This prospectus supplement and accompanying prospectus relates to the issuance and sale of up to approximately $3,600,000 of shares of our common stock, par value $0.005 per share, from time to time through our sales agent, A.G.P. / Alliance Global Partners, or A.G.P. These sales, if any, will be made pursuant to a sales agreement, dated September 28, 2020, between us and A.G.P., which we refer to as the sales agreement.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act of 1933, as amended, which we refer to as the Securities Act, including sales made directly on the NYSE American market, on any other existing trading market for our common stock or to or through a market maker or through an electronic communications network. A.G.P. will act as sales agent on a commercially reasonable efforts basis, consistent with its normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of the NYSE American market. There is no specific date on which the offering will end, there are no minimum sale requirements and there are no arrangements to place any of the proceeds of this offering in an escrow, trust or similar account.

A.G.P. will be entitled to compensation at a fixed commission rate of 3.0% of the gross proceeds from the sale of our common stock pursuant to the sales agreement. In connection with the sale of the common stock on our behalf, A.G.P. may, and will with respect to sales effected in an “at the market offering”, be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of A.G.P. may be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to A.G.P. against certain civil liabilities, including liabilities under the Securities Act.

As of September 24, 2020, the aggregate market value of our outstanding common stock held by non-affiliates was $10,805,639, based on 68,841,920 shares of outstanding common stock, of which 18,815,814 shares are held by affiliates, and a per share price of $0.216, which represents the closing sale price of our common stock on August 3, 2020. As of the date of this Prospectus Supplement, we have not offered and sold common stock pursuant to General Instruction I.B.6 to Form S-3 during the 12-calendar month period that ends on and includes the date hereof. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering with a value exceeding more than one-third of our “public float” (the market value of our common stock held by our non-affiliates) in any 12-month period so long as our public float remains below $75,000,000. In addition, due to the limits with respect to our common stock authorization contained in our Certificate of Incorporation, we anticipate limiting the number of shares we can issue under this prospectus supplement to approximately 15,000,000 shares of common stock until we either (i) seek approval from our shareholders to increase our stock authorization or (ii) implement a reverse stock split, which has been approved by our shareholders.

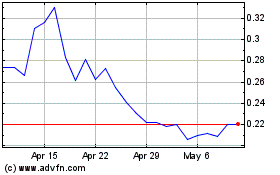

Our common stock is listed on the NYSE American under the symbol “ENSV.” The last reported sale price of our common stock on the NYSE American on September 24, 2020 was $0.1385 per share.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this Prospectus Supplement may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). All statements other than statements of historical facts contained in this Prospectus Supplement are forward-looking statements. These forward-looking statements can generally be identified by the use of words such as “may,” “will,” “could,” “should,” “project,” “intends,” “plans,” “pursue,” “target,” “continue,” “believes,” “anticipates,” “expects,” “estimates,” “predicts,” or “potential,” the negative of such terms or variations thereon, or other comparable terminology. Statements that describe our future plans, strategies, intentions, expectations, objectives, goals or prospects are also forward-looking statements. Actual results could differ materially from those anticipated in these forward-looking statements. Forward-looking statements are subject to known and unknown risks and uncertainties, including, among others, the risks set forth in the section of this Prospectus Supplement entitled “Risk Factors” and included or incorporated by reference in this Prospectus Supplement and the accompanying prospectus, as well as the following factors:

|

|

●

|

substantial doubt exists about our ability to continue as a going concern;

|

|

|

●

|

our ability to regain compliance with NYSE American listing requirements or face delisting from that exchange;

|

|

|

●

|

adverse developments in the global economy and pandemic risks related to the COVID-19 virus and the resulting diminished demand for oil and natural gas;

|

|

|

●

|

recent significant decreases in the prices for crude oil and natural gas which has resulted in exploration and production companies cutting back their capital expenditures for oil and gas well drilling which in turn resulted in significantly reduced demand for our drilling completion services, thereby negatively affecting our revenues, results of operations and financial condition;

|

|

|

●

|

fierce competition for the services we provide in our areas of operations, which has increased significantly due to the recent decrease in prices for oil and natural gas;

|

|

|

●

|

our capital requirements and uncertainty of obtaining additional funding on terms acceptable to us;

|

|

|

●

|

the impact of general economic conditions on the demand for oil and natural gas and the availability of capital which may impact our ability to perform services for our customers;

|

|

|

●

|

the geographical diversity of our operations which, while it could diversify the risks related to a slow-down in one area of operations, also adds significantly to our costs of doing business;

|

|

|

●

|

our history of losses and working capital deficits which were significant;

|

|

|

●

|

weather and environmental conditions, including abnormal warm winters in our areas of operations that adversely impact demand for our services;

|

|

|

●

|

our ability to retain key members of our management and key technical employees;

|

|

|

●

|

the impact of environmental, health and safety and other governmental regulations, and of current or pending legislation with which we and our customers must comply;

|

|

|

●

|

risks relating to any unforeseen liabilities;

|

|

|

●

|

federal and state initiatives relating to the regulation of hydraulic fracturing; and

|

|

|

●

|

sales or issuances of our common stock and the price and volume volatility of our common stock.

|

All forward-looking statements are expressly qualified in their entirety by the cautionary statements in this section and elsewhere in this document. Other than as required under applicable securities laws, we do not assume a duty to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, changes in expectations or otherwise. You should not place undue reliance on these forward-looking statements. All forward-looking statements speak only as of the date of this Prospectus Supplement or, if earlier, as of the date they were made.

PROSPECTUS SUPPLEMENT SUMMARY

This summary provides a brief overview of information contained elsewhere in or incorporated by reference into this Prospectus Supplement and the accompanying prospectus. Because it is abbreviated, this summary does not contain all of the information that you should consider before investing in our common stock. You should carefully read this entire Prospectus Supplement, the accompanying prospectus and any free writing prospectus distributed by us before making an investment decision, including the information presented under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in this Prospectus Supplement and the financial statements and other information included in or incorporated by reference into this Prospectus Supplement and the accompanying prospectus.

Overview

We and our wholly owned subsidiaries provide various services to the domestic onshore oil and natural gas industry. These services include frac water heating (completion services) and hot oiling and acidizing (production services). We own and operate a fleet of approximately 390 specialized trucks, trailers, frac tanks and other well-site related equipment and serves customers in several major domestic oil and gas fields including the DJ Basin/Niobrara area in Colorado, the Bakken area in North Dakota, the Marcellus and Utica Shale area in Pennsylvania and Ohio, the Powder River Basin in Wyoming and the Eagle Ford Shale in Texas.

We were originally incorporated as Aspen Exploration Corporation (“Aspen”) under the laws of the State of Delaware on February 28, 1980 for the primary purpose of acquiring, exploring and developing oil and natural gas and other mineral properties. During the first half of 2009, Aspen disposed of its oil and natural gas producing assets and, as a result, was no longer engaged in active business operations. On December 30, 2010, Aspen changed its name to “Enservco Corporation.”

Corporate Structure

Our business operations are conducted primarily through our wholly owned subsidiary, Heat Waves Hot Oil Service LLC (“Heat Waves”).

Overview of Business Operations

As described above, we primarily conduct our business operations through our operating subsidiary, Heat Waves, which provides oil field services to the domestic onshore oil and natural gas industry. These services include frac water heating (completion services) and hot oiling and acidizing (production services). We currently operate in the following geographic regions:

|

|

●

|

Eastern USA Region, including the southern region of the Marcellus Shale formation (southwestern Pennsylvania and northern West Virginia) and the Utica Shale formation in Pennsylvania and Ohio. The Eastern USA Region operations are deployed from Heat Waves’ operations center in Carmichaels, Pennsylvania, which opened in the first quarter of 2011.

|

|

|

●

|

Rocky Mountain Region, including western Colorado and southern Wyoming (DJ Basin and Niobrara formations), central Wyoming (Powder River Basin) and western North Dakota and eastern Montana (Bakken formation). The Rocky Mountain Region operations are deployed from Heat Waves’ operations centers in Killdeer, North Dakota, and Mead, Colorado.

|

|

|

●

|

Central USA Region, including the Mississippi Lime and Hugoton Field in southwestern Kansas, Texas panhandle, and northwestern Oklahoma, the Stack and Scoop plays in the Anadarko Basin in Oklahoma and the Eagle Ford Shale and Permian Basin in Texas. The Central USA Region operations are deployed from the operations center in Jourdanton, Texas.

|

Amended Financing

We were in default with East West Bank (the “Bank”) under our existing Loan and Security Agreement (the “2017 Credit Agreement”) and the Bank had declared us to be in violation of certain covenants under the 2017 Credit Agreement and, as a result, in default and had reserved all its rights and remedies under that agreement including the right to accelerate and declare our loans due (which approximately totaled $33 million). On September 23, 2020, we entered into a Fifth Amendment to the Loan and Security Agreement and Waiver (the “Amendment”) with the Bank, as described in our Form 8-K filed with the SEC on September 28, 2020, incorporated herein by reference. A summary of the Amendment, which is qualified in its entirety to the Form 8-K is as follows:

|

|

●

|

The Bank agreed to waive its available rights and remedies as a result of the existing events of default.

|

|

|

●

|

Reduced the principal balance of the loan from approximately $33 million to approximately $17 million and restructured the nature of the borrowing from a revolving line of credit to a term loan with a maturity date of October 15, 2021 (the “Maturity Date”).

|

|

|

●

|

In addition to our obligation to pay all outstanding amounts owed to the Bank on the Maturity Date, if as of the last day of any month, commencing with the month ending October 31, 2020, the aggregate balance of our cash on deposit in deposit accounts at the Bank is greater than the aggregate gross receipts of equity sold by us after September 18, 2020, then, no later than the fifteenth (15th) day of the immediately following month, we are required to make a principal prepayment of at least $275,000 towards our Bank obligations.

|

|

|

●

|

Revised the financial covenants to include a (i) minimum liquidity requirement of $1.5 million which will begin to be measured on December 31, 2020, and (ii) a limit on annual capital expenditures of $1.2 million.

|

|

|

●

|

Provided a new revolving line of credit allowing up to a maximum of the lesser of 85% of our eligible receivables or $1 million. Both the “term loan” and the revolving line of credit bear interest at a non-default rate per annum equal to the sum of (a) cash interest at a rate per annum equal to the Prime Rate plus two (2) percentage points; and (b) non-cash, payment-in-kind interest (“PIK Interest”) at the rate of three percent (3%) per annum. We are required to pay all cash interest monthly, beginning on October 15, 2020. All PIK Interest accrues until, and is payable in full on, the Maturity Date.

|

|

|

●

|

In consideration for the approximate $16 million reduction in the principal of the debt, we issued the Bank 8,000,000 shares of our restricted common stock (the “Bank Shares”). We have agreed to file a registration statement with the Securities and Exchange Commission to register the Bank Shares for resale into the public market. We have also agreed to assist the Bank in reselling its Bank Shares, including by holding at least one road show presentation. Notwithstanding our obligation to register the Bank Shares, the Bank has agreed to not dispose of any of the Bank Shares until the date six months after the date of the Amendment. We also issued to the Bank a warrant to purchase up to 15 million of our shares of common stock at $0.25 per share exercisable beginning on September 23, 2021 through September 23, 2025.

|

|

|

●

|

We have agreed to seek additional equity financing through both the public and private equity markets in order to fund our operating requirements.

|

|

|

●

|

Cross River Partners L.P., our largest shareholder, has agreed not to sell any of its shares of our common stock into the open market prior to the earliest of October 15, 2021, the date the Bank exercises its warrants described above, or any other date mutually agreed upon by the Bank and Cross River Partners. Richard A. Murphy, our Principal Executive Officer and member of our Board of Directors, controls Cross River Partners and its affiliated entities.

|

Other Financing

We have entered into a $1.9 million promissory note with a commercial bank pursuant to the Paycheck Protection Program under Division A, Title I of the CARES Act, which was enacted March 27, 2020. The note bears interest at 1% annually and matures April 10, 2022, although amounts of the note may be forgiven if proceeds are used for qualifying expenses such as payroll and group healthcare benefits, mortgages and mortgage interest, rent and utilities. We have used the proceeds for qualifying expenses.

Going Concern

Our financial statements have been prepared on the going concern basis, which contemplates the continuity of normal business activities and the realization of assets and settlement of liabilities in the normal course of business. We incurred a net loss of approximately $7.2 million for the six months ended June 30, 2020. As of June 30, 2020, we had total current liabilities of approximately $37.6 million, which exceeded our total current assets of $3.20 million by $34.4 million. As noted above, on September 23, 2020, we entered into an amendment with our Bank pursuant to which we received significant debt reduction and restructured our 2017 Credit Agreement. However, we cannot give assurance that we will be able to meet our modified obligations to the Bank. We have very limited liquidity and expect negative cash flow from operations in the near term.

NYSE American Listing Issues

Our common stock has sold and may continue to sell at a price per share well below $1.00. The NYSE American rules contain requirements with respect to continued listing standards, which include, among other things, when it appears to the Board of Directors of the Exchange that “the extent of public distribution or the aggregate market value of the security has become so reduced as to make further dealings on the Exchange inadvisable” (Rule 1002).

On November 12, 2019 we received notification from the NYSE American indicating that the Company was not in compliance with Sections 1003(a)(i) and (ii) of the NYSE’s Company Guide in that it has reported stockholders’ equity of less than $2 million as of December 31, 2019, and reported losses from continuing operations and/or net losses in its four most recent fiscal years.

Shortly thereafter, we provided the NYSE with a plan of compliance that contemplates a combination of the debt and additional equity capital proposed to be sought by us in order to achieve the stockholders’ equity requirement, and we have received the necessary stockholder approval to effect a reverse stock split of our common stock at an exchange ratio of not less than 1-for-10 and not greater than 1-for-25, in seeking to meet the minimum stock price standard. We have updated our compliance plan with the NYSE American on an ongoing basis, and our common stock continues to be listed while we seek to regain compliance with the stockholders’ equity and stock price requirements. It is not certain how long it will take for us to meet the foregoing requirements and the NYSE American could determine to delist our common stock in the meantime.

If we fail to meet or otherwise satisfy the requirements, our common stock may be delisted. If our common stock is delisted, we would be forced to list our common stock on the OTC Markets or some other quotation medium, depending on our ability to meet the specific requirements of those quotation systems. In that case, we may lose some or all of our institutional investors and selling our common stock on the OTC Markets would be more difficult because smaller quantities of shares would likely be bought and sold and transactions could be delayed. These factors could result in lower prices and larger spreads in the bid and ask prices for shares of our common stock. Further, because of the additional regulatory burdens imposed upon broker-dealers with respect to de-listed companies, delisting could discourage broker-dealers from effecting transactions in our stock, further limiting the liquidity of our shares. These factors could have a material adverse effect on the trading price, liquidity, value and marketability of our stock.

Recent Market Conditions

During March 2020, a global pandemic was declared by the World Health Organization related to the rapidly growing outbreak of a novel strain of coronavirus (“COVID-19”). The pandemic has significantly impacted the economic conditions in the United States, with accelerated effects in February and March, as federal, state and local governments react to the public health crisis, creating significant uncertainties in the United States economy. As a result of these developments, the Company expects a material adverse impact on its revenues, results of operations and cash flows. The situation is rapidly changing and additional impacts to the business may arise that we are not aware of currently. We cannot predict whether, when or the manner in which the conditions surrounding COVID-19 will change including the timing of lifting any restrictions or office closure requirements.

In addition, certain producing countries within the Organization of Petroleum Exporting Countries and their allies (" OPEC+") group have attempted to increase market share through pricing activity that has contributed to a severe decline in domestic oil prices and, correspondingly, drilling and operating activity within our markets. Subsequent to the end of the second quarter, OPEC+ countries have reportedly agreed to cooperate in limited and short-term production cuts, the impact of which is uncertain at this time.

The full extent of the impact of COVID-19 and OPEC+ actions on our operations and financial performance depends on future developments that are uncertain and unpredictable, including the duration and spread of the pandemic, its impact on capital and financial markets, any new information that may emerge concerning the severity of the virus, its spread to other regions as well as the actions taken to contain it, production response of domestic oil producers to lower oil prices, and the adherence to and continuity of OPEC+ production cuts, among others.

Risk Factors

An investment in our common stock involves significant risks that include (i) substantial doubt exists about our ability to continue as a going concern, and (ii) the speculative nature of oil and natural gas exploration, volatile commodity prices, competition and other material factors, including developments in the global economy and pandemic risks related to the COVID-19 virus and the resulting diminished demand for oil and natural gas. You should carefully consider, in addition to the other information contained in this Prospectus Supplement, the risks described in “Risk Factors” before investing in our common stock. These risks could materially affect our business, financial condition and results of operations and cause the trading price of our common stock to decline. You could lose part or all of your investment.

Corporate Information

Our executive (or corporate) offices are located at 14133 County Road 9 ½, Longmont, Colorado 80504. Our telephone number is (303) 333-3678. Our website is www.enservco.com. Information contained on or accessible through our website is not incorporated by reference in or otherwise a part of this Prospectus Supplement.

THE OFFERING

|

Common stock offered by us pursuant to this prospectus supplement

|

|

Shares of common stock, par value $0.005 per share, for an aggregate offering of up to approximately $3,600,000 (subject to limitation as noted immediately below.)

|

|

|

|

|

|

Common stock to be outstanding following the offering

|

|

Approximately 94,932,198 shares (excluding treasury shares), assuming the sale of the maximum aggregate amount of approximately $3,600,000 of shares of our common stock at an assumed offering price of $0.1385 per share, which is the last reported sale price for our common stock as reported on the NYSE American on September 24, 2020. However, due to the limits with respect to our common stock authorization contained in our Certificate of Incorporation, we anticipate limiting the number of shares we can issue under this prospectus supplement to approximately 15,000,000 shares of common stock until we either (i) seek approval from our shareholders to increase our stock authorization or (ii) implement a reverse stock split, which has been approved by our shareholders. Assuming the 15,000,000 share limitation at an assumed offering price of $0.1385 per share for gross proceeds of $2,077,500, we would have approximately 83,845,250 shares of common outstanding (excluding treasury shares). In addition, the actual number of shares to be sold in the offering is not known currently and will furthermore vary depending on the sales prices in the offering.

|

|

|

|

|

|

Manner of offering

|

|

“At the market offering” that may be made from time to time on the NYSE American or other market for our common stock in the United States through our agent, A.G.P. A.G.P. will make all sales using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreeable terms between the sales agent and us. See “Plan of Distribution.”

|

|

|

|

|

|

Use of proceeds:

|

|

We anticipate that any cash proceeds received from this offering will be used for debt repayment and general working capital purposes. See “Use of Proceeds” beginning on page S-11.

|

|

|

|

|

|

Risk factors:

|

|

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” of this Prospectus Supplement.

|

|

|

|

|

|

NYSE American trading symbol:

|

|

ENSV

|

The number of shares of Common Stock shown above is based on 68,841,920 (excluding Treasury Shares of 103,600) shares issued and outstanding as of September 24, 2020, and excludes as of such date:

|

|

●

|

1,730,998 shares of our Common Stock issuable upon exercise of outstanding options and awards granted pursuant to our 2016 Stock Incentive Plan, and 127,400 unexercised options that remain outstanding under the Company’s frozen 2010 Stock Incentive Plan, at a combined weighted-average exercise price of $0.42 per share;

|

|

|

●

|

(i) 30,000 warrants issued in June 2016 to the principals of the Company’s existing investor relations firm to acquire 30,000 shares of our common stock exercisable at $0.70 per share, (ii) warrants to acquire 625,000 shares of our common stock exercisable at $0.20 per share issued to Cross River Partners, L.P. in connection with an Amended and Restated Subordinated Loan Agreement with between us and Cross River Partners, L.P. and (iii) warrants to acquire 15,000,000 shares of our common stock exercisable at $0.25 per share issued to the Bank in connection with the amendment to our 2017 Credit Facility; and

|

|

|

●

|

6,100,836 shares of our common stock reserved for issuance under equity awards that may be granted under our 2016 Stock Incentive Plan in the future.

|

RISK FACTORS

An investment in our common stock involves a high degree of risk. Prior to making a decision about investing in our common stock, you should carefully consider the risk factors listed below, together with the other information contained and incorporated by reference in this Prospectus Supplement and the accompanying prospectus, including in particular the risks described in detail in our Annual Report on Form 10-K for the year ended December 31, 2019 incorporated herein by reference, as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. If any of these risks actually occurs, our business, results of operations and financial condition could suffer, and you could lose all or part of your investment.

Additional Risks Related to this Offering

The common stock offered under this prospectus supplement and the accompanying prospectus may be sold in “at the market offerings”, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares under this prospectus supplement and the accompanying prospectus at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or maximum sales price. Investors may experience declines in the value of their shares as a result of share sales made at prices lower than the prices they paid.

The actual number of shares we will issue under the sales agreement with A.G.P., at any one time or in total, and the aggregate proceeds that we receive as a result of those issuances, are uncertain.

Subject to certain limitations in the sales agreement with A.G.P., limits with respect to our common stock authorization contained in our Certificate of Incorporation and compliance with applicable law, we have the discretion to deliver placement notices to A.G.P. at any time throughout the term of the sales agreement. The number of shares that are sold to A.G.P. after delivering a placement notice, and the aggregate proceeds that we realize therefrom, will fluctuate based on the market price of our common stock during the sales period and limits we set with A.G.P.

Our common stock could be delisted from the NYSE American if we fail to regain compliance with the NYSE American’s stockholders’ equity continued listing standards. Our ability to publicly or privately sell equity securities and the liquidity of our common stock could be adversely affected if we are delisted from the NYSE American.

On November 12, 2019 we received notification from the NYSE American LLC (the “NYSE American”) indicating that the Company was not in compliance with Sections 1003(a)(i) and (ii) of the NYSE’s Company Guide in that it has reported stockholders’ equity of less than $2 million as of December 31, 2019, and reported losses from continuing operations and/or net losses in its four most recent fiscal years.

As discussed elsewhere in this prospectus supplement, we are working with the NYSE American to regain compliance with the NYSE’s continued listing standard related to stockholders’ equity and other issues. For instance, we have received the necessary stockholder approval to effect a reverse stock split of our common stock at an exchange ratio of not less than 1-for-10 and not greater than 1-for-25, in seeking to meet the minimum stock price standard. We have updated our compliance plan with the NYSE American on an ongoing basis, and our common stock continues to be listed while we seek to regain compliance with the stockholders’ equity and stock price requirements.

In addition, our common stock has sold and may continue to sell at a price per share well below $1.00. The NYSE American rules contain requirements with respect to continued listing standards, which include, among other things, when it appears to the Board of Directors of the Exchange that “the extent of public distribution or the aggregate market value of the security has become so reduced as to make further dealings on the Exchange inadvisable”.

If we fail to meet or otherwise satisfy the requirements, our common stock may be delisted. If our common stock is delisted, we would be forced to list our common stock on the OTC Markets or some other quotation medium, depending on our ability to meet the specific requirements of those quotation systems. In that case, we may lose some or all of our institutional investors and selling our common stock on the OTC Markets would be more difficult because smaller quantities of shares would likely be bought and sold and transactions could be delayed. These factors could result in lower prices and larger spreads in the bid and ask prices for shares of our common stock. Further, because of the additional regulatory burdens imposed upon broker-dealers with respect to de-listed companies, delisting could discourage broker-dealers from effecting transactions in our stock, further limiting the liquidity of our shares. These factors could have a material adverse effect on the trading price, liquidity, value and marketability of our stock.

In addition, delisting from NYSE American would adversely affect our ability to raise additional financing through the public or private sale of equity securities. Delisting could also have additional negative ramifications, including the potential loss of confidence by employees and fewer business development opportunities.

If you purchase our securities sold in this offering you may experience immediate dilution in your investment as a result of this offering.

Because the price per share of common stock being offered in this offering may be substantially higher than the net tangible book value per share of our common stock, you may experience substantial dilution to the extent of the difference between the effective offering price per share of common stock you pay in this offering and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book value as of June 30, 2020, was approximately $(9,504,650), or $(0.17) per share of common stock. Net tangible book value per share is equal to our total tangible assets minus total liabilities, all divided by the number of shares of common stock outstanding. Assuming that an aggregate of 15,000,000 shares of our common stock are sold at a price of $0.1385 per share, the last reported sale price of our common stock on the NYSE American on September 24, 2020, for aggregate gross proceeds to us of $2,077,500 million and after deducting commissions payable by us, you will experience immediate dilution of $0.04 per share, representing the difference between our as adjusted net tangible book value per share as of June 30, 2020 after giving effect to this offering at the assumed offering price. See “Dilution” beginning on page S-14 below for a more detailed discussion of the dilution you may incur if you participate in this offering.

Purchasers in this offering may experience additional dilution of their investment in the future.

We will need additional capital to fund our future operational plans but cannot assure you that we will be able to obtain sufficient capital from this offering or from other potential sources of financing. As part of any future financing, we are generally not restricted from issuing additional securities, including shares of common stock, securities that are convertible into or exchangeable for, or that represent the right to receive, common stock or substantially similar securities. In particular, we may conduct one or more additional offerings simultaneously with, or following, this offering. The issuance of securities in these or any other offerings may cause further dilution to our stockholders, including investors in this offering. In order to raise additional capital, such securities may be at prices that are not the same as the price per share in this offering. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders, including investors who purchase securities in this offering. The price per share at which we sell additional shares of our common stock or securities convertible into common stock in future transactions may be higher or lower than the price per share in this offering.

We do not expect to pay dividends in the future. As a result, any return on investment may be limited to the value of our common stock.

We do not anticipate paying cash dividends on our common stock in the foreseeable future. The payment of dividends on our common stock will depend on our earnings, financial condition and other business and economic factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on an investment in our common stock will only occur if our stock price appreciates.

Liquidity and Debt Risks

We provide the following update to our liquidity and debt risk factors:

Inadequate liquidity could materially and adversely affect our business operations.

Although we recently amended our credit facility with the Bank, we continue to have significant outstanding indebtedness of approximately $17 million under our credit facility. As of September 24, 2020, we did not have the ability to draw down any further funds under the revolving credit line included in our amended credit facility. Our borrowings under the credit facility are collateralized by substantially all of our assets. In addition, we experienced significant declines in revenues in the fourth quarter of 2019 and the first two quarters of 2020 compared to the prior year’s comparable quarters and have very limited cash flow.

There can be no assurance that we will satisfy the amended arrangements under our 2017 Credit Agreement. Given our current financial situation we may be required to accept onerous terms on any transactions that may occur. If we are unable to meet our obligations under the amended 2017 Credit Agreement, the Bank may accelerate the maturities under the default provisions of our amended 2017 Credit Agreement and put into jeopardy our ability to operate as a going concern.

In addition, our ability to satisfy any other existing or new obligations will depend upon our ability to achieve increased utilization of our equipment, which is highly influenced by weather and our customers’ activities. We cannot assure that our business will generate sufficient cash flows from operations, or that operating funds will be available to us in an amount sufficient to fund our liquidity needs. Our amended 2017 Credit Agreement requires us to seek additional private or public equity financing to meet our obligations and fund our working capital. If we do not succeed in these endeavors, we may fail to continue as a going concern and or a business. We cannot assure you that we will be able to raise capital through future financings on terms acceptable to us or at all. Furthermore, any proceeds that we could realize from any financings or dispositions may not be adequate to meet our debt service or other obligations then due.

Our debt obligations have reduced, and may reduce in the future, our financial and operating flexibility.

In addition to the debt on our amended 2017 Credit Agreement described immediately above, as of June 30, 2020 we owed approximately $10.5 million to other parties pursuant to various secured and unsecured subordinate debt agreements and accounts payable. A high level of indebtedness subjects us to several material adverse risks. We are required to devote a significant portion of our cash flows to servicing our debt. Our ability to meet our debt obligations and to reduce our level of indebtedness depends on our future performance and as of June 30, 2020 we had experienced three significantly reduced operating quarters (2019 fourth quarter and the first two quarter of 2020) compared to the like quarters in the prior years.

General economic conditions, weather, oil and natural gas prices and financial, business and other factors affect our operations and our future performance. We experienced a heavy downturn in demand for our services in the fourth quarter of 2019 that has continued through 2020 to date. Many of these factors are beyond our control. If we do not have sufficient funds on hand to pay our obligations when due, we may be required to refinance our indebtedness, incur additional indebtedness, sell assets or sell additional shares of our common stock. We may not be able to complete such transactions on terms acceptable to us, or at all. Our failure to generate sufficient funds to pay our debts or to undertake any of these actions successfully could result in a default on our debt obligations, which would materially adversely affect our business, results of operations and financial condition and our ability to continue as a business.

We are currently in a very difficult operating environment.

We face a very difficult operating environment in 2020 with exploration and production companies significantly cutting back their drilling and completion plans and exerting significant pressure on us to reduce our prices for the services we provide. Given our operating results experienced in the fourth quarter of 2019 and the first two quarters of 2020, we cannot assure conditions in our industry will improve during the balance of 2020, if at all.

Our auditors and management have expressed substantial doubt about our ability to continue as a going concern.

As disclosed in the consolidated financial statements incorporated by reference in this Prospectus Supplement, we incurred net losses of $7.7 million and $5.9 million for the years ended December 31, 2019 and 2018, respectively, and a net loss of approximately $7.2 million for the six months ended June 30, 2020. Additionally, we have experienced revenue declines, have very limited liquidity, and expect negative cash flow from operations in the near term. We believe these circumstances raise substantial doubt about our ability to continue as a going concern.

Our ability to continue as a going concern is dependent on achievement of significantly increased revenues, raising equity or additional debt and/or a combination transaction with another entity. If we are not able to generate the funds needed to cover our ongoing expenses, then we may be forced to cease operations or seek bankruptcy protection, in which event our stockholders could lose their entire investment.

USE OF PROCEEDS

After giving effect to the sale of the 15,000,000 shares of common stock at an assumed price of $0.1385 per share for gross proceeds of $2,077,500, we estimate that the maximum potential net proceeds we will receive will be approximately $1,915,000, after deducting the agent’s fees and estimated offering expenses. However, we cannot guarantee if or when these net proceeds will be received and the method by which they are offered to the public. The amount of proceeds from this offering will depend upon the number of shares of our common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the sales agreement with A.G.P. as a source of financing. Any portion of the entire gross $3,600,000 million amount included in this prospectus supplement that is not sold or included in an active placement notice pursuant to the sales agreement may be made available later for sale in other offerings pursuant to the accompanying base prospectus. If no shares are sold under the sales agreement, the full $3,600,000 of shares of common stock may be made available later for sale in other offerings pursuant to the accompanying base prospectus.

We intend to use the net proceeds of this offering to (i) repay Bank indebtedness that matures on October 15, 2021 and bears interest at a non-default rate per annum equal to the sum of (a) cash interest at a rate per annum equal to the Prime Rate plus two (2) percentage points; and (b) non-cash, payment-in-kind interest (“PIK Interest”) at the rate of three percent (3%) per annum, and (ii) fund working capital for the upcoming winter season when our products and services are at their highest demand.

Capitalization

The following table summarizes our cash and cash equivalents, certain other items from our historical consolidated balance sheet, and capitalization as of June 30, 2020:

|

|

●

|

on a pro forma basis, giving effect to: (i) the issuance of 8,000,000 shares of our common stock and forgiveness of approximately $16 million of debt with the Bank as described elsewhere in the prospectus supplement and in our Current Report on Form 8-K filed on September 28, 2020, and (ii) the conversion Cross River Partners L.P, our largest shareholder, of subordinated notes in the aggregate amount $1,514,737 of outstanding principal and accrued interest into 6,054,022 shares of our common stock at approximately $0.25 per share as described in our Current Report on Form 8-K filed on September 16, 2020; and

|

|

|

●

|

on a pro forma as adjusted basis, giving effect to the sale by us of 15,000,000 shares of our common stock in this offering at an assumed public offering price of $0.1385 per share, the last reported sale price for our common stock as reported on the NYSE American on September 24, 2020, after deducting the estimated commissions at the fixed commission rate of 3.0%, as well as estimated offering expenses.

|

The as-adjusted information below is illustrative only, and our capitalization following the closing of this offering may differ from that shown below based on the public offering price and other terms of this offering determined at pricing. You should read the following table in conjunction with the sections entitled “Use of Proceeds,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere or incorporated by reference in this prospectus supplement and our financial statements and related notes thereto, which are incorporated by reference in this prospectus supplement.

|

|

|

As of June 30, 2020

|

|

|

|

|

Actual

|

|

|

Proforma with

Cross River

conversion (1)

|

|

|

Proforma with

Bank

Refinancing(2)

|

|

|

As Adjusted

for ATM

Offering(3)

|

|

|

|

|

(Unaudited)

(in thousands, except share amounts)

|

|

|

Cash and cash equivalents

|

|

$

|

429

|

|

|

$

|

429

|

|

|

$

|

429

|

|

|

$

|

2,344

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

|

2,100

|

|

|

|

1,835

|

|

|

|

1,835

|

|

|

|

1,835

|

|

|

Long-term debt (including current portion)

|

|

|

36,635

|

|

|

|

35,385

|

|

|

|

20,886

|

|

|

|

20,866

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' (Deficit) Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.005 par value, 10,000,000 shares authorized, no shares outstanding

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

Issued and outstanding common stock $.005 par value, 100,000,000 shares authorized, 55,030,663 shares issued; 103,600 shares of treasury stock and 54,927,063 shares of outstanding (actual), 61,043,018 shares issued; 103,600 shares of treasury stock and 60,939,418 shares outstanding (as adjusted (1)), 69,043,018 shares issued; 103,600 shares of treasury stock and 68,939,418 shares outstanding (as adjusted (2)) 84,043,018 shares issued; 103,600 shares of treasury stock and 83,939,418 shares outstanding (as adjusted (3))

|

|

|

275

|

|

|

|

305

|

|

|

|

345

|

|

|

|

420

|

|

|

Additional paid-in capital (3)

|

|

|

22,435

|

|

|

|

23,920

|

|

|

|

26,412

|

|

|

|

28,252

|

|

|

Accumulated deficit

|

|

|

(32,214

|

)

|

|

|

(32,214

|

)

|

|

|

(20,247

|

)

|

|

|

( 20,247

|

)

|

|

Total stockholders' (deficit) equity

|

|

|

(9,504

|

)

|

|

|

(7,989

|

)

|

|

|

6,510

|

|

|

|

8,425

|

|

|

Total Capitalization

|

|

$

|

27,131

|

|

|

$

|

27,396

|

|

|

$

|

27,396

|

|

|

$

|

29,311

|

|

__________________________

(1) Cross River Partners converted $1,250,000 of long-term subordinated debt in addition to approximately $265,000 of accrued interest into our common stock at approximately $0.25 per share, equating to 6,054,022 shares. The price at the time of conversion was $0.1320 per share of common stock. Total outstanding common stock immediately after the conversion was 60,939,418, excluding treasury shares.

(2) East West Bank forgave $16,000,000 in senior indebtedness in exchange for 8,000,000 shares of our common stock at $0.1385 per share. Additionally, East West Bank received 15,000,000 warrants with an exercise price of $0.25. The warrants had a fair value of $0.0949 at the grant date. The decrease in debt recognized includes the undiscounted future cash flows of the remaining debt, which includes all future accrued interest. Total common share count after closing was 68,939,418, excluding treasury shares.

(3) Assumes the sale of 15,000,000 shares of our common stock in this offering at $0.1385 per share less 3% commission and estimated offering expenses both totaling $162,325.

The number of shares of common stock issued and outstanding as shown above excludes as of such date:

|

|

●

|

1,730,998 shares of our common stock issuable upon exercise of outstanding option our 2016 Stock Incentive Plan, at a weighted-average exercise price of $0.42 per share and 127,400 unexercised options under the Company’s frozen 2010 Stock Incentive Plan, at a weighted-average exercise price of $0.42 per share;

|

|

|

●

|

(i) 30,000 warrants issued in June 2016 to the principals of the Company’s existing investor relations firm to acquire 30,000 shares of our common stock exercisable at $0.70 per share, (ii) warrants to acquire 625,000 shares of our common stock exercisable at $0.20 per share issued to Cross River Partners, L.P. in connection with an Amended and Restated Subordinated Loan Agreement with between us and Cross River Partners, L.P. and (iii) warrants to acquire 15,000,000 shares of our common stock exercisable at $0.25 per share issued to the Bank in connection with the amendment to our 2017 Credit Facility; and

|

|

|

●

|

6,100,836 shares of our common stock reserved for issuance under equity awards that may be granted under our 2016 Stock Incentive Plan in the future.

|

DILUTION

If you invest in our common stock, your interest will be diluted to the extent of the difference between the price per share you pay in this offering and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book value of our common stock as of June 30, 2020, was approximately $(9,504,650), or approximately $(0.17) per share of common stock, based upon 54,927,063 shares outstanding. In calculating dilution in connection with this offering, we have adjusted the June 30, 2020, net tangible book value and outstanding shares of common stock to give effect to, on a pro forma basis (i) the issuance of 8,000,000 shares of our common stock and forgiveness of approximately $16 million of debt with the Bank as described elsewhere in the prospectus supplement and in our Current Report on Form 8-K filed on September 28, 2020, and (ii) the conversion by Cross River Partners L.P, our largest shareholder, of subordinated notes in the aggregate amount $1,514,737 of outstanding principal and accrued interest into 6,054,022 shares of our common stock at approximately $0.25 per share as described in our Current Report on Form 8-K filed on September 16, 2020.

Net tangible book value per share (on an actual or as adjusted basis) is equal to our total tangible assets, less our total liabilities, divided by the total number of shares outstanding (on an actual or as pro forma adjusted basis) as of June 30, 2020.

After giving effect to the sale of up to a maximum aggregate amount of 15,000,000 shares of our common stock at an assumed offering price of $0.1385 per share, which was the sale price for our common stock as reported on the NYSE American on September 24, 2020, and after deducting offering commissions of 3% and estimated offering expenses totaling $62,325 payable by us, our net tangible book value as of June 30, 2020 on a pro forma adjusted basis would have been approximately $8,425 million, or $.10 per share of common stock. This represents an immediate increase in the net tangible book value of $.01 per share to our existing stockholders and an immediate and substantial dilution of $.04 per share to new investors who purchase our common stock in the offering.

|

Public offering price per share

|

|

|

|

|

|

$

|

0.1385

|

|

|

Net tangible book value per share at June 30, 2020, as pro forma adjusted

|

|

$

|

0.09

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to investors purchasing our common stock in this offering

|

|

$

|

0.01

|

|

|

|

|

|

|

Pro forma as adjusted net tangible book value per share as of June 30, 2020 after giving effect to this offering

|

|

|

|

|

|

$

|

0.10

|

|

|

Dilution per share to investors purchasing our common stock in this offering

|

|

|

|

|

|

$

|

0.04

|

|

The number of shares of common stock shown above is based on 55,005,663 shares issued and outstanding as of June 30, 2020 before pro forma adjustments, and 68,841,920 after pro forma adjustments, and excludes as of such date:

|

|

●

|

1,730,998 shares of our common stock issuable upon exercise of outstanding option our 2016 Stock Incentive Plan, at a weighted-average exercise price of $0.42 per share and 127,400 unexercised options under the Company’s frozen 2010 Stock Incentive Plan, at a weighted-average exercise price of $0.42 per share;

|

|

|

●

|

(i) 30,000 warrants issued in June 2016 to the principals of the Company’s existing investor relations firm to acquire 30,000 shares of our common stock exercisable at $0.70 per share, (ii) warrants to acquire 625,000 shares of our common stock exercisable at $0.20 per share issued to Cross River Partners, L.P. in connection with an Amended and Restated Subordinated Loan Agreement with between us and Cross River Partners, L.P. and (iii) warrants to acquire 15,000,000 shares of our common stock exercisable at $0.25 per share issued to the Bank in connection with the amendment to our 2017 Credit Facility; and

|

|

|

●

|

6,100,836 shares of our common stock reserved for issuance under equity awards that may be granted under our 2016 Stock Incentive Plan in the future.

|

To the extent that any of these outstanding awards or warrants are exercised or we issue additional shares under our equity incentive plans, there will be further dilution to new investors. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

We have entered into the sales agreement with A.G.P., under which we may issue and sell our common stock having an aggregate offering price of up to approximately $3,600,000 from time to time through A.G.P., acting as our sales agent. The sales agreement has been filed as an exhibit to our Current Report on Form 8-K filed with the SEC on September 28, 2020, which is incorporated by reference in this prospectus supplement. The actual dollar amount and number of shares of common stock we sell pursuant to this prospectus supplement will be dependent, among other things, on market conditions and our capital raising requirements. The sales of our common stock, if any, under the sales agreement may be made by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act, including sales made directly on the NYSE American market, on any other existing trading market for our common stock or to or through a market maker or through an electronic communications network.

Each time that we wish to issue and sell shares of our common stock under the sales agreement, we will provide A.G.P. with a placement notice describing the amount of shares to be sold or the gross proceeds to be raised in a given time period, the time period during which sales are requested to be made, any limitation on the amount of shares of common stock that may be sold in any single day, any minimum price below which sales may not be made or any minimum price requested for sales in a given time period and any other instructions relevant to such requested sales. Upon receipt of a placement notice, A.G.P., as our sales agent, will use commercially reasonable efforts, consistent with its normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of the NYSE American, to sell shares of our common stock under the terms and subject to the conditions of the placement notice and the sales agreement. We or A.G.P. may suspend the offering of common stock pursuant to a placement notice upon proper notice and subject to other conditions. A.G.P., in its sole discretion, may decline to accept any placement notice. During the term of the sales agreement, A.G.P. will not engage in any market making, bidding, stabilization or other trading activity with regard to our common stock if such activity would be prohibited under Regulation M or other anti-manipulation rules under the Securities Act.

A.G.P. will provide written confirmation to us no later than the opening of the trading day on the NYSE American market following the trading day on which shares of our common stock are sold through A.G.P. under the sales agreement. Each confirmation will include the number of shares sold on the preceding day, the net proceeds to us and the commissions payable by us to A.G.P. in connection with the sales.

We will pay A.G.P. commissions for its services in acting as agent in the sale of our common stock pursuant to the sales agreement. A.G.P. will be entitled to compensation at a fixed commission rate of 3.0% of the gross proceeds from the sale of our common stock pursuant to the sales agreement, less certain concessions, as applicable, which concessions if applicable shall not in any way reduce the maximum amount of proceeds to be received by us as set forth on the cover of this prospectus supplement. Because there are no minimum sale requirements as a condition to this offering, the actual total public offering price, commissions and net proceeds to us, if any, are not determinable at this time. We estimate that the total expenses for this offering, excluding compensation payable to A.G.P. and certain expenses reimbursable to A.G.P. under the terms of the sales agreement, will be approximately $63,000.

Settlement for sales of common stock will occur on the second trading day following the date on which any sales are made (or on such other date as is industry practice for regular-way trading), unless otherwise specified in the applicable placement notice, in return for payment of the net proceeds to us. There are no arrangements to place any of the proceeds of this offering in an escrow, trust or similar account. Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and A.G.P. may agree upon.

In connection with the sale of the common stock on our behalf, A.G.P. may, and will with respect to sales effected in an “at the market offering”, be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of A.G.P. may be deemed to be underwriting commissions or discounts.

We have agreed to provide indemnification and contribution to A.G.P. against certain civil liabilities, including liabilities under the Securities Act. We also have agreed to reimburse A.G.P. for its reasonable out-of-pocket expenses, including the fees and disbursements of counsel to A.G.P., incurred in connection with the offering, up to a maximum amount of $40,000.

The offering pursuant to the sales agreement will terminate upon the earlier of (i) the sale of all shares of common stock subject to the agreement and (ii) termination of the sales agreement as permitted therein. We may terminate the sales agreement in our sole discretion at any time by giving 10 days’ prior notice to A.G.P. A.G.P. may terminate the sales agreement under the circumstances specified in the sales agreement and in its sole discretion at any time by giving 10 days’ prior notice to us.

This prospectus supplement and the accompanying base prospectus may be made available in electronic format on a website maintained by A.G.P., and A.G.P. may distribute this prospectus supplement and the accompanying base prospectus electronically.

A.G.P. has no relationship with us other than its current role as sales agent for our offering of common stock pursuant to the sales agreement described above.

DIVIDEND POLICY

We have not paid cash dividends on our common stock in the past two fiscal years to date, and we do not anticipate that we will declare or pay dividends on our common stock in the foreseeable future. Payment of dividends, if any, is within the sole discretion of our Board of Directors and will depend, among other factors, upon our earnings, capital requirements and our operating and financial condition.

DESCRIPTION OF CAPITAL STOCK

General

The following description summarizes certain important terms of our capital stock. Because it is only a summary, it does not contain all the information that may be important to you. For a complete description of the matters set forth in this section entitled “Description of Capital Stock,” you should refer to our amended and restated certificate of incorporation (the “Certificate of Incorporation”), and our amended and restated bylaws (the “Bylaws”), and to the applicable provisions of Delaware law. Our authorized capital stock consists of 110,000,000 shares of capital stock, $0.005 par value per share, of which:

|

|

●

|

100,000,000 shares are designated as common stock; and

|

|

|

●

|

10,000,000 shares are designated as preferred stock.

|

As of September 24, 2020, there were 69,043,018 shares of common stock issued, of which 68,939,418 were outstanding and 103,600 shares were held as treasury stock. As of September 24, 2020, no shares of preferred stock were outstanding. Our Board of Directors is authorized, without stockholder approval except as required by the listing standards of the NYSE American, to issue additional shares of capital stock.

Common Stock

Dividend Rights

Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of common stock are entitled to receive dividends out of funds legally available if our Board of Directors, in its discretion, determines to issue dividends and then only at the times and in the amounts that our Board of Directors may determine.

Voting Rights

Holders of common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders. We have not provided for cumulative voting for the election of directors in the Certificate of Incorporation. Each successor elected to replace a director whose term of office expires at an annual meeting will serve for a term of one year ending on the date of the next annual meeting of stockholders and until his or her respective successor has been duly elected and qualified. The directors are subject to election by a majority of the votes cast at each annual meeting of stockholders. In the event that the number of nominees for director exceeds the number of directors to be elected, directors shall be elected by a plurality of the votes cast.

No Preemptive or Similar Rights

Our common stock is not entitled to preemptive rights, and is not subject to conversion, redemption or sinking fund provisions.

Right to Receive Liquidation Distributions

If we become subject to a liquidation, dissolution or winding-up, the assets legally available for distribution to our stockholders would be distributable ratably among the holders of common stock and any participating preferred stock outstanding at that time, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights of and the payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

Fully Paid and Non-Assessable

All of the outstanding shares of common stock are fully paid and non-assessable and the shares offered hereby will be, upon issuance, fully paid and non-assessable.

Preferred Stock

Pursuant to our Certificate of Incorporation, we are currently authorized to designate and issue up to 10,000,000 shares of preferred stock, $0.005 par value per share. Our Board of Directors is authorized, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in each series and to fix the designation, powers, preferences and rights of the shares of each series and any of its qualifications, limitations or restrictions, in each case without further vote or action by our stockholders. Our Board of Directors can also increase or decrease the number of shares of any series of preferred stock, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. Our Board of Directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of us and might adversely affect the market price of common stock and the voting and other rights of the holders of common stock. We have no current plan to issue any shares of preferred stock. We have no shares of preferred stock issued or outstanding.

Anti-Takeover Provisions

The provisions of Delaware law, our Certificate of Incorporation and our Bylaws, which are summarized below, may have the effect of delaying, deferring or discouraging another person from acquiring control of our company. They are also designed, in part, to encourage persons seeking to acquire control of us to negotiate first with our Board of Directors. We believe that the benefits of increased protection of our potential ability to negotiate with an unfriendly or unsolicited acquirer outweigh the disadvantages of discouraging a proposal to acquire us because negotiation of these proposals could result in an improvement of their terms.

Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws

The Certificate of Incorporation and the Bylaws include a number of provisions that could deter hostile takeovers or delay or prevent changes in control of our Board of Directors or management team, including the following:

Board of Directors Vacancies. The Certificate of Incorporation and the Bylaws authorize only our Board of Directors to fill vacant directorships, including newly created seats. In addition, the number of directors constituting our Board of Directors will be permitted to be set only as provided in, or in the manner provided by the Bylaws. The Certificate of Incorporation provides that the number of directors will be no fewer than three and no more than nine, as determined by resolution of our Board of Directors from time to time. These provisions would prevent a stockholder from increasing the size of our Board of Directors and then gaining control of our Board of Directors by filling the resulting vacancies with its own nominees. This will make it more difficult to change the composition of our Board of Directors and will promote continuity of management.

Special Meeting of Stockholders. The Certificate of Incorporation provides that special meetings of our stockholders may be called by our Board of Directors, our President or by our President or upon request to do so by holders of at least 10% of our outstanding shares entitled to vote at the meeting. Shareholders requesting such action must also provide all of the information that would be required to be included in a proxy statement under Section 14(a) of the Exchange Act.

Advance Notice Requirements for Director Nominations. The Bylaws provide advance notice procedures for stockholders seeking to nominate candidates for election as directors at our annual meeting of stockholders. The Bylaws also specify certain requirements regarding the form and content of a stockholder’s notice of such nominations. These provisions might preclude our stockholders from making nominations for directors at our annual meeting of stockholders if the proper procedures are not followed. We expect that these provisions may also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of the Company.

No Cumulative Voting. The Delaware General Corporation Law (the “DGCL”), provides that stockholders are not entitled to cumulate votes in the election of directors unless a corporation’s certificate of incorporation provides otherwise. The Certificate of Incorporation does not provide for cumulative voting.

Amendment of Certificate of Incorporation Provisions. Any amendment of the above provisions in the Certificate of Incorporation requires approval by holders of at least a majority of the voting power of our then outstanding capital stock except for Article VII governing director liability and indemnification which requires the affirmative vote of two-thirds of our outstanding stock entitled to vote thereon.

Issuance of Undesignated Preferred Stock. Our Board of Directors has the authority, without further action by our stockholders, to issue up to 10,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by our Board of Directors. The existence of authorized but unissued shares of preferred stock would enable our Board of Directors to render more difficult or to discourage an attempt to obtain control of our Company by means of a merger, tender offer, proxy contest or other means.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare, Inc., 350 Indiana Street, Suite 800, Golden, Colorado 80401. Its telephone number is (303) 262-0600.

Limitations of Liability and Indemnification

The Certificate of Incorporation contains provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by Delaware law. Consequently, our directors are not to be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for the following:

|

|

●

|

any breach of their duty of loyalty to us or our stockholders;

|

|

|

●

|

any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

|

|

|

●

|

unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the DGCL; or

|

|

|

●

|

any transaction from which they derived an improper personal benefit.

|

Any amendment to, or repeal of, these provisions will not eliminate or reduce the effect of these provisions in respect of any act, omission or claim that occurred or arose prior to that amendment or repeal. If the DGCL is amended to provide for further limitations on the personal liability of directors of corporations, then the personal liability of our directors will be further limited to the greatest extent permitted by the DGCL.

The Bylaws provide that we will indemnify, to the fullest extent permitted by law, any person who is or was a party or is threatened to be made a party to any action, suit or proceeding by reason of the fact that he or she is or was one of our directors or officers or is or was serving at our request as a director or officer of another corporation, partnership, joint venture, trust or other enterprise. The Bylaws provide that we may indemnify to the fullest extent permitted by law any person who is or was a party or is threatened to be made a party to any action, suit or proceeding by reason of the fact that he or she is or was one of our employees or agents or is or was serving at its request as an employee or agent of another corporation, partnership, joint venture, trust or other enterprise. The Bylaws also provide that we must advance expenses incurred by or on behalf of a director or officer in advance of the final disposition of any action or proceeding, subject to limited exceptions.

The limitation of liability and indemnification provisions included in the Certificate of Incorporation, the Bylaws and in indemnification agreements that we have entered into or will enter into with our directors and executive officers may discourage stockholders from bringing a lawsuit against our directors and executive officers for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation against our directors and executive officers, even though an action, if successful, might benefit us and our stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage awards against directors and executive officers as required by these indemnification provisions. At present, we are not aware of any pending litigation or proceeding involving any person who is or was one of our directors, officers, employees or other agents or is or was serving at our request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, for which indemnification is sought, and we are not aware of any threatened litigation that may result in claims for indemnification.

We may obtain insurance policies under which, subject to the limitations of the policies, coverage is provided to our directors and executive officers against loss arising from claims made by reason of breach of fiduciary duty or other wrongful acts as a director or executive officer, including claims relating to public securities matters, and to us with respect to payments that may be made by us to these directors and executive officers pursuant to its indemnification obligations or otherwise as a matter of law.

Certain of our non-employee directors may, through their relationships with their employers, be insured and/or indemnified against certain liabilities incurred in their capacity as members of our Board of Directors.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Anti-Takeover Provisions of our Certificate of Incorporation

Our certificate of incorporation permits us to issue, without any further vote or action by the stockholders, shares of preferred stock in one or more series and, with respect to each such series, to fix the number of shares constituting the series and the designation of the series, the voting powers (if any) of the shares of the series, and the preferences and relative, participating, optional, and other special rights, if any, and any qualification, limitations or restrictions of the shares of such series. This provision may be deemed to have an anti-takeover effect and could be used to delay, deter, or prevent a tender offer or takeover attempt that a stockholder might consider to be in its best interests, including attempts that might result in a premium being paid over the market price for the shares held by stockholders.

Delaware Law