India Globalization Capital, Inc. (NYSEAM: IGC) announces its

financial results for the Fiscal Year Ended March 31, 2019.

Fiscal 2019 revenue was approximately $5.12 million compared to

approximately $2.19 million for Fiscal 2018. In both years, revenue

was primarily derived from our India based Infrastructure Business

which consists of a) rental of heavy equipment; b) execution of

construction contracts; and c) the sale of infrastructure

commodities.

During the two last weeks of Fiscal 2019, sales commenced in the

Plant and Cannabinoid Business. Specifically, on March 22, 2019,

the Company began offering hemp-based cannabidiol (CBD) under the

brand Holi HempTM and that contributed $25 thousand to total

revenue. On March 27, 2019 HyalolexTM, the Company’s flagship

product for helping improve the quality of life for elderly

patients suffering from Alzheimer’s, became available through

select dispensaries in Puerto Rico.

SG&A expense for Fiscal 2019 was approximately $3.52 million

as compared to approximately $1.73 million for Fiscal 2018.

Approximately $1.1 million of the increase is due to legal and

professional fees.

Research and Development (R&D) expense for Fiscal 2019 was

approximately $1.3 million compared to approximately $137 thousand

for the Fiscal 2018. R&D expenses are entirely from our Plant

and Cannabinoid Business and relate primarily to a) HyalolexTM,

SerosapseTM, NatrinolTM, and Holi HempTM products; b) costs

associated with the preparation of FDA filings, and preparation for

medical trials; and c) inventory that was shown as work in progress

in Fiscal 2018.

Net loss for Fiscal 2019 was approximately $4.1 million or $0.13

per share, compared to approximately $1.79 million or $0.06 per

share for Fiscal 2018. Increased expenses outlined above were

primarily the cause of the larger loss.

About IGC:

IGC has two lines of business: a) infrastructure, and b) plant

and cannabinoid-based products. The company is based in Maryland,

U.S.A. Our website: www.igcinc.us.Twitter @IGCIR

Forward-looking Statements:

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934.

These forward-looking statements are based largely on IGC’s

expectations and are subject to a number of risks and

uncertainties, certain of which are beyond IGC’s control. Actual

results could differ materially from these forward-looking

statements as a result of, among other factors, competitive

conditions in the industries in which IGC operates, failure to

commercialize one or more of the technologies of IGC, general

economic conditions that are less favorable than expected, the

Federal Food and Drug Administration’s (FDA) general position

regarding hemp based products and our products in particular, and

other factors, many of which are discussed in our SEC filings. In

light of these risks and uncertainties, there can be no assurance

that the forward-looking information contained in this release will

in fact occur.

India Globalization Capital,

Inc.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

March 31, 2019

($)

March 31, 2018

($)

ASSETS Current assets:

Cash and cash equivalents 25,610 1,658 Accounts receivable, net of

allowances 84 558 Inventory 248 486 Investment held for sale - 148

Deposits and advances 781 355

Total current

assets 26,723 3,205 Intangible assets, net

184 128 Property, plant and equipment, net 5,886 6,237 Investments

in unlisted securities 794 799 Claims and advances 878

484

Total long-term assets 7,742

7,648 Total assets 34,465

10,853 LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities: Accounts payable 319

258 Accrued liabilities and others 509 288 Short-term loan 50 -

Notes payable - 1,800

Total current liabilities

878 2,346 Loan - 427 Other liabilities

15 15

Total non-current liabilities

15 442 Total liabilities

893 2,788 Commitments and

Contingencies – See Note 11 Stockholders' equity:

Common stock and additional paid-in

capital, $0.0001 par value: 150,000,000 shares authorized;

39,501,407 and 30,764,192 shares issued

and outstanding as on

March 31, 2019 and March 31, 2018

respectively.

94,043 63,917 Accumulated other comprehensive loss (2,419 ) (2,057

) Accumulated deficit (58,052 ) (53,795 )

Total

stockholders' equity 33,572 8,065

Total liabilities and stockholders' equity

34,465 10,853

These financial statements should be read in

connection with the accompanying notes on Form 10-K for thefiscal

year ending March 31, 2019, filed with the SEC on June 14,

2019.

India Globalization Capital,

Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

(in thousands, except loss per share)

Years Ended March 31, 2019

($)

2018

($)

Revenues 5,116 2,193 Cost of revenues (4,984 ) (2,111 )

Gross

profit 132 82 General and administrative expenses

(3,519 ) (1,734 ) Research and development expenses (1,256 ) (137 )

Operating loss (4,643 ) (1,789 )

Other income – net 548 3

Loss before income taxes

(4,095 ) (1,786 ) Income taxes expense

(2 ) -

Net loss attributable to common

stockholders (4,097 ) (1,786

) Foreign currency translation adjustments (362 ) (9 )

Comprehensive loss (4,459 )

(1,795 ) Loss per share attributable to

common stockholders: Basic & diluted $ (0.13 ) $ (0.06 )

Weighted-average number of shares used in computing loss per share

amounts:

35,393 27,937

These financial statements should be read in

connection with the accompanying notes on Form 10-K for thefiscal

year ending March 31, 2019, filed with the SEC on June 14,

2019.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190617005242/en/

Claudia Grimaldi301-983-0998

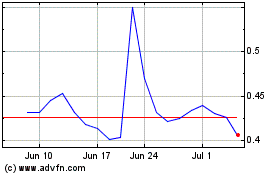

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

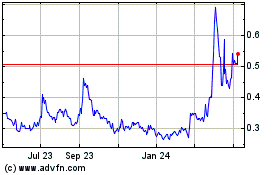

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Apr 2023 to Apr 2024