Filed Pursuant to Rule 424(b)(5)

Registration No. 333-249641

PROSPECTUS

SUPPLEMENT

(To Prospectus dated November 10, 2020)

COHEN & COMPANY INC.

Up to $5,108,136

Shares of Common Stock

We previously entered into an Equity Distribution

Agreement, or the Sale Agreement, with Northland Securities, Inc., (trade name Northland Capital Markets), or Northland, relating

to shares of our common stock, par value $0.01 per share, offered by this prospectus supplement. In accordance with the terms of

the Sale Agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $75,000,000 from

time to time through Northland, acting as sales agent. As of the date of this prospectus supplement, we have remaining capacity

to sell up to $75,000,000 of our common stock under the amended Sale Agreement.

As of the date of this prospectus supplement, the aggregate market value of our common stock held by nonaffiliates pursuant to General

Instruction I.B.6 of Form S-3 is $15,324,409, which is based on 709,792 shares of our common stock outstanding held by non-affiliates

and a price of $21.59 per share, the closing price of our common stock on October 12, 2020, which is the highest closing sale price of

our common stock on the NYSE American stock exchange within the sixty (60) days prior to the date of this prospectus supplement. During

the prior twelve (12) calendar month period that ends on and includes the date hereof, we have not offered or sold any shares of our common

stock pursuant to General Instruction I.B.6 to Form S-3.

As a result of the limitations set forth in General Instruction I.B.6 to Form

S-3 and the current public float of our common stock, and in accordance with the terms of the sales agreement, we may offer and sell additional

shares of our common stock having an aggregate offering price of $5,108,136 (which is one third of $15,324,409) in any twelve (12) month

calendar period from time to time through Northland. If our public float increases such that we may sell additional amounts under the

Sale Agreement and the registration statement of which this prospectus is a part, we will file a prospectus supplement prior to making

additional sales. In no event will we sell securities in public primary offerings on Form S-3 with a value exceeding more than one-third

of our public float (as defined by General Instruction I.B.6) in any twelve (12) calendar month period so long as our public float remains

below $75 million.

Sales of the shares of common stock, if

any, under this prospectus supplement will be made by any method permitted that is deemed an “at the market offering”

as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. Northland is not

required to sell any specific amount but will act as our sales agent using commercially reasonable efforts consistent with its

normal trading and sales practices. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Northland will be entitled to compensation

at a commission rate of 2.5% of the gross offering proceeds of the shares sold under the Sale Agreement. See “Plan of Distribution”

beginning on page S-9 for additional information regarding the compensation to be paid to Northland. In connection with the sale

of shares of common stock on our behalf, Northland will be deemed to be an “underwriter” within the meaning of the

Securities Act and the compensation paid to Northland will be deemed to be underwriting commissions or discounts. We have also

agreed to provide indemnification and contribution to Northland with respect to certain liabilities, including civil liabilities

under the Securities Act.

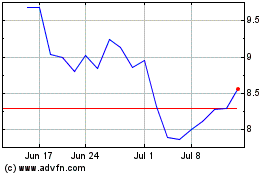

Our common stock trades on the NYSE American

stock exchange under the symbol “COHN”. On November 30, 2020, the last reported sale price of our common stock on the

NYSE American stock exchange was $16.78 per share.

__________________________________________

Investing in our common stock involves

a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

beginning on page S-7 of this prospectus supplement, and beginning on page 3 of the accompanying base prospectus, and under similar

headings in the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus.

__________________________________________

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus supplement

and the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Northland Capital Markets

The date of this prospectus supplement

is December 1, 2020

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

Page

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first

part is this prospectus supplement, which describes the terms of this offering of our common stock and also adds to and updates

information contained in the accompanying base prospectus and the documents incorporated by reference into this prospectus supplement

and the accompanying base prospectus. The second part, the accompanying base prospectus, dated November 10, 2020, including the

documents incorporated by reference into it, provides more general information, some of which may not apply to the shares of common

stock offered by this prospectus supplement. Generally, when we refer to this “prospectus,” we are referring to both

parts of this document combined.

To the extent there is a conflict between

the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying base

prospectus or in any document incorporated by reference that was filed with the Securities and Exchange Commission, or the SEC,

before the date of this prospectus supplement, on the other hand, or the information contained in any free writing prospectus prepared

by or on behalf that we have authorized for use in connection with this offering, you should rely on the information in this prospectus

supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date

- for example, a document incorporated by reference in this prospectus supplement or the accompanying base prospectus - the statement

in the document having the later date modifies or supersedes the earlier statement unless otherwise specified.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference

into this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose

of allocating risk among the parties to such agreement, and should not be deemed to be a representation, warranty or covenant to

you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the information

contained in or incorporated by reference into this prospectus and any free writing prospectus prepared by or on our behalf that

we have authorized for use in connection with this offering. We have not, and Northland has not, authorized any dealer, salesperson

or other person to provide any information or to make any representation other than those contained or incorporated by reference

into this prospectus or into any free writing prospectus prepared by or on our behalf or to which we have referred you. If anyone

provides you with additional, different or inconsistent information, you should not rely on it. We and Northland take no responsibility

for and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and Northland

is not, making an offer to sell our common stock in any jurisdiction where the offer or sale is not permitted. You should assume

that the information appearing or incorporated by reference into this prospectus and in any free writing prospectus prepared by

or on our behalf that we have authorized for use in connection with this offering is accurate only as of the date of each such

respective document. Our business, financial condition, results of operations and prospects may have changed since those dates.

You should read this prospectus, including the documents incorporated by reference, and any free writing prospectus prepared by

or on our behalf that we have authorized for use in connection with this offering, in their entirety before making an investment

decision. You should also read and consider the information in the documents we have referred you to in the sections of this prospectus

supplement entitled, “Documents Incorporated By Reference” and “Where You Can Find More Information,” and

the sections of the accompanying base prospectus entitled “Incorporation of Certain Documents By Reference” and “Where

You Can Find More Information.”

Other than in the United States, no action

has been taken by us or Northland that would permit a public offering of the common stock offered by this prospectus in any jurisdiction

where action for that purpose is required. The common stock offered by this prospectus may not be offered or sold, directly or

indirectly, nor may this prospectus or any other offering material or advertisements in connection with the offer and sale of the

shares be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable

rules and regulations of that jurisdiction. Persons into whose possession this prospectus comes are advised to inform themselves

about and to observe any restrictions relating to this offering and the distribution of this prospectus. This prospectus does not

constitute an offer to sell or a solicitation of an offer to buy the common stock offered by this prospectus in any jurisdiction

in which such an offer or a solicitation is unlawful.

Unless stated otherwise or the context otherwise

requires, references in this prospectus to the “Company,” “we,” “us,” or “our”

refer to Cohen & Company Inc. and our subsidiaries through which we conduct our business, including Cohen & Company, LLC,

our operating subsidiary.

INFORMATION

REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying

base prospectus contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities

Exchange Act of 1934, as amended, or the Exchange Act. The Private Securities Litigation Reform Act of 1995 provides certain

“safe harbor” provisions for forward-looking statements. All forward-looking statements made in this prospectus, any

prospectus supplement, any other offering material and any documents we incorporate by reference are made pursuant to the Private

Securities Litigation Reform Act. Forward-looking statements discuss matters that are not historical facts. Because they discuss

future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,”

“estimate,” “intend,” “could,” “should,” “would,” “may,”

“seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,”

“forecast,” “foresee,” “potential,” “continue” negatives thereof or similar expressions.

Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations

about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that

may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations

or plans expressed or implied by such forward-looking statements.

Forward-looking statements include, without

limitation, statements regarding our current and future business activities, operational matters, risk factors, cash needs, cash

reserves, liquidity, operating and capital expenses, financing options, including the state of the capital markets and our ability

to access the capital markets, expense reductions, the future outlook of the Company, operating results and pending litigation.

Although we believe our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable,

we cannot assure you that we will achieve or realize these plans, intentions or expectations, and actual results, performance or

achievements may differ materially from those that might be anticipated from our forward-looking statements. This can occur as

a result of inaccurate assumptions or as a consequence of known or unknown risks and uncertainties. Factors that may cause our

actual results, performance or achievements to differ materially from that contemplated by such forward-looking statements include,

among others:

|

|

•

|

|

integration of operations;

|

|

|

|

|

|

|

|

•

|

|

business strategies;

|

|

|

|

|

|

|

|

•

|

|

growth opportunities;

|

|

|

|

|

|

|

|

•

|

|

competitive position;

|

|

|

|

|

|

|

|

•

|

|

market outlook;

|

|

|

|

|

|

|

|

•

|

|

expected financial position;

|

|

|

|

|

|

|

|

•

|

|

expected results of operations;

|

|

|

|

|

|

|

|

•

|

|

future cash flows;

|

|

|

|

|

|

|

|

•

|

|

financing plans;

|

|

|

|

|

|

|

|

•

|

|

plans and objectives of management;

|

|

|

|

|

|

|

|

•

|

|

tax treatment of business combinations;

|

|

|

|

|

|

|

|

•

|

|

fair value of assets; and

|

|

|

|

|

|

|

|

•

|

|

any other statements regarding future growth, future cash needs, future operations, business plans and future financial results that are not historical facts.

|

We

operate in a continually changing business environment, and new risk factors emerge from time to time. Management cannot predict

such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or the extent to which

any factor, or combination of factors, may cause actual results, performance or achievements to differ materially from those projected

in any forward-looking statements. We have included important factors in the cautionary statements included in this prospectus

supplement and the accompanying base prospectus under the heading “Risk Factors,” and in the documents incorporated

by reference into this prospectus supplement and the accompanying base prospectus, that we believe could cause actual results or

events to differ materially from the forward-looking statements that we make.

Moreover, we operate in a very competitive

and rapidly changing environment, and new risks emerge from time to time. It is not possible for us to predict all risks, nor can

we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially and adversely from those contained in any forward-looking statements we may make. In light of these

risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur and actual

results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking

statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected

in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for

the accuracy and completeness of the forward-looking statements. Except to the extent required by law, we undertake no obligation

to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events,

conditions, circumstances or assumptions underlying such statements, or otherwise.

You should read this prospectus supplement

and the documents incorporated by reference in this prospectus supplement with the understanding that our actual future results,

levels of activity, performance and events and circumstances may be materially different from what we expect. All subsequent written

and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety

by the cautionary statements contained throughout this prospectus supplement, the accompanying base prospectus and in the information

incorporated by reference herein or therein.

PROSPECTUS SUPPLEMENT SUMMARY

This summary

highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference

into this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider

in making your investment decision. For a more complete understanding of our company and this offering, you should read carefully

this entire prospectus supplement, including the information incorporated by reference into this prospectus supplement, and any

free writing prospectus prepared by or on our behalf that we have authorized for use in connection with this offering, including

the “Risk Factors” section beginning on page S-7 of this prospectus supplement, page 3 of the accompanying base prospectus,

our consolidated financial statements and the related notes thereto and the other documents incorporated by reference into this

prospectus supplement.

Overview

We are a financial services company specializing

in the fixed income markets. We are a holding company that conducts our business primarily through Cohen & Company, LLC, our

operating company subsidiary (the “Operating LLC”). We were founded in 1999 as an investment firm focused on small-cap

banking institutions but have grown to provide an expanding range of capital markets and asset management services. Our business

segments are Capital Markets, Asset Management, and Principal Investing.

Capital

Markets. The Company’s Capital Markets business segment consists primarily of fixed income sales, trading,

matched book repurchase agreement financing, new issue placements in corporate and securitized products, and advisory services.

The Company’s fixed income sales and trading group provides trade execution to corporate investors, institutional investors,

mortgage originators, and other smaller broker-dealers. The Company specializes in a variety of products, including but not limited

to: corporate bonds, asset backed securities, mortgage backed securities (“MBS”), residential mortgage backed securities,

collateralized debt obligations (“CDOs”), collateralized loan obligations, collateralized bond obligations, collateralized

mortgage obligations, municipal securities, to-be-announced securities and other forward agency MBS contracts, Small Business Administration

loans, U.S. government bonds, U.S. government agency securities, brokered deposits and certificates of deposit for small banks,

and hybrid capital of financial institutions including trust preferred securities, whole loans, residential transition loans and

other structured financial instruments. The Company also offers execution and brokerage services for equity products. The Company

operates its capital markets activities primarily through its subsidiaries: J.V.B. Financial Group LLC, a broker-dealer subsidiary

in the United States, and Cohen & Company Financial Limited (formerly known as EuroDekania Management LTD), a subsidiary regulated

by the Financial Conduct Authority (formerly known as Financial Services Authority) in the United Kingdom (“CCFL”)

and Cohen & Company Financial (Europe) Limited, a subsidiary regulated by the Central Bank of Ireland in Ireland.

Asset

Management. The Company’s Asset Management business segment manages assets within CDOs, managed accounts,

joint ventures, and investment funds (collectively referred to as “Investment Vehicles”). A CDO is a form of secured

borrowing. The borrowing is secured by different types of fixed income assets such as corporate or mortgage loans or bonds. The

borrowing is in the form of a securitization, which means that the lenders are actually investing in notes backed by the assets.

In the event of default, the lenders will have recourse only to the assets securing the loan. The Company’s Asset Management

business segment includes its fee-based asset management operations, which include ongoing base and incentive management fees.

Principal

Investing. The Company’s Principal Investing business segment is comprised of investments that the Company

has made for the purpose of earning an investment return rather than investments made to support the Company’s trading, matched

book repo, or other Capital Markets business segment activities. These investments are included in the Company’s other investments,

at fair value and investments in equity method affiliates in the Company’s consolidated balance sheets.

We generate our revenue by business segment

primarily through:

Capital Markets

● Trading

activities of the Company, which include execution and brokerage services, riskless trading activities as well as gains and losses

(unrealized and realized) and income and expense earned on securities and derivatives classified as trading; our trading activities

which include execution and brokerage services, securities lending activities, riskless trading activities as well as gains and

losses (unrealized and realized) and income and expense earned on securities classified as trading;

● Net

interest income on the Company’s matched book repo financing activities; and

● New

issue and advisory revenue comprised primarily of (i) new issue revenue associated with originating, arranging, or placing newly

created financial instruments and (ii) revenue from advisory services, new issue and advisory revenue comprised primarily of (a)

origination fees for corporate debt issues originated by us; (b) revenue from advisory services; and (c) new issue revenue associated

with arranging and placing the issuance of newly created debt, equity, and hybrid financial instruments.

Asset Management

● Asset

management fees for the Company’s on-going asset management services provided to certain Investment Vehicles, which may

include fees both senior and subordinate to the securities in the Investment Vehicle, and incentive management fees earned based

on the performance of the various Investment Vehicles.

Principal Investing

● Gains

and losses (unrealized and realized) and income and expense earned on securities classified as other investments, at fair value.

The Company was incorporated in the State

of Maryland in October 2003. Our principal executive offices are located at 2929 Arch Street, Suite 1703, Philadelphia, Pennsylvania

19104, and our telephone number is (215) 701-9555.

THE OFFERING

|

Common stock offered by us:

|

Shares

having an aggregate offering price of up to $5,108,136.

|

|

|

|

|

Common stock to be outstanding following the offering:

|

Up

to 1,638,735 shares (as more fully described below in Outstanding Shares), assuming sales of 304,418 shares of our common

stock in this offering at an offering price of $16.78 per share, which was the last reported sale price of our shares on the

NYSE American stock exchange on November 30, 2020. The actual number of shares issued will vary depending on the sales price

under this offering.

|

|

|

|

|

Manner of offering:

|

“At the market offering” that may be made from time

to time on the NYSE American stock exchange or other existing trading markets for our common stock through our sales agent, Northland.

See “Plan of Distribution” on page S-9 of this prospectus supplement.

|

|

|

|

|

Use of proceeds:

|

We expect to use the net proceeds from the sale of our securities

for our operations and for other general corporate purposes, including, but not limited to, capital expenditures, repayment or

refinancing of borrowings, working capital, investments and acquisitions. See “Use of Proceeds” on page S-8 of this

prospectus supplement.

|

|

|

|

|

Risk factors:

|

Investing in our common stock involves a high degree of risk.

Please read the information contained in and incorporated by reference under the heading “Risk Factors” beginning on

page S-9 of this prospectus supplement, the “Risk Factors” section beginning on page 3 of the accompanying base prospectus

and the documents incorporated by referenced into this prospectus supplement.

|

|

|

|

|

NYSE American Market symbol:

|

“COHN”

|

|

|

|

|

Outstanding Shares

|

The number of shares of our common stock

to be outstanding after this offering is based on 1,334,317 shares of our common stock outstanding as of November 30, 2020, and

excludes:

• 200,000

shares of our common stock available for future issuances under our 2020 Long-Term Incentive Plan (the

“Equity Incentive Plan”) as of November 30, 2020;

• 3,081,171 shares of our common stock issuable upon the potential exchange of outstanding membership interests of Cohen & Company,

LLC, our operating subsidiary; and

• Shares

of our common stock issuable in respect of a convertible promissory notes issued by the Company to certain investors and

described in our Annual Report on Form 10-K for the year ended December 31, 2019.

|

RISK

FACTORS

Investing in our common stock is speculative

and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described in

this prospectus supplement and the documents incorporated by reference into this prospectus, including the “Risk Factors”

section of our Annual Report on Form 10-K for the year ended December 31, 2019 and Amendment No. 1 thereto on Form 10-K/A filed with the SEC on May 7, 2020 which is incorporated by reference into this prospectus, as updated by annual, quarterly and other

reports and documents we file with the SEC after the date of this prospectus supplement and that are incorporated by reference

into this prospectus supplement. The risks and uncertainties described below constitute all of the material risks of the Company

of which we are currently aware; however, the risks and uncertainties described below may not be the only risks the Company will

face. Additional risks and uncertainties of which we are presently unaware, or that we do not currently deem to be material, may

become important factors that affect us and could materially and adversely affect our business, financial condition, results of

operations and the trading price of our common stock.

Risks Related to This Offering

A substantial number of shares of our common stock may

be sold in the market following this offering, which may depress the market price for our common stock.

Sales of a substantial number of shares

of our common stock in the public market following this offering could cause the market price of our common stock to decline. Although

there can be no assurance that any of the $5 million worth of shares being offered under this prospectus supplement will be sold

or the price at which any such shares might be sold, assuming that an aggregate of 304,418 shares of our common stock are sold

pursuant to this prospectus supplement, in each case, for example, at a price of $16.78 per share, the last reported sale price

of our common stock on the NYSE American stock exchange on November 30, 2020, upon completion of this offering, based on 1,334,317

shares of our common stock outstanding as of November 30, 2020, we will have outstanding an aggregate of 1,638,735 shares of common

stock, assuming no exercise of outstanding stock options convertible notes. A substantial majority of our outstanding shares are,

and all of the shares sold in this offering upon issuance will be, freely tradable without restriction or further registration

under the Securities Act, unless these shares are owned or purchased by “affiliates” as that term is defined in Rule

144 under the Securities Act.

Moreover, if we issue options or warrants

to purchase or acquire our common stock in the future and those options or warrants are exercised you may experience further dilution.

Holders of shares of our common stock have no preemptive rights that entitle them to purchase their pro rata share of any offering

of shares of any class or series.

You may experience future dilution as a result of future

equity offerings.

In order to raise additional capital, we

may in the future offer additional shares of common stock or other securities convertible into or exchangeable for our common stock

at prices that may not be the same as the price per share in this offering. We may sell shares of common stock or other securities

convertible into or exchangeable for our shares in any other offering at a price per share that is less than the price per share

paid by investors in this offering, and investors purchasing common stock or other securities convertible into or exchangeable

for our common stock in the future could have rights superior to existing shareholders. The price per share at which we sell additional

shares of common stock or other securities convertible or exchangeable into common stock, in future transactions may be higher

or lower than the price per share paid by investors in this offering.

We have broad discretion in how we use the net proceeds

of this offering, and we may not use these proceeds effectively or in ways with which you agree.

Our management will have broad discretion

as to the use of the net proceeds from this offering. Because of the number and variability of factors that will determine our

use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Accordingly,

you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity,

as part of your investment decision, to assess whether the proceeds will be used appropriately. These net proceeds could be applied

in ways that do not improve our operating results or increase the value of your investment. See “Use of Proceeds” on

page S-8 of this prospectus supplement for a description of our proposed use of proceeds from this offering.

The actual number of shares we will issue under the Sale

Agreement with Northland, at any one time or in total, is uncertain.

Subject to certain limitations in the Sale

Agreement with Northland and compliance with applicable law, we have the discretion to deliver placement notices to Northland at

any time throughout the term of the Sale Agreement. The number of shares that are sold by Northland after delivering a placement

notice will fluctuate based on the market price of the common stock during the sales period and limits we set with Northland.

We do not expect to pay dividends in the foreseeable future.

As a result, you must rely on stock appreciation for any return on your investment.

Our board of directors has not declared

cash dividends recently. Any future distributions to our stockholders will depend upon certain factors affecting our operating

results, some of which are beyond our control. Our ability to make cash distributions is based on many factors, including the return

on our investments, operating expense levels and certain restrictions imposed by Maryland law. Some of these factors are beyond

our control and a change in any such factor could affect our ability to make distributions in the future. We may not be able to

make distributions. Our stockholders should rely on increases, if any, in the price of our Common Stock for any return on their

investment. Furthermore, we are dependent on distributions from the Operating LLC to be able to make distributions. Furthermore,

we may in the future become subject to additional contractual restrictions on, or prohibitions against, the payment of dividends.

USE

OF PROCEEDS

We may issue and sell our shares of common

stock having aggregate sales proceeds of up to $5 million from time to time under this prospectus supplement. Because there is

no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions

and proceeds to us, if any, are not determinable at this time. There can be no assurance that, in the future, we will sell any

shares under or fully utilize the Sale Agreement with Northland as a source of financing.

We expect to use the net proceeds from the

sale of our securities for our operations and for other general corporate purposes, including, but not limited to, capital expenditures,

repayment or refinancing of borrowings, working capital, investments and acquisitions.

PLAN

OF DISTRIBUTION

We have entered into a Sale Agreement, with

Northland, under which we may offer and sell up to $75 million of our shares of common stock from time to time through Northland

acting as agent. Sales of our shares of common stock, if any, under this prospectus supplement and the accompanying prospectus

will be made by any method that is deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the

Securities Act.

Each time we wish to issue and sell our

shares of common stock under the Sale Agreement, we will notify Northland of the number of shares to be issued, the dates on which

such sales are anticipated to be made, any limitation on the number of shares to be sold in any one day and any minimum price below

which sales may not be made. Once we have so instructed Northland, unless Northland declines to accept the terms of such notice,

Northland has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell

such shares up to the amount specified on such terms. The obligations of Northland under the Sale Agreement to sell our shares

of common stock are subject to a number of conditions that we must meet.

The settlement of sales of shares between

us and Northland is generally anticipated to occur on the second trading day following the date on which the sale was made. Sales

of our shares of common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository

Trust Company or by such other means as we and Northland may agree upon. There is no arrangement for funds to be received in an

escrow, trust or similar arrangement.

We will pay Northland a commission equal

to 2.5% of the gross offering proceeds of the shares of common stock sold pursuant to the Sale Agreement. Because there is no

minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and

proceeds to us, if any, are not determinable at this time. In addition, we have agreed in the Sale Agreement to reimburse Northland

for the fees and disbursements of its counsel incurred in connection with the offering contemplated by the Sale Agreement, including

any review and qualification by FINRA, in an amount not to exceed $150,000 through the fourth business day following execution

of the Sale Agreement, in addition to an amount up to $25,000 for each quarterly period thereafter. We estimate that the total

expenses for the offering, excluding any commissions or expense reimbursement payable to Northland under the terms of the Sale

Agreement, will be approximately $35,000. The remaining sale proceeds, after deducting any other transaction fees, will equal

our net proceeds from the sale of such shares.

Northland will provide written confirmation

to us following the close of trading on the NYSE American stock exchange each day in which shares of our common stock are sold

under the Sale Agreement setting forth (i) the amount sold on such day, (ii) the price or prices at which such shares

were sold on such day, (iii) the gross offering proceeds received from such sale, (iv) the net proceeds to the Company

and (v) the commission payable by the Company to Northland with respect to such sales.

In connection with the sale of our shares

of common stock on our behalf, Northland will be deemed to be an “underwriter” within the meaning of the Securities

Act, and the compensation of Northland will be deemed to be underwriting commissions or discounts. We have agreed to indemnify

Northland against certain civil liabilities, including liabilities under the Securities Act. We have also agreed to contribute

to payments Northland may be required to make in respect of such liabilities.

The offering of our shares of common stock

pursuant to the Sale Agreement will terminate upon the earlier of (i) the sale of all shares of common stock subject to the Sale

Agreement and (ii) the termination of the Sale Agreement as permitted therein. We and Northland may each terminate the Sale Agreement

at any time.

This summary of the material provisions

of the Sale Agreement does not purport to be a complete statement of its terms and conditions. A copy of the Sale Agreement will

be filed as an exhibit to a current report on Form 8-K filed under the Securities Exchange Act of 1934, as amended, or the Exchange

Act, and incorporated by reference in this prospectus supplement.

Northland and its affiliates may in the

future provide various investment banking, commercial banking, financial advisory and other financial services for us and our affiliates,

for which services they may in the future receive customary fees. In the course of its business, Northland may actively trade our

securities for its own account or for the accounts of customers, and, accordingly, Northland may at any time hold long or short

positions in such securities.

A prospectus supplement and the accompanying

prospectus in electronic format may be made available on a website maintained by Northland, and Northland may distribute the prospectus

supplement and the accompanying prospectus electronically.

Northland Capital Markets is the trade name

for certain capital markets and investment banking divisions of Northland Securities, Inc., Member FINRA and SIPC.

LEGAL

MATTERS

Certain legal matters in connection with

this offering will be passed upon for us by Duane Morris LLP. Faegre Drinker Biddle & Reath LLP is acting as counsel for the

sales agent in connection with this offering.

EXPERTS

Grant Thornton LLP,

independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report

on Form 10-K for the year ended December 31, 2019 and Amendment No. 1 thereto on Form 10-K/A filed with the SEC on May 7, 2020,

which are incorporated by reference in this prospectus supplement and elsewhere in the registration statement. Our financial statements

are incorporated by reference in reliance on Grant Thornton LLP’s reports, given on their authority as experts in accounting

and auditing.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to

“incorporate by reference” information into this prospectus supplement, which means that we can disclose important

information to you by referring you to another document filed separately with the SEC. The documents incorporated by reference

into this prospectus supplement contain important information that you should read.

The following documents

are incorporated by reference into this document:

|

|

•

|

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020, June 30, 2020 and September 30, 2020, filed on May 8, 2020, August 7, 2020 and November 6, 2020, respectively;

|

|

|

•

|

our Current Reports on Form 8-K filed with the SEC on February

3, 2020, February

12, 2020, March

5, 2020, March

10, 2020, April

7, 2020, May

7, 2020, May

8, 2020, May

22, 2020, June

19, 2020, July

1, 2020 (two

filings), August

7, 2020, August

31, 2020, September

11, 2020, September

29, 2020, October

15, 2020 (two

filings), October

30, 2020, November

4, 2020 and November 30, 2020;

|

|

|

•

|

the description of the Company’s preferred stock purchase rights set forth in its registration statements on Form 8-A filed with the SEC on March 10, 2020, including any amendments or reports filed for the purpose of updating such description.

|

We also incorporate

by reference into this prospectus supplement all documents that are filed by us with the SEC (other than current reports or portions

thereof furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items and other

portions of documents that are furnished, but not filed, pursuant to applicable rules promulgated by the SEC) pursuant to Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the initial registration statement of which this prospectus supplement

forms a part but prior to the termination of the offering. These documents include periodic reports, such as Annual Reports on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements. Please see “Where

You Can Find More Information” for additional information.

Any statement contained

herein or in a document incorporated or deemed to be incorporated by reference into this document will be deemed to be modified

or superseded for purposes of the document to the extent that a statement contained in this document or any other subsequently

filed document that is deemed to be incorporated by reference into this document modifies or supersedes the statement.

We will provide to

each person, including any beneficial owner, to whom a prospectus is delivered, upon written or oral request, without charge a

copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with the prospectus,

including exhibits which are specifically incorporated by reference into such documents. Anyone, including a beneficial owner,

to whom a prospectus is delivered, may request a copy of all documents that are incorporated by reference in this prospectus by

writing or telephoning us at the following address and number:

Cohen & Company

Inc.

Investor Relations

2929 Arch Street, Suite

1703

Philadelphia, Pennsylvania

19104

(215) 701-8952

Exhibits to the filings will not be sent,

however, unless those exhibits have specifically been incorporated by reference.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. You may read and copy any materials we file with the SEC at the following

location of the SEC:

Public Reference Room

100 F Street, N.E.

Washington, D.C. 20549

You may

obtain information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains

a Web site that contains reports, proxy and information statements and other information that we electronically file with the SEC,

which you can access over the Internet at http://www.sec.gov. We maintain a Web site at https://cohenandcompany.com/ with information

about our Company. Information contained on our Web site or any other Web site is not incorporated into this prospectus supplement

and does not constitute a part of this prospectus supplement. Our Web site address referenced above is intended to be an inactive

textual reference only and not an active hyperlink to our Web site.

PROSPECTUS

COHEN & COMPANY INC.

$75,000,000

PREFERRED STOCK

DEPOSITARY SHARES

COMMON STOCK

PREFERRED STOCK PURCHASE RIGHTS

SUBSCRIPTION RIGHTS

WARRANTS

UNITS

We may from time to time in one or more offerings offer and

sell up to $75,000,000 aggregate dollar amount of preferred stock (either separately or represented by depositary shares), common

stock (including, if applicable, any associated preferred stock purchase rights), subscription rights, and warrants, as well as

units that include any of these securities. The preferred stock, subscription rights, warrants, and units may be convertible into

or exercisable or exchangeable for common or preferred stock of our Company.

We may offer the securities separately or together, in separate

series or classes and in amounts, at prices and on terms described in one or more supplements to this prospectus and other offering

material.

We may offer and sell these securities to or through one or

more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis.

This prospectus describes some of the general terms that may

apply to these securities and the general manner in which they may be offered. The specific terms of any securities to be offered,

and any other information relating to a specific offering including the specific manner in which the securities may be offered,

will be set forth in a supplement to this prospectus. The prospectus supplement may also add, update or change information contained

in this prospectus. You should read this prospectus and each applicable prospectus supplement carefully before you invest.

Our common stock trades on the NYSE American stock exchange

under the symbol “COHN.” Our principal executive offices are located at the Cira Centre, 2929 Arch Street, Suite 1703,

Philadelphia, Pennsylvania 19104. The telephone number at our principal executive offices is (215) 701-9555. As of November 9,

2020, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $12.94 million. We have

not offered any of our securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to

and including the date of this prospectus.

See the “Risk Factors” on page 3 of this

prospectus for certain risks that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is November

10, 2020.

TABLE

OF CONTENTS

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we

filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf

process, we may sell any combination of the securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the

securities offered by us. Each time we sell securities, we will provide a prospectus supplement, information that is incorporated

by reference into this prospectus, or other offering material that will contain specific information about the terms of that offering.

The prospectus supplement and any other offering material may also add to, update or change information contained in the prospectus

or in documents we have incorporated by reference into this prospectus and, accordingly, to the extent inconsistent, information

in or incorporated by reference in this prospectus is superseded by the information in the prospectus supplement and any other

offering material related to such securities.

The prospectus supplement to be attached to the front of this

prospectus may describe, as applicable: the terms of the securities offered, the initial public offering price, the price paid

for the securities, net proceeds and the other specific terms related to the offering of these securities.

You should read carefully the entire prospectus, as well as

the documents incorporated by reference in the prospectus, the applicable prospectus supplement and any other offering material,

before making an investment decision.

Other than in those sections of this prospectus where we have

otherwise indicated, when used in this prospectus, the terms “the Company,” “we,” “us,” and

“our” refer to Cohen & Company Inc., a Maryland corporation, and its consolidated subsidiaries, unless the

context otherwise requires. Each reference in this prospectus to the Company’s common stock includes any preferred stock

purchase rights or other similar rights associated with the common stock, unless the context otherwise requires.

You should rely only on the information contained or incorporated

by reference in this prospectus, any prospectus supplement and any other offering material. We have not authorized any other person

to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not making an offer to sell these securities in any jurisdiction where the offer and sale is not permitted. You should

not assume that the information appearing in this prospectus, any prospectus supplement, any other offering material or the documents

incorporated by reference herein or therein is accurate as of any date other than their respective dates, regardless of the time

of delivery of this prospectus, any prospectus supplement, or any other offering material or of any sale of a security. Our business,

financial condition, results of operation and prospects may have changed since those dates.

THIS PROSPECTUS MAY NOT BE USED TO SELL ANY SECURITIES

UNLESS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

THE COMPANY

We are a financial services company specializing in the fixed

income markets. We are a holding company that conducts our business primarily through Cohen & Company, LLC, our operating

company subsidiary (the “Operating LLC”). We were founded in 1999 as an investment firm focused on small-cap banking

institutions, but have grown to provide an expanding range of capital markets and asset management services. Our business segments

are Capital Markets, Asset Management, and Principal Investing.

Capital Markets. The

Company’s Capital Markets business segment consists primarily of fixed income sales, trading, matched book repurchase agreement

financing, new issue placements in corporate and securitized products, and advisory services. The Company’s fixed income

sales and trading group provides trade execution to corporate investors, institutional investors, mortgage originators, and other

smaller broker-dealers. The Company specializes in a variety of products, including but not limited to: corporate bonds, asset

backed securities, mortgage backed securities (“MBS”), residential mortgage backed securities, collateralized debt

obligations (“CDOs”), collateralized loan obligations, collateralized bond obligations, collateralized mortgage obligations,

municipal securities, to-be-announced securities and other forward agency MBS contracts, Small Business Administration loans, U.S.

government bonds, U.S. government agency securities, brokered deposits and certificates of deposit for small banks, and hybrid

capital of financial institutions including trust preferred securities, whole loans, residential transition loans and other structured

financial instruments. The Company also offers execution and brokerage services for equity products. The Company operates its capital

markets activities primarily through its subsidiaries: J.V.B. Financial Group LLC, a broker-dealer subsidiary in the United States,

and Cohen & Company Financial Limited (formerly known as EuroDekania Management LTD), a subsidiary regulated by the Financial

Conduct Authority (formerly known as Financial Services Authority) in the United Kingdom (“CCFL”) and Cohen &

Company Financial (Europe) Limited, a subsidiary regulated by the Central Bank of Ireland in Ireland.

Asset Management. The

Company’s Asset Management business segment manages assets within CDOs, managed accounts, joint ventures, and investment

funds (collectively referred to as “Investment Vehicles”). A CDO is a form of secured borrowing. The borrowing is secured

by different types of fixed income assets such as corporate or mortgage loans or bonds. The borrowing is in the form of a securitization,

which means that the lenders are actually investing in notes backed by the assets. In the event of default, the lenders will have

recourse only to the assets securing the loan. The Company’s Asset Management business segment includes its fee-based asset

management operations, which include ongoing base and incentive management fees.

Principal Investing.

The Company’s Principal Investing business segment is comprised of investments that the Company has made for the purpose

of earning an investment return rather than investments made to support the Company’s trading, matched book repo, or other

Capital Markets business segment activities. These investments are included in the Company’s other investments, at fair value

and investments in equity method affiliates in the Company’s consolidated balance sheets.

We generate our revenue by business segment primarily through:

Capital Markets

|

|

·

|

Trading activities of the Company, which include execution and brokerage services, riskless trading activities as well as gains

and losses (unrealized and realized) and income and expense earned on securities and derivatives classified as trading; our trading

activities which include execution and brokerage services, securities lending activities, riskless trading activities as well as

gains and losses (unrealized and realized) and income and expense earned on securities classified as trading;

|

|

|

·

|

Net interest income on the Company’s matched book repo financing activities; and

|

|

|

·

|

New issue and advisory revenue comprised primarily of (i) new issue revenue associated with originating, arranging, or

placing newly created financial instruments and (ii) revenue from advisory services, new issue and advisory revenue comprised

primarily of (a) origination fees for corporate debt issues originated by us; (b) revenue from advisory services; and

(c) new issue revenue associated with arranging and placing the issuance of newly created debt, equity, and hybrid financial

instruments.

|

Asset Management

|

|

·

|

Asset management fees for the Company’s on-going asset management services provided to certain Investment Vehicles, which

may include fees both senior and subordinate to the securities in the Investment Vehicle, and incentive management fees earned

based on the performance of the various Investment Vehicles.

|

Principal Investing

|

|

·

|

Gains and losses (unrealized and realized) and income and expense earned on securities classified as other investments, at

fair value.

|

The Company was incorporated in the State of Maryland in October 2003.

Our principal executive offices are located at 2929 Arch Street, Suite 1703, Philadelphia, Pennsylvania 19104, and our telephone

number is (215) 701-9555.

RISK FACTORS

Investing in our securities involves risk and uncertainties.

Please see the risk factors under the heading “Item 1A – Risk Factors” in our most recent annual report on Form 10-K,

which is on file with the SEC and is incorporated herein by reference, and which may be amended, supplemented or superseded from

time to time by other reports we file with the SEC in the future. Before making an investment decision, you should carefully consider

these risks and other uncertainties as well as other information we include or incorporate by reference in this prospectus and

any prospectus supplement. The risks and uncertainties incorporated by reference include all of the material risks of the Company

of which we are currently aware; however, these risks and uncertainties may not be the only risks the Company will face. Additional

risks and uncertainties of which we are presently unaware, or that we do not currently deem material, may become important factors

that affect us and could materially and adversely affect our business, financial condition, results of operations and the trading

price of our securities.

DISCLOSURE REGARDING FORWARD-LOOKING

STATEMENTS

Some of the statements in this prospectus, any prospectus supplement,

or any other offering materials and any documents we incorporate by reference may constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The

Private Securities Litigation Reform Act of 1995 provides certain “safe harbor” provisions for forward-looking statements.

All forward-looking statements made in this prospectus, any prospectus supplement, any other offering material and any documents

we incorporate by reference are made pursuant to the Private Securities Litigation Reform Act. Forward-looking statements discuss

matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include

words such as “anticipate,” “believe,” “estimate,” “intend,” “could,”

“should,” “would,” “may,” “seek,” “plan,” “might,” “will,”

“expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,”

“continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are

made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements

involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance

or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking

statements.

Forward-looking statements include, without limitation, statements

regarding our current and future business activities, operational matters, cash needs, cash reserves, liquidity, operating and

capital expenses, financing options, including the state of the capital markets and our ability to access the capital markets,

expense reductions, the future outlook of the Company, operating results and pending litigation. Although we believe our plans,

intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you

that we will achieve or realize these plans, intentions or expectations, and actual results, performance or achievements may differ

materially from those that might be anticipated from our forward-looking statements. This can occur as a result of inaccurate assumptions

or as a consequence of known or unknown risks and uncertainties. Factors that may cause our actual results, performance or achievements

to differ materially from that contemplated by such forward-looking statements include, among others:

|

|

·

|

integration of operations;

|

|

|

·

|

expected financial position;

|

|

|

·

|

expected results of operations;

|

|

|

·

|

plans and objectives of management;

|

|

|

·

|

tax treatment of business combinations;

|

|

|

·

|

fair value of assets; and

|

|

|

·

|

any other statements regarding future growth, future cash needs, future operations, business plans and future financial results

that are not historical facts.

|

These forward-looking statements represent our intentions,

plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. These

statements could be affected by general domestic and international economic and political conditions, uncertainty as to the future

direction of the economy and vulnerability of the economy to domestic or international incidents, as well as market conditions

in our industry. Many of those factors are outside of our control and could cause actual results to differ materially from the

results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the

events described in the forward-looking statements might not occur or might occur to a different extent or at a different time

than we have described. You should consider the areas of risk and uncertainty described above and discussed under the heading

“Item 1A – Risk Factors” and in other sections of our annual report on Form 10-K

for the year ended December 31, 2019 as well as in our other reports filed from time to time with the SEC that are incorporated

by reference into this prospectus. You are cautioned not to place undue reliance on these forward-looking statements, which speak

only as of the date of our Annual Report on Form 10-K or other reports filed with the SEC, as applicable. Actual results

may differ materially as a result of various factors, some of which are outside our control, including the following:

|

|

·

|

a decline in general economic conditions or the global financial markets;

|

|

|

·

|

losses or reductions in business volume due to impact of the COVID-19 pandemic;

|

|

|

·

|

losses caused by financial or other problems experienced by third parties;

|

|

|

·

|

losses due to unidentified or unanticipated risks;

|

|

|

·

|

losses (whether realized or unrealized) on our principal investments;

|

|

|

·

|

a lack of liquidity, i.e., ready access to funds for use in our businesses, including the availability of securities financing

from our clearing agency and the Fixed Income Clearing Corporation the (“FICC”); or the availability of financing at

prohibitive rates;

|

|

|

·

|

the ability to attract and retain personnel;

|

|

|

·

|

the ability to meet regulatory capital requirements administered by federal agencies;

|

|

|

·

|

an inability to generate incremental income from acquired, newly established or expanded businesses;

|

|

|

·

|

unanticipated market closures due to inclement weather or other disasters;

|

|

|

·

|

the volume of trading in securities including collateralized securities transactions;

|

|

|

·

|

the liquidity in capital markets;

|

|

|

·

|

the creditworthiness of our correspondents, trading counterparties, and banking and margin customers;

|

|

|

·

|

changing interest rates and their impacts on U.S. residential mortgage volumes;

|

|

|

·

|

competitive conditions in each of our business segments;

|

|

|

·

|

the availability of borrowings under credit lines, credit agreements, warehouse agreements, and our credit facilities;

|

|

|

·

|

our continued membership in the FICC;

|

|

|

·

|

the potential misconduct or errors by our employees or by entities with whom we conduct business; and

|

|

|

·

|

the potential for litigation and other regulatory liability.

|

We caution the reader that the factors described above may not

be exhaustive. We operate in a continually changing business environment, and new risk factors emerge from time to time. Management

cannot predict such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or the extent

to which any factor, or combination of factors, may cause actual results, performance or achievements to differ materially from

those projected in any forward-looking statements. Except to the extent required by law, we undertake no obligation to update or

revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances

or assumptions underlying such statements, or otherwise. All subsequent written and oral forward-looking statements attributable

to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout

this prospectus or in any prospectus supplement or in the information incorporated by reference herein or therein.

USE OF PROCEEDS

Unless indicated otherwise in the applicable prospectus supplement

or other offering material, we expect to use the net proceeds from the sale of our securities for our operations and for other

general corporate purposes, including, but not limited to, capital expenditures, repayment or refinancing of borrowings, working

capital, investments and acquisitions. Additional information on the use of net proceeds from the sale of securities offered by

this prospectus may be set forth in the applicable prospectus supplement or other offering material relating to such offering.

If net proceeds from a specific offering will be used to repay indebtedness, the applicable prospectus supplement or other offering

material will describe the relevant terms of the debt to be repaid. If net proceeds from a specific offering will be used to acquire

assets, other than in the ordinary course of business, or to finance acquisitions of other businesses, the applicable prospectus

supplement or other offering material will describe the relevant terms of the acquisition or financing.

DILUTION

If required, we will set forth in a prospectus supplement the

following information regarding any material dilution of the equity interests of investors purchasing securities in an offering

under this prospectus:

|

|

·

|

the net tangible book value per share of our equity securities before and after the offering;

|

|

|

·

|

the amount of the increase in such net tangible book value per share attributable to the cash payments made by purchasers in

the offering; and

|

|

|

·

|

the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers.

|

PLAN OF DISTRIBUTION

We may sell the securities from time to time in one or more

transactions through underwriters or dealers, through agents, or directly to one or more purchasers, in private transactions, at

a fixed price or prices, which may be changed, or from time to time at market prices prevailing at the time of sale, at prices

related to the prevailing market prices, or at negotiated prices. We will describe the method of distribution and the terms of

the offering of the securities in a prospectus supplement, information incorporated by reference or other offering material, including:

|

|

·

|

the name or names of the underwriters, if any, and the respective amounts underwritten;

|

|

|

·

|

the purchase price of the securities and the proceeds we will receive from the sale;

|

|

|

·

|

any underwriting discounts and other items constituting underwriters’ compensation;

|

|

|

·

|

any initial public offering price;

|

|

|

·

|

any discounts or concessions allowed or reallowed or paid to dealers; and

|

|

|

·

|

any securities exchange or market on which the securities may be listed.

|

Only underwriters we name in the prospectus supplement, information

incorporated by reference or other offering material are underwriters of the securities offered thereby.

If we use underwriters in the sale, they will acquire the securities

for their own account and may resell them from time to time in one or more transactions, including negotiated transactions, at

a fixed public offering price or at varying prices determined at the time of sale. We may offer the securities to the public through

underwriting syndicates represented by managing underwriters or by underwriters without a syndicate. Subject to certain conditions,

the underwriters will be obligated to purchase all the securities of the class offered by the prospectus supplement, information

incorporated by reference or other offering material. In connection with the sale of securities, underwriters may receive compensation

from us or from purchasers of securities for whom they may act as agents. This compensation may be in the form of discounts, concessions,

or commissions.

Underwriters may sell securities to or through dealers, and

these dealers may receive compensation in the form of discounts, concessions, or commissions from the underwriters and/or commissions

from the purchasers for whom they may act as agents. Underwriters, dealers and agents that participate in the distribution of securities

could be considered underwriters, and any discounts or commissions received by them from us and any profit on the resale of securities

by them could be considered underwriting discounts and commissions, under the Securities Act. Any public offering price and any

discounts or concessions allowed or reallowed or paid to dealers may change from time to time.

If we sell securities to a dealer, we will sell the securities

to the dealer, as principal. The name of the dealer and the terms of the transaction will be set forth in the prospectus supplement,

information incorporated by reference, or other offering material. The dealer may then resell the securities to the public at varying

prices to be determined by the dealer at the time of resale.

We may sell securities directly or through agents we designate

from time to time. We will name any agent involved in the offering and sale of securities, and we will describe any commissions

we will pay the agent, in the prospectus supplement, information incorporated by reference or other offering material. Unless the

prospectus supplement states otherwise, our agent will act on a best-efforts basis for the period of its appointment.

Under agreements entered into by us for the purchase or sale

of securities, underwriters, dealers and agents may be entitled to indemnification by us against certain liabilities, including

liabilities under the Securities Act, or to contribution with respect to payments which they may be required to make in respect

thereof. Underwriters, dealers and agents may be customers of, engage in transactions with, or perform services for, us in the

ordinary course of business.

Offers to purchase securities may be solicited, and sales thereof

may be made, by us directly to institutional investors or others who may be deemed to be underwriters within the meaning of the

Securities Act with respect to any resales of those securities. The terms of any such offer will be set forth in the prospectus

supplement, information incorporated by reference or other offering material.

If we offer securities in a subscription rights offering to

our existing security holders, we may enter into a standby underwriting agreement with dealers, acting as standby underwriters.

We may pay the standby underwriters a commitment fee for the securities they commit to purchase on a standby basis. If we do not

enter into a standby underwriting arrangement, we may retain a dealer-manager to manage a subscription rights offering for us.

If so indicated in the prospectus supplement, we will authorize

the underwriters or other persons acting as our agents to solicit offers by certain institutional investors to purchase securities

from us under contracts requiring payment and delivery on a future date. The obligations of any purchaser under these contracts

will be subject to the condition that the purchase of the offered securities shall not at the time of delivery be prohibited under

the laws of the jurisdiction to which that purchaser is subject. The underwriters and other agents will not have any responsibility

in respect of the validity or performance of these contracts.

Upon written instruction from us, a sales agent party to a distribution

agency agreement with us will use its commercially reasonable efforts to sell on our behalf, as our agent, the shares of common

stock offered as agreed upon by us and the sales agent. We will designate the maximum amount of shares of common stock to be sold

through the sales agent, on a daily basis or otherwise as we and the sales agent agree. Subject to the terms and conditions of

the applicable distribution agency agreement, the sales agent will use its commercially reasonable efforts to sell, as our sales

agent and on our behalf, all of the designated shares of common stock. We may instruct the sales agent not to sell shares of common

stock if the sales cannot be affected at or above the price designated by us in any such instruction. We may suspend the offering

of shares of common stock under any distribution agency agreement by notifying the sales agent. Likewise, the sales agent may suspend

the offering of shares of common stock under the applicable distribution agency agreement by notifying us of such suspension.

We also may sell shares to the sales agent as principal for

its own account at a price agreed upon at the time of sale. If we sell shares to the sales agent as principal, we will enter into

a separate agreement setting forth the terms of such transaction.

The offering of common stock pursuant to a distribution agency

agreement will terminate upon the earlier of (1) the sale of all shares of common stock subject to the distribution agency

agreement or (2) the termination of the distribution agency agreement by us or by the sales agent.

Sales agents under our distribution agency agreements may make