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of July 13, 2022, by each person known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock, each of our executive officers and directors, and all our officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and does not necessarily indicate beneficial ownership for any other purpose. Under these rules, beneficial ownership includes those shares of common stock over which the stockholder has sole or shared voting or investment power. It also includes shares of common stock that the stockholder has a right to acquire within 60 days through the exercise of any option, or other right. The percentage ownership of the outstanding common stock, which is based upon shares of common stock outstanding as of July 13, 2022, is based on the assumption, expressly required by the rules of the SEC, that only the person or entity whose ownership is being reported has exercised options to purchase shares of our common stock.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Unless otherwise indicated, we believe that all persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them. Unless otherwise noted, the nature of the ownership set forth in the table below is common stock of the Company. The table below sets forth as of July 13, 2022, except as noted in the footnotes to the table, certain information with respect to the beneficial ownership of the Company’s common stock by (i) all persons or groups, according to the most recent Schedule 13D or Schedule 13G filed with the SEC or otherwise known to us, to be the beneficial owners of more than 5% of the outstanding common stock of the Company, (ii) each director of the Company, (iii) the executive officers named in the Summary Compensation Table, and (iv) all such executive officers and directors of the Company as a group.

| |

|

Shares Owned

|

|

|

Name and Address of Beneficial Owner/Named Executive Officers and Directors: (1)

|

|

Number of Shares

Beneficially Owned (3)

|

|

|

Percentage

of Class*

|

|

|

Ram Mukunda (2)

|

|

|

6,374,760

|

|

|

|

10.8

|

%

|

| |

|

|

|

|

|

|

|

|

|

Claudia Grimaldi

|

|

|

837,987

|

|

|

|

1.4

|

%

|

| |

|

|

|

|

|

|

|

|

|

Richard Prins

|

|

|

1,330,000

|

|

|

|

2.3

|

%

|

| |

|

|

|

|

|

|

|

|

|

James Moran

|

|

|

150,000

|

|

|

|

0.3

|

%

|

| |

|

|

|

|

|

|

|

|

|

John Lynch

|

|

|

396,901

|

|

|

|

0.7

|

%

|

| |

|

|

|

|

|

|

|

|

|

All Executive Officers and Directors as a group (5 persons)

|

|

|

9,089,648

|

|

|

|

15.5

|

%

|

*Based on fully diluted 58,768,904 shares of common stock outstanding as of July 13, 2022.

|

(1)

|

Unless otherwise indicated, the address of each of the individuals listed in the table is c/o India Globalization Capital, Inc., 10224 Falls Road, Potomac, MD 20854.

|

|

(2)

|

The beneficial ownership table does not include 777,417 shares of common stock that is owned by Mr. Mukunda’s spouse for which Mr. Mukunda has no voting, financial or dispositive rights.

|

|

(3)

|

The beneficial ownership table includes approximately 5.1 million shares granted but not vested/issued to individuals listed in the table as of July 13, 2022.

|

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Information about our executive officers, and directors

The names, ages, and positions of our executive officers and directors as of March 31, 2022, were as follows:

|

Name

|

|

Positions

|

|

Age

|

|

|

Director Since

|

|

|

Term will Expire

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Ram Mukunda

|

|

President, Chief Executive Officer, and Director (Class C director)

|

|

63

|

|

|

2005

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Richard Prins

|

|

Chairman of the Board of Directors and the Audit,

Disclosure and Compensation Committees

(Class B director)

|

|

65

|

|

|

2007

|

|

|

2024

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

John Lynch

|

|

Director (Class A director)

|

|

84

|

|

|

2021

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

James Moran

|

|

Director (Class C director)

|

|

77

|

|

|

2022

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Claudia Grimaldi

|

|

Vice-President, Principal Financial Officer, Chief Compliance Officer, and Director (Class A director)

|

|

51

|

|

|

2022

|

|

|

2023

|

|

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

The principal occupations for the past five years (and, in some instances, for prior years) of each of our executive officers and directors are set out in Proposal One. There are no family relationships between any of our executive officers or directors.

Board of directors and independence

Our Board of Directors is divided into three classes (Class A, Class B, and Class C) with only one class of directors being elected each year and each class serving a three-year term. The term of office of the Class A director, consisting of John Lynch and Claudia Grimaldi, will expire at the 2023 annual meeting of stockholders. The term of office of the Class B director, currently consisting of Richard Prins, will expire at the 2024 annual meeting of stockholders. The term of office of the Class C director, currently consisting of Ram Mukunda and James Moran, will expire at the 2025 annual meeting of stockholders assuming the directors are re-elected at this Annual Meeting. These individuals have played a key role in identifying and evaluating prospective acquisition candidates, selecting the target businesses, and structuring, negotiating, and consummating acquisitions.

The NYSE American, upon which our shares are listed, requires the majority of our Board to be “independent.” The NYSE American listing standards define an “independent director” generally as a person, other than an officer or an employee of the Company, who does not have a relationship with the Company that would interfere with the director’s exercise of independent judgment. Consistent with these standards, the Board of Directors has determined that Messrs. Prins, Moran, and Lynch are independent directors.

Board leadership structure

The Board believes its current leadership structure best serves the objectives of the Board’s oversight of management, the Board’s ability to conduct its roles and responsibilities on behalf of IGC’s shareholders, and IGC’s overall corporate governance. The Board also believes that the separation of the Chairman and CEO roles allows the CEO to focus his time and energy on operating and managing IGC, while leveraging the Chairman’s experience and perspectives. The Board periodically reviews its leadership structure to determine whether it continues to best serve IGC and its shareholders.

Board oversight of risk management

The Board is responsible for overseeing the major risks facing the Company while management is responsible for assessing and mitigating the Company’s risks on a day-to-day basis. The Board has designated the Audit Committee with the responsibility for overseeing enterprise risk management. The Audit Committee discusses the steps management has taken to monitor and mitigate these risks, if any. In establishing and reviewing IGC’s executive compensation, the Compensation Committee considers whether the compensation program is focused on long-term shareholder value creation and whether it encourage short-term risk taking at the expense of long-term results. The Compensation Committee has also reviewed IGC’s compensation program and has concluded that these programs do not create risks that are reasonably likely to have a material adverse effect on IGC. Other Board committees also consider risks within their areas of responsibility and apprise the Board of significant risks and management’s response to those risks.

Audit committee

Our Board of Directors has established an Audit Committee currently composed of two independent directors who report to the Board of Directors. Messrs. Prins and Lynch, each of whom is an independent director under the NYSE American listing standards, serve as members of our Audit Committee. Mr. Prins is the Chairman of our Audit Committee. In addition, we have determined that Messrs. Prins and Lynch are “audit committee financial experts,” as that term is defined under Item 407 of Regulation S-K. The Audit Committee is responsible for meeting with our independent accountants regarding, among other issues, audits and the adequacy of our accounting and control systems. The Committee follows the audit committee charter, which is reviewed once a year and available on the Company’s website.

Compensation committee

Our Board of Directors has established a Compensation Committee composed of two independent directors, Messrs. Lynch, and Prins. Mr. Prins is the current Chairman of our Compensation Committee. The Compensation Committee’s purpose is to review and approve compensation paid to our officers and directors and to administer our 2018 Omnibus Incentive Plan. As per the compensation committee charter, candidate experience, knowledge, and performance are used to evaluate the candidate Plan, and if Proposal Three is approved, to administer the grant of up to 3,000,000 shares. The compensation is accordingly decided for the candidate as per the industry standards. The Committee follows the compensation committee charter, which is reviewed once a year and available on the Company’s website.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Compensation committee interlocks and insider participation

Our Compensation Committee is comprised of two independent members of the Board of Directors, Richard Prins and John Lynch. No executive officer of the Company served as a director or member of the compensation committee of any other entity. The Compensation Committee was responsible for determining executive compensation and the award of stock, and stock options to employees, advisors, and directors during Fiscal 2022. No consultants were used by the Compensation Committee during this fiscal year.

Nominating and corporate governance committee

In the future, we intend to establish a nominating and corporate governance committee. The primary purpose of the nominating and corporate governance committee will be to identify individuals qualified to become directors, recommend to the Board of Directors the candidates for election by stockholders or appointment by the Board of Directors to fill a vacancy, recommend to the Board of Directors the composition and chairs of Board of Directors committees, develop and recommend to the Board of Directors guidelines for effective corporate governance, and lead an annual review of the performance of the Board of Directors and each of its committees. We do not have any formal process for stockholders to nominate a director for election to our Board of Directors. Currently, nominations are selected or recommended by a majority of the independent directors as stated in Section 804(a) of the NYSE American Company Guide. Since the Company is a smaller reporting company with limited officers and directors, the committee currently does not have a nomination committee charter. Board of Director nominations occur by either selection or recommendation of a majority of the independent directors.

Disclosure Committee

The CEO and the PFO supervise and oversee the Disclosure Committee. The Board has appointed Mr. Richard Prins as the Chairperson of the Disclosure Committee. The Disclosure Committee’s responsibilities are to design, implement and regularly evaluate the Company’s internal controls and procedures, to ensure that the company provides the stakeholders, including the SEC, security holders, and the investment community, disclosures that comply with regulations and other compliance obligations. The Disclosure Committee will review all required material and relevant reports related to disclosure statements, including annual reports on Form 10-K, quarterly reports on Form 10-Q, press releases, and social media containing financial information and other related public documents. The Disclosure Committee meets not less than once per quarter and reviews and reassess the adequacy of the Disclosure Committee’s Charter at least annually.

Ownership Guidelines

To align the interests of the Board of Directors directly with the interests of the stockholders, the Committee recommends that each Board member maintain a minimum ownership interest in our company. We have implemented IGC’s Stock Ownership Guidelines requiring directors to retain ownership of 35% of the common stock that they receive upon joining the Board, if any, and that they receive as part of any compensation during their tenure on the Board, if any, except that the Stock Ownership Guidelines shall not apply where a director transfers stock to a personal trust(s) or makes a gift.

Audit Committee Financial Expert

The Audit Committee will at all times be composed exclusively of “independent directors” who are “financially literate,” as defined under the NYSE American listing standards, who understand the audit committee functions. The NYSE American’s listing standards define “financially literate” as being able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. In addition, we must certify to the NYSE American that the Audit Committee has, and will continue to have, at least one member who has past employment experience in finance, accounting, or auditing, requisite professional certification in accounting, or other comparable experience or background that results in the individual’s financial sophistication, along with understanding of internal control over financial reporting. The Board of Directors has determined that Messrs. Prins and Lynch satisfy the NYSE American’s definition of financial sophistication and qualify as “audit committee financial experts,” as defined under rules and regulations of the SEC.

Board and committee meetings

During Fiscal 2022, there were 19 Board meetings, 8 meetings of the Audit Committee and 2 Compensation Committee meetings, all of which were attended, either in person or telephonically, by all our directors of the Board and all of the members of the committees, respectively.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Communications with the Board

Any matter intended for the Board, or any individual member of the Board should be directed to Investor Relations at the Company’s principal executive office, with a request to forward the communication to the intended recipient. In general, any shareholder communication delivered to the Company for forwarding to Board members will be forwarded in accordance with the shareholder’s instructions. However, the Company reserves the right not to forward to Board members any abusive, threatening, or otherwise inappropriate materials.

Indemnification agreements

We are party to indemnification agreements with each of the executive officers and directors. Such indemnification agreements require us to indemnify these individuals to the fullest extent permitted by law. Under the terms of the indemnification agreements, we intend to agree to indemnify our officers and directors against expenses, judgments, fines, penalties, or other amounts actually and reasonably incurred by the independent director in connection with any proceeding if the officer or director acted in good faith and did not derive an improper personal benefit from the transaction or occurrence that is the basis of the proceeding.

Annual meeting attendance

All directors, either in person or telephonically, attended the 2021 annual shareholders meeting. We have a formal policy requiring the members of our Board of Directors to attend annual stockholder meetings in person or by telephone or video conference.

Corporate governance, code of conduct and ethics

A code of business conduct and ethics is a written standard designed to deter wrongdoing and to promote (a) honest and ethical conduct, (b) full, fair, accurate, timely and understandable disclosure in regulatory filings and public statements, (c) compliance with applicable laws, rules, and regulations, (d) the prompt reporting violation of the code and (e) accountability for adherence to the code. The Company has adopted a written code of ethics (the “Code of Ethics”) that applies to the Company’s Chief Executive Officer and senior financial officers, including the Company’s Principal Accounting Officer, Controller, and persons performing similar functions (collectively, the “Senior Financial Officers”), in accordance with applicable federal securities laws and the rules of the NYSE American, and to all employees. Investors or any other person may view our Code of Ethics free of charge on the corporate governance subsection of the investor relations portion of our website at www.igcinc.us. The Company has established separate audit and compensation committees that are described elsewhere in this report. The Company does not have a separate nominating committee. Accordingly, Board of Director nominations occur by either selection or recommendation of a majority of the independent directors.

All our data, except accounting data, is stored in the cloud on multiple servers which helps us mitigate the overall risk of losing data. As part of corporate governance, we also have a cybersecurity policy that employees are required to comply with to safeguard their systems from cyber-attacks.

Director and Officer Derivative Trading and Hedging Policy

The Company has adopted a policy which prohibits our officers, non-employee directors, and key personnel from purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our common stock.

Delinquent Section 16(a) reports

Section 16(a) of the Securities and Exchange Act of 1934, as amended, requires our officers, directors, and beneficial owners of more than 10% of our equity securities to timely file certain reports regarding ownership of and transactions in our securities with the SEC. Copies of the required filings must also be furnished to us. Section 16(a) compliance was required during Fiscal 2022. Based solely on a review of Forms 3, 4, and 5 and amendments thereto furnished to us pursuant to Rule 16a-3(e) under the Exchange Act, we believe that Fiscal 2022’s filing requirements under Section 16(a) of the Exchange Act have been satisfied, except for (1) a Form 4 reporting one transaction by Rohit Goel filed with the SEC on May 17, 2021, (2) a Form 4 reporting three transactions by Claudia Grimaldi filed with the SEC on December 23, 2021, (3) a Form 4 reporting five transactions by Ram Mukunda filed with the SEC on December 23, 2021 (4) a Form 4 reporting 4 transactions by Richard K. Prins filed with the SEC on December 27, 2021 and (5) a Form 4 reporting two transactions by James P. Moran filed with the SEC on January 28, 2022.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Compensation for Executive Officers of the Company

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by, or paid to (i) all individuals serving as the smaller reporting company's principal executive officer or acting in a similar capacity during the last completed fiscal year (PEO), regardless of compensation level; (ii) the smaller reporting company's two most highly compensated executive officers other than the PEO who were serving as executive officers at the end of the last completed fiscal year and whose compensation exceeded $100,000 a year; and (iii) up to two additional individuals for whom disclosure would have been provided pursuant to paragraph (ii) but for the fact that the individual was not serving as an executive officer of the smaller reporting company at the end of the last completed fiscal year.

Summary Compensation Table

(in thousands)

|

Name and Principal Position

|

|

Year

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock Awards (1)

($)

|

|

|

Other compensation (2)

($)

|

|

|

Total Compensation

($)

|

|

|

Ram Mukunda

|

|

2022

|

|

|

320 |

|

|

|

200 |

|

|

|

4,974 |

|

|

|

9 |

|

|

|

5,503 |

|

|

President and CEO

|

|

2021

|

|

|

292 |

|

|

|

500 |

|

|

|

- |

|

|

|

9 |

|

|

|

801 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Claudia Grimaldi

|

|

2022

|

|

|

150 |

|

|

|

75 |

|

|

|

516 |

|

|

|

1 |

|

|

|

742 |

|

|

Vice President, CCO, and PFO

|

|

2021

|

|

|

147 |

|

|

|

100 |

|

|

|

- |

|

|

|

1 |

|

|

|

248 |

|

|

(1)

|

The Stock Awards represent the fair value of stock awards to the named executive officer as computed using the closing price at the day of grant. The Stock Awards include vested and unvested grants of stock awards as reflected in the table titled “Stock Awards at Fiscal Year End.” They also include two categories of Stock Awards that are set out in the tables titled “Performance Based Stock Awards” and “Market Price Based Stock Awards.” neither of these categories of Stock Awards vested as of March 31, 2022. Two milestones of the Performance based Category of Stock Awards described elsewhere were met during June 2022. Therefore, a total of 837 thousand shares vested as of the filing of this Form DEF14A.

|

|

(2)

|

Includes life insurance.

|

Compensation to Directors

(in thousands)

The following table shows, for fiscal 2022, the compensation awarded to, earned by, or paid to non-employee directors who served on the Board during the fiscal year.

|

Name

|

|

Stock

Awards (1)

|

|

|

Total

Compensation

($)

|

|

|

Richard Prins

|

|

|

800 |

|

|

|

977 |

|

| |

|

|

|

|

|

|

|

|

|

James Moran

|

|

|

150 |

|

|

|

147 |

|

| |

|

|

|

|

|

|

|

|

|

John Lynch

|

|

|

300 |

|

|

|

377 |

|

|

(1)

|

The Stock Awards represent the fair value of stock awards to the named director as computed using the closing price at the day of grant. The Stock Awards include vested and unvested grants of stock awards as reflected in the table titled “Stock Awards at Fiscal Year End.” They also include two categories of Stock Awards that are set out in the tables titled “Performance Based Stock Awards” and “Market Price Based Stock Awards” neither of these categories of Stock Awards vested as of March 31, 2022. Two milestones of the Performance based Category of Stock Awards described elsewhere were met during June 2022. Therefore, a total of 163 thousand shares vested as of the filing of this Form DEF14A.

|

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Outstanding Equity Awards at Fiscal End

(in thousands)

|

Name

|

|

Number of

shares or units

of stock that

have not vested (#)

|

|

|

Market value of

shares or units of

stock that have

not vested ($)

|

|

|

Market value of vested

stock awards in Fiscal Year ($)

|

|

|

Total Value of

Stock Awards ($)

|

|

|

Ram Mukunda

|

|

|

3,867

|

|

|

|

4,511

|

|

|

|

463

|

|

|

|

4,974

|

|

|

Claudia Grimaldi

|

|

|

317

|

|

|

|

400

|

|

|

|

116

|

|

|

|

516

|

|

|

Richard Prins

|

|

|

700

|

|

|

|

838

|

|

|

|

139

|

|

|

|

977

|

|

|

James Moran

|

|

|

100

|

|

|

|

98

|

|

|

|

49

|

|

|

|

147

|

|

|

John Lynch

|

|

|

150

|

|

|

|

168

|

|

|

|

209

|

|

|

|

377

|

|

The Stock Awards reflect the grant date fair value, in accordance with Accounting Standards Codification (ASC) Topic 718, Compensation — Stock Compensation (formerly Statement of Financial Accounting Standards (SFAS) No. 123R) for awards pursuant to the Company’s equity incentive program. During fiscal 2022, 150,000 options are issued and outstanding to our directors.

Included in the tables above are two categories of Stock Awards: (i) performance-based stock awards that are based on achieving milestones in the area of drug development; and (ii) market price-based awards, based on advancing the IGC stock price.

The Company believes that as of March 31, 2022, 1.25 million Stock Awards are not probable. Two milestones of the Performance based Category of Stock Awards were met during June 2022. Therefore, a total of 1 million shares vested as of the filing of this Form DEF14A.

The assumptions used in calculating fair value and amortization schedule based on the probability of achieving milestones and targets are included in Note 14, “Stock-Based Compensation” of the Notes to the Consolidated Financial Statements included in our Annual Reports on Form 10-K filed with the SEC on June 22, 2022. The Company cautions that the amounts reported in the Director Compensation Table for these awards may not represent the amounts that the directors will realize from the awards. Whether, and to what extent, an individual realizes value will depend on the Company’s actual operating performance and stock price fluctuations.

Employment contracts

Ram Mukunda has served as President and Chief Executive Officer of our Company since its inception. On November 18, 2021, the Company, and Mr. Mukunda entered into the 2021 CEO Employment Agreement that expires on November 17, 2026. Pursuant to the 2021 CEO Employment Agreement, we pay Mr. Mukunda a base salary of $360,000 per year. The Employment Agreement provides that the Board of Directors of our Company may review and update the targets and amounts for the net revenue and salary and contract bonuses on an annual basis. Mr. Mukunda is entitled to benefits, including insurance, participation in company-wide 401(k), reimbursement of business expenses, 20 days of annual paid vacation, sick leave, domestic help, driver, cook, and a car (subject to partial reimbursement by Mr. Mukunda of rental payments for the car and reimbursement of business expenses). In the event of a termination without cause, including a change of control, we would be required to pay Mr. Mukunda 1.5 times the average of the total compensation as disclosed in the previous two 10-K filings prior to termination. In addition, all unvested shares would be subject to immediate vesting.

Claudia Grimaldi has served as Vice President, Principal Financial Officer, Chief Compliance Officer, and Director of our subsidiaries since May 9, 2018. On June 14, 2019, the Company and Ms. Grimaldi entered into an Employment Agreement that expires on May 8, 2023 (the “2019 Employment Agreement”). Pursuant to the Employment Agreement, we pay Ms. Grimaldi a base salary of $150,000 per year. The Employment Agreement provides that the Company may review and update performance targets and contract bonuses on an annual basis. Ms. Grimaldi is entitled to benefits, including insurance, participation in company-wide 401(k), reimbursement of business expenses, 20 days of annual paid vacation, sick leave, and a car (subject to partial reimbursement by Ms. Grimaldi of rental payments for the car). In the event of a termination without cause, including a change of control, we would be required to pay Ms. Grimaldi 1.5 times her compensation. In addition, unvested shares that would otherwise vest in a 12-month period would be subject to immediate vesting.

For non-employee directors, the Company has a standard compensation arrangement such as fees for committee service, service as chairperson of the board, or a committee, and meeting attendance.

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Compensation risk assessment

In setting compensation, the Compensation Committee considers the risks to our stockholders and to achievement of our goals that may be inherent in our compensation programs. The Compensation Committee reviewed and discussed its assessment with management and concluded that our compensation programs are within industry standards and are designed with the appropriate balance of risk and reward to align employees’ interests with those of our Company and do not incent employees to take unnecessary or excessive risks. Although a portion of our executives’ and employees’ compensation is performance-based and “at risk,” we believe our compensation plans are appropriately structured and are not reasonably likely to result in a material adverse effect on our Company.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Certain Relationships and Related Transactions

During the last two fiscal years, we have not entered into any material transactions or series of transactions that would be considered material in which any officer, director or beneficial owner of 5% or more of any class of our capital stock, or any immediate family member of any of the preceding persons, had direct or indirect material interest, nor are there any such transactions presently proposed, other than the agreements with the affiliates of our CEO as described under “Executive Compensation – Compensation for Executive Officers of the Company.”

Review, approval, or ratification of related party transactions

We have a written policy for the review and approval of transactions with related persons. It is our policy for the disinterested members of our Board to review all related party transactions on a case-by-case basis. To receive approval, a related-party transaction must have a business purpose for us and be on terms that are fair and reasonable to us and as favorable to us as would be available from non-related entities in comparable transactions.

AUDIT INFORMATION

Principal Accountant Fees and Services

Manohar Chowdhry & Associates (MCA) is our Principal Independent Registered Public Accounting Firm engaged to examine our financial statements for Fiscal 2022. During the Company’s two most recent fiscal years ended March 31, 2022, and 2021, and through June 6, 2022, the Company did not consult with MCA on (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that may be rendered on the Company’s financial statements, and MCA has not provided either a written report or oral advice to the Company that was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue; or (ii) the subject of any disagreement, as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions, or a reportable event within the meaning set forth in Item 304(a)(1)(v) of Regulation S-K.

Audit related and other fees

The table below shows the fees that we paid or accrued for the audit and other services provided by Manohar Chowdhry & Associates for Fiscal 2022 and Fiscal 2021.

Audit fees

This category includes the audit of our annual financial statements, review of financial statements included in our annual and quarterly reports and services that are normally provided by the independent registered public accounting firms in connection with engagements for those fiscal years. This category also includes advice on audit and accounting matters that arose during, or as a result of, the audit or the review of interim financial statements.

Internal control audit fees

This category includes the audit of the Company’s internal control over financial reporting based on criteria established in Internal Control—Integrated Framework: (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

| FYE2022 Form DEF 14A

| FYE2022 Form DEF 14A

Audit-related fees

This category consists of assurance and related services by the independent registered public accounting firms that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.” The services for the fees disclosed under this category include services relating to our registration statement and consultation regarding our correspondence with the SEC.

Tax fees

This category consists of professional services rendered for tax compliance, tax planning, and tax advice. These services include tax return preparation and advice on state and local tax issues.

All other fees

This category consists of fees for other miscellaneous items.

| |

|

(in thousands)

|

|

| |

|

March 31,

|

|

| |

|

2022

|

|

|

2021

|

|

| |

|

|

|

|

|

|

|

|

|

Audit fees - Manohar Chowdhry & Associates

|

|

$ |

64 |

|

|

$ |

64 |

|

|

Audit-related fees - Manohar Chowdhry & Associates

|

|

|

- |

|

|

|

- |

|

|

Tax fees

|

|

|

9 |

|

|

|

9 |

|

|

All other fees

|

|

|

- |

|

|

|

- |

|

|

Total

|

|

$ |

73 |

|

|

$ |

73 |

|

Policy on pre-approval of audit and permissible non-audit services of independent auditors

Consistent with SEC policies regarding auditor independence, the audit committee of our Board of Directors has responsibility for appointing, setting compensation, and overseeing the work of the independent auditor. In recognition of this responsibility, our Board of Directors has established a policy to pre-approve all audit and permissible non-audit services provided by the independent auditor. Prior to engagement of the independent auditor for the next year’s audit, management may submit, if necessary, an aggregate of services expected to be rendered during that year for each of the following four categories of services to our Board of Directors for approval.

| |

1.

|

Audit services include audit work performed in the preparation of financial statements and audit of internal controls, as well as work that generally only the independent auditor can reasonably be expected to provide, including comfort letters, statutory audits, and attest services and consultation regarding financial accounting and/or reporting standards.

|

| |

2.

|

Audit-Related services are for assurance and related services that are traditionally performed by the independent auditor, including due diligence related to mergers and acquisitions, employee benefit plan audits, and special procedures required to meet certain regulatory requirements.

|

| |

3.

|

Tax services include all services performed by the independent auditor’s tax personnel except those services specifically related to the audit of the financial statements, and includes fees in the areas of tax compliance, tax planning, and tax advice.

|

| |

4.

|

Other Fees are those associated with services not captured in the other categories.

|

Prior to engagement, our Board of Directors pre-approves these services by category of service. The fees are budgeted, and our Board of Directors requires the independent auditor and management to report actual fees versus the budget periodically throughout the year by category of service. During the year, circumstances may arise when it may become necessary to engage the independent auditor for additional services not contemplated in the original pre-approval. In those instances, our Board of Directors requires specific pre-approval before engaging the independent auditor.