Filed

Pursuant to Rule 424(b)(5)

Registration

Nos. 333-230740 and 333-252757

PROSPECTUS SUPPLEMENT

(To

Prospectus dated May 8, 2019)

Document

Security Systems, Inc.

12,319,346

Shares of Common Stock

We

are offering 12,319,346 shares of our common stock pursuant to this prospectus supplement and the accompanying prospectus.

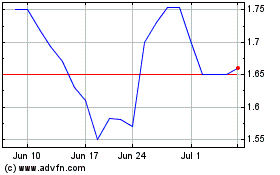

Our

common stock is listed on the NYSE American LLC under the symbol “DSS.” The last reported sale price of our common

stock on the NYSE American LLC on February 5, 2021 was $3.41 per share.

Investing

in our common stock involves risks that are described in the “Risk Factors” beginning on page S-11 of this prospectus

for a discussion of information that should be considered in connection with an investment in our common stock.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

2.80

|

|

|

$

|

34,494,168.80

|

|

|

Underwriting discount(1)

|

|

$

|

0.21

|

|

|

$

|

2,587,062.66

|

|

|

Proceeds, before expenses, to us

|

|

$

|

2.59

|

|

|

$

|

31,907,106.14

|

|

|

(1)

|

The

underwriters will receive compensation in addition to the underwriting discount. See the “Underwriting” section

of this prospectus for additional information regarding total underwriter compensation.

|

We

have granted a 45-day option to the underwriters to purchase up to 1,847,901 additional shares of common stock solely to

cover over-allotments, if any.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or

passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary

is a criminal offense.

The

underwriters expect to deliver our shares to purchasers in the offering on or about February 9, 2021.

Sole

Book-Running Manager

Aegis

Capital Corp.

The

date of this prospectus supplement is February 4, 2021.

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and

also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into

this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus, gives more general information

about securities we may offer from time to time, some of which does not apply to this offering. Generally, when we refer to this

prospectus, we are referring to both parts of this document combined together with all documents incorporated by reference. If

the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on

the information contained in this prospectus supplement. However, if any statement in one of these documents is inconsistent with

a statement in another document having a later date — for example, a document incorporated by reference into this prospectus

supplement or the accompanying prospectus — the statement in the document having the later date modifies or supersedes the

earlier statement. You should rely only on the information contained in or incorporated by reference into this prospectus supplement

or contained in or incorporated by reference into the accompanying prospectus to which we have referred you. We have not authorized

anyone to provide you with information that is different. If anyone provides you with different or inconsistent information, you

should not rely on it. The information contained in, or incorporated by reference into, this prospectus supplement and contained

in, or incorporated by reference into, the accompanying prospectus is accurate only as of the respective dates thereof, regardless

of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of securities. It is important

for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including

the documents incorporated by reference herein and therein, in making your investment decision. You should also read and consider

the information in the documents to which we have referred you under the captions “Where You Can Find More Information”

and “Incorporation of Information by Reference” in this prospectus supplement and in the accompanying prospectus.

We

are offering to sell, and are seeking offers to buy, securities only in jurisdictions where such offers and sales are permitted.

The distribution of this prospectus supplement and the accompanying prospectus and the offering of securities in certain jurisdictions

or to certain persons within such jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus supplement and the accompanying prospectus must inform themselves about and observe any restrictions relating

to the offering of securities and the distribution of this prospectus supplement and the accompanying prospectus outside the United

States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with,

an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying

prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

All

trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience,

the trademarks and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should

not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their

rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship

with, or endorsement or sponsorship of us by, any other companies.

DISCLOSURE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and any accompanying prospectus, including the documents that we incorporate by reference, contain forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E

of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Such forward-looking statements include those that express

plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical

fact. These forward-looking statements are based on our current expectations and projections about future events and they are

subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from

those expressed or implied in such statements.

In

some cases, you can identify forward-looking statements by terminology, such as “expects,” “anticipates,”

“intends,” “estimates,” “plans,” “believes,” “seeks,” “may,”

“should,” “could” or the negative of such terms or other similar expressions. Accordingly, these statements

involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in

them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus

supplement.

You

should read this prospectus supplement, the accompanying prospectus and the documents that we reference herein and therein and

have filed as exhibits to the registration statement, of which this prospectus supplement is part, completely and with the understanding

that our actual future results may be materially different from what we expect. You should assume that the information appearing

in this prospectus supplement and any accompanying prospectus is accurate as of the date on the cover page of this prospectus

supplement. Because the risk factors referred to above, as well as the risk factors referred to on page S-11 of this prospectus

supplement and incorporated herein by reference, could cause actual results or outcomes to differ materially from those expressed

in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which it is made, and except as may be required under applicable

securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the

date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time,

and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from

those contained in any forward-looking statements. We qualify all of the information presented in this prospectus supplement and

the accompanying prospectus, and particularly our forward-looking statements, by these cautionary statements.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights information contained elsewhere or incorporated by reference into this prospectus supplement and the accompanying

prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our common

stock. You should read this entire prospectus supplement and the accompanying prospectus carefully, including the “Risk

Factors” contained in this prospectus supplement and incorporated by reference herein, “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related

notes and the other documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

Unless

we have indicated otherwise or the context otherwise requires, references in this prospectus supplement, the accompanying prospectus

or the documents incorporated by reference herein and therein to the “Company,” DSS,” “we,” “us”

and “our” refer to Document Security Systems, Inc. and its subsidiaries.

Company

Overview

Document

Security Systems, Inc. (together with its consolidated subsidiaries (unless the context otherwise requires), referred to herein

as “Document Security Systems,” “DSS,” “we,” “us,” “our” or the “Company”)

operates in eight business lines through eight (8) DSS subsidiaries located around the globe.

Of

the eight subsidiaries, three of those have historically been the core subsidiaries of the Company:

|

|

(1)

|

Premier

Packaging Corporation (DSS Packaging and Printing Group) operates in the paper board folding carton, smart packaging and document

security printing markets. It markets, manufactures and sells paper products designed to protect valuable information from

unauthorized scanning, copying, and digital imaging.

|

|

|

|

|

|

|

(2)

|

DSS

Digital Inc. and its subsidiaries (DSS Digital Group) research, develop, market and sell the Company’s digital products

worldwide. The primary product is AuthentiGuard®, which is a brand authentication application that integrates the Company’s

counterfeit deterrent technologies with proprietary digital data security-based solutions.

|

|

|

|

|

|

|

(3)

|

DSS

Technology Management Inc., manages, licenses and acquires intellectual property (“IP”) assets for the purpose

of monetizing these assets through a variety of value-enhancing initiatives, including, but not limited to, investments in

the development and commercialization of patented technologies, licensing, strategic partnerships and commercial litigation.

|

In

addition to the subsidiaries listed above, in 2019 and early 2020, DSS has created five new wholly owned subsidiaries:

|

|

(4)

|

DSS

Blockchain Security, Inc., intends to specialize in the development of blockchain security technologies for tracking and tracing

solutions for supply chain logistics and cyber securities across global markets.

|

|

|

|

|

|

|

(5)

|

Decentralize

Sharing Systems, Inc., seeks to provide services to assist companies in the new business model of the peer-to-peer decentralized

sharing marketplaces. It also has established a direct marketing or network marketing business line which is designed to sell

products or services directly to the public through independent distributors, rather than selling through the traditional

retail market.

|

|

|

|

|

|

|

(6)

|

DSS

Securities, Inc., has been established to develop or to acquire assets in the securities trading or management arena, and

to pursue two parallel streams of digital asset exchanges in multiple jurisdictions: (i) securitized token exchanges, focusing

on digitized assets from different vertical industries and (ii) utilities token exchanges, focusing on “blue-chip”

utility tokens from solid businesses.

|

|

|

|

|

|

|

(7)

|

DSS

BioHealth Security, Inc., is our business line which we will intend to invest in or to acquire companies related to the biohealth

and biomedical field, including businesses focused on the research to advance drug discovery and development for the prevention,

inhibition, and treatment of neurological, oncology and immuno-related diseases. This new division will place special focus

on open-air defense initiatives, which curb transmission of air-borne infectious diseases such as tuberculosis and influenza,

among others.

|

|

|

|

|

|

|

(8)

|

DSS

Secure Living, Inc., intends to develop top of the line advanced technology, energy efficiency, quality of life living environments

and home security for everyone for new construction and renovations of residential single and multifamily living facilities.

|

Our

four reporting segments are as follows:

DSS

Packaging and Printing Group - Operating under the name Premier Packaging Corporation, the DSS Packaging and Printing

Group produces custom packaging serving clients in the pharmaceutical, nutraceutical, beverage, specialty foods, photo packaging

and direct marketing industries, among others. The group also provides active and intelligent packaging and document security

printing services for end-user customers along with technical support for our technology licensees. The division produces a wide

array of printed materials, such as folding cartons and paperboard packaging, security paper, vital records, prescription paper,

birth certificates, secure coupons and parts tracking forms. The division also provides resources and production equipment for

our ongoing research and development of security printing, authentication and related technologies.

DSS

Digital Group - This division researches, develops, markets and sells worldwide the Company’s digital products,

including and primarily our AuthentiGuard® product, which is a brand authentication application that integrates the Company’s

counterfeit deterrent technologies with proprietary digital data security-based solutions. The AuthentiGuard® product allows

our customers to implement a security mark utilizing conventional printing methods that is copy and counterfeit-resistant and

that can be read and recorded utilizing smartphones and other digital image capture devices, which can be utilized by that customer’s

suppliers, field personnel and end users throughout its global product supply and distribution chains.

DSS

Technology Management - Since its acquisition in 2013, DSS Technology Management’s primary mission has been to monetize

its various patent portfolios through commercial litigation and licensing. Except for investment in its social networking related

patents, we have historically partnered with various third-party funding groups in connection with patent monetization programs.

It is our intent to de-emphasize and ultimately wind down this business line. While Management will continue to assert and defend

the existing patents and purse potential infringements as they are identified, we do not intend to seek out new patent portfolios.

Direct

Marketing - Direct marketing or network marketing is designed to sell products or services directly to the public through

independent distributors, rather than selling through the traditional retail market. We believe this business has significant

growth potential in the now popular “gig economy”. Consistent with the Company’s strategic business plan and

vision, we plan to enter the direct marketing or network marketing industry and take advantage of the opportunities that exist.

We have entered into partnerships with existing direct marketing companies to access U.S., Canadian, Asian and Pacific Rim markets.

In addition, we have acquired various domestic and international operating licenses from those companies. Through the acquisitions

we have secured product licenses, formulas, existing sales networks, patents, web sites, and other resources to initiate sales

and revenue generation for this line and launched our HWHGIG and HWH Marketplace direct selling platforms.

Recent

Developments

American

Medical REIT Inc.

On

March 3, 2020 the Company, via its subsidiary DSS Securities, entered into a share subscription agreement and loan arrangement

with LiquidValue Asset Management Pte Ltd., AMRE Asset Management, Inc. and American Medical REIT Inc. under which it acquired

a 52.5% controlling ownership interest in AMRE Asset Management Inc. (“AAMI”) which currently has a 93% equity interest

in American Medical REIT Inc. (“AMRE”). AAMI is a real estate investment trust (“REIT”) management company

of which sets the strategic vision and formulate investment strategy and manages the assets and liabilities for AMRE. AMRE is

organized for the purposes of acquiring hospitals and other acute or post-acute care centers from leading clinical operators with

dominant market share in secondary and tertiary markets and leasing each property to a single operator under a triple-net lease.

To date, AAMI and AMRE has not generated revenue.

Alset

International Limited (formally Singapore eDevelopment Limited)

As

of March 31, 2020, the Company owned 83,174,129 ordinary shares of Alset International Limited (“Alset Intl”, formally

Singapore eDevelopment Limited), a company incorporated in Singapore and publicly listed on the Singapore Exchange Limited, and

warrants to purchase an additional 44,005,182 ordinary shares at an exercise price of SGD$0.04 (US$0.029) per share. On June 25,

2020, the Company exercised those warrants bringing its total ownership to 127,179,311 ordinary shares or approximately 10% of

the outstanding shares of Alset Intl at September 30, 2020. As of June 30, 2020, the Company carried its investment in Alset Intl

at cost, less impairments under ASU No. 2016-01, “Recognition and Measurement of Financial Assets and Financial Liabilities”.

During the third quarter of 2020, the Company determined that the investment has a readily determinable fair value based on the

volume of shares traded on the Singapore Exchange which evidences a ready market for shares, as well as a consistent and observable

market price. Accordingly, this investment is now classified as a marketable equity security and is classified as a long-term

asset on our consolidated balance sheets as the Company has the intent and ability to hold the investments for a period of at

least one year. The Company’s marketable equity securities are measured at fair value with gains and losses recognized in

other income (expense). At the time of the change in classification, the Company recorded an unrealized gain of approximately

$2.1 million. The Chairman of the Company, Mr. Heng Fai Ambrose Chan, is the Executive Director and Chief Executive Officer of

Alset Intl. Mr. Chan is also the majority shareholder of Alset Intl as well as the largest shareholder of the Company. The fair

value of the marketable equity security of Alset Intl as of September 30, 2020 was approximately $5,583,000.

Sharing

Services Global Corp.

As

of June 30, 2020, the Company had acquired and owned approximately 17% of the issued and outstanding shares of Sharing Services

Global Corp. (“SHRG”), a publicly traded company, as a marketable equity security investment. In the third quarter

of 2020, the Company, through a series of class A common shares acquisitions in July 2020, the Company acquired in aggregate an

ownership interest in SHRG of greater than 20%. At that time, it was determined that the Company had the ability to exercise significant

influence over SHRG. Accordingly, on July 22, 2020, the Company began prospectively utilizing the equity method of accounting

for its investment in SHRG in accordance with ASC Topic 323 and will recognize our share of their earnings and losses within our

consolidated statement of operations and comprehensive income (loss). Due to a lag in financial reporting of SHRG, the Company

has not recorded any share of earnings or losses during the period ended September 30, 2020. On a go-forward basis, earnings or

losses from SHRG will be recorded on a two-month lag. As of July 22, 2020, the Company owned 62,417,593 class A common shares

of SHRG with an adjusted basis of $11.3 million. As of September 30, 2020, the Company held 62,457,378 class A common shares,

equating to a 32.2% ownership interest in SHRG, and prior to adopting the equity method had recorded unrealized gains on marketable

securities of approximately $6.1 million for the nine months then ended. As of July 22, 2020, the carrying value of the Company’s

equity method investment exceeded our share of the book value of SHRG’s underlying net assets by approximately $9.5 million,

which represents primarily intangible assets and goodwill arising from acquisitions.

Equipment

Line of Credit

On

July 31, 2020, Premier Packaging Corporation entered into a Loan Agreement and accompanying Term Note Non-Revolving Line of Credit

Agreement with Citizens Bank pursuant to which Citizens agreed to lend up to $900,000 to permit Premier Packaging Corporation

to purchase equipment from time to time that it may need for use in its business. The aggregate principal balance outstanding

under the Equipment Acquisition Line of Credit bears interest thereon at a per annum rate of 2% above the LIBOR Advantage Rate

until the Conversion Date (as defined in the Term Note Non-Revolving Line of Credit Agreement). Effective on the Conversion Date,

the interest shall be adjusted to a fixed rate equal to 2% above the bank’s Cost of Funds, as determined by Citizens. As

of September 30, 2020, the loan had a balance of $0 and Premier Packaging Corporation still has available $900,000 for equipment

borrowings.

Acquisition

of Impact BioMedical

On

August 21, 2020, we closed the share exchange agreement we entered into on April 27, 2020, with DSS BioHealth Security, Inc.,

our wholly owned subsidiary (“DBHS”), Alset Intl, and Global BioMedical Pte Ltd, a Singapore corporation and wholly

owned subsidiary of Alset Intl (“GBM”), pursuant to which, among other things, DBHS acquired all of the outstanding

capital stock of Impact BioMedical Inc., a Nevada corporation and wholly owned subsidiary of GBM (“Impact BioMedical”),

through a share exchange, with Impact BioMedical becoming a direct wholly owned subsidiary of DBHS. Impact BioMedical strives

to leverage its scientific know-how and intellectual property rights to provide solutions that have been plaguing the biomedical

field for decades. By tapping into the scientific expertise of its partners, Impact BioMedical has undertook a concerted effort

in the research and development (R&D), drug discovery and development for the prevention, inhibition, and treatment of neurological,

oncological and immune related diseases. The consideration for the Impact BioMedical shares was the following issued to GBM by

DSS: (i) 483,333 newly issued shares of common stock of DSS, nominally valued at $3,132,000, or $6.48 per share; and (ii) 46,868

newly issued shares of a new series of perpetual convertible preferred stock of DSS (the “Series A Preferred Stock”)

with a stated value of $46,868,000, or $1,000 per share, for a total consideration valued at $50 million. The Series A Preferred

Stock is convertible into shares of common stock of DSS at a conversion price of $6.48 of preferred stock stated value per share

of common stock, subject to a 19.9% beneficial ownership conversion limitation (a so-called “blocker”) based on the

total issued and outstanding shares of common stock of DSS beneficially owned by GBM. Holders of the Series A Preferred Stock

have no voting rights, except as required by applicable law or regulation, and no dividends will accrue or be payable on the Series

A Preferred Stock. The holders of Series A Preferred Stock are entitled to a liquidation preference of $1,000 per share, and the

Company has the right to redeem all or any portion of the then outstanding shares of Series A Preferred Stock, pro rata among

all holders, at a redemption price per share equal to the liquidation value per share. Both the Company and Alset Intl obtained

approvals of the acquisition transaction from their respective shareholders.

We

are currently in the process of completing the purchase price accounting and related allocations associated with the acquisition

of Impact BioMedical. Due to several factors, including a discount for illiquidity, the value of the Series A Preferred Stock

was discounted from $46,868,000 to $35,187,000, thus reducing the final consideration given to approximately $38,319,000. The

Company is also in the process of completing valuations and useful lives for certain Technology and In Process Research &

Development assets acquired in the transaction as well the non -controlling interest portion of Impact BioMedical and its subsidiaries

and the purchase price allocation will be completed with finalization of those valuations. We expect the preliminary purchase

price accounting to be completed and reported in our Annual

Report on Form 10-K for the year ended December 31, 2020. As of September 30, 2020, Impact

Biomedical has not generated revenue.

On

October 16, 2020, GBM converted 4,293 shares of our Series A Preferred Stock having a par value of $0.02 per share in exchange

for 662,500 restricted shares of our common stock based upon a liquidation value of $1,000 and a conversion price of $6.48 per

share pursuant to Section 8.2(a) of the Certificate of Designation of Series A Convertible Preferred Stock.

Alset

Title Company

In

August 2020, the Company’s wholly owned subsidiary, DSS Securities, Inc., entered into a corporate venture to form and operate

a real estate title agency, under the name and flagging of Alset Title Company, Inc., a Texas corporation (“ATC”).

DSS Securities, Inc. will own 70% of this venture with the other two shareholders being attorneys necessary to complete the state

application and permitting process. There was no activity for the nine months ended September 30, 2020.

BMI

Capital International LLC

On

September 10, 2020, the Company’s wholly owned subsidiary, DSS Securities, Inc., entered into membership interest purchase

agreement with BMI Financial Group, Inc. a Delaware corporation (“BMIF”) and BMI Capital International LLC, a Texas

limited liability company (“BMIC”), whereby DSS Securities, Inc. purchased 14.9% membership interests in BMIC for

$100,000. DSS Securities also has the option to purchase an additional 10% of the outstanding membership interest. This option

expires on September 10, 2022. BMIC is a broker-dealer registered with the Securities and Exchange Commission, is a member of

the Financial Industry Regulatory Authority, Inc. (“FINRA”), and is a member of the Securities Investor Protection

Corporation (“SIPC”). The Company’s chairman of the board and another independent board member of the Company

also have ownership interest in this joint venture.

Presidio

Property Trust

On

October 7, 2020, DSS Securities, Inc. took part in an initial public offering of Presidio Property Trust, Inc., a Maryland corporation

(“Presidio”), that invests primarily in commercial properties, such as office, industrial and retail properties, as

well as in residential model home properties, in regionally dominant markets across the United States. As part of this offering,

we purchased 200,000 shares of Presidio’s Series A Common Stock at $5.00 per share for a total purchase price of $1,000,000.

BioMed

Technologies Distribution Agreement and Share Subscription

Effective

December 9, 2020, Impact BioMedical entered into an exclusive distribution agreement with BioMed Technologies Asia Pacific Holdings

Limited (“BioMed”), which is focused on manufacturing natural probiotics, pursuant to which Impact BioMedical will

directly market, advertise, promote, distribute and sell certain BioMed products to resellers. The products to be distributed

by Impact BioMedical include BioMed’s PGut Premium ProbioticsTM, PGut Allergy ProbioticsTM, PGut SupremeSlim

ProbioticsTM, PGut Kids ProbioticsTM, and PGut Baby ProbioticsTM. Under the terms of the distribution

agreement, Impact BioMedical will have exclusive rights to distribute the products within the United States, Canada, Singapore,

Malaysia, and South Korea and non-exclusive distribution rights in all other countries. In exchange, Impact BioMedical agreed

to certain obligations, including mutual marketing obligations to promote sales of the products. The distribution agreement has

an initial term of ten years and may be terminated by Impact BioMedical at its option, at any time, and for any reason, or by

BioMed for an uncured material breach by Impact BioMedical or if Impact BioMedical becomes bankrupt or insolvent.

In

connection with the distribution agreement, Impact BioMedical also entered into a subscription agreement with BioMed, pursuant

to which Impact BioMedical agreed to purchase 525 ordinary shares of BioMed at a purchase price of HK$9,333.33 per share for total

consideration of HK$4,900,000 (approximately US$630,000). The subscription agreement provides, among other things, Impact BioMedical

the right to appoint a new director to the board of BioMed. With respect to an issuance of shares to a third party by BioMed,

Impact BioMedical will have the right of first refusal to purchase such shares, as well as customary tag-along rights.

Paycheck

Protection Program

As

part of the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) which was established and provides for

loans to qualifying businesses for amounts up to 2.5 times of the average monthly payroll expenses of the qualifying business,

subsidiaries of the Company had applied for and received $1,072,000 under the Paycheck Protection Program. As of August 4, 2020,

pursuant to the terms of the SBA PPP program, the Company submitted applications for its subsidiaries Premier Packaging and DSS

Digital for a requested 100% loan forgiveness. In November and December 2020, Premier Packaging and DSS Digital received notification,

respectively, from the SBA that their loans in total approximating $969,000, inclusive of interest, had been forgiven. AAMI, also

a subsidiary of the Company, pursuant to the terms of the SBA PPP program, submitted its application for 100% loan forgiveness

in October 2020 and still awaits SBA determination.

Employment

Agreement

On

November 19, 2020, the Company, DSS Cyber Security Pte. Ltd. (“DCS”), a subsidiary of the Company, and Mr. Heng Fai

Chan, the Chief Executive Officer of DCS and the Chairman of the Board of Directors of the Company, entered into an amendment

(the “2020 Amendment”) to Mr. Chan’s employment agreement (the “2019 Employment Agreement”) dated

September 23, 2019, effective January 1, 2020, pursuant to which (i) the term of the 2019 Employment Agreement was extended to

December 31, 2022 and (ii) Mr. Chan’s salary and bonus were adjusted and redefined for the period from January 1, 2020 till

December 31, 2022. Pursuant to the 2020 Amendment, Mr. Chan’s monthly base salary has been reduced to $1 commencing January

1, 2020 and Mr. Chan is eligible to receive certain performance bonuses based upon the annual market capitalization growth of

the Company and the annual net asset value change of the Company. The growth bonus will be equal to 5% of the year over year increase

in DSS’s market capitalization, with the measurement of DSS’s market capitalization determined by (a) the total number

of outstanding shares of DSS common stock at fiscal year-end multiplied by (b) the 10-day volume weighted average price of DSS

common stock on the principal trading market prior to such year end. The annual net value bonus will be equal to 5% of the year

over year increase of DSS’s net asset value, with the measurement of DSS’s fiscal year end net asset value (equal

to DSS’s total assets minus total liabilities) calculated in accordance with generally accepted accounting principles.

HWH

World Inc.

On

January 6, 2021, the Company, Alset Intl, Health Wealth Happiness Pte. Ltd. (“HWH”), a wholly-owned subsidiary of

Alset Intl, and HWH World Inc. (“HWH World”), a wholly-owned subsidiary of HWH, entered into a binding term sheet,

pursuant to which, subject to our due diligence on HWH World, necessary approvals and consents, and the terms and conditions to

be set forth in a definitive agreement, we will acquire and purchase all of the outstanding equity interest in HWH World for a

consideration of the lesser of $14.8 million or the value of HWH World assessed by an independent third-party. We would have the

option to pay the purchase price in cash or in shares of the our common stock at a rate of $6.32 per share, the average closing

price of our common stock for the five trading days prior to January 6, 2021. In accordance with the term sheet, the parties will

enter into a definitive acquisition agreement within three months from the date of the term sheet, or at a later date as mutually

agreed, and complete the transaction within six months from the date of the term sheet, or at a later date as mutually agreed.

The term sheet is legally binding and will terminate upon the earlier of (1) July 6, 2021, (2) mutual agreement by the parties

to terminate, or (3) the execution of the definitive agreement for the transaction. HWH World is a direct marketing company that

sells cosmetic, and nutraceutical products to an international market.

Financial

Impact of COVID-19 Pandemic

The

COVID-19 pandemic has created global economic turmoil and has potentially permanently impacted how many businesses operate and

how individuals will socialize and shop in the future. The Company continues to feel the effect of the COVID-19 business shutdowns

and consumer stay-at-home protections. But the effect of the economic shutdown has impacted our business lines differently; some

more severely than others. In most cases we believe the negative economic trends and reduced sales will recover over time. However,

management had determined that one of its business lines, DSS Plastics, has been more severely impacted by the pandemic than our

other divisions and we do not believe this is a short-term phenomenon. As a result, management has decided to fully impair its

goodwill related to DSS Plastics. The impact to DSS’s first quarter earnings of this impairment was approximately $685,000.

Exit

of Plastic Printing Business

On

May 22, 2020, our management announced that it had committed to a restructuring plan to further reduce our operating expenses

in response to the economic challenges and uncertainty resulting from the COVID-19 pandemic and its potential permanent impact

on our plastics business. As part of this restructuring, our management had decided to exit our plastic printing business line,

which we operate under Plastic Printing Professionals, Inc. (DSS Plastics Group), a wholly-owned subsidiary of the Company, and

to fully impair our goodwill related to DSS Plastics Group. The sale of DSS Plastics Group was consummated and closed on August

14, 2020. The remaining assets of DSS Plastics Group were either sold, separately disposed, or retained by other existing DSS

businesses lines.

In

addition, we have initiated efforts to sub-lease the DSS Plastics Group property, which has approximately 3.5 years remaining

on its lease term at an estimated annual lease cost of $240,000 per year. Ongoing costs in connection with the closing of this

business line will be associated primarily with lease related costs. Further, the impact to our earnings of the goodwill impairment

for our first quarter ended March 31, 2020, and the nine months ended September 30, 2020, was approximately $685,000

January

2021 Common Stock Public Offering

On

January 19, 2021, the Company entered into an underwriting agreement, as amended by Amendment No. 1 effective as of January 19,

2021, with Aegis Capital Corp. (“Aegis”), as representative of the underwriters, which provided for the issuance and

sale by the Company and the purchase by the underwriters, in a firm commitment underwritten public offering (the “January

2021 Offering”), of 6,666,666 shares of the Company’s common stock, $0.02 par value per share. Subject to the terms

and conditions contained in the underwriting agreement, the shares were offered in a public offering at a price of $3.60 per share,

less certain underwriting discounts and commissions. The Company also granted the underwriters a 45-day option to purchase up

to 1,000,000 additional shares of the Company’s common stock on the same terms and conditions for the purpose of covering

any over-allotments in connection with the Offering, which was subsequently exercised in full. The net offering proceeds

to the Company from the Offering were approximately $25.0 million, after deducting estimated underwriting discounts and commissions

and other estimated offering expenses. The Company intends to use the net proceeds from this offering to fund the development

and growth of new business lines, acquisition opportunities, and general corporate and working capital needs. The initial offering

was closed on January 22, 2021, and the overallotment was exercised on January 28, 2021.

Corporate

Information

Our

principal executive offices are located at 200 Canal View Boulevard, Suite 104, Rochester, New York 14623, USA. Our telephone

number is +1-585-325-3610. Our corporate website is www.dsssecure.com. Information contained in or accessible through our

website is not part of this prospectus.

|

Common

stock offered by us

|

|

12,319,346

shares

|

|

|

|

|

|

Common

stock outstanding prior to this offering (as of February 3, 2021)

|

|

13,502,878

shares

|

|

|

|

|

|

Common

stock to be outstanding immediately following this offering

|

|

25,822,224

shares

|

|

|

|

|

|

Underwriters’

option to purchase additional shares from us

|

|

1,847,901

shares

|

|

|

|

|

|

Use

of proceeds

|

|

We

estimate that we will receive net proceeds from this offering of approximately $31.4 million, or approximately $36.1

million if the underwriter exercises its overallotment option, after deducting the underwriting discounts and commissions

and estimated offering expenses payable by us. We currently intend to use the net proceeds from this offering, together with

our existing cash, to fund (1) the development and growth of our new business lines, (2) acquisition opportunities, and (3)

the Company’s general corporate and working capital needs. We estimate that at least $20.4 million of the net

proceeds from this offering will be invested into our new business line growth and development, $9.0 million will be

used for possible acquisitions or investments in complementary businesses, products, services, technologies or existing assets,

and approximately $2.0 million will be used for general corporate and working capital needs. See “Use of Proceeds”

below.

|

|

|

|

|

|

Dividend

policy

|

|

We

have never paid cash dividends, and we do not anticipate paying a cash dividend in 2021. We anticipate that we will retain

any earnings and other cash resources for investment in our business. The payment of dividends on our common stock is subject

to the discretion of our board of directors and will depend on our operations, financial position, financial requirements,

general business conditions, restrictions imposed by financing arrangements, if any, legal restrictions on the payment of

dividends and other factors that our board of directors deems relevant.

|

|

|

|

|

|

Risk

factors

|

|

An

investment in our common stock involves a high degree of risk. You should read the “Risk Factors” section of this

prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock.

|

|

|

|

|

|

NYSE

American symbol

|

|

DSS

|

The

number of shares of common stock to be outstanding after this offering is based on 13,502,878 shares of common stock outstanding

at February 3, 2021, and excludes the following:

|

|

●

|

19,261

shares of common stock issuable upon exercise of stock options outstanding at a weighted-average exercise price of $150.44

per share;

|

|

|

|

|

|

|

●

|

40,681

shares of common stock issuable upon exercise of warrants outstanding at a weighted-average exercise price of $33.52 per share;

|

|

|

|

|

|

|

●

|

6,570,174

shares of common stock issuable upon conversion of the outstanding Series A Preferred Stock, subject to a beneficial ownership

conversion limitation; and

|

|

|

|

|

|

|

●

|

191,314

shares of common stock reserved and available for issuance under our equity compensation plans.

|

Unless

otherwise indicated, all information in this prospectus reflects or assumes no exercise by the underwriters of their option to

purchase up to 1,847,901 additional shares of common stock in this offering.

RISK

FACTORS

Our

business is influenced by many factors that are difficult to predict and that involve uncertainties that may materially affect

our actual operating results, cash flows and financial condition. Before making an investment decision about our common stock,

you should carefully consider the specific factors set forth under the caption “Risk Factors” in this prospectus supplement

and in our periodic and current reports filed with the SEC that are incorporated by reference herein (including the “Risk

Factors” set forth in Item 8.01 of our Current Report on Form 8-K filed with the SEC on July 1, 2020), together with all

of the other information appearing in this prospectus, in the applicable prospectus supplement or incorporated by reference into

this prospectus in light of your particular investment objectives and financial circumstances.

Risks

Relating to Our Business

We

have secured indebtedness, and a potential risk exists that we may be unable to satisfy our obligations to pay interest and principal

thereon when due or negotiate acceptable extensions or settlements.

We

have outstanding indebtedness (described below), most of which is secured by assets of various DSS subsidiaries and guaranteed

by the Company. Given our history of operating losses and our cash position, there is a risk that we may not be able to repay

indebtedness when due. If we were to default on any of our other indebtedness that require payments of cash to settle such default

and we do not receive an extension or a waiver from the creditor and the creditor were to foreclose on the secured assets, it

could have a material adverse effect on our business, financial condition and operating results.

As

of September 30, 2020, we had the following significant amounts of outstanding indebtedness:

|

|

●

|

$1,110,000

due under a promissory note with Citizens Bank used to purchase our packaging division facility. We are required to pay monthly

installments of $7,000 with interest fixed at 4.22% until June 2029, at which time a balloon payment of the remaining principal

balance will be due. The promissory note is secured by a first mortgage on our packaging division facility.

|

|

|

|

|

|

|

●

|

$900,000

in a term note non-revolving line of credit with Citizens Bank used by Premier Packaging Corporation (“Premier Packaging”)

to purchase equipment. Effective on the Conversion Date, the interest shall be adjusted to a fixed rate equal to 2% above

the bank’s Cost of Funds, as determined by Citizens. The note had no borrowings against it as of September 30, 2020.

|

|

|

|

|

|

|

●

|

$801,000

in a term note non-revolving line of credit with Citizens Bank used by Premier Packaging Corporation (“Premier Packaging”)

to purchase equipment. The note is amortized over a 48-month period and payable in monthly installments of $13,000. Interest

accrues at 1 Month LIBOR plus 2.00%.

|

|

|

|

|

|

|

●

|

$100,000

in a zero-interest promissory note entered into by the Company’s DSS Asia subsidiary to acquire Guangzhou Hotapps Technology

Pte Ltd., a Chinese company. This note was paid in full in October 2020.

|

|

|

|

|

|

|

●

|

$800,000

revolving credit line with Citizens Bank by Premier Packaging payable in monthly installments of interest only. The revolving

credit line bears interest at 1 Month LIBOR plus 2.0% and had no borrowings against it at as of September 30, 2020.

|

|

|

|

|

|

|

●

|

$200,000

unsecured promissory note between AMRE and LiquidValue Asset Management Pte Ltd. The note calls for interest to be paid annually

on March 2 with interest fixed at 8.0% and matures on March 2, 2022. The holder is a related party owned by the Chairman of

the Company’s board of directors.

|

|

|

|

|

|

|

●

|

$1,072,000

under the Paycheck Protection Program, which was established as part of CARES Act, and provides for loans to qualifying businesses

for amounts up to 2.5 times of the average monthly payroll expenses of the qualifying business. As of August 4, 2020, pursuant

to the terms of the SBA PPP program, the Company submitted applications for Premier Packaging and DSS Digital for a requested

100% loan forgiveness. AAMI, pursuant to the terms of the SBA PPP program, submitted its application for 100% loan forgiveness

in October 2020.

|

The

Citizens credit facilities for the Company’s subsidiary, Premier Packaging, contain various covenants including fixed charge

coverage ratio, tangible net worth and current ratio covenants which are tested annually at December 31. For the year ended December

31, 2019, Premier Packaging was in compliance with the annual covenants.

The

value of our intangible assets and investments may not be equal to their carrying values.

As

of September 30, 2020, we had approximately $39.5 million of net intangible assets. Approximately $38.3 million is associated

with the acquisition of Impact Biomedical, Inc. The Company is in the process of completing valuations and useful lives for certain

Technology and In Process Research & Development assets acquired in the transaction as well the non -controlling interest

portion of Impact BioMedical, Inc. and its subsidiaries and the purchase price allocation will be completed with finalization

of those valuations. We expect the preliminary purchase price accounting to be completed during the three months ending December

31, 2020. Approximately $287,000 of this amount are intangible assets which derive their value from patents or patent rights.

If licensing efforts and litigation are not successful, the values of these assets could be reduced. We are required to evaluate

the carrying value of such intangibles and goodwill and the fair value of investments whenever events or changes in circumstances

indicate that the carrying value of an intangible asset, including goodwill, and investment may not be recoverable. If any of

our intangible assets, goodwill or investments are deemed to be impaired then it will result in a significant reduction of the

operating results in such period. As noted above, management has determined that the goodwill of DSS Plastics has been permanently

and materially impaired due to the global pandemic and other market factors.

Risks

Relating to this Offering

Our

share price may be volatile and could decline substantially

The

market price of our common stock has been and may continue to be volatile. Many factors may cause the market price for our common

stock to decline, including:

|

|

●

|

shortfalls

in revenues, cash flows or continued losses from operations;

|

|

|

|

|

|

|

●

|

delays

in development or roll-out of any of our products;

|

|

|

|

|

|

|

●

|

announcements

by one or more competitors of new product acquisitions or technological innovations; and

|

|

|

|

|

|

|

●

|

unfavorable

outcomes from litigation.

|

In

addition, the stock market experiences extreme fluctuations in price and volume that particularly affect the market price of shares

of companies like ours. These price and volume fluctuations are often unrelated or disproportionate to the operating performance

of the affected companies. Because of this volatility, we may fail to meet the expectations of our stockholders or of securities

analysts, and our stock price could decline as a result. Declines in our stock price for any reason, as well as broad-based market

fluctuations or fluctuations related to our financial results or other developments, may adversely affect your ability to sell

your shares at a price equal to or above the price at which you purchased them. Decreases in the price of our common stock may

also lead to de-listing of our common stock.

Management

will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

We

have not allocated specific amounts of the net proceeds from this offering for any specific purpose. Accordingly, our management

will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that

you do not agree with or that do not improve our results of operations or enhance the value of our common stock. See “Use

of Proceeds.” Our failure to apply these funds effectively could have a material adverse effect on our business, financial

results, operating results and/or cash flow and could cause the price of our common stock to decline.

Our

outstanding options, warrants and convertible preferred stock, and the availability for resale of certain of the underlying shares,

may adversely affect the trading price of our common stock.

As

of February 3, 2021, there were outstanding:

|

●

|

stock

options to purchase approximately 19,261 shares of our common stock at a weighted-average exercise price of $150.44 per share;

|

|

|

|

|

●

|

40,681

shares of common stock issuable upon exercise of warrants outstanding at a weighted-average exercise price of $33.52 per share;

and

|

|

|

|

|

●

|

6,570,174

shares of common stock issuable upon conversion of the outstanding Series A Preferred Stock, subject to a beneficial ownership

conversion limitation.

|

|

|

|

|

●

|

Our

outstanding options, warrants and convertible preferred stock could adversely affect our ability to obtain future financing

or engage in certain mergers or other transactions, since the holders thereof may exercise them at a time when we may be able

to obtain additional capital through a new offering of securities on terms more favorable to us than the terms of outstanding

securities. For the life of the options, warrants and convertible preferred stock, the holders have the opportunity to profit

from a rise in the market price of our common stock without assuming the risk of ownership. The issuance of shares upon the

exercise of outstanding options, warrants and preferred stock would also dilute the ownership interests of our existing stockholders.

|

Additional

financing or future equity issuances may result in future dilution to our shareholders.

We

expect that we will need to raise additional funds in the future to finance our internal growth, our merger and acquisition plans,

investment activities, continued research and product development, and for other reasons. Any required additional financing may

not be available on terms acceptable to us, or at all. If we raise additional funds by issuing equity securities, you may experience

significant dilution of your ownership interest and the newly issued securities may have rights senior to those of the holders

of our common stock. The price per share at which we sell additional securities in future transactions may be higher or lower

than the price per share in this offering. Alternatively, if we raise additional funds by obtaining loans from third parties,

the terms of those financing arrangements may include negative covenants or other restrictions on our business that could impair

our operational flexibility and would also require us to fund additional interest expense. If adequate additional financing is

not available when required or is not available on acceptable terms, we may be unable to successfully execute our business plan.

Because

we do not currently intend to pay cash dividends on our common stock, stockholders will primarily benefit from an investment in

our stock only if it appreciates in value.

We

have never declared or paid any cash dividends on our shares of stock. We currently intend to retain all future earnings, if any,

for use in the operations and expansion of the business. As a result, we do not anticipate paying cash dividends in the foreseeable

future. Any future determination as to the declaration and payment of cash dividends or non-cash dividends will be at the discretion

of our board of directors and will depend on factors the board of directors deems relevant, including among others, our results

of operations, financial condition and cash requirements, business prospects, and the terms of any of our financing arrangements.

Accordingly, realization of a gain on stockholders’ investments will primarily depend on the appreciation of the price of

our stock. There is no guarantee that our stock will appreciate in value.

General

Risks

Because

certain of our stockholders control a significant number of shares of our common stock, they may have effective control over actions

requiring stockholder approval.

As

of February 3, 2021, our directors, executive officers and principal stockholders (those beneficially owning in excess of 5%),

and their respective affiliates, beneficially own approximately 14.2% of our outstanding shares of common stock. As a result,

these stockholders, acting together, could have the ability to control the outcome of matters submitted to our stockholders for

approval, including the election of directors and any merger, consolidation or sale of all or substantially all of our assets.

As such, these stockholders, acting together, could have the ability to exert influence over the management and affairs of our

company. Accordingly, this concentration of ownership might harm the market price of our common stock by:

|

|

●

|

delaying,

deferring or preventing a change in corporate control;

|

|

|

|

|

|

|

●

|

impeding

a merger, consolidation, takeover or other business combination involving us; or

|

|

|

|

|

|

|

●

|

discouraging

a potential acquirer from making a tender offer or otherwise attempting to obtain control of us.

|

If

securities or industry analysts do not publish research or reports about our business, or if they change their recommendations

regarding our stock adversely, our stock price and trading volume could decline.

The

trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish

about us or our business. Our research coverage by industry and financial analysts is currently limited. Even if our analyst coverage

increases, if one or more of the analysts who cover us downgrade our stock, our stock price would likely decline. If one or more

of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial

markets, which in turn could cause our stock price or trading volume to decline.

USE

OF PROCEEDS

We

estimate that we will receive net proceeds of approximately $31.4 million from the sale of the shares of common stock offered

in this offering, or approximately $36.1 million if the underwriters exercise their over-allotment option in full, after

deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We

currently intend to use the net proceeds from this offering, together with our existing cash, to fund (1) the development and

growth of our new business lines, (2) acquisition opportunities, and (3) the general corporate and working capital needs. We estimate

that at least $20.4 of the net proceeds from this offering will be invested into our new business line growth and development,

$9.0 will be used for possible acquisitions or investments in complementary businesses, products, services, technologies

or existing assets, and approximately $2.0 will be used for general corporate and working capital needs.

We

may change the amount of net proceeds to be used specifically for any of the foregoing purposes. The amounts and timing of our

actual expenditures will depend upon numerous factors, including our sales and marketing and commercialization efforts, demand

for our products, our operating costs and the other factors described under “Risk Factors” in this prospectus. Accordingly,

our management will have significant discretion and flexibility in applying the net proceeds from this offering. Pending any use,

as described above, we intend to invest the net proceeds in high-quality, short-term, interest-bearing securities.

Although

we may use a portion of the net proceeds of this offering for the acquisition or licensing, as the case may be, of additional

technologies, other assets or businesses, or for other strategic investments or opportunities, we have no current understandings,

agreements or commitments to do so.

DIVIDEND

POLICY

We

have never paid cash dividends, and we do not anticipate paying a cash dividend in 2021. We anticipate that we will retain any

earnings and other cash resources for investment in our business. The payment of dividends, whether in cash or in non-cash form,

on our common stock is subject to the discretion of our board of directors and will depend on our operations, financial position,

financial requirements, general business conditions, restrictions imposed by financing arrangements, if any, legal restrictions

on the payment of dividends and other factors that our board of directors deems relevant.

CAPITALIZATION

The

following table sets forth our capitalization as of September 30, 2020:

|

|

●

|

on

an actual basis; and

|

|

|

|

|

|

|

●

|

on a pro forma basis to give effect to issuances

of common stock after September 30, 2020, which includes the conversion of 4,293 shares of Series A Preferred Stock into

662,500 shares of common stock, and the sale by us of 7,666,666 shares of our common stock in a public offering at the price

of $3.60 per share;

|

|

|

|

|

|

|

●

|

on

a pro forma as-adjusted basis to reflect the issuance and sale by us of 12,319,346 shares of our common stock in this

offering at the public offering price of $2.80 per share, after deducting underwriting discounts and commissions and

estimated offering expenses payable by us and the receipt by us of the proceeds of such sale.

|

You

should read this information together with the section titled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Report

on Form 10-Q for the quarter ended September 30, 2020, which are incorporated by reference in this prospectus, and our consolidated

financial statements and related notes incorporated by reference in this prospectus.

|

|

|

As of September 30, 2020

|

|

|

|

|

Actual

|

|

|

Pro Forma

|

|

|

Pro Forma As Adjusted

|

|

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

11,645,000

|

|

|

$

|

36,590,000

|

|

|

|

67,951,000

|

|

|

Long-term debt, net

|

|

$

|

3,041,000

|

|

|

$

|

3,041,000

|

|

|

$

|

3,041,000

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.02 par value; 47,000 shares authorized, issued and outstanding; liquidation value

$1,000 per share, $47,000,000 aggregate; 43,000 shares issued and outstanding (pro forma and pro forma as adjusted),

Liquidation value $1,000 per share, $43,000,000 aggregate.

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

1,000

|

|

|

Common stock, $0.02 par value; 200,000,000 shares authorized, 5,174,000

shares issued and outstanding (actual); 13,503,166 issued and outstanding (pro forma); 25,822,512 issued and outstanding

(pro forma as adjusted)

|

|

|

103,000

|

|

|

|

269,000

|

|

|

|

515,000

|

|

|

Additional paid-in capital

|

|

|

174,423,000

|

|

|

|

199,202,000

|

|

|

|

230,317,000

|

|

|

Non-controlling interest in subsidiary

|

|

|

(307,000

|

)

|

|

|

(307,000

|

)

|

|

|

(307,000

|

)

|

|

Accumulated deficit

|

|

|

(100,905,000

|

)

|

|

|

(100,905,000

|

)

|

|

|

(100,905,000

|

)

|

|

Total shareholders’ equity

|

|

|

73,315,000

|

|

|

|

98,260,000

|

|

|

|

129,621,000

|

|

|

Total capitalization

|

|

$

|

76,356,000

|

|

|

$

|

101,301,000

|

|

|

$

|

132,662,000

|

|

The

number of shares of our common stock to be outstanding upon completion of this offering is based on 5,174,000 shares of our common

stock outstanding as of September 30, 2020, and excludes:

|

|

●

|

19,261

shares of common stock issuable upon exercise of stock options outstanding at a weighted-average exercise price of $150.44

per share;

|

|

|

|

|

|

|

●

|

40,681

shares of common stock issuable upon exercise of warrants outstanding at a weighted-average exercise price of $33.52 per share;

|

|

|

|

|

|

|

●

|

7,232,670

shares of common stock issuable upon conversion of the outstanding Series A Preferred Stock, subject to a beneficial ownership

conversion limitation; and

|

|

|

|

|

|

|

●

|

191,314

shares of common stock reserved and available for issuance under our equity compensation plans.

|

(See

“Prospectus Summary—The Offering” above for information on shares of common stock, options and warrants as of

February 3, 2021.)

DESCRIPTION

OF THE SECURITIES WE ARE OFFERING

In

this offering, we are offering 12,319,346 shares of our common stock at the public offering price of $2.80 per share.

The material terms and provisions of our common stock are described under the captions “Description of Securities”

and “Description of Common Stock,” each beginning on page 6 of the accompanying prospectus.

UNDERWRITING

Aegis

Capital Corp. is acting as the representative of the underwriters of the offering. We have entered into an underwriting agreement

dated February 4, 2021, with the representative. Subject to the terms and conditions of the underwriting agreement, we

have agreed to sell to the underwriters named below and the underwriters named below have severally agreed to purchase, at the

public offering price less the underwriting discount set forth on the cover page of this prospectus supplement, the following

respective number of shares of our common stock:

|

Underwriter

|

|

Number

of

Shares

|

|

|

Aegis

Capital Corp.

|

|

|

12,319,346

|

|

The

underwriters are committed to purchase all the shares of common stock offered by us other than those covered by the option to

purchase additional shares described below, if they purchase any shares. The obligations of the underwriters may be terminated

upon the occurrence of certain events specified in the underwriting agreement. Furthermore, pursuant to the underwriting agreement,

the underwriters’ obligations are subject to customary conditions and representations and warranties contained in the underwriting

agreement, such as receipt by the underwriters of officers’ certificates and legal opinions.

We

have agreed to indemnify the underwriters against specified liabilities, including liabilities under the Securities Act of 1933,

as amended, and to contribute to payments the underwriters may be required to make in respect thereof.

The

underwriters are offering the common stock, subject to prior sale, when, as and if issued to and accepted by them, subject to

approval of legal matters by their counsel and other conditions specified in the underwriting agreement. The underwriters reserve

the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

The

underwriters propose to offer the common stock offered by us to the public at the public offering price set forth on the cover

page of this prospectus supplement. In addition, the underwriters may offer some of the common stock to other securities dealers

at such price less a concession of $0.105 per share. After the initial offering, the public offering price and concession

to dealers may be changed.

We

have granted the underwriters an over-allotment option. This option, which is exercisable for up to 45 days after the date of

this prospectus supplement, permits the underwriters to purchase a maximum of 1,847,901 additional shares of common stock

from us to cover over-allotments. If the underwriters exercise all or part of this option, they will purchase shares of common

stock covered by the option at the public offering price that appears on the cover page of this prospectus supplement, less the

underwriting discount. If this option is exercised in full, the total price to the public will be approximately $39.7 million

and the total proceeds, before expenses, to us will be $36.3 million.

Underwriting

Discount. The following table shows the public offering price, underwriting discount, non-accountable underwriters’ expense allowance and proceeds, before expenses, to us.

The information assumes either no exercise or full exercise by the underwriters of their over-allotment option.

|

|

|

|

|

|

Total

|

|

|

|

|

Per Share

|

|

|

Without

Over-Allotment

|

|

|

With

Over-Allotment

|

|

|

Public offering price

|

|

$

|

2.800

|

|

|

$

|

34,494,168.80

|

|

|

$

|

39,668,291.60

|

|

|

Underwriting discount (7.5%)

|

|

$

|

0.210

|

|

|

$

|

2,587,062.66

|

|

|

$

|

2,975,121.87

|

|

|

Non-accountable expense allowance (1%)

|

|

$

|

0.028

|

|

|

$

|

344,941.69

|

|

|

$

|

396,682.92

|

|

|

Proceeds, before expenses, to us

|

|

$

|

2.562

|

|

|

$

|

31,562,164.45

|

|

|

$

|

36,296,486.81

|

|

We

have also agreed to pay all expenses relating to the offering, including (a) all filing fees and expenses relating to the registration

of the shares to be sold in the offering (including shares sold upon exercise of the underwriters’ over-allotment option)

with the Securities and Exchange Commission; (b) all fees associated with the review of the offering by FINRA and all fees and

expenses relating to the listing of such shares on the NYSE American; (c) all fees, expenses and disbursements relating to the

registration, qualification or exemption of securities offered under the “blue sky” securities laws designated by

the underwriters; (d) all fees, expenses and disbursements relating to the registration, qualification or exemption of securities

offered under the securities laws of foreign jurisdictions designated by the underwriters; (e) transfer and/or stamp taxes, if

any, payable upon the transfer of the shares from the Company to the representative; (f) fees and expenses of our accountants;

and (g) fees and expenses of the representative, including representative’s legal counsel, not to exceed $75,000.

We

estimate that the total expenses of the offering, excluding underwriting discount and non-accountable expense allowance, will

be approximately $201,000.

Discretionary

Accounts. The underwriters do not intend to confirm sales of the securities offered hereby to any accounts over which they

have discretionary authority.

Lock-Up

Agreements. Pursuant to certain “lock-up” agreements, (a) our executive officers and directors as of the pricing

date of the offering, have agreed, subject to certain exceptions, not to offer, issue, sell, contract to sell, encumber, grant

any option for the sale of or otherwise dispose of any securities of the Company without the prior written consent of the representative,

until April 22, 2021, and (b) we, and any successor, have agreed, subject to certain exceptions, until April 22, 2021,

not to (1) offer, sell or otherwise transfer or dispose

of, directly or indirectly, any shares of capital stock of the Company or (2) file or caused to be filed any registration statement

with the SEC relating to the offering of any shares of our capital stock or any securities convertible into or exercisable or

exchangeable for shares of our capital stock.

This

lock-up provision applies to common stock and to securities convertible into or exchangeable or exercisable for common stock.

It also applies to common stock owned now or acquired later by the person executing the agreement or for which the person executing

the agreement later acquires the power of disposition. The exceptions permit, among other things and subject to restrictions,

the issuance of common stock upon the exercise of outstanding stock options and warrants or other outstanding convertible securities.

Right of First Refusal. The representative

shall have a right of first refusal until January 22, 2022, to act as lead managing underwriter and book runner and/or

lead placement agent for each and every future public equity or equity convertible offering of the Company.

Electronic

Offer, Sale and Distribution of Shares. A prospectus in electronic format may be made available on the websites maintained

by one or more of the underwriters or selling group members, if any, participating in this offering and one or more of the underwriters

participating in this offering may distribute prospectuses electronically. The representative may agree to allocate a number of

shares to underwriters and selling group members for sale to their online brokerage account holders. Internet distributions will

be allocated by the underwriters and selling group members that will make internet distributions on the same basis as other allocations.