Enservco Updates Stockholders on Preliminary First Quarter Financial Results

April 16 2020 - 4:01PM

Enservco Corporation (NYSE American: ENSV), a diversified national

provider of specialized well-site services to the domestic onshore

conventional and unconventional oil and gas industries, today

announced it expects 2020 first quarter revenue to be between $9.3

million and $9.4 million versus revenue of $24.8 million in the

first quarter last year. These preliminary revenue estimates

have been adjusted to reflect the discontinuation of water transfer

operations in the fourth quarter of 2019. In addition, net

income and adjusted EBITDA for the first quarter are expected to

decrease significantly compared to prior-year levels.

Ian Dickinson, President and CEO, said the results reflect

ongoing weakness in domestic oil and gas activity levels driven by

lower commodity prices, related pricing pressures, and the more

recent and broader impact of the COVID-19 pandemic. In response to

the challenging market environment, we have taken meaningful action

to right size the cost structure and win additional market share.

He added that it is too early in the first quarter close process to

provide adjusted EBITDA information.

Enservco also announced it has entered into a $1.9 million

promissory note with East West Bank pursuant to the Paycheck

Protection Program under Division A, Title I of the CARES Act,

which was enacted March 27, 2020. The note bears interest at

1% annually and matures April 10, 2022, although amounts of the

note may be forgiven if proceeds are used for qualifying expenses

such as payroll and group healthcare benefits, mortgages and

mortgage interest, rent and utilities. Enservco intends to

use all proceeds for qualifying expenses.

In addition, Enservco announced it has received notification

from the NYSE American LLC (the “NYSE American”) indicating

that the Company is not in compliance with the NYSE American’s

continued listing standards set forth in Section 1003(a)(iii) of

the Company Guide in that it has reported stockholders’ equity of

less than $6 million as of December 31, 2019, and reported losses

from continuing operations and/or net losses in its five most

recent fiscal years. Section 1003(a)(iii) is one of three

equity thresholds the Company is not in compliance with. The

Company previously reported non-compliance with the two other

thresholds – Section 1003(a)(i) and Section 1003(a)(ii).

On February 19, 2020, Enservco announced that the NYSE

American LLC (the “NYSE American”) has approved the Company’s plan

to regain compliance with the NYSE’s continued listing standard

related to stockholders’ equity. Accordingly, Enservco’s

common stock will continue to be listed on the NYSE American

pursuant to an extension.

The Company’s compliance plan calls for Enservco to achieve a

stockholders’ equity balance of at least $6.0 million by June 3,

2021. Under terms of the extension, Enservco will be required

to demonstrate progress toward its stockholders’ equity compliance

plan and to provide the NYSE American with quarterly updates.

About EnservcoThrough its various operating

subsidiaries, Enservco provides a wide range of oilfield services,

including hot oiling, acidizing, frac water heating, and related

services. The Company has a broad geographic footprint

covering seven major domestic oil and gas basins and serves

customers in Colorado, Montana, New Mexico, North Dakota, Oklahoma,

Pennsylvania, Ohio, Texas, Wyoming and West

Virginia. Additional information is available at

www.enservco.com

Cautionary Note Regarding Forward-Looking

StatementsThis news release contains information that is

"forward-looking" in that it describes events and conditions

Enservco reasonably expects to occur in the future. Expectations

for the future performance of Enservco are dependent upon a number

of factors, and there can be no assurance that Enservco will

achieve the results as contemplated herein. Certain statements

contained in this release using the terms "may," “intends,”

"expects to," and other terms denoting future possibilities, are

forward-looking statements. The accuracy of these statements cannot

be guaranteed as they are subject to a variety of risks, which are

beyond Enservco's ability to predict, or control and which may

cause actual results to differ materially from the projections or

estimates contained herein. Among these risks are those set forth

in Enservco’s annual report on Form 10-K for the year ended

December 31, 2019, and subsequently filed documents with the

SEC. Forward looking statements in this news release that are

subject to risk include the Company’s ability to regain compliance

with the NYSE American’s listing requirements and the possibility

that amounts of the promissory note will be forgiven. It is

important that each person reviewing this release understand the

significant risks attendant to the operations of Enservco.

Enservco disclaims any obligation to update any forward-looking

statement made herein, except as required by law.

Contact:Pfeiffer High Investor

Relations, Inc.Jay PfeifferPhone: 303-880-9000Email:

jay@pfeifferhigh.com

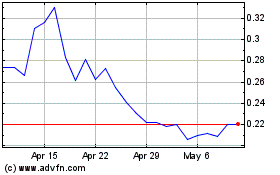

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Mar 2024 to Apr 2024

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Apr 2023 to Apr 2024