UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14C INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

|

[ ]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

for the use of the Commission only (as permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive

Proxy Statement

|

|

[X]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material Pursuant to §240.14a-12

|

|

DOCUMENT

SECURITY SYSTEMS, INC.

|

|

(Name

of Registrant as Specified In Its Charter)

|

|

|

|

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

No

fee required.

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-1l (a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

VOTE

FOR DOCUMENT SECURITY SYSTEMS DIRECTOR NOMINEES

ON

THE ENCLOSED WHITE PROXY CARD TODAY

November

18, 2019

Dear

Fellow Document Security Systems Stockholder,

I

am writing to you, concerning your Company’s upcoming 2019 Annual Meeting of Stockholders, which will be held on December

9, 2019. For this meeting, you will be making important voting decisions, which can improve your Company’s prospects for

recovery and growth, and thereby have a major impact on the future value of your investment.

We

are in the process of executing a major business turnaround for your Company which is outlined below. Last spring, soon after

my appointment as CEO, I determined that the prior management had made a major strategic blunder, by focusing too much of the

Company’s time and resources on attempting to monetize the Company’s intellectual property assets, while neglecting

our core businesses.

The

Company was also in need of a major capital infusion, to financially stabilize the business. Our Chairman, Mr.

Heng Fai Ambrose Chan, stepped forward to make crucially needed equity investments, to enable your new management team

time to better implement our strategic business turnaround plan and return your Company to profitability. Mr. Chan is a highly

accomplished, world class entrepreneur, whose wisdom, advice and experience is proving invaluable, as we proceed with this turnaround

effort.

Your

Board of Directors has also been enhanced and transformed by the addition of highly qualified and proven business leaders, who

are included in our proposed slate of seven directors. We possess the experience and expertise needed to successfully execute

our Company’s new strategic business plan. These proposed directors include current and former C-level executives from major

companies, and veteran professionals responsible for investing hundreds of millions of dollars into growth companies. Collectively,

we bring fresh perspectives to the Company’s business, and we are committed to the execution of a major business turnaround,

for the benefit of all of our stockholders.

I

am requesting that you take prompt action to vote “FOR” all of Document Security Systems’ director candidates,

on the enclosed WHITE proxy card or instruction form, in order to help assure that there is no disruption in the execution

of our plan to turnaround the Company. We have high confidence that our strategic plan for profitable growth will realize Document

Security Systems’ potential and create substantial long-term stockholder value.

Here

in summary are the primary elements of our new strategic business plan:

Revive

the Company’s Core Businesses – We are upgrading equipment and products to enhance cross-selling opportunities

with existing customers and will rejuvenate research and development on digital anti-counterfeit technology products.

Substantial

Reduction of Corporate Overhead and Cash Burn* – Since last spring, we have reduced the Company’s monthly cash

burn by more than $160,000, by eliminating non-essential layers of management and redundant operating expense and by renegotiating

vendor contracts.

Exit

Unprofitable Business Lines – To preserve capital and stop further cash drain, we are shutting down the costly IP monetization

business line.

Implement

Business Diversification Initiatives – As stability of the core business is restored, we plan to both internally

develop and acquire profitable new businesses, which are in some cases complimentary to our core businesses and addressable

markets and, in others, open exciting new opportunities for expansion into new business lines.

PLEASE

SUPPORT OUR STRATEGIC PLAN TO REVIVE DOCUMENT SECURITY SYSTEMS

BY

VOTING THE WHITE PROXY CARD TODAY.

As

you might be aware, three small stockholders, who have labeled themselves as a “Concerned Shareholders Group,” are

now threatening to launch a proxy contest, to displace your new CEO and six current members of your Board of Directors, with seven

of their own hand-picked nominees, none of whom have disclosed that they possess any prior public company Board experience or

any public company management experience. In addition, this group has not disclosed any concrete alternative business plan to

create stockholder value and is instead deceptively seeking to assign blame to your new management for the blunders of the prior

management.

From

our perspective, a proxy contest involving these seven questionable alternate director nominees can only serve to disrupt the

implementation of our new strategic business plan to turn around your Company. Should you receive proxy materials from this

so-called Concerned Shareholders Group, or their affiliates, we urge you to completely disregard them and take no action. Please

do NOT vote any BLUE proxy card this Group may send.

Your

new management team and reconstituted Board of Directors are committed to the successful turnaround of your Company, and the creation

of substantial long-term stockholder value. Please vote the enclosed WHITE proxy card today “FOR” all of your Company’s

seven director nominees, “FOR” Proposals 2, 3, and 4, and for “1 YEAR” for Proposal 5.

Thank

you for your prompt attention and your support. Sincerely,

Frank

D. Heuszel, CEO of Document Security Systems, Inc.

You

may also vote your shares electronically, via telephone or internet, by following the enclosed instructions. If you have any questions

about voting your shares, you may also contact The Proxy Advisory Group, LLC, which is assisting us in this matter, by calling

212-616-2180, or by emailing info@proxyadvisory.net

*Prior

to April 2019, DSS was burning cash by approximately $255,000 per month. Over the previous five years, the Company had transitioned

from a profitable packaging and security printing company to a company more focused on an IP Monetization business line. (IP monetization

is simply the business art of turning a patent to value and return by monetizing that asset through licensing, sale-license back,

joint-venturing, exploiting co-development arrangements, and pursuing aggressive legal prosecutions of other businesses that infringe

on the patent.) The company’s attempted transformation to this new line of business failed simply because the company didn’t

have sufficient capital to initiate and sustain litigation against major corporations (Apple, Intel Corp, SK Hynix, Samsung Electronics,

Qualcomm, Seoul Semiconductor, Everlight, Cree, Lite-On Inc, and Nichia Corp.), and the selection of the initial patents which

were purchased, were not strong cases. The result was that all available capital was focused on the IP business and the previous

core business lines suffered from want of capital and attention, and in fact management specifically instructed line managers

to pare back the companies and its new business searches. As a result, business lines revenues were insufficient to meet their

own cash flow needs let alone the holding company’s overhead costs, and the Company burned capital at an accelerated rate

and DSS was unable to meet its operating payments as they became due.

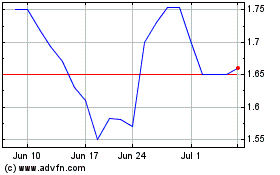

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024