UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of Report (Date of earliest event reported)

September 15,

2020

|

cbdMD, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

North Carolina

|

001-38299

|

47-3414576

|

|

(State or other jurisdiction of incorporation or

organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

8845 Red Oak Blvd, Charlotte, NC 28217

(Address of principal executive offices)(Zip Code)

Registrant's

telephone number, including area code: (704) 445-3060

|

_______________________________________

|

|

(Former name or former address, if changed since last

report)

|

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

☐

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

☐

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

common

|

YCBD

|

NYSE

American

|

|

8%

Series A Cumulative Convertible Preferred Stock

|

YCBD PR

A

|

NYSE

American

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this

chapter).

|

Emerging

growth company ☑

|

|

If an

emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange

Act. ☐

Item

5.02

Departure

of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

September 15, 2020, with an effective date of October 1, 2020, the

Company entered into an Executive Employment Agreement with T.

Ronan Kennedy pursuant to which Mr. Kennedy was hired to serve as

the Company’s Chief Financial Officer. Biographical

information for Mr. Kennedy is as follows:

Mr.

Kennedy, 41, has served as Chief Financial Officer of AMV Holdings,

LLC, a Mooresville, NC-based vaping and e-cigarette retailer,

manufacturer and wholesaler since 2015. During his tenure, AMV grew

from a 9-store regional chain to a platform of over 100 U.S.

locations and a growing European footprint. Since the passing of

the Farm Bill in late 2018, Mr. Kennedy assisted AMV expand into

the manufacturing and retailing of CBD products. Prior to his role

at AMV, Mr. Kennedy spent 9 years at Meriturn Partners, LLC, a

Raleigh, NC-based middle-market private equity firm focused on

acquiring and advising middle-market companies, where he was a

Principal. In his role with Meriturn Partners, LLC, Mr. Kennedy has

led all facets of transactions, including due diligence, financial

analysis and capital raising and in 2014 helped lead

Meriturn’s original acquisition of AMV’s predecessor.

Since 2014 Mr. Kennedy has also provided independent advisory and

consulting services with select organizations and his engagements

have included leading the financial analysis on sale-side

engagements, assistance in negotiating a $40 million sale to a

strategic buyer, advising secured creditors through restructuring

of a restaurant group, and serving as a co-trustee for a specialty

pharmaceutical company. From 2001 to 2004 Mr. Kennedy held

engineering and manufacturing roles with Visteon Corporation, a $16

billion Tier 1 automotive supplier. Mr. Kennedy received a B.S. in

Mechanical Engineering from Virginia Polytechnic Institute &

State University and a M.B.A. from the Fuqua School of Business,

Duke University. Since 2019 Mr. Kennedy has served on the Board of

Directors of Nexus Capital Real Estate Inc., a Rochester, NY-based

real estate investment firm.

The

term of Mr. Kennedy’s Executive Employment Agreement is one

year, and may be renewed by us for additional one year terms upon

60 days prior notice to Mr. Kennedy. As compensation for his

services, we agreed to pay him an annual base salary of $250,000,

and he is entitled to received a performance bonus, payable in a

combination of cash and awards of common stock, and the performance

bonus will be based upon his relative achievement of annual

performance goals established by our board of directors upon

recommendation of the compensation committee, with input from

senior executive management. Mr. Kennedy is also entitled to a

discretion bonus and he is entitled to participate in all benefit

programs we offer our employees, reimbursement for business

expenses and four weeks of annual paid vacation.

As additional compensation on the effective date

of the agreement we will grant him (i) a restricted stock

award of an aggregate of 50,000 shares of our common stock, and

(ii) 10 year stock options to purchase 350,000 shares of our common

stock, vesting subject to continued employment as follows:

(A) 100,000 shares at an

exercise price of $3.50 per share shall vest in equal amounts over

a three year period on October 1, 2021, October 1, 2022 and October

1, 2023, respectively; (B) an additional 125,000 shares at an

exercise price of $5.00 per share shall vest in equal amounts over

a three year period on October 1, 2021, October 1, 2022 and October

1, 2023, respectively; and (B) an additional 125,000 shares at an

exercise price of $6.50 per share shall vest in equal amounts over

a three year period on October 1, 2021, October 1, 2022 and October

1, 2023, respectively.

The agreement may terminated for cause, upon his

death or disability, or by us without cause. If we terminate the

agreement for cause, or if it terminates upon Mr. Kennedy’s

death, or if he voluntarily terminates the agreement, neither Mr.

Kennedy nor his estate (as the case may be) is entitled to any

severance or other benefits following the date of termination. If

we should terminate the agreement without cause, we are obligated

to continue to pay to Mr. Kennedy his base salary for the

balance of the term of this agreement; provided that, in no event

shall the remaining base salary to which he would be entitled to be

for less than six months regardless of when the term ends. If at

any time during the term, Mr. Kennedy’s employment with us is

terminated by us not for cause within the lesser of the remaining

term or one year after the Change of Control (as defined in the

agreement) or in the 90 days prior to the Change of Control upon

the request of the acquiror, we are obligated to him an amount

equal to the greater of (i) 1.5 multiplied by his then base salary

or (ii) all of his base salary remaining to be paid during the

initial term, payable in a lump-sum payment on the termination date

of his employment hereunder but not earlier than the closing of the

Change of Control. The agreement also contains customary

confidentiality, non-disclosure and indemnification

provisions.

On September 16,

2020 Mark Elliott entered into a Separation and General Release

(the “Separation Agreement”) with the cbdMD, Inc. (the

“Company”) and its subsidiaries resigning as Chief

Financial Officer and Chief Operating Officer and all other

capacities, effective October 1, 2020. His resignation was pursuant

to Section 6(d) of his Employment Agreement dated September 6, 2018

(the “Elliott Employment Agreement”). Under the

Separation Agreement the Company has agreed to provide Mr. Elliott

with the following benefits: (i) in exchange for transition

services to be provided by Mr. Elliott from October 1, 2020 through

February 28, 2021, Mr. Elliott will be paid through December 31,

2021 in accordance with the Company's regular bi-weekly payroll

practices, his current salary, along with benefits;

(ii) to the extent not

already vested, all options and restricted stock previously issued

to Mr. Elliott shall fully vest and the Company will extend the

option exercise period and provide for a cashless exercise of such

options; and (iii) upon the effectiveness of the Separation

Agreement, in exchange for the transition services being offered by

Employee from October 1, 2020 through February 28, 2021, Mr.

Elliott shall receive options to purchase 300,000 shares of the

Company’s common stock, exercisable at $2.60 per share for a

period of 3 years on a cashless basis. Mr. Elliott has agreed to

release Company from the provisions contained in the Elliott

Employment Agreement, provided that Mr. Elliott and the Company

agree that provisions relating to confidential information shall

remain full force and effect. The Company has also agreed to

release Mr. Elliott from his non-competition obligations under the

Elliott Employment Agreement. In consideration for the compensation

payable under the Separation Agreement Mr. Elliott has also agreed

to release the Company, its shareholders, directors, officers,

employees and agents from all claims, whether known or unknown,

related to his employment. The agreement also contains customary

non-disclosure and non-disparagement

provisions.

The

description of the terms and conditions of each of the Executive

Employment Agreement with Mr. Kennedy and the Separation Agreement

with Mr. Elliott is qualified in its entirety by reference to the

agreement which is filed as Exhibit 10.1 and Exhibit 10.2,

respectively, to this report.

Item

9.01

Financial

Statements and Exhibits.

|

|

|

|

|

Incorporated by Reference

|

|

Filed or

Furnished

Herewith

|

|

No.

|

|

Exhibit Description

|

|

Form

|

|

Date Filed

|

|

Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive

Employment dated September 15, 2020

|

|

|

|

|

|

|

|

Filed

|

|

|

|

Separation

Agreement dated September 16, 2020

|

|

|

|

|

|

|

|

Filed

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

cbdMD,

Inc.

|

|

|

|

|

|

Date:

September 18, 2020

|

By:

|

/s/

Marty Sumichrast

|

|

|

|

Marty

Sumichrast, co-Chief Executive Officer

|

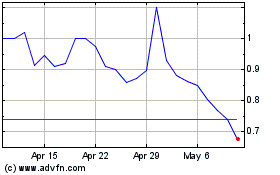

cbdMD (AMEX:YCBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

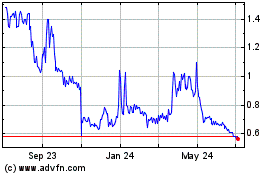

cbdMD (AMEX:YCBD)

Historical Stock Chart

From Apr 2023 to Apr 2024