Current Report Filing (8-k)

October 12 2021 - 5:16PM

Edgar (US Regulatory)

0001309082false00013090822021-10-052021-10-05iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 5, 2021

|

Camber Energy, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

001-32508

|

|

20-2660243

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

|

15915 Katy Freeway

Suite 450, Houston, Texas

|

|

77094

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (281) 404-4387

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None.

|

Title of each class

|

|

Trading Symbols(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 Par Value Per Share

|

|

CEI

|

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets.

On October 5, 2021, Viking Energy Group, Inc. (“Viking”), a majority-owned subsidiary of Camber Energy, Inc. (“Camber” or the “Company”), entered into an Assignment of Membership Interests (the “Assignment Agreement”) with TO Ichor 2021, L.L.C. (“Assignee”), pursuant to which Viking assigned all of its membership interests in Ichor Energy Holdings, L.L.C. (“Holdings”) to the Assignee, effective October 5, 2021.

Holdings is the owner of all of the membership interests in Ichor Energy, LLC (“Ichor Energy”), which owns all of the membership interests of Ichor Energy LA, LLC (“Ichor LA”) and Ichor Energy TX, LLC (“Ichor TX” and, together with Holdings, Ichor Energy and Ichor LA, the “Ichor Entities”), which collectively owned approximately 58 producing wells, 31 salt water disposal wells, 46 shut in wells and 4 inactive wells as of June 30, 2021. The assets held by the Ichor Entities were acquired by the Ichor Entities in December 2018 from an affiliate of the Assignee (the “Original Acquisition”).

In connection with the Original Acquisition, Holdings and Ichor Energy entered into that certain Term Loan Credit Agreement, dated as of December 28, 2018, by and among Holdings, Ichor Energy, ABC Funding, LLC, as administrative agent, and the lenders party thereto (the “Term Loan”). The obligations under the Term Loan are secured by mortgages on the oil and gas leases of the Ichor Entities, a security agreement covering all assets of Ichor Energy, and a pledge by Ichor Holdings of all if the membership interests in Ichor Energy. Camber and Viking are not parties to the Term Loan. Concurrent with the closing of the Original Acquisition and entrance into the Term Loan in December 2018, Ichor Energy also entered into one or more hedge contracts with respect to a certain percentage of the estimated oil and gas production from Ichor Energy’s oil and gas assets, expiring on or about December 28, 2022. The consideration for the conveyance of the Ichor Entities by Viking was the assumption by Assignee of all of the obligations associated with the Ichor Entities.

The Assignment Agreement contains a right of first refusal, and provides that if the Assignee receives an arms-length bona fide offer from any third party to purchase any of the membership interests in Holdings, such interests shall first be offered to Viking, and Viking shall have the right, exercisable within thirty (30) calendar days, to elect to purchase such membership interests upon substantially the same terms and conditions as are contained in the offer.

The foregoing description of the Assignment Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified by, the full text of the Assignment Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(a) Pro Forma Financial Information

As previously disclosed in Camber’s Current Report on Form 8-K filed on September 16, 2021, Camber is filing restated financial statements and, accordingly, is currently unable to provide financial statements giving pro forma effect to the Assignment Agreement. Camber will provide unaudited pro forma financial statements giving effect to the transactions under the Assignment Agreement as of and for the periods required by Regulation S-X on or about the time that it provides reclassified financial statements.

Please see the Current Report on Form 8-K filed today by Viking, which includes unaudited pro forma financial statements of Viking as of and for the six months ended June 30, 2021 and year ended December 31, 2020, in each case giving effect to the transactions under the Assignment Agreement.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CAMBER ENERGY, INC.

|

|

|

|

|

|

|

|

Date: October 12, 2021

|

By:

|

/s/ James A. Doris

|

|

|

|

Name:

|

James A. Doris

|

|

|

|

Title:

|

Chief Executive Officer

|

|

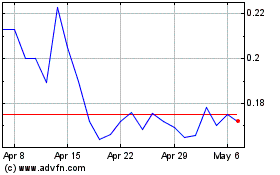

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024