Settlement to result in, among other items,

appointment of two new Minority Directors plus an additional

independent board member, establishment of a Strategic Review

Committee, requirement of majority of independent stockholders vote

on related party transactions and commitment to purchase a pro rata

share and provide backstop support for an equity offering

Globalstar, Inc. (NYSE American: GSAT) (“the Company”), together

with Mudrick Capital Management, L.P. (“Mudrick Capital”) and

Warlander Asset Management, LP (“Warlander”) and all other

litigation parties are pleased to announce that the parties have

entered into a Settlement Agreement related to the litigation

brought by Mudrick Capital and Warlander in Delaware Chancery Court

involving Globalstar and certain of its directors, officers and

employees.

As a result of the Settlement Agreement, the parties have agreed

to the addition of three new seasoned telecom executives to the

Company’s Board of Directors: Keith Cowan, Ben Wolff and Mike

Lovett. These new directors will be immediately appointed to the

Globalstar Board of Directors to fill three vacancies left by

existing board members who support this settlement and volunteered

to step down from their positions. Messrs. Cowan and Wolff will be

designated the “Minority Directors” and at the end of Minority

Directors’ terms such seats shall be filled by candidates elected

by a plurality vote of minority stockholders. Both Minority

Directors shall be appointed to a new, standing Strategic Review

Committee, and one Minority Director will be appointed to each of

the Compensation Committee and the Nominating & Corporate

Governance Committee. Additionally, Timothy Taylor, Vice President

of Thermo and Globalstar’s Vice President of Finance, Business

Operations and Strategy will join the board to fill a vacancy left

by a fourth board member retiring from his position on the

board.

The Strategic Review Committee will be comprised of Minority

Directors Ben Wolff, Keith Cowan, and two other directors, William

Hasler and Timothy Taylor. The Strategic Review Committee’s first

order of business shall be to assess financing options for

Globalstar. Furthermore, the Strategic Review Committee will have

exclusive authority for the review and oversight of certain events

and its approval shall be necessary for events including but not

limited to: (i) any acquisition by Thermo and/or any Jay Monroe

affiliated party or person of additional newly-issued securities of

Globalstar, subject to certain exceptions; (ii) any extraordinary

corporate transaction, such as a merger, reorganization or

liquidation, involving Globalstar or any of its subsidiaries; (iii)

any sale or transfer of a material amount of assets of Globalstar

or any sale or transfer of assets of any of its subsidiaries which

are material to Globalstar; (iv) any further change in the Board of

Directors of Globalstar, including any plans or proposals to change

the number or term of directors or to fill any vacancies on the

Board, provided that only elections of Minority Directors shall be

within the authority of the Strategic Review Committee; (v) any

material change in the present capitalization or dividend policy of

Globalstar; (vi) any transaction between the Company and Thermo or

one or more of its affiliates that has a value in excess of

$250,000 (subject to certain exceptions) and (vii) any other

material changes in Globalstar’s lines of business or corporate

structure. The Globalstar Certificate of Incorporation will be

amended to establish the Strategic Review Committee which shall

remain in place until such time as Thermo and its affiliates no

longer beneficially own 45% or more of Globalstar’s outstanding

stock. Additionally, the Certificate of Incorporation and Bylaws

will be amended to require a majority of independent stockholders

to vote on any related party transaction between Globalstar and Jay

Monroe, or Thermo and its and their respective affiliates, with a

value of $5 million or more (subject to certain exceptions).

Within five business days of an event of (i) refinancing of 85%

of Globalstar’s bank debt, (ii) refinancing of a minimum of $150

million of Globalstar’s bank debt with a minimum two year extension

of maturity on the remaining balance, or (iii) an extension of

maturity or amortization holiday on such debt of two years or more,

Thermo has agreed to convert all of its outstanding subordinated

debt into Globalstar common equity at the contractual conversion

price under its subordinated loan agreement. If triggered, this

conversion will have the additional benefit of immediately reducing

the Company’s debt by at least $116 million.

The Settlement Agreement requires Globalstar to conduct an

undiscounted equity offering (less any underwriting discount) of

its common stock to qualified and readily identifiable Globalstar

stockholders on a pro rata basis, based on ownership, in an amount

recommended by Globalstar’s management of not more than $60

million, exclusive of any funds raised pursuant to an underwriter

option. Thermo, Mudrick Capital and Warlander have agreed to

purchase their pro rata share of any such offering and to backstop

the balance offered to, but not purchased by, other Globalstar

stockholders, on a pro rata basis based on their respective

ownerships of Globalstar’s common stock. The settlement and any

related fee award is subject to confirmatory diligence and

confirmation and approval by the Delaware Chancery Court.

This press release shall not constitute an offer to sell or the

solicitation of any offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

Jay Monroe, Executive Chairman of Globalstar, commented,

“Globalstar and Thermo are pleased with this outcome and happy to

put this litigation behind us. We would like to thank the outgoing

directors for their many years of service to the Company and would

like to welcome Ben, Keith and Mike to the Globalstar team. In the

last week, we have spent a significant amount of time with all

three of them and believe that they will be excellent board

members, especially given their deep telecom and spectrum

experience which is so important to our future plans.”

Mr. Monroe continued, “We are pleased to have reached agreement

with Mudrick Capital and Warlander and appreciate their support

moving forward. Litigation is costly and time consuming, and we

prefer to focus our time and resources on moving towards value

realization which this settlement frees us up to do. We continue to

believe in Globalstar’s potential and welcome the new directors to

help us realize it. Our management team looks forward to working

with the Strategic Review Committee and the full Board of Directors

on the continued thoughtful examination of our business.”

Jason Mudrick, the President and Chief Investment Officer of

Mudrick Capital and Eric Cole, Chief Executive Officer of

Warlander, together issued the following statement: “This

settlement reflects a constructive dialogue with the Globalstar

team and we look forward to continuing our collaborative

relationship in order to further enhance shareholder value. We

continue to strongly believe in the value of Globalstar’s assets

and its ability to monetize those assets. The details of this

settlement - including the minority shareholder provisions such as

the new Minority Directors, a new independent director, and the

Strategic Review Committee - provide us with additional confidence

for the future of this Company. We are also excited to have Ben,

Keith and Mike join the Globalstar board. Given their expertise in

the telecom sector and with successful spectrum transactions, we

believe they will add tremendous value immediately. We are

confident that the Settlement heralds a new era of sustainable

value creation for the benefit of all of Globalstar’s

stockholders.”

Ben Wolff, Keith Cowan and Mike Lovett jointly issued the

following statement: “We believe Globalstar has a unique collection

of assets and are excited to join the Board of Directors. We look

forward to working with the rest of the Board and the management

team to enhance value for all stakeholders.”

About Globalstar’s New Minority and Independent

Directors

Keith Cowan

Since January 2013, Mr. Cowan has served as the Chief Executive

Officer of Cowan Consulting Corporation LLC, a privately held

company that manages investments and provides strategic planning

and board advisory services. From July 2007 to January 2013, Mr.

Cowan was the President of Strategic Planning and Corporate

Initiatives at Sprint Corporation, with responsibilities that

included developing the long-term strategic plan for Sprint,

restructuring and managing Clearwire Corporation as a public

company consortium including Sprint, Comcast, Time Warner Cable,

Intel, Google, and Bright House Networks, and managing the sale of

control of Sprint to Softbank. From May 1996 to January 2007, Mr.

Cowan held a variety of roles at BellSouth Corporation, which

subsequently merged with AT&T, including Chief Development

Officer, Chief Network Field Officer and President of Marketing and

Product Management. Mr. Cowan’s time at BellSouth included his

instrumental role in the creation and governance of Cingular

Wireless and responsibility for entering, governing and exiting

many of BellSouth’s international wireless partnerships in Europe,

the Middle East, South America, and Asia.

Mr. Cowan has served as a board member of over a dozen private

companies, two public companies, and numerous not-for-profit and

civic organizations, including, currently, his service as Chairman

of the Board of Aegex Technologies, CX Technologies (ENGAGEcx),

Cobra Legal Solutions and Venadar LLC.

Ben Wolff

Mr. Wolff serves as the Chairman and CEO of Sarcos Robotics, a

global leader in mobile, dexterous, tele-operated robots. Mr.

Wolff served from 2009 to 2014 as Chief Executive Officer,

President and Chairman at satellite communications firm ICO Global

Communications which was subsequently renamed Pendrell Corp. In

2003, Mr. Wolff co-founded Clearwire Corporation, where he served

as President, CEO and Co-Chairman. Mr. Wolff oversaw the growth of

the company to more than $1 billion in revenues and 3,500

employees, raising more than $12 billion in debt and equity

financing during his tenure. Clearwire was sold to Sprint in 2013

for more than $14 billion. From 2004 to 2011, Mr. Wolff also served

as President of Eagle River Investments, a telecom and technology

focused private equity and venture capital fund, and as a member of

the board of directors of various public and private Eagle River

portfolio companies.

Michael Lovett

Since October 2012, Mr. Lovett has served as managing partner of

Eagle River Partners LLC, a privately held investment and advisory

company. Until April 2012, Mr. Lovett served as the CEO and

President of Charter Communications. Previously he was COO and

joined Charter in August 2003 as Senior Vice President of

Operations. Mr. Lovett’s career in cable and telecom related

companies began in 1980 with Centel Communications where he held a

number of positions in operations. He was with Jones Intercable

Inc. from 1989 to 1999 rising to Senior Vice President with

responsibility for operations in nine states; and AT&T

Broadband as Regional Vice President of Operations from June 1999

to November 2000. He served as Executive Vice President of

Operations for OneSecure Inc. a managed security service company

providing management/monitoring of firewalls and virtual private

networks from November 2000 to December 2001; and was Chief

Operating Officer for Voyant Technologies Inc. a voice conferencing

hardware/software solutions provider in Denver from December 2001

to August 2003.

About Globalstar

Globalstar is a leading provider of mobile satellite voice and

data services. Customers around the world in industries such as

government, emergency management, marine, logging, oil & gas

and outdoor recreation rely on Globalstar to conduct business

smarter and faster, maintain peace of mind and access emergency

personnel. Globalstar data solutions are ideal for various asset

and personal tracking, data monitoring, M2M and IoT applications.

The Company's products include mobile and fixed satellite

telephones, the innovative Sat-Fi satellite hotspot, Simplex and

Duplex satellite data modems, tracking devices and flexible service

packages.

About Mudrick Capital

Mudrick Capital Management, L.P. is an SEC-registered investment

adviser specializing in distressed credit and deep value event

driven investing. Mudrick Capital manages capital for a diverse

group of sophisticated institutions and individuals, including

endowments, foundations, insurance companies, private banks,

fund-of-funds, pensions, family offices and high net worth

individuals.

About Warlander Asset Management

Founded in 2015, Warlander Asset Management, LP is an

SEC-registered investment adviser that specializes in long/short,

credit-oriented investments, focused on opportunistically investing

across the full spectrum of global fixed income and

credit-sensitive equities.

This press release contains forward-looking statements within

the meaning of federal securities laws and regulations. These

forward-looking statements are identified by their use of terms and

phrases such as “believe,” “expect,” “intend,” “project,”

“anticipate,” “position,” and other similar terms and phrases,

including references to assumptions and forecasts of future

results. Forward-looking statements are not guarantees of future

performance and involve known and unknown risks, uncertainties and

other factors which may cause the actual results to differ

materially from those anticipated at the time the forward-looking

statements are made. These risks include, but are not limited to

the risk that the anticipated settlement may be terminated, the

consummation of the financing and those risks and uncertainties

associated with the Company’s business described from time to time

in its filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K filed on February 23,

2018. Although the Company believes the expectations reflected in

such forward-looking statements are based upon reasonable

assumptions, the Company can give no assurance that the

expectations will be attained or that any deviation will not be

material. All information in this release is as of the date of this

release, and the Company undertakes no obligation to update any

forward-looking statement to conform the statement to actual

results or changes in its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181217005352/en/

Globalstar contact information:Samantha

DeCastrosamantha.decastro@globalstar.com

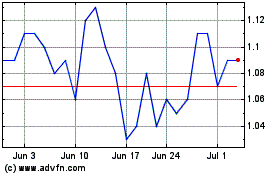

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

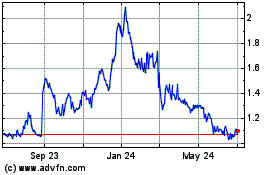

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Apr 2023 to Apr 2024