Cohen & Company Inc. (NYSE American: COHN; “Cohen”), a

financial services firm specializing in fixed income markets and,

more recently, in special purpose acquisition company (“SPAC”)

markets, announced that Dan Nash and Jerry Serowik have joined its

indirect, wholly-owned subsidiary J.V.B. Financial Group, LLC

(“JVB”).

Cohen operates a global network of more than 85 professionals in

four principal offices throughout the U.S. and Europe focused on

asset management, principal investing, and capital markets

services. JVB specializes in securities financing and the sales and

trading of fixed income securities. Nash and Serowik will lead the

expansion of JVB’s Investment Banking division and work closely

with team members at Cohen to create a leading diversified

financial services firm.

“Dan Nash and Jerry Serowik are incredibly strong,

well-respected bankers, and we are thrilled to welcome them to

JVB,” said Daniel Cohen, Chairman of the Cohen Board of Directors.

“We have worked with Dan and Jerry on numerous transactions and are

excited to partner with them as they grow a leading advisory and

capital markets business with a strong focus on our clients. Their

combined experience and leadership will be an asset across the

entire firm as we continue to grow and pursue new

opportunities.”

“I am excited to join the JVB team alongside Jerry and build

something special together,” said Nash. “In addition to being

one of the most respected SPAC sponsors and early believers in the

SPAC product, JVB pioneered a tiered sponsor structure. This

thought leadership and partnership approach to the SPAC process are

attributes we look forward to bringing to our client advisory

business.”

Nash has been named Head of Investment Banking and is

responsible for leading all aspects of Investment Banking,

including mergers & acquisitions advisory, private capital

markets, equity capital markets and PIPE transactions. Serowik has

been named Head of Equity Capital Markets and is responsible for

leading JVB’s capital markets practice, with a particular focus and

expertise around SPAC and PIPE transactions. In addition, Felix

Burmeister, formerly at Code Advisors and Wells Fargo, will support

Nash and Serowik as Director of Investment Banking with a focus on

covering technology sector clients across the full spectrum of

JVB’s investment banking advisory services. Tyler Humphrey,

formerly at FT Partners, has also joined the team. JVB intends to

open an office in the San Francisco Bay Area, expanding the

organization’s reach into Silicon Valley.

About Dan Nash

Dan Nash was most recently Global Head of Internet Investment

Banking at Wells Fargo Securities, where he advised many leading

technology companies on IPOs, acquisitions, SPAC mergers, private

placements and debt financings. Dan helped grow the Technology

investment banking business significantly at Wells Fargo and was

the lead investment banker on a number of notable transactions,

including Carvana's IPO, Shift’s SPAC sale and PIPE, and Cipher’s

SPAC sale. Prior to Dan's recent role at Wells Fargo, Dan was the

Chief Financial Officer at MZ, a leading mobile gaming company,

where he was responsible for all aspects of MZ’s financial

operations. Prior to MZ and Wells Fargo, he held multiple

investment banking and finance positions at BofA Merrill Lynch,

Riverstone Networks and Intel Corp.

About Jerry Serowik

Jerry Serowik was most recently Managing Director, Head of SPACs

at Wells Fargo Securities. He led all aspects of the SPAC practice

and grew the business considerably at Wells Fargo, leading a number

of notable SPAC IPOs, PIPEs and Capital Market Advisory

assignments. Serowik has over 17 years of Capital Markets

expertise, including prior roles at Wells Fargo Securities and Bear

Stearns. Before running the SPAC practice at Wells Fargo, he led a

long list of equity transactions across all industry verticals from

the Syndicate desk, including Carvana’s IPO.

About JVB Financial

J.V.B. Financial Group, LLC (member FINRA, SIPC), an indirect,

wholly owned subsidiary of Cohen & Company Inc., specializes in

securities financing and the sales and trading of fixed income

securities. JVB’s mission is to be the premier distribution

platform to its customers, providing trusted advice, intelligent

solutions, and superior execution. For more information, please

visit www.jvbfinancial.com.

About Cohen & Company Inc.

Cohen & Company Inc. (NYSE American: COHN) is a financial

services company specializing in fixed income markets and, more

recently, in SPAC markets. It was founded in 1999 as an investment

firm focused on small-cap banking institutions but has grown to

provide an expanding range of capital markets and asset management

services. Cohen & Company’s operating segments are Capital

Markets, Asset Management, and Principal Investing. The Capital

Markets segment consists of fixed income sales, trading, and

matched book repo financing as well as new issue placements in

corporate and securitized products, and advisory services,

operating primarily through Cohen & Company’s subsidiaries,

J.V.B. Financial Group, LLC in the United States and Cohen &

Company Financial (Europe) Limited in Europe. The Asset Management

segment manages assets through collateralized debt obligations,

managed accounts, and investment funds. As of December 31, 2020,

the Company managed approximately $2.8 billion in primarily fixed

income assets in a variety of asset classes including US and

European trust preferred securities, subordinated debt, and

corporate loans. As of December 31, 2020, 74.3% of the Company’s

assets under management were in collateralized debt obligations

that Cohen & Company manages, which were all securitized prior

to 2008. The Principal Investing segment is comprised primarily of

investments the Company holds related to its SPAC franchise and

other investments the Company has made for the purpose of earning

an investment return rather than investments made to support its

trading, matched book repo, or other capital markets business

activity. For more information, please visit

www.cohenandcompany.com.

Forward-looking Statements

This communication, including any attachments, is intended for

the exclusive use of the addressee(s) and may contain confidential,

proprietary or legally privileged information. No confidentiality

or privilege is waived or lost by any transmission of this

communication to an unintended recipient. If the reader of this

message is not the intended recipient or an authorized

representative of the intended recipient, you are hereby notified

that any dissemination or use of the information contained herein

is strictly prohibited and may be illegal. Information herein is

obtained from sources believed to be reliable and accurate, but we

do not guarantee it as such. This is not a research report, nor a

product of any research department. Prices and availability may

change without notice. Changes to assumptions may have a material

impact on results. This is not an offer, recommendation or

solicitation to buy or sell any financial product. You are

responsible for analyzing any proposed trade in the context of your

objectives, overall portfolio, liquidity and risk tolerance. The

sender of this transmission and its employees may execute trades,

recommend trades, or have positions relating to the subject issuers

that are inconsistent with the positions, if any, taken herein. The

sender of this transmission and its affiliates reserve the right to

monitor, review and archive the content of all electronic messages

sent and/or received by any of its employees. Additional

information is available upon request.

Contact

InvestorsCohen & Company Inc.Joseph W. Pooler, Jr.Executive

Vice President and Chief Financial

Officer215-701-8952investorrelations@cohenandcompany.com

MediaJoele Frank, Wilkinson Brimmer KatcherJames Golden or

Andrew Squire212-355-4449jgolden@joelefrank.com or

asquire@joelefrank.com

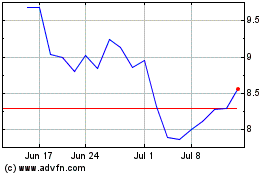

Cohen & (AMEX:COHN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cohen & (AMEX:COHN)

Historical Stock Chart

From Apr 2023 to Apr 2024