Current Report Filing (8-k)

February 21 2020 - 5:26PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 20, 2020

DOCUMENT

SECURITY SYSTEMS, INC.

(Exact

name of registrant as specified in its charter)

|

New

York

|

|

001-32146

|

|

16-1229730

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

200

Canal View Boulevard

Suite

300

Rochester,

NY

|

|

14623

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (585) 325-3610

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Ticker

symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.02 par value per share

|

|

DSS

|

|

The

NYSE American LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01 Entry into a Material Definitive Agreement.

On

February 20, 2020, Document Security Systems, Inc., a New York corporation (the “Company”) entered into an underwriting

agreement (the “Underwriting Agreement”) with Aegis Capital Corp. (the “Underwriter”), which provided

for the issuance and sale by the Company and the purchase by the Underwriter, in a firm commitment underwritten public offering

(the “Offering”), of 22,222,223 shares of the Company’s common stock, $0.02 par value per share. Subject to

the terms and conditions contained in the Underwriting Agreement, the shares were sold to the Underwriter at a public offering

price of $0.18 per share, less certain underwriting discounts and commissions. The Company also granted the Underwriters a 45-day

option to purchase up to 3,333,333 additional shares of the Company’s common stock on the same terms and conditions for

the purpose of covering any over-allotments in connection with the Offering. The net offering proceeds to the Company from the

Offering are estimated to be approximately $4 million, after deducting estimated underwriting discounts and commissions and other

estimated offering expenses, and assuming no exercise of the Underwriter’s over-allotment option. The Company intends to

use the net proceeds from this offering to fund development of new business lines, to upgrade machinery and facilities, to service

remaining commitments under the IP monetization business and for strategic growth initiatives, including possible acquisitions

or investments in complementary businesses, products, services, technologies or assets, as well as for working capital and general

corporate purposes. Heng Fai Ambrose Chan, the Chairman of the Company’s Board of Directors, purchased $2 million of shares

in the Offering.

The

Offering is expected to close on or about February 25, 2020, subject to customary closing conditions set forth in the Underwriting

Agreement. The Offering is being made pursuant to the Company’s registration statement on Form S-1 (File No. 333-236082),

which was declared effective by the Securities and Exchange Commission (the “SEC”) on February 14, 2020 under the

Securities Act of 1933, as amended (the “Securities Act”). A final prospectus describing the terms of the proposed

offering will be filed with the SEC and will be available on the SEC’s website located at http://www.sec.gov.

The

Underwriting Agreement contains customary representations, warranties and covenants of the Company, customary conditions to closing,

indemnification obligations of the Company and the Underwriter, including for liabilities under the Securities Act, and termination

and other provisions customary for transactions of this nature. The Company and all of the Company’s executive officers

and directors have also agreed not to sell or transfer any securities of the Company held by them for a period of 180 days from

February 20, 2020, subject to limited exceptions.

This

Current Report on Form 8-K contains forward-looking statements that involve risks and uncertainties, such as statements related

to the anticipated closing of the Offering and the amount of net proceeds expected from the Offering. The risks and uncertainties

involved include the Company’s ability to satisfy certain conditions to closing on a timely basis or at all, as well as

other risks detailed from time to time in the Company’s filings with the SEC.

The

foregoing summary of the Underwriting Agreement is qualified in its entirety by reference to the full text of the Underwriting

Agreement, a copy of which is filed herewith as Exhibit 1.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item

8.01 Other Information.

On

February 20, 2020, the Company issued a press release announcing the pricing of the Offering. A copy of this press release is

filed as Exhibit 99.1 hereto, and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to

be signed on its behalf by the undersigned hereunto duly authorized.

|

|

DOCUMENT

SECURITY SYSTEMS, INC.

|

|

|

|

|

|

Dated:

February 21, 2020

|

By:

|

/s/

Frank D. Heuszel

|

|

|

Name:

|

Frank

D. Heuszel

|

|

|

Title:

|

Chief

Executive Officer and Interim Chief Financial Officer

|

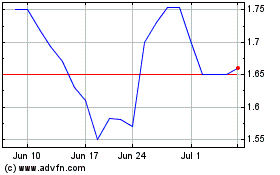

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024