-- 14.8% year-over-year increase in home care

revenue --

Electromed, Inc. (“Electromed” or the “Company”) (NYSE American:

ELMD), a leader in innovative airway clearance technologies, today

announced financial results for the three months ended June 30,

2018 (“Q4 FY 2018”).

Q4 FY 2018 Highlights

- Net revenue increased 13.3% to $8.2

million from $7.3 million during the three months ended June 30,

2017 (“Q4 FY 2017”). Net revenue for the prior year comparable

period included a favorable impact of $703,000 from a one-time item

related to a settlement agreement with Centers for Medicare and

Medicaid Services.

- Gross profit rose 12.2% to $6.7 million

from $6.0 million in Q4 FY 2017.

- Operating income grew 5.1% to $1.6

million from $1.5 million in Q4 FY 2017.

- Net income expanded 18.2% to $1.1

million, or $0.13 per diluted share, from $946,000, or $0.11 per

diluted share, in Q4 FY 2017.

- Cash flow from operating activities

increased 48.1% to $570,000 from $385,000 in Q4 FY 2017.

- Field sales employees grew to 50 at the

end of Q4 FY 2018 from 40 at the end of Q4 FY 2017.

Kathleen Skarvan, President and Chief Executive Officer of

Electromed, commented, “In the fourth quarter of fiscal 2018, we

delivered strong top and bottom-line growth, driven by a 14.8%

year-over-year increase in home care revenue. We benefitted from

investments made earlier in the year to expand our sales force,

improve our reimbursement skills and processes, and advance

physician awareness and education surrounding the benefits of high

frequency chest wall oscillation therapy (“HFCWO”) with our

SmartVest® device. As a result, this quarter we achieved a greater

number of referrals, of significantly higher quality, translating

into exceptional growth in approvals.”

Ms. Skarvan continued, “The incremental investments initiated in

fiscal 2018 position Electromed for double-digit revenue and

earnings growth over the next few years. Looking ahead, we remain

focused on improving sales force productivity, enhancing our

reimbursement processes, increasing HFCWO awareness and education

among physicians and patients, promulgating evidence-based studies

that differentiate SmartVest, developing innovative device

features, and expanding our covered lives.

“Last month, we announced the first independent study suggesting

that HFCWO therapy with SmartVest significantly reduces severe

exacerbations and hospitalizations, and may meaningfully slow the

otherwise normal progression of non-cystic fibrosis bronchiectasis.

A growing body of evidence, including this study, reinforces our

optimism for expanding the market for HFCWO and gaining share in

the large, underpenetrated bronchiectasis market. As always, our

underlying mission is to improve quality-of-life and outcomes for a

greater number of patients with compromised pulmonary function,

while reducing overall healthcare utilization through SmartVest

airway clearance therapy.”

Q4 FY 2018 Review

Net revenue increased 13.3% to $8.2 million in Q4 FY 2018 from

$7.3 million in Q4 FY 2017, primarily driven by higher home care

revenue. Home care revenue rose 14.8% to $7.7 million in Q4 FY 2018

from $6.7 million in Q4 FY 2017, primarily due to growth in

approvals as a result of continued improvements in our

reimbursement operations that led to a greater referral to approval

percentage and a higher average selling price per device. Net

revenue for the prior year comparable period included a favorable

impact of $703,000 from a one-time item related to a settlement

agreement with Centers for Medicare and Medicaid Services.

Gross profit increased 12.2% to $6.7 million, or 81.7% of net

revenue, in Q4 FY 2018 from $6.0 million, or 82.5% of net revenue,

in Q4 FY 2017. The increase in gross profit resulted primarily from

an increase in home care revenue.

Operating expenses, which include selling, general and

administrative (“SG&A”) as well as research and development

(“R&D”) expenses, totaled $5.1 million, or 62.4% of revenue, in

Q4 FY 2018 compared with $4.5 million, or 61.7% of revenue, in the

same period of the prior year. SG&A expenses increased 14.4% to

$5.1 million in Q4 FY 2018 from $4.4 million in Q4 FY 2017,

primarily due to higher payroll and compensation-related expenses

and increased travel, meals and entertainment expenses which were

driven by the expansion of our sales force. These increased costs

were partially offset by a $406,000 refund of medical device excise

taxes that was recognized during Q4 FY 2018. R&D expenses

totaled $81,000 in Q4 FY 2018 compared to $65,000 in Q4 FY

2017.

Operating income increased 5.1% to $1.6 million in Q4 FY 2018

from $1.5 million in Q4 FY 2017, primarily due to increased gross

profit driven by higher revenue and a refund of medical device

excise taxes, which were partially offset by costs related to the

expansion of our sales force.

Net income before income tax expense rose 7.6% to $1.6 million

in Q4 FY 2018 from $1.5 million in Q4 FY 2017.

Net income increased 18.2% to $1.1 million, or $0.13 per diluted

share, in Q4 FY 2018, from $946,000, or $0.11 per diluted share, in

Q4 FY 2017. In Q4 FY 2018, income tax expense totaled $500,000,

compared to $559,000 in the same period of the prior year.

Full Year FY 2018

Summary

For the twelve months ended June 30, 2018, revenue grew 11.0% to

$28.7 million from $25.9 million in fiscal 2017, driven by a 13.8%

increase in home care revenue. Gross margins were 79.6%, compared

to 79.5% in the prior fiscal year, while net income was $1.9

million, or $0.22 per diluted share, compared to $2.2 million, or

$0.26 per diluted share in fiscal 2017.

Financial Condition

Electromed’s balance sheet at June 30, 2018 included cash of

$7.5 million, long-term debt including current maturities of $1.1

million, working capital of $17.5 million, and shareholders’ equity

of $21.9 million.

Conference Call

Management will host a conference call on September 26, 2018 at

8:00 am CT (9:00 am ET) to discuss Q4 FY 2018 financial results and

other matters.

Interested parties may participate in the call by dialing:

- (877) 407-9753 (Domestic)

- (201) 493-6739 (International)

The conference call will also be accessible via the following

link: http://www.investorcalendar.com/event/37302.

For those who cannot listen to the live broadcast, an online

webcast replay will be available in the Investor Relations section

of Electromed’s web site at: http://investors.smartvest.com/.

About Electromed, Inc.

Electromed, Inc. manufactures, markets, and sells products that

provide airway clearance therapy, including the SmartVest® Airway

Clearance System, to patients with compromised pulmonary function.

The Company is headquartered in New Prague, Minnesota and was

founded in 1992. Further information about Electromed can be found

at www.smartvest.com.

Cautionary Statements

Certain statements in this release constitute forward-looking

statements as defined in the U.S. Private Securities Litigation

Reform Act of 1995. Forward-looking statements can generally be

identified by words such as “believe,” “estimate,” “expect,” “may,”

“plan” “potential,” “should,” “will,” and similar expressions,

including the negative of these terms, but they are not the

exclusive means of identifying such statements. Forward-looking

statements cannot be guaranteed and actual results may vary

materially due to the uncertainties and risks, known or unknown

associated with such statements. Examples of risks and

uncertainties for the Company include, but are not limited to: the

competitive nature of our market; risks associated with expansion

into international markets; changes to Medicare, Medicaid, or

private insurance reimbursement policies; new drug or

pharmaceutical discoveries; changes to health care laws; changes

affecting the medical device industry; our need to maintain

regulatory compliance and to gain future regulatory approvals and

clearances; our ability to protect and expand our intellectual

property portfolio; our ability to renew our line of credit or

obtain additional credit as necessary; our ability to develop new

sales channels for our product; and general economic and business

conditions, as well as other factors described from time to time in

our reports to the Securities and Exchange Commission (including

the Company’s most recent Annual Report on Form 10-K, as amended

from time to time, and subsequent reports on Form 10-Q and Form

8-K). Investors should not consider any list of such factors to be

an exhaustive statement of all of the risks, uncertainties or

potentially inaccurate assumptions investors should take into

account when making investment decisions. Shareholders and other

readers should not place undue reliance on “forward-looking

statements,” as such statements speak only as of the date of this

release.

Financial Tables Follow:

Electromed, Inc. Condensed Balance

Sheets June 30, 2018 June 30, 2017

Assets Current Assets Cash $ 7,455,844 $ 5,573,709 Accounts

receivable (net of allowances for doubtful accounts of $45,000)

11,563,208 9,949,759 Inventories 2,360,693 2,559,485 Prepaid

expenses and other current assets 832,202 393,319

Total current assets 22,211,947 18,476,272 Property and

equipment, net 3,091,242 3,303,233 Finite-life intangible assets,

net 649,103 721,276 Other assets 91,912 99,868 Deferred income

taxes 594,000 460,000

Total assets $

26,638,204 $ 23,060,649

Liabilities and Shareholders’

Equity Current Liabilities Current maturities of long-term debt

$ 1,101,043 $ 50,703 Accounts payable 810,644 663,376 Accrued

compensation 1,209,738 946,623 Income taxes payable 397,390 156,524

Warranty reserve 760,000 640,000 Other accrued liabilities

464,357 438,748

Total current liabilities 4,743,172

2,895,974 Long-term debt, less current maturities and net of debt

issuance costs - 1,097,125

Total liabilities

4,743,172 3,993,099 Commitments and

Contingencies Shareholders' Equity

Common stock, $0.01 par value; authorized:

13,000,000 shares; 8,288,659 and 8,230,167 issuedand outstanding at

June 30, 2018 and June 30, 2017, respectively

82,887 82,302 Additional paid-in capital 14,953,103 14,028,602

Retained earnings 6,859,042 4,956,646

Total

shareholders’ equity 21,895,032 19,067,550

Total liabilities and shareholders’ equity $ 26,638,204 $

23,060,649

Electromed, Inc. Condensed

Statements of Operations

For the Three Months Ended June

30,

For the Twelve Months Ended June

30,

2018 2017 2018 2017 Net revenues $

8,240,564 $ 7,273,901 $ 28,697,622 $ 25,861,144 Cost of revenues

1,507,159 1,272,100 5,841,601 5,292,715

Gross profit 6,733,405 6,001,801

22,856,021 20,568,429 Operating expenses Selling,

general and administrative 5,061,167 4,422,953 19,596,053

16,402,214 Research and development 81,320 64,621

251,443 596,876

Total operating expenses

5,142,487 4,487,574 19,847,496

16,999,090

Operating income 1,590,918 1,514,227 3,008,525

3,569,339 Interest income (expense), net 28,296

(8,733) 19,871 (49,867)

Net income before

income taxes 1,619,214 1,505,494 3,028,396 3,519,472

Income tax expense 500,000 559,000 1,126,000

1,290,000

Net income $ 1,119,214 $ 946,494 $

1,902,396 $ 2,229,472 Income per share: Basic $ 0.14 $ 0.12

$ 0.23 $ 0.27 Diluted $ 0.13 $ 0.11 $ 0.22 $ 0.26

Weighted-average common shares outstanding: Basic 8,221,437

8,171,319 8,207,365 8,168,152 Diluted

8,578,295 8,493,619 8,620,102 8,461,120

Electromed, Inc. Condensed

Statements of Cash Flows Twelve Months Ended June

30, 2018 2017 Cash Flows From Operating

Activities Net income $ 1,902,396 $ 2,229,472 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation 676,426 636,709 Amortization of finite-life intangible

assets 113,601 118,418 Amortization of debt issuance costs 6,351

13,067 Share-based compensation expense 862,674 479,482 Deferred

taxes (134,000) (117,000) Loss on disposal of property and

equipment 25,990 3,302 Loss on disposal of intangible assets 4,122

132,724 Changes in operating assets and liabilities: Accounts

receivable (1,613,449) (2,338,322) Inventories 234,594 (28,334)

Prepaid expenses and other assets (433,363) 49,864 Income tax

receivable - 192,685 Income tax payable 240,866 156,524 Accounts

payable and accrued liabilities 555,992 (337,470)

Net cash provided by operating activities 2,442,200

1,191,121 Cash Flows From Investing Activities

Expenditures for property and equipment (526,227) (618,763)

Expenditures for finite-life intangible assets (45,550)

(68,385)

Net cash used in investing activities

(571,777) (687,148) Cash Flows From Financing

Activities Principal payments on long-term debt including capital

lease obligations (50,700) (48,747) Issuance of common stock upon

exercise of options 62,412 - Payments of deferred financing fees

- (4,872)

Net cash provided by (used in) financing

activities 11,712 (53,619)

Net increase in

cash 1,882,135 450,354 Cash Beginning of period

5,573,709 5,123,355 End of period $ 7,455,844 $ 5,573,709

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180925006120/en/

Electromed, Inc.Jeremy Brock, 952-758-9299Chief Financial

Officerinvestorrelations@electromed.comorThe Equity Group

Inc.Kalle Ahl, CFA, 212-836-9614kahl@equityny.comDevin

Sullivan, 212-836-9608dsullivan@equityny.com

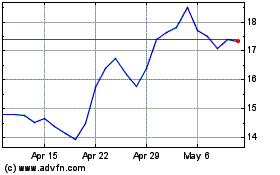

Electromed (AMEX:ELMD)

Historical Stock Chart

From Aug 2024 to Sep 2024

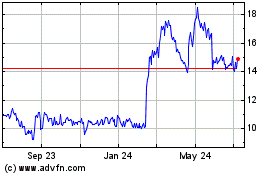

Electromed (AMEX:ELMD)

Historical Stock Chart

From Sep 2023 to Sep 2024