Comstock Mining Inc. (“Comstock” or the “Company”) (NYSE American:

LODE) today provided updates on key components of the Company’s

strategic objectives.

Strategic Focus, Corporate Realignment and

Transformation

In 2019, the Comstock Board of Directors approved a

transformational strategy focused on high-value, cash-generating,

precious metal-based activities, (the “Strategic Focus”) including,

but not limited to, precious-metal exploration, resource

development, economic feasibility assessments, mineral production,

and related ventures of environmentally friendly and economically

enhancing mining and processing technologies. The Company has

enabled the Strategic Focus with a legal entity realignment that is

facilitating both the disposition of non-mining assets while

positioning the development of its 100% owned mineral properties

(for example, our Dayton Resource Area and our Spring Valley

exploration targets) and a number of highly focused and strategic

transactions, ventures and partnerships that facilitate the

development of our other mineral properties (for example, Lucerne

and our other mineral properties located in Storey County) while

advancing investments in new ventures, like Mercury Clean Up LLC

and Sierra Springs Opportunity Fund Inc., and its subsidiaries,

that successfully acquired the Silver Springs Regional Airport and

an adjacent 180,000+ square foot manufacturing facility called

Sierra Clean Processing LLC.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6834143a-b3ed-4d2a-bc64-e9dd66e8e007

Mr. Corrado De Gasperis, Executive Chairman and CEO stated, “Our

realignment and transformation has repositioned the Company to

first unlock unrealized shareholder value and then create and

deliver new value from precious metal based innovations and

developments, including our Dayton resource and the MCU joint

venture.”

Value Proposition

Comstock’s foundational value starts with its land, water and

mineral rights on and in the historic, world-class Comstock Lode

district, and our planned growth is based on Comstock’s

exploitation of existing mineral resources, planned resource

developments, new, clean-technology-based ventures from its

established and permitted platform. This platform includes the 100%

owned Comstock Processing LLC, that has crushing, leaching,

processing, metallurgical labs and equipment, where the Company’s

clean-technology platform, joint ventures and partnerships identify

and enable opportunities for significant value growth, especially

in the area of mercury remediation and reprocessing of

residual-leached mineralized materials. The following table

summarizes the components of Comstock’s announced strategies and a

valuation buildup based on the estimated potential, future

contributions to the value of the Company for each opportunity

(with the low representing the most known and quantifiable and the

high representing least known or most nascent):

| (Dollars in

millions) |

Valuation Targets(1) |

|

Strategic Value Proposition |

Low |

High |

|

Investment in the Sierra Springs Opportunity Fund |

$ |

2.5 |

$ 115.0+ |

| Mercury Clean-up –

International Project #2 |

25.0 |

62.5+ |

| Mercury Clean-up –

International Project #1 |

25.0 |

62.5+ |

| Mercury Clean-up – Comstock

Project |

1.5 |

20.0+ |

| Leach Material Reprocessing –

Comstock Project |

7.0 |

60.0+ |

| Dayton Mineral Resource

Development |

40.0 |

120.0+ |

| Lucerne

Mineral Resource Development |

24.0 |

60.0+ |

|

Initial Consolidated Comstock Value Target

Ranges |

$ |

125.0 |

$ 500.0+ |

| (Dollars in millions) |

Valuation Estimate |

|

Non-Mining Assets |

Low |

|

High |

| Non-Mining Senior Water

Rights |

$ 4.0 |

$ |

4.5 |

| Non-Mining Land Values |

9.0 |

|

10.5 |

|

Residual Land Values (post-reclamation) |

24.0 |

|

32.0 |

|

Total Base Land Value |

$ 37.0 |

$ |

47.0 |

Note (1): Valuation Targets represent management

estimates (please see forward looking statements at the end of this

release).

Mr. De Gasperis continued, “We made remarkable progress with

numerous objectives completed during the fourth quarter of last

year. During November, we closed on the sale of 50% of the

membership interest in Comstock Mining LLC to Tonogold and

effectively facilitated the launch of Sierra Springs Opportunity

Fund Inc. In late December, Sierra Springs closed on its first

acquisitions including the Silver Springs Regional Airport LLC and

the 180,000 plus square foot Sierra Clean Processing LLC,

manufacturing facility, both completed just before last year end.

We also regained full compliance with our NYSE listing and further

escrowed deposits on our non-mining asset sales in Silver Springs.

The platform is now repositioned for tremendous growth and we are

starting to close and realize the value of this progress.”

Non-mining Asset Sales and the Northern Nevada

Opportunity Zones

Last year, the U.S. Treasury confirmed that all of Storey County

and significant parts of Silver Springs, NV, had been certified as

Qualified Opportunity Zones. The Company owns non-mining assets in

these locations, including substantial lands and senior water

rights in Silver Springs, NV, and the Gold Hill Hotel in Storey

County, NV.

These two, adjacent qualified opportunity zones are located on

growing, high volume, logistical highways, railways and airports,

with the State of Nevada investing over $125 million in the new USA

Parkway and the four-lane expansion of Highway 50, all converging

in Silver Springs, NV.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a19a6833-7617-4f7d-bae6-7a1dda2be422

Sierra Springs Opportunity Fund Inc. (“SSOF”) was formed to

capitalize on the extraordinary, explosive growth of high-tech

industries in northern Nevada, and its qualified opportunity zones,

and has already purchased the Silver Springs Regional Airport and

an adjacent, 180,000 plus square foot manufacturing complex, and

secured the rights to thousands of developable acres of land and

other assets, including an agreement to purchase Comstock’s Silver

Springs properties and water rights, all within the immediate

proximity of the Tahoe Reno Industrial (TRI) Center.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/76df942f-0267-4c8c-b194-7d0526cf3e8b

Comstock expects its ownership, on a fully diluted basis, to be

approximately 9% of the SSOF.

Non-mining Asset Sales and Repositioned Financial

Position

The Company has agreed to sell and escrowed its two properties

in Silver Springs, and over 200 acre-feet of senior water rights

for just over $10 million and has received an additional $300,000

deposit toward the purchase of these non-mining properties. The

closing dates for these sales is now January 31, 2020. The Company

has already reduced its debenture down to approximately $4.9

million, and upon completion of the non-mining asset sales, the

Company’s remaining debt will be eliminated, plus initial funding

for the Company’s planned growth initiatives. The following

sequence of pro formas represents the near-term transition of

Comstock’s financial position over the next 6 months, giving effect

to the elimination of debts and other obligations, including the

Northern Comstock JV obligations and transitioning to a debt free,

JV obligation-free, well-funded Company, positioned for

growth.

|

(US$ in thousands, except per share data) |

Pro FormaLucerne Sale

(50%)12/31/2019 |

Pro Forma Post Silver Springs

Sales1/31/2020 |

Pro Forma Lucerne & Daney Sales

(100%)6/30/2020 |

|

Cash and Cash Equivalents |

$ |

1,015 |

$ |

4,500 |

$ |

10,000 |

| Assets Held For Sale

and Cash Payments Due |

|

|

|

|

|

Lucerne Properties |

$ |

769 |

$ |

769 |

$ |

-0- |

|

Industrial Land & Water (Silver Springs) |

|

2,739 |

-0- |

-0- |

|

Commercial Land (Downtown Silver Springs) (1) |

|

3,590 |

-0- |

-0- |

|

Daney Ranch and Gold Hill Hotel |

|

2,625 |

|

2,625 |

|

487 |

|

Total Assets Held For Sale |

$ |

9,723 |

$ |

2,704 |

$ |

487 |

|

Cash Obligation Due-From-Tonogold |

$ |

5,275 |

$ |

4,550 |

$ |

-0- |

|

Tonogold Convertible Preferred Stock (2)(3)(4) |

|

9,050 |

|

9,150 |

|

9,150 |

|

Total Assets Intended for Sale/Monetization |

$ |

24,058 |

$ |

16,404 |

$ |

9,637 |

| Debt and

Other Obligations |

|

|

|

|

Senior Secured Debenture |

$ |

4,929 |

$ |

-0- |

$ |

-0- |

|

Northern Comstock JV |

|

7,102 |

|

7,102 |

-0- |

|

Equipment Financing (CAT) |

|

699 |

|

669 |

-0- |

|

Total Debt and Other Obligations |

$ |

12,730 |

$ |

7,771 |

$ |

-0- |

|

|

|

|

|

|

Total Common Shares Outstanding |

27,236,489(5) |

27,236,489(5) |

27,236,489(5) |

|

|

|

|

|

- Represents the acquisition of the non-mining asset (160-acre

Downtown Silver Springs) parcel in December 2019, contracted to

sell in January 2020.

- Represents Convertible Preferred Stock received from Tonogold

with a stated value of $4,750 and a fair-market-valued of $5,650 as

of September 30, 2019.

- Represents Convertible Preferred Stock received from Tonogold

with a stated value of $6,000 and a fair-market-valued of $9,050 as

of December 31, 2019.

- Represents an additional $100,000 of Convertible Preferred

Stock at the stated value due to be received from Tonogold in

January 2020.

- Includes 1,842,446 restricted common shares privately placed in

December, 2019, for proceeds of $550,000.

Comstock Mining LLC and Tonogold Closing

Tonogold now has a 50% membership interest in Comstock Mining

LLC, the entity that owns the Lucerne mine. The transaction alone

is expected to deliver well over $24 million ($11.2 million in

cash, $6.1 million in stock and over $7 million in assumed

liabilities) of tangible value to Comstock. The agreement also

subsidizes $2.2 million in annualized savings and retains a 1.5%

NSR royalty on Lucerne plus future rents payable under a

Lease-Option for using the Company’s processing facilities. These

agreements are expected to and may deliver additional value to

Comstock of $20-$35 million based on Tonogold’s final mine plans.

The remaining $5.275 million in cash owed to the Company represents

a secured obligation of Tonogold with payments continuing through

June 2020. The $6.1 million in Tonogold Convertible Preferred Stock

is valued at over $9 million at December 31, 2019.

Comstock Processing LLC and Mercury Clean Up

LLC

During 2019, Comstock Processing LLC, entered into a definitive

agreement with Mercury Clean Up LLC (“MCU”), in collaboration with

Oro Industries Inc. (“Oro”), for the manufacture and global

deployment of mercury remediation systems with proprietary

mechanical, hydro, electro-chemical and oxidation processes to

reclaim, treat and remediate mercury, and the entrapped precious

metals, from soils, waste and tailings. Comstock and MCU have

secured the necessary permits and are beginning to mobilize

equipment to commence drilling and sampling. The state-of the-art

mercury remediation equipment is scheduled to begin arriving on

site this month and the Company is targeting domestic and

international opportunities with estimated annualized revenues of

$100 million each. Comstock has ownership options for 25% of MCU

and other rights that can result in Comstock receiving up to 62.5%

of the profits for each of these mercury remediation opportunities.

Securing these mercury remediation opportunities could result in

profits of $25-$62.5 million, per project, for the Company.

Corporate Update and NYSE Compliance with

Continued Listing StandardsLast week, the Company received

a letter from the NYSE American LLC (the “Exchange”), stating that

the Company was in full compliance with the Exchange’s continued

listing standards set forth in Part 10 of the Exchange’s Company

Guide. The Exchange specifically noted that the Company has

resolved the Company’s previously announced low selling price

deficiency. Effective January 3, 2020, the “.bc” designation,

signifying below-compliance with NYSE American listing standards

was removed from the Company’s trading symbol. Mr. De Gasperis,

concluded, “We are positioned for value growth and we delivered on

our commitment to maintain the NYSE American listing standards and

we could not be prouder of our commitment to and collaboration with

this world-class platform and the regulatory protections it

provides for all of our shareholders. We look forward to delivering

on our strategic value propositions and updating our investors on

all of our progress throughout 2020.

About Comstock Mining Inc.

Comstock Mining Inc. is a Nevada-based, gold and silver mining

company with extensive, contiguous property in the Comstock

District and is an emerging leader in sustainable, responsible

mining that is currently commercializing environment-enhancing,

precious-metal-based technologies, products and processes for

precious metal recovery. The Company began acquiring properties in

the Comstock District in 2003. Since then, the Company has

consolidated a significant portion of the Comstock District,

amassed the single largest known repository of historical and

current geological data on the Comstock region, secured permits,

built an infrastructure and completed its first phase of

production. The Company continues evaluating and acquiring

properties inside and outside the district expanding its footprint

and exploring all of our existing and prospective opportunities for

further exploration, development and mining. The Company’s goal is

to grow per-share value by commercializing environment-enhancing,

precious-metal-based products and processes that generate

predictable cash flow (throughput) and increase the long-term

enterprise value of our northern Nevada based platform.

Forward-Looking Statements

This press release and any related calls or discussions may

include forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements,

other than statements of historical facts, are forward-looking

statements. The words “believe,” “expect,” “anticipate,”

“estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,”

“would,” “potential” and similar expressions identify

forward-looking statements, but are not the exclusive means of

doing so. Forward-looking statements include statements about

matters such as: consummation of all pending transactions; project,

asset or Company valuations; future industry market conditions;

future explorations, acquisitions, investments and asset sales;

future performance of and closings under various agreements; future

changes in our exploration activities; future estimated mineral

resources; future prices and sales of, and demand for, our

products; future impacts of land entitlements and uses; future

permitting activities and needs therefor; future production

capacity and operations; future operating and overhead costs;

future capital expenditures and their impact on us; future impacts

of operational and management changes (including changes in the

board of directors); future changes in business strategies,

planning and tactics and impacts of recent or future changes;

future employment and contributions of personnel, including

consultants; future land sales, investments, acquisitions, joint

ventures, strategic alliances, business combinations, operational,

tax, financial and restructuring initiatives; the nature and timing

of and accounting for restructuring charges and derivative

liabilities and the impact thereof; contingencies; future

environmental compliance and changes in the regulatory environment;

future offerings of equity or debt securities; the possible

redemption of debentures and associated costs; future working

capital, costs, revenues, business opportunities, debt levels, cash

flows, margins, earnings and growth. These statements are based on

assumptions and assessments made by our management in light of

their experience and their perception of historical and current

trends, current conditions, possible future developments and other

factors they believe to be appropriate. Forward-looking statements

are not guarantees, representations or warranties and are subject

to risks and uncertainties, many of which are unforeseeable and

beyond our control and could cause actual results, developments and

business decisions to differ materially from those contemplated by

such forward-looking statements. Some of those risks and

uncertainties include the risk factors set forth in our filings

with the SEC and the following: counterparty risks; capital

markets’ valuation and pricing risks; adverse effects of climate

changes or natural disasters; global economic and capital market

uncertainties; the speculative nature of gold or mineral

exploration, including risks of diminishing quantities or grades of

qualified resources; operational or technical difficulties in

connection with exploration or mining activities; contests over

title to properties; potential dilution to our stockholders from

our stock issuances and recapitalization and balance sheet

restructuring activities; potential inability to comply with

applicable government regulations or law; adoption of or changes in

legislation or regulations adversely affecting businesses;

permitting constraints or delays; decisions regarding business

opportunities that may be presented to, or pursued by, us or

others; the impact of, or the non-performance by parties under

agreements relating to, acquisitions, joint ventures, strategic

alliances, business combinations, asset sales, leases, options and

investments to which we may be party; changes in the United States

or other monetary or fiscal policies or regulations; interruptions

in production capabilities due to capital constraints; equipment

failures; fluctuation of prices for gold or certain other

commodities (such as silver, zinc, cyanide, water, diesel fuel and

electricity); changes in generally accepted accounting principles;

adverse effects of terrorism and geopolitical events; potential

inability to implement business strategies; potential inability to

grow revenues; potential inability to attract and retain key

personnel; interruptions in delivery of critical supplies,

equipment and raw materials due to credit or other limitations

imposed by vendors or others; assertion of claims, lawsuits and

proceedings; potential inability to satisfy debt and lease

obligations; potential inability to maintain an effective system of

internal controls over financial reporting; potential inability or

failure to timely file periodic reports with the SEC; potential

inability to list our securities on any securities exchange or

market; inability to maintain the listing of our securities; and

work stoppages or other labor difficulties. Occurrence of such

events or circumstances could have a material adverse effect on our

business, financial condition, results of operations or cash flows

or the market price of our securities. All subsequent written and

oral forward-looking statements by or attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

these factors. Except as may be required by securities or other

law, we undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise. Neither this press release nor any

related calls or discussions constitutes an offer to sell, the

solicitation of an offer to buy or a recommendation with respect to

any securities of the Company, the fund or any other issuer.

| Contact

information: |

|

|

| Comstock Mining Inc. P.O. Box

1118 Virginia City, NV 89440 ComstockMining.com |

Corrado De Gasperis Executive

Chairman & CEO Tel (775) 847-4755

degasperis@comstockmining.com |

Zach Spencer Director of

External Relations Tel (775) 847-5272

Ext.151questions@comstockmining.com |

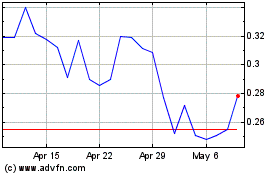

Comstock (AMEX:LODE)

Historical Stock Chart

From Mar 2024 to Apr 2024

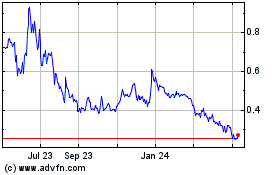

Comstock (AMEX:LODE)

Historical Stock Chart

From Apr 2023 to Apr 2024