Additional Proxy Soliciting Materials (definitive) (defa14a)

April 26 2021 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x

|

|

|

|

Filed by a Party other than the Registrant ¨

|

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material under §240.14a-12

|

|

|

|

COHEN & COMPANY INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

Cohen & Company Inc.

Cira Centre

2929 Arch Street, Suite 1703

Philadelphia, PA 19104

SUPPLEMENT TO PROXY STATEMENT

For

THE 2021 ANNUAL GENERAL MEETING OF STOCKHOLDERS

To Be Held Wednesday, June 9, 2021

This supplement, dated April 26, 2021

(this “Supplement”), supplements the definitive proxy statement (the “Proxy Statement”) filed by Cohen & Company

Inc. (the “Company”) with the U.S. Securities and Exchange Commission (the “SEC”) on April 13, 2021 and made available

to the Company’s stockholders in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”)

for the 2021 annual meeting of stockholders of the Company to be held on June 9, 2021 at 10:00 a.m., Eastern Time. This Supplement is

being filed with the SEC and made available to stockholders on April 26, 2021. Our Board of Directors has fixed the close of business

on April 12, 2021 as the record date for determining the stockholders entitled to notice of, and to vote at, the annual meeting and any

adjournments or postponements thereof. Only stockholders of record of our common stock, par value $0.01 per share, our Series E Voting

Non-Convertible Preferred Stock, par value $0.001 per share, and/or our Series F Voting Non-Convertible Preferred Stock, par value $0.001

per share, at the close of business on the record date will be entitled to notice of, and to vote at, the annual meeting and any adjournments

or postponements thereof.

The Company mailed the Notice of Internet

Availability of Proxy Materials to stockholders on or about April 15, 2021. The Proxy Statement previously advised stockholders that,

with respect to Proposal Two, abstentions will not be counted as votes cast. However, it is a policy of the New York Stock Exchange that

abstentions will count as votes cast with respect to Proposal Two. Accordingly, the section titled “Abstentions and Broker Non-Votes”

on page 4 of the Proxy Statement under the heading “INFORMATION ABOUT THE ANNUAL MEETING” is hereby revised in its entirety

to read as follows:

“For purposes of Proposals One

(the election of directors), Two (the approval of Amendment No. 1 to the 2020 Long-Term Incentive Plan), and Three (the ratification of

the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the year ending December 31,

2021) and the approval of any other matters properly presented at the meeting, abstentions (except with respect to Proposal Two)

and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will

be considered present for the purpose of determining the presence of a quorum at the meeting. With respect to Proposal Two, abstentions

will be counted as votes cast and will have the same effect as “Against” votes. A “broker non-vote” results when

a broker, bank or other nominee properly executes and returns a proxy but indicates that the nominee is not voting with respect to a particular

matter because the nominee has not received voting instructions from the beneficial owner. With respect to Proposal Three, we do not expect

any broker non-votes because Proposal Three is a “non-routine” matter and your broker will be permitted to vote your shares

in its discretion on Proposal Three, if you do not instruct your broker on how to vote your shares on Proposal Three.”

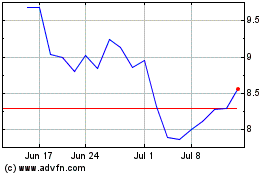

Cohen & (AMEX:COHN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cohen & (AMEX:COHN)

Historical Stock Chart

From Apr 2023 to Apr 2024