Notification That Quarterly Report Will Be Submitted Late (nt 10-q)

November 12 2019 - 3:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

SEC File Number

001-12505

NOTIFICATION OF LATE FILING

(Check One): ☐ Form 10-K ☐ Form 20-F ☐ Form 11-K ý Form 10-Q ☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR

For Period Ended: September 30, 2019

☒ Transition Report on Form 10-K

☒ Transition Report on Form 20-F

☒ Transition Report on Form 11-K

☒ Transition Report on Form 10-Q

☒ Transition Report on Form N-SAR

For the Transition Period Ended: ________________________

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing checked above, identify the item(s) to which the notification relates:

PART I -- REGISTRANT INFORMATION

|

|

|

|

|

|

Core Molding Technologies, Inc.

|

|

|

Full name of Registrant

|

|

|

|

|

|

N/A

|

|

|

Former name if Applicable

|

|

|

|

|

|

800 Manor Park Drive

|

|

|

Address of Principal Executive Office (Street and Number)

|

|

|

|

|

|

Columbus, Ohio 43228-0183

|

|

|

City, State and Zip Code

|

|

PART II -- RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate.)

|

|

|

|

|

|

|

|

(a)

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

[X]

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

The accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III-- NARRATIVE

Core Molding Technologies, Inc. (the “Company”) has been delayed in completing the preparation of its Quarterly Report on Form 10-Q for the quarter ended September 30, 2019 (the “Form 10-Q”) in order to permit additional time to (1) finalize the calculation of a non-cash impairment charge for goodwill related to the HPI reporting unit for the quarterly period, which charge is anticipated to be approximately $4.1 million, (2) finalize the calculation to record a valuation allowance against the Company’s net deferred tax assets in the United States, which valuation allowance is anticipated to be approximately $1.9 million, (3) provide information to the Company's independent registered public accounting firm necessary for it to complete its review, and (4) finalize disclosures associated with the Company's compliance with certain covenants within its existing credit facility. As of September 30, 2019, the Company was not in compliance with the fixed charge coverage ratio requirement under the Company's Amended and Restated Credit Agreement, dated January 16, 2018, as amended (the “A/R Credit Agreement”) between KeyBank National Association, as administrative agent (the “Administrative Agent”), and the other lenders party thereto. The Company is currently in negotiations with the Administrative Agent to enter into a forbearance agreement to address this non-compliance and to establish milestones for the Company related to the restructuring or refinancing of its existing debt. The Company's negotiations are ongoing and any agreements in principle will impact the disclosures to be included in the Form 10-Q, including any conclusions with respect to whether there is substantial doubt about the Company's ability to continue as a going concern (as such term is used in FASB Accounting Standards Codification Subtopic No. 205-40, Presentation of Financial Statements -Going Concern). The Company is actively working to complete these negotiations, however such forbearance may not be effected prior to filing the 10-Q, and notwithstanding the Company intends to file the Quarterly Report within the grace period prescribed in Rule 12b-25 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

PART IV -- OTHER INFORMATION

(1) Name and telephone number of person to contact in regard to this notification

|

|

|

|

|

|

|

|

|

John Zimmer

|

|

(614)

|

|

870-5000

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

(2) Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s). [X] Yes [ ] No

(3) Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

[X] Yes [ ] No

As noted in Part III above, the Company will record a non-cash impairment charge of approximately $4.1 million on goodwill related to the HPI reporting unit and record a valuation allowance of approximately $1.9 million against the Company’s net deferred tax assets in the United States for the three and nine months ended September 30, 2019.

|

|

|

|

|

Core Molding Technologies, Inc.

|

|

(Name of Registrant as Specified in Charter)

|

Has caused this notification to be signed on its behalf by the undersigned thereunto duly authorized.

Date November 12, 2019 By /s/ John Zimmer

John Zimmer

Vice President, Secretary, Treasurer and Chief Financial Officer

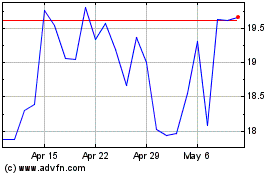

Core Molding Technologies (AMEX:CMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

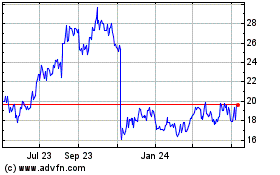

Core Molding Technologies (AMEX:CMT)

Historical Stock Chart

From Apr 2023 to Apr 2024