Amended Statement of Beneficial Ownership (sc 13d/a)

April 20 2020 - 1:58PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT

TO §240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 3)

|

CENTRUS ENERGY CORP.

|

|

(Name of Issuer)

|

|

|

|

CLASS

A COMMON STOCK, $0.10 PAR VALUE

|

|

(Title of Class of Securities)

|

15643U104

(CUSIP Number)

Morris Bawabeh

15 Ocean Avenue

Brooklyn, NY 11225

Telephone: (718) 703-8441

With a copy to:

Len Breslow, Esq.

Breslow & Walker, LLP

100 Jericho Quadrangle, Suite 230

Jericho, NY 11753

Telephone: (516) 822-6505

|

|

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

|

|

April 13, 2020

|

|

Date of Event Which Requires Filing of this Statement

|

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box x

Note.

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

(Continued on following pages)

Page 1 of 7

|

1

|

NAMES OF REPORTING PERSONS

Morris Bawabeh

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A

GROUP

(see instructions)

|

|

(a) o

(b) o

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS* (see instructions)

|

|

PF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED

PURSUANT TO ITEM 2(d) OR 2(e)

|

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

United States

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With

|

7

|

SOLE VOTING POWER

|

|

|

|

8

|

SHARED VOTING POWER

1,550,500 shares1

(see Item 5 infra)

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

1,550,500 shares1 (see Item 5 infra)

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

1,550,500 shares1 (see Item 5

infra)

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES (see instructions)

|

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

11

17.9%1 (see Item 5 infra)

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

|

1

The reporting person disclaims beneficial ownership of these securities except to the extent of his equity interest therein.

|

1

|

NAMES OF REPORTING PERSONS

Kulayba LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A

GROUP

(see instructions)

|

|

(a) o

(b) o

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS* (see instructions)

|

|

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED

PURSUANT TO ITEM 2(d) OR 2(e)

|

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

United States

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With

|

7

|

SOLE VOTING POWER

1,505,500 shares (see Item 5 infra)

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

1,505,500 shares (see Item 5 infra)

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

1,505,500 shares (see Item 5 infra)

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES (see instructions)

|

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

11

17.4% (see Item 5 infra)

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

M&D Bawabeh Foundation, Inc.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A

GROUP

(see instructions)

|

|

(a) o

(b) o

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS* (see instructions)

|

|

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED

PURSUANT TO ITEM 2(d) OR 2(e)

|

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

New York

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With

|

7

|

SOLE VOTING POWER

45,000 shares (see Item 5 infra)

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

45,000 shares (see Item 5 infra)

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,000 shares (see Item 5 infra)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES (see instructions)

|

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

11

0.5% (see Item 5 infra)

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO

|

|

|

Explanatory Note:

This Amendment

No. 3 (this “Amendment”) to the Statement of Beneficial Ownership on Schedule 13D amends Amendment

No. 2 to the Schedule 13D (the “Schedule 13D”) filed on February 7, 2017 with the Securities and Exchange

Commission with respect to shares of Class A common stock of Centrus Energy Corp. Capitalized terms used but not defined in this

Amendment have the meaning set forth in the Schedule 13D. This Amendment is being filed to amend and supplement the Schedule 13D

as set forth herein.

|

Item 4.

|

Purpose of Transaction.

|

Item 4 of the Schedule 13D is hereby amended

and restated in its entirety so that it shall now read as follows:

The Shares disclosed herein

were acquired for investment purposes. The reporting persons do not have any present plan or proposal which would relate to or

result in any of the matters set forth in subparagraphs (a)-(j) of Item 4 of Schedule 13D, except that on April 13, 2020, they

entered into a Voting and Nomination Agreement (the “Voting Agreement”) with the Issuer. Pursuant to the Voting

Agreement, (a) the Issuer agreed (i) to include Michael O’Shaughnessy as a nominee in the Issuer’s slate of nominees

for election as directors of the Issuer at the Issuer’s 2020 annual meeting of stockholders (the “2020 Annual Meeting”),

and (ii) to use commercially reasonable efforts to cause the election of Mr. O’Shaughnessy to the Issuer’s board of

directors (the “Board”) at the 2020 Annual Meeting (including recommending that the Issuer’s stockholders

vote in favor of the election of Mr. O’Shaughnessy), and (b) each reporting person agreed (i) to cause to be present and

to vote at the 2020 Annual Meeting all shares of the Issuer for which such reporting person is the beneficial owner in accordance

with the recommendations of the Issuer’s management, and (ii) to cause to be present and to vote all shares of the Issuer

for which such reporting person is the beneficial owner for the Issuer’s slate of nominees for election as directors of the

Issuer at the Issuer’s 2021 annual meeting of stockholders (the “2021 Annual Meeting”), provided that

Mr. O’Shaughnessy is included in the slate of directors nominated by the Issuer. If Mr. O’Shaughnessy withdraws from

the Board or is unable to, refuses to, or otherwise does not consent to be nominated to serve on the Board, the reporting persons

may designate a replacement reasonably acceptable to the Issuer to be included as a nominee in the Issuer’s slate of nominees

for election as directors of the Issuer at the 2021 Annual Meeting; in any event, each reporting person shall remain obligated

to cause all of the Issuer’s shares for which it is the beneficial owner to be present at the 2021 Annual Meeting and to

vote for the Issuer’s slate of nominees.

The foregoing description

of the Voting Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Voting

Agreement, a copy of which is attached as Exhibit 10.1 hereto and is incorporated herein by reference.

The reporting persons

intend to review their investments in the Issuer on a continuing basis. Depending on various factors including, without limitation,

the Issuer’s financial position and investment strategy, the price levels of the Shares, conditions in the securities markets

and general economic and industry conditions, the reporting persons may in the future take such actions with respect to their investments

in the Issuer as they deem appropriate including, without limitation, purchasing additional Shares, selling some or all of their

Shares, engaging in short selling of or any hedging or similar transaction with respect to the Shares or changing their intention

with respect to any and all matters referred to in Item 4.

|

Item 5.

|

Interests in Securities of the Issuer.

|

Item 5 of the Schedule 13D is hereby amended

and restated in its entirety so that it shall now read as follows:

|

|

(a)

|

Amount beneficially owned and percent of class: See items 11 and 13 of the cover pages.

|

|

|

|

|

|

|

(b)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or to direct the vote: See items 7-10 of the cover pages.

|

|

|

|

|

|

|

(ii)

|

Shared power to vote or to direct the vote: See items 7-10 of the cover pages.

|

|

|

|

|

|

|

(iii)

|

Sole power to dispose or to direct the disposition of: See items 7-10 of the cover pages.

|

|

|

|

|

|

|

(iv)

|

Shared power to dispose or to direct the disposition of: See items 7-10 of the cover pages.

|

|

|

(c)

|

See Exhibit B attached to this Amendment for a list of

transactions with respect to the Shares by the reporting persons.

|

Kulayba LLC is

a limited liability company of which Mr. Morris Bawabeh is the sole member.

M&D Bawabeh

Foundation, Inc. is a 501(c)(3) charitable foundation. Mr. Morris Bawabeh is a director and an officer of the Foundation. Mr. Bawabeh

has no pecuniary interest in Shares held by the Foundation and disclaims beneficial ownership of such Shares.

The percentages

of beneficial ownership shown herein are based on 8,673,976 Shares issued and outstanding as of March 3, 2020 as reported on the

Issuer’s Form 10-K for the year ended December 31, 2019, filed on March 27, 2020.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Item 6 of the Schedule 13D is hereby amended

and restated in its entirety so that it shall now read as follows:

Reference is made to the

Voting Agreement defined and described in Item 4.

|

Item 7.

|

Material to be Filed as Exhibits.

|

Item 7 of the Schedule 13D is hereby amended

and restated in its entirety so that it shall now read as follows:

|

|

Exhibit A:

|

Joint Filing Agreement among the reporting persons

|

|

|

Exhibit B:

|

Transactions in the Shares

|

|

|

Exhibit C:

|

Voting and Nomination Agreement, dated as of April 13, 2020, by and among the reporting persons and the Issuer (incorporated by

reference to Exhibit 10.1 of the Issuer’s Form 8-K dated April 13, 2020).

|

SIGNATURE

After reasonable inquiry

and to the best of their knowledge and belief, each of the undersigned hereby certifies that the information set forth in this

statement is true, complete and correct.

Dated: April 20, 2020

|

|

/s/ Morris Bawabeh

|

|

|

Morris Bawabeh

|

|

|

|

|

|

|

Kulayba LLC

|

|

|

|

|

|

|

By:

|

/s/ Morris Bawabeh

|

|

|

|

Morris Bawabeh, Sole Member

|

|

|

|

|

|

|

M&D Bawabeh Foundation, Inc.

|

|

|

|

|

|

By:

|

/s/ Morris Bawabeh

|

|

|

|

Morris Bawabeh, President

|

|

Attention:

|

Intentional misstatements or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001).

|

Exhibit B

SCHEDULE OF TRANSACTIONS IN SHARES

|

Reporting Person

|

Date of

Transaction

|

Number of Shares

Sold (S)/Acquired(A)

|

Price Per

Share

|

Where/How

Effected

|

|

M&D Bawabeh Foundation, Inc.

|

10/24/17

|

5,000 (S)

|

$3.5282

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

3/19/18

|

10,000 (S)

|

$3.75

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

9/6/18

|

9,500 (S)

|

$2.37

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

5/29/29

|

15,000 (A)*

|

n/a*

|

Private transaction

|

|

M&D Bawabeh Foundation, Inc.

|

6/06/19

|

3,526 (S)

|

$3.5053

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

7/17/19

|

6,474 (S)

|

$3.44

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

8/29/19

|

556 (S)

|

$3.10

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

9/18/19

|

4,444 (S)

|

$3.2104

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

50 (S)

|

$4.90

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

2,600 (S)

|

$4.90

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

1,300 (S)

|

$4.90

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

1,050 (S)

|

$4.90

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

100 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

1,200 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

200 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

900 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

500 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

300 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

500 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

600 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

100 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

400 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

10/30/19

|

200 (S)

|

$4.92

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

2/26/20

|

2,200 (S)

|

$7.7878

|

Open Market

|

|

M&D Bawabeh Foundation, Inc.

|

2/26/20

|

2,800 (S)

|

$7.7878

|

Open Market

|

*Shares were gifted to the Foundation.

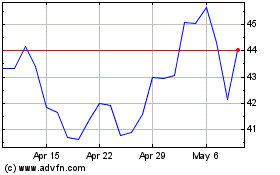

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Mar 2024 to Apr 2024

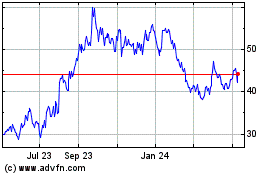

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Apr 2023 to Apr 2024