Franklin Street Properties Corp. (the “Company”, “FSP”, “we” or

“our”) (NYSE American: FSP), a real estate investment trust (REIT),

announced its results for the second quarter ended June 30,

2019.

George J. Carter, Chairman and Chief Executive Officer,

commented as follows:

“Leasing activity within our property portfolio of 32

operating and 3 redevelopment properties continued at a strong pace

during the second quarter of 2019 and, when combined with our first

quarter, set a record for the amount of square footage leased in

the first half of any FSP fiscal year. In addition, while the price

of crude oil was volatile during the second quarter of 2019, we

believe that a continuation at recent pricing levels could maintain

support to the many businesses and their growth plans within our

energy-influenced markets of Houston and Denver. Prospective new

tenant activity at our 3 redevelopment properties located in Miami,

Minneapolis and Charlotte continued to be robust during the second

quarter of 2019. We expect to make meaningful progress with these

assets during the remainder of 2019. With over $600 million of

available liquidity as of June 30, 2019, we are confident that we

have the financial resources needed to maximize our leasing and

redevelopment value-add opportunities.”

Highlights

- Net income was $1.6 million or $0.02 per basic and diluted

share for the second quarter ended June 30, 2019. Funds From

Operations (FFO) was $23.8 million or $0.22 per basic and diluted

share for the second quarter ended June 30, 2019.

- Adjusted Funds From Operations (AFFO) was $0.03 per basic and

diluted share for the second quarter ended June 30, 2019.

- We are raising our full year FFO guidance for 2019, which is

now estimated to be in the range of $0.84 to $0.88 per basic and

diluted share from our previously estimated range of $0.81 to $0.87

per basic and diluted share.

- On June 27, 2019, one of our single-asset REITs, FSP Energy

Tower I Corp., sold the property owned by it to a third party.

Following that sale, we received approximately $51 million as

repayment in full of a mortgage loan.

Leasing Update

- Our directly owned real estate portfolio of 32 operating

properties (excluding 3 redevelopment properties) totaling

approximately 9.5 million square feet was approximately 88.1%

leased as of June 30, 2019.

- During the quarter ended June 30, 2019, we leased approximately

375,000 square feet, of which approximately 123,000 square feet was

with new tenants. During the six months ended June 30, 2019, we

leased approximately 835,000 square feet, of which approximately

218,000 square feet was with new tenants. The leasing total

represents a first half record high for FSP. The average first half

leasing total for the prior five years was approximately 563,000

square feet.

- The weighted average GAAP base rent achieved on leasing

activity during the first half of 2019 was $31.46 per square foot

and the portfolio weighted average rent per occupied square foot

increased from $29.01 as of December 31, 2018 to $29.68 as of June

30, 2019.

Dividend Update

On July 5, 2019, the Company announced that its Board of

Directors declared a regular quarterly cash dividend for the three

months ended June 30, 2019 of $0.09 per share of common stock that

will be paid on August 8, 2019 to stockholders of record on July

19, 2019.

Non-GAAP Financial

Information

A reconciliation of Net income (loss) to FFO, AFFO and

Sequential Same Store NOI and our definitions of FFO, AFFO and

Sequential Same Store NOI can be found on Supplementary Schedules H

and I.

Real Estate Update

Supplementary schedules provide property information for the

Company’s owned and managed real estate portfolio as of June 30,

2019. The Company will also be filing an updated supplemental

information package that will provide stockholders and the

financial community with additional operating and financial data.

The Company will file this supplemental information package with

the SEC and make it available on its website at

www.fspreit.com.

FFO Guidance

We are raising our full year net income or loss guidance for

2019, which is estimated to be in the range of net income of

approximately $0.00 to net income of $0.04 per basic and diluted

share, and are introducing guidance for the third quarter of 2019,

which is estimated to be in the range of net income of

approximately $0.00 to net income of approximately $0.02 per basic

and diluted share. We are raising our full year FFO guidance for

2019, which is estimated to be in the range of approximately $0.84

to $0.88 per basic and diluted share, and are introducing guidance

for the third quarter of 2019, which is estimated to be in the

range of approximately $0.21 to $0.23 per basic and diluted share.

This guidance (a) excludes the impact of future acquisitions,

developments, dispositions, debt financings or repayments or other

capital market transactions; (b) reflects estimates from our

ongoing portfolio of properties, other real estate investments and

general and administrative expenses; and (c) reflects our current

expectations of economic conditions. We will update guidance

quarterly in our earnings releases. There can be no assurance that

the Company’s actual results will not differ materially from the

estimates set forth above.

A reconciliation of the guidance for net income (loss) per share

to the guidance for FFO per share is provided as follows:

Q3 2019 Range

Full Year 2019 Range

Low

High

Low

High

Net income (loss) per share

$

0.00

$

0.02

$

0.00

$

0.04

Depreciation & Amortization

0.21

0.21

0.84

0.84

Funds From Operations per share

$

0.21

$

0.23

$

0.84

$

0.88

Today’s news release, along with other news about Franklin

Street Properties Corp., is available on the Internet at

www.fspreit.com. We routinely post information that may be

important to investors in the Investor Relations section of our

website. We encourage investors to consult that section of our

website regularly for important information about us and, if they

are interested in automatically receiving news and information as

soon as it is posted, to sign up for E-mail Alerts.

Earnings Call

A conference call is scheduled for July 31, 2019 at 11:00 a.m.

(ET) to discuss the second quarter 2019 results. To access the

call, please dial 1-800-464-8240. Internationally, the call may be

accessed by dialing 1-412-902-6521. To access the call from Canada,

please dial 1-866-605-3852. To listen via live audio webcast,

please visit the Webcasts & Presentations section in the

Investor Relations section of the Company's website

(www.fspreit.com) at least ten minutes prior to the start of the

call and follow the posted directions. The webcast will also be

available via replay from the above location starting one hour

after the call is finished.

About Franklin Street Properties Corp.

Franklin Street Properties Corp., based in Wakefield,

Massachusetts, is focused on infill and central business district

(CBD) office properties in the U.S. Sunbelt and Mountain West, as

well as select opportunistic markets. FSP seeks value-oriented

investments with an eye towards long-term growth and appreciation,

as well as current income. FSP is a Maryland corporation that

operates in a manner intended to qualify as a real estate

investment trust (REIT) for federal income tax purposes. To learn

more about FSP please visit our website at www.fspreit.com.

Forward-Looking Statements

Statements made in this press release that state FSP’s or

management’s intentions, beliefs, expectations, or predictions for

the future may be forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. This press

release may also contain forward-looking statements, such as our

ability to lease space in the future, expectations for FFO and net

income (loss) in future periods, expectations for operating

performance, expectations for crude oil prices and their impact on

the Houston and Denver markets in future periods, value

creation/enhancement in future periods, expectations for growth and

leasing activities in future periods, expectations regarding the

timing, leasing and economic results of our redevelopment

properties that are based on current judgments and current

knowledge of management and are subject to certain risks, trends

and uncertainties that could cause actual results to differ

materially from those indicated in such forward-looking statements.

Accordingly, readers are cautioned not to place undue reliance on

forward-looking statements. Investors are cautioned that our

forward-looking statements involve risks and uncertainty, including

without limitation, economic conditions in the United States,

including the level of interest rates, disruptions in the debt

markets, economic conditions in the markets in which we own

properties, risks of a lessening of demand for the types of real

estate owned by us, changes in government regulations and

regulatory uncertainty, uncertainty about governmental fiscal

policy, geopolitical events and expenditures that cannot be

anticipated such as utility rate and usage increases, delays in

construction schedules, unanticipated repairs, additional staffing,

insurance increases and real estate tax valuation reassessments.

See the “Risk Factors” set forth in Part I, Item 1A of our Annual

Report on Form 10-K for the year ended December 31, 2018, as the

same may be updated from time to time in subsequent filings with

the United States Securities and Exchange Commission. Although we

believe the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results,

levels of activity, acquisitions, dispositions, performance or

achievements. We will not update any of the forward-looking

statements after the date of this press release to conform them to

actual results or to changes in our expectations that occur after

such date, other than as required by law.

Franklin Street Properties

Corp. Earnings Release Supplementary Information Table of

Contents

Franklin Street Properties Corp. Financial

Results

A-C

Real Estate Portfolio Summary

Information

D

Portfolio and Other Supplementary

Information

E

Percentage of Leased Space

F

Largest 20 Tenants – FSP Owned

Portfolio

G

Reconciliation and Definitions of Funds

From Operations (FFO) and Adjusted

Funds From Operations (AFFO)

H

Reconciliation and Definition of

Sequential Same Store results to Property Net

Operating Income (NOI) and Net Income

(Loss)

I

Franklin Street Properties Corp.

Financial Results Supplementary Schedule A Condensed Consolidated

Income (Loss) Statements (Unaudited)

For the

For the

Three Months Ended

Six Months Ended

June 30,

June 30,

(in thousands, except per share

amounts)

2019

2018

2019

2018

Revenue:

Rental

$

65,485

$

65,409

$

128,844

$

131,037

Related party revenue:

Management fees and interest income from

loans

1,322

1,276

2,674

2,532

Other

6

9

11

18

Total revenue

66,813

66,694

131,529

133,587

Expenses:

Real estate operating expenses

17,116

16,954

34,842

34,105

Real estate taxes and insurance

12,801

12,292

24,903

23,469

Depreciation and amortization

22,109

23,591

45,354

47,626

General and administrative

3,702

3,082

7,211

6,514

Interest

9,371

9,753

18,739

19,239

Total expenses

65,099

65,672

131,049

130,953

Income before taxes on income and equity

in loss of non-consolidated REITs

1,714

1,022

480

2,634

Tax expense on income

81

75

52

157

Equity in loss of non-consolidated

REITs

—

(282

)

—

(387

)

Net income

$

1,633

$

665

$

428

$

2,090

Weighted average number of shares

outstanding, basic and diluted

107,231

107,231

107,231

107,231

Net income per share, basic and

diluted

$

0.02

$

0.01

$

0.00

$

0.02

Franklin Street Properties Corp.

Financial Results Supplementary Schedule B Condensed Consolidated

Balance Sheets (Unaudited)

June 30,

December 31,

(in thousands, except share and par value

amounts)

2019

2018

Assets:

Real estate assets:

Land

$

191,578

$

191,578

Buildings and improvements

1,886,294

1,857,935

Fixtures and equipment

10,607

8,839

2,088,479

2,058,352

Less accumulated depreciation

460,798

432,579

Real estate assets, net

1,627,681

1,625,773

Acquired real estate leases, less

accumulated amortization of $70,108 and $101,897, respectively

49,475

59,595

Cash, cash equivalents and restricted

cash

13,100

11,177

Tenant rent receivables

6,366

3,938

Straight-line rent receivable

61,438

54,006

Prepaid expenses and other assets

8,052

10,400

Related party mortgage loan

receivables

21,530

70,660

Other assets: derivative asset

4,645

14,765

Office computers and furniture, net of

accumulated depreciation of $1,428 and $1,512, respectively

154

197

Deferred leasing commissions, net of

accumulated amortization of $26,930 and $24,318, respectively

50,901

47,591

Total assets

$

1,843,342

$

1,898,102

Liabilities and Stockholders’ Equity:

Liabilities:

Bank note payable

$

—

$

25,000

Term loans payable, less unamortized

financing costs of $4,995 and $5,722, respectively

765,005

764,278

Series A & Series B Senior Notes, less

unamortized financing costs of $1,067 and $1,150, respectively

198,933

198,850

Accounts payable and accrued expenses

54,282

59,183

Accrued compensation

2,191

3,043

Tenant security deposits

9,118

6,319

Lease liability

2,059

—

Other liabilities: derivative

liabilities

8,132

—

Acquired unfavorable real estate leases,

less accumulated amortization of $5,034 and $6,605,

respectively

3,114

3,795

Total liabilities

1,042,834

1,060,468

Commitments and contingencies

Stockholders’ Equity:

Preferred stock, $.0001 par value,

20,000,000 shares authorized, none issued or outstanding

—

—

Common stock, $.0001 par value,

180,000,000 shares authorized, 107,231,155 and 107,231,155 shares

issued and outstanding, respectively

11

11

Additional paid-in capital

1,356,457

1,356,457

Accumulated other comprehensive income

(loss)

(3,487

)

14,765

Accumulated distributions in excess of

accumulated earnings

(552,473

)

(533,599

)

Total stockholders’ equity

800,508

837,634

Total liabilities and stockholders’

equity

$

1,843,342

$

1,898,102

Franklin Street Properties Corp.

Financial Results Supplementary Schedule C Condensed Consolidated

Statements of Cash Flows (Unaudited)

For the

Six Months Ended

June 30,

(in thousands)

2019

2018

Cash flows from operating

activities:

Net income

$

428

$

2,090

Adjustments to reconcile net income or

loss to net cash provided by operating activities:

Depreciation and amortization expense

46,791

49,050

Amortization of above and below market

leases

(193

)

(208

)

Equity in loss of non-consolidated

REITs

—

387

Decrease in allowance for doubtful

accounts and write-off of accounts receivable

(91

)

(80

)

Changes in operating assets and

liabilities:

Tenant rent receivables

(2,337

)

(836

)

Straight-line rents

(4,829

)

299

Lease acquisition costs

(2,603

)

(398

)

Prepaid expenses and other assets

2,392

325

Accounts payable and accrued expenses

(8,741

)

(8,609

)

Accrued compensation

(852

)

(1,863

)

Tenant security deposits

2,799

193

Payment of deferred leasing

commissions

(8,114

)

(6,641

)

Net cash provided by operating

activities

24,650

33,709

Cash flows from investing

activities:

Property improvements, fixtures and

equipment

(28,944

)

(24,281

)

Distributions in excess of earnings from

non-consolidated REITs

—

710

Repayment of related party mortgage loan

receivable

51,530

530

Investment in related party mortgage loan

receivable

(2,400

)

—

Proceeds received from liquidating

trust

1,470

—

Net cash provided by (used in) investing

activities

21,656

(23,041

)

Cash flows from financing

activities:

Distributions to stockholders

(19,302

)

(30,025

)

Borrowings under bank note payable

45,000

30,000

Repayments of bank note payable

(70,000

)

(10,000

)

Deferred financing costs

(81

)

(14

)

Net cash used in financing activities

(44,383

)

(10,039

)

Net increase in cash, cash equivalents

and restricted cash

1,923

629

Cash, cash equivalents and restricted

cash, beginning of year

11,177

9,819

Cash, cash equivalents and restricted

cash, end of period

$

13,100

$

10,448

Franklin Street Properties Corp.

Earnings Release Supplementary Schedule D Real Estate Portfolio

Summary Information (Unaudited & Approximated)

Commercial portfolio lease expirations

(1)

Total

% of

Year

Square Feet

Portfolio

2019

335,299

3.4%

2020

801,274

8.1%

2021

685,244

6.9%

2022

1,221,950

12.3%

2023

651,756

6.6%

Thereafter (2)

6,207,987

62.7%

9,903,510

100.0%

_______________________

(1) Percentages are determined based upon total square footage.

(2) Includes 1,132,755 square feet of current vacancies at our

operating properties and 356,633 square feet of current vacancies

at our redevelopment properties. We define redevelopment properties

as properties being developed, redeveloped or where

development/redevelopment is complete but that are not yet

stabilized.

(dollars & square feet in 000's)

As of June 30, 2019 (a)

# of

% of

Square

% of

State

Properties

Investment

Portfolio

Feet

Portfolio

Colorado

6

$

544,745

33.5%

2,620

26.5%

Texas

9

345,057

21.2%

2,415

24.4%

Georgia

5

320,753

19.7%

1,967

19.9%

Minnesota

3

119,813

7.4%

754

7.6%

Virginia

4

81,238

5.0%

685

6.9%

North Carolina

2

51,172

3.1%

322

3.2%

Missouri

2

46,323

2.8%

351

3.5%

Illinois

2

48,148

3.0%

372

3.8%

Florida

1

41,206

2.5%

213

2.1%

Indiana

1

29,226

1.8%

205

2.1%

Total

35

$

1,627,681

100.0%

9,904

100.0%

(a) Includes investment in our redevelopment properties. We

define redevelopment properties as properties being developed,

redeveloped or where complete, but that are not yet stabilized.

Franklin Street Properties Corp.

Earnings Release Supplementary Schedule E Portfolio and Other

Supplementary Information (Unaudited & Approximated)

Recurring Capital Expenditures

Six Months

(in thousands)

For the Three Months Ended

Ended

31-Mar-19

30-Jun-19

30-Jun-19

Tenant improvements

$

8,318

$

10,169

$

18,487

Deferred leasing costs

4,239

3,666

7,905

Non-investment capex

2,413

4,049

6,462

$

14,970

$

17,884

$

32,854

Six Months

For the Three Months Ended

Ended

31-Mar-18

30-Jun-18

30-Jun-18

Tenant improvements

$

6,777

$

8,212

$

14,989

Deferred leasing costs

1,021

5,314

6,335

Non-investment capex

1,858

2,558

4,416

$

9,656

$

16,084

$

25,740

Square foot & leased

percentages

June 30,

December 31,

2019

2018

Operating Properties (a):

Number of properties

32

32

Square feet

9,498,858

9,486,650

Leased percentage

88.1%

89.0%

Redevelopment Properties:

Number of properties

3

3

Square feet

404,652

404,652

Leased percentage

11.9%

27.2%

Managed Properties - Single Asset REITs

(SARs):

Number of properties

2

3

Square feet

348,545

674,342

Total Operating, Redevelopment and

Managed Properties:

Number of properties

37

38

Square feet

10,252,055

10,565,644

(a) Excludes investment in our redevelopment properties. We

define redevelopment properties as properties being developed,

redeveloped or where development/redevelopment is complete but that

are not yet stabilized.

Franklin Street Properties Corp.

Earnings Release Supplementary Schedule F Percentage of Leased

Space (Unaudited & Estimated)

First

Second

% Leased (1)

Quarter

% Leased (1)

Quarter

as of

Average %

as of

Average %

Property Name

Location

Square Feet

31-Mar-19

Leased (2)

30-Jun-19

Leased (2)

1

MEADOW POINT

Chantilly, VA

138,537

100.0%

100.0%

100.0%

100.0%

2

TIMBERLAKE

Chesterfield, MO

234,496

100.0%

100.0%

95.7%

97.1%

3

TIMBERLAKE EAST

Chesterfield, MO

117,036

100.0%

100.0%

100.0%

100.0%

4

NORTHWEST POINT

Elk Grove Village, IL

177,095

100.0%

100.0%

100.0%

100.0%

5

PARK TEN

Houston, TX

157,460

96.4%

95.1%

96.4%

96.4%

6

PARK TEN PHASE II

Houston, TX

156,746

65.5%

65.5%

66.9%

66.4%

7

GREENWOOD PLAZA

Englewood, CO

196,236

100.0%

100.0%

100.0%

100.0%

8

ADDISON

Addison, TX

289,302

89.3%

89.3%

82.4%

82.4%

9

COLLINS CROSSING

Richardson, TX

300,887

99.4%

99.4%

99.4%

99.4%

10

INNSBROOK

Glen Allen, VA

298,456

57.3%

57.3%

57.3%

57.3%

11

RIVER CROSSING

Indianapolis, IN

205,059

95.0%

94.5%

95.0%

95.0%

12

LIBERTY PLAZA

Addison, TX

216,834

74.5%

78.7%

71.5%

69.1%

13

380 INTERLOCKEN

Broomfield, CO

240,359

90.5%

91.5%

97.1%

97.1%

14

390 INTERLOCKEN

Broomfield, CO

241,512

98.2%

98.2%

98.2%

98.2%

15

ELDRIDGE GREEN

Houston, TX

248,399

100.0%

100.0%

100.0%

100.0%

16

ONE OVERTON PARK

Atlanta, GA

387,267

80.1%

79.8%

80.6%

80.3%

17

LOUDOUN TECH

Dulles, VA

136,658

95.7%

95.7%

98.9%

98.9%

18

4807 STONECROFT

Chantilly, VA

111,469

100.0%

100.0%

100.0%

100.0%

19

121 SOUTH EIGHTH ST

Minneapolis, MN

297,209

80.9%

80.9%

86.9%

82.9%

20

EMPEROR BOULEVARD

Durham, NC

259,531

100.0%

100.0%

100.0%

100.0%

21

LEGACY TENNYSON CTR

Plano, TX

202,049

91.6%

90.9%

91.6%

91.6%

22

ONE LEGACY

Plano, TX

214,110

100.0%

100.0%

100.0%

100.0%

23

909 DAVIS

Evanston, IL

195,098

91.2%

91.2%

93.3%

91.9%

24

ONE RAVINIA DRIVE

Atlanta, GA

386,602

89.7%

91.7%

85.7%

87.0%

25

TWO RAVINIA

Atlanta, GA

411,047

78.4%

77.4%

69.3%

72.8%

26

WESTCHASE I & II

Houston, TX

629,025

80.1%

82.2%

77.3%

79.2%

27

1999 BROADWAY

Denver, CO

677,378

77.1%

76.6%

78.7%

78.3%

28

999 PEACHTREE

Atlanta, GA

621,946

90.7%

87.0%

90.9%

90.8%

29

1001 17th STREET

Denver, CO

655,420

98.5%

98.2%

98.5%

98.5%

30

PLAZA SEVEN

Minneapolis, MN

326,757

87.4%

87.6%

88.6%

87.8%

31

PERSHING PLAZA

Atlanta, GA

160,145

97.4%

97.4%

97.4%

97.4%

32

600 17th STREET

Denver, CO

608,733

86.7%

85.9%

86.9%

86.7%

OPERATING TOTAL

9,498,858

88.5%

88.4%

88.1%

88.1%

33

FOREST PARK

Charlotte, NC

62,212

0.0%

0.0%

0.0%

0.0%

34

BLUE LAGOON

Miami, FL

212,619

0.0%

0.0%

0.0%

0.0%

35

801 MARQUETTE AVE

Minneapolis, MN

129,821

37.0%

37.0%

37.0%

37.0%

REDEVELOPMENT TOTAL

404,652

11.9%

11.9%

11.9%

11.9%

OWNED PORTFOLIO TOTAL

9,903,510

_______________________

(1) % Leased as of month's end includes all leases that expire

on the last day of the quarter. (2) Average quarterly percentage is

the average of the end of the month leased percentage for each of

the 3 months during the quarter.

Franklin Street Properties Corp.

Earnings Release Supplementary Schedule G Largest 20 Tenants – FSP

Owned Portfolio (Unaudited & Estimated)

The following table includes the largest

20 tenants in FSP’s owned portfolio based on total square feet:

As of June 30, 2019

% of

Tenant

Sq Ft

Portfolio

1

IQVIA Holdings Inc.

259,531

2.6%

2

CITGO Petroleum Corporation

248,399

2.5%

3

Newfield Exploration Company

234,495

2.4%

4

US Government

223,641

2.3%

5

Centene Management Company, LLC

216,879

2.2%

6

Eversheds Sutherland (US) LLP

179,868

1.8%

7

EOG Resources, Inc.

169,167

1.7%

8

The Vail Corporation

164,636

1.7%

9

T-Mobile South, LLC dba T-Mobile

151,792

1.5%

10

Citicorp Credit Services, Inc.

146,260

1.5%

11

Petrobras America, Inc.

144,813

1.5%

12

Jones Day

140,342

1.4%

13

Argo Data Resource Corporation

140,246

1.4%

14

Worldventures Holdings, LLC

129,998

1.3%

15

Kaiser Foundation Health Plan

120,979

1.2%

16

VMWare, Inc.

119,558

1.2%

17

Giesecke & Devrient America

112,110

1.1%

18

Northrop Grumman Systems Corp.

111,469

1.1%

19

Randstad General Partner (US)

109,638

1.1%

20

ADS Alliance Data Systems, Inc.

107,698

1.1%

Total

3,231,519

32.6%

Franklin Street Properties Corp.

Earnings Release Supplementary Schedule H Reconciliation and

Definitions of Funds From Operations (“FFO”) and Adjusted Funds

From Operations (“AFFO”)

A reconciliation of Net income (loss) to

FFO and AFFO is shown below and a definition of FFO and AFFO is

provided on Supplementary Schedule I. Management believes FFO and

AFFO are used broadly throughout the real estate investment trust

(REIT) industry as measurements of performance. The Company has

included the National Association of Real Estate Investment Trusts

(NAREIT) FFO definition as of May 17, 2016 in the table and notes

that other REITs may not define FFO in accordance with the current

NAREIT definition or may interpret the current NAREIT definition

differently. The Company’s computation of FFO and AFFO may not be

comparable to FFO or AFFO reported by other REITs or real estate

companies that define FFO or AFFO differently.

Reconciliation of Net Income to FFO and

AFFO:

Three Months Ended

Six Months Ended

June 30,

June 30,

(In thousands, except per share

amounts)

2019

2018

2019

2018

Net income

$

1,633

$

665

$

428

$

2,090

Equity in loss from non-consolidated

REITs

—

282

—

387

FFO from non-consolidated REITs

—

978

—

1,862

Depreciation & amortization

22,028

23,468

45,161

47,418

NAREIT FFO

23,661

25,393

45,589

51,757

Lease Acquisition costs

108

—

290

—

Funds From Operations (FFO)

$

23,769

$

25,393

$

45,879

$

51,757

Funds From Operations (FFO)

$

23,769

$

25,393

$

45,879

$

51,757

Reverse FFO from non-consolidated

REITs

—

(978)

—

(1,862)

Distributions from non-consolidated

REITs

—

355

—

710

Amortization of deferred financing

costs

720

713

1,437

1,424

Straight-line rent

(3,689)

259

(4,829)

299

Tenant improvements

(10,169)

(8,212)

(18,487)

(14,989)

Leasing commissions

(3,666)

(5,314)

(7,905)

(6,335)

Non-investment capex

(4,049)

(2,558)

(6,462)

(4,416)

Adjusted Funds From Operations (AFFO)

$

2,916

$

9,658

$

9,633

$

26,588

Per Share Data

EPS

$

0.02

$

0.01

$

0.00

$

0.02

FFO

$

0.22

$

0.24

$

0.43

$

0.48

AFFO

$

0.03

$

0.09

$

0.09

$

0.25

Weighted average shares (basic and

diluted)

107,231

107,231

107,231

107,231

Funds From Operations (“FFO”)

The Company evaluates performance based on Funds From

Operations, which we refer to as FFO, as management believes that

FFO represents the most accurate measure of activity and is the

basis for distributions paid to equity holders. The Company defines

FFO as net income or loss (computed in accordance with GAAP),

excluding gains (or losses) from sales of property, hedge

ineffectiveness, acquisition costs of newly acquired properties

that are not capitalized and lease acquisition costs that are not

capitalized plus depreciation and amortization, including

amortization of acquired above and below market lease intangibles

and impairment charges on properties or investments in

non-consolidated REITs, and after adjustments to exclude equity in

income or losses from, and, to include the proportionate share of

FFO from, non-consolidated REITs.

FFO should not be considered as an alternative to net income or

loss (determined in accordance with GAAP), nor as an indicator of

the Company’s financial performance, nor as an alternative to cash

flows from operating activities (determined in accordance with

GAAP), nor as a measure of the Company’s liquidity, nor is it

necessarily indicative of sufficient cash flow to fund all of the

Company’s needs.

Other real estate companies and the National Association of Real

Estate Investment Trusts, or NAREIT, may define this term in a

different manner. We have included the NAREIT FFO as of May 17,

2016 in the table and note that other REITs may not define FFO in

accordance with the current NAREIT definition or may interpret the

current NAREIT definition differently than we do.

We believe that in order to facilitate a clear understanding of

the results of the Company, FFO should be examined in connection

with net income or loss and cash flows from operating, investing

and financing activities in the consolidated financial

statements.

Adjusted Funds From Operations (“AFFO”)

The Company also evaluates performance based on Adjusted Funds

From Operations, which we refer to as AFFO. The Company defines

AFFO as (1) FFO, (2) excluding our proportionate share of FFO and

including distributions received, from non-consolidated REITs, (3)

excluding the effect of straight-line rent, (4) plus the

amortization of deferred financing costs and (5) less recurring

capital expenditures that are generally for maintenance of

properties, which we call non-investment capex or are second

generation capital expenditures. Second generation costs include

re-tenanting space after a tenant vacates, which include tenant

improvements and leasing commissions.

We exclude development/redevelopment activities, capital

expenditures planned at acquisition and costs to reposition a

property. We also exclude first generation leasing costs, which are

generally to fill vacant space in properties we acquire or were

planned for at acquisition.

AFFO should not be considered as an alternative to net income or

loss (determined in accordance with GAAP), nor as an indicator of

the Company’s financial performance, nor as an alternative to cash

flows from operating activities (determined in accordance with

GAAP), nor as a measure of the Company’s liquidity, nor is it

necessarily indicative of sufficient cash flow to fund all of the

Company’s needs. Other real estate companies may define this term

in a different manner. We believe that in order to facilitate a

clear understanding of the results of the Company, AFFO should be

examined in connection with net income or loss and cash flows from

operating, investing and financing activities in the consolidated

financial statements.

Franklin Street Properties Corp.

Earnings Release Supplementary Schedule I Reconciliation and

Definition of Sequential Same Store results to property Net

Operating Income (NOI) and Net Income (Loss)

Net Operating Income (“NOI”)

The Company provides property performance

based on Net Operating Income, which we refer to as NOI. Management

believes that investors are interested in this information. NOI is

a non-GAAP financial measure that the Company defines as net income

or loss (the most directly comparable GAAP financial measure) plus

general and administrative expenses, depreciation and amortization,

including amortization of acquired above and below market lease

intangibles and impairment charges, interest expense, less equity

in earnings of nonconsolidated REITs, interest income, management

fee income, hedge ineffectiveness, gains or losses on the sale of

assets and excludes non-property specific income and expenses. The

information presented includes footnotes and the data is shown by

region with properties owned in the periods presented, which we

call Sequential Same Store. The comparative Sequential Same Store

results include properties held for the periods presented and

exclude properties that are redevelopment properties, which include

properties being developed, redeveloped or where redevelopment is

complete but are in lease-up and are not stabilized, dispositions

and significant nonrecurring income such as bankruptcy settlements

and lease termination fees. NOI, as defined by the Company, may not

be comparable to NOI reported by other REITs that define NOI

differently. NOI should not be considered an alternative to net

income or loss as an indication of our performance or to cash flows

as a measure of the Company’s liquidity or its ability to make

distributions. The calculations of NOI and Sequential Same Store

are shown in the following table:

Rentable

Square Feet

Three Months Ended

Three Months Ended

Inc

%

(in thousands)

or RSF

30-Jun-19

31-Mar-19

(Dec)

Change

Region

East

945

$

3,301

$

3,185

$

116

3.6

%

MidWest

1,553

5,174

5,163

11

0.2

%

South

4,382

15,196

14,272

924

6.5

%

West

2,619

11,240

10,559

681

6.4

%

Property NOI* from Operating

Properties

9,499

34,911

33,179

1,732

5.2

%

Dispositions and Redevelopment

Properties

405

(215)

(205)

(10)

0.0

%

NOI*

9,904

$

34,696

$

32,974

$

1,722

5.2

%

Sequential Same Store

$

34,911

$

33,179

$

1,732

5.2

%

Less Nonrecurring

Items in NOI* (a)

706

35

671

(2.0)

%

Comparative

Sequential Same Store

$

34,205

$

33,144

$

1,061

3.2

%

Three Months Ended

Three Months Ended

Reconciliation to Net income

(loss)

30-Jun-19

31-Mar-19

Net income (loss)

$

1,633

$

(1,205)

Add (deduct):

(Gain) loss on sale of properties

—

—

Hedge ineffectiveness

—

—

Management fee income

(645)

(677)

Depreciation and amortization

22,109

23,245

Amortization of above/below market

leases

(81)

(112)

General and administrative

3,703

3,509

Interest expense

9,371

9,368

Interest income

(1,259)

(1,294)

Equity in (income) loss of

non-consolidated REITs

—

—

Non-property specific items, net

(135)

140

NOI*

$

34,696

$

32,974

(a) Nonrecurring Items in NOI include proceeds from

bankruptcies, lease termination fees or other significant

nonrecurring income or expenses, which may affect

comparability.

*Excludes NOI from investments in and interest income from

secured loans to non-consolidated REITs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190730006046/en/

For Franklin Street Properties Corp. Georgia Touma,

877-686-9496

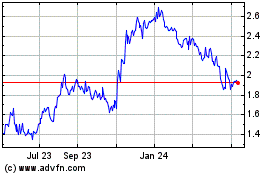

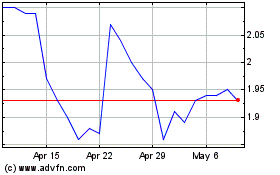

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Apr 2023 to Apr 2024