UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 31, 2020

|

Camber Energy, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

001-32508

|

|

20-2660243

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

1415 Louisiana, Suite 3500, Houston, Texas

77002

(Address of principal executive offices)

(210) 998-4035

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

x

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

x

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 Par Value Per Share

|

CEI

|

NYSE American

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On February 15, 2020,

the Company entered into a letter agreement with Sylva International LLC d/b/a SylvaCap Media (“SylvaCap”),

pursuant to which SylvaCap agreed to act as the Company’s non-exclusive digital marketing service provider in consideration

for an aggregate of 100,000 shares of restricted common stock, which are fully-earned upon their issuance, and $50,000 per month

during the term of the agreement, which was to end on June 15, 2020. On May 19, 2020, the Company entered into a first amendment

to the SylvaCap agreement. Pursuant to the amendment, the Company and SylvaCap extended the term of the letter agreement to October

19, 2020. The 100,000 shares were issued on May 15, 2020. On August 31, 2020, the parties entered into a second amendment to the

agreement. Pursuant to the amendment, the parties agreed to amend the engagement agreement to increase the stock fee payable thereunder

to 175,000 shares of common stock of the Company and to provide for the agreement to remain in place until the earlier of (a) October

19, 2020; and (b) the closing of the Company’s currently contemplated merger with Viking Energy Group, Inc. SylvaCap also

made representations regarding its financial condition and investing knowledge pursuant to the amendment in order for the Company

to confirm that an exemption from registration exists for the issuance of the shares.

As previously disclosed

in the Current Report on Form

8-K filed by the Company with the Securities and Exchange Commission on February 5, 2020, on

February 3, 2020, the Company entered into an Agreement and Plan of Merger (“Original Merger Agreement”) with

Viking Energy Group, Inc. (“Viking”). The agreement provides that, upon the terms and subject to the conditions

set forth therein, a newly-formed wholly-owned subsidiary of the Company (“Merger Sub”) will merge with and

into Viking (the “Merger”), with Viking surviving the Merger as a wholly-owned subsidiary of the Company.

Subsequently,

the Company and Viking agreed to amend the Original Merger Agreement on May 27, 2020, June 15, 2020 and June 25, 2020 (collectively,

the “Merger Amendments”).

On

August 31, 2020, the Company and Viking entered into an Amended and Restated Merger Agreement (the “A&R Merger Agreement”)

to amend and restate the Original Agreement. In addition to restating the Merger Amendments, the A&R Merger Agreement amended

the agreement to: (a) provide for Viking to continue to have 28,092 shares of its Series C Preferred Stock issued and outstanding

as of the closing of the Merger; (b) provide for such Series C Preferred Stock of Viking to be exchanged, on a one-for-one basis

for a series of Series A Convertible Preferred Stock of the Company (discussed below under Item 5.03), which have substantially

similar terms as the Viking Series C Preferred Stock (as recently amended), but with the holder thereof having the right to convert

such Series A Convertible Preferred Stock into, and the right to vote a number of voting shares equal to, the number of shares

of common stock of Camber which would have been issuable to the holder of such Series C Preferred Stock of Viking upon the closing

of the Merger, had such preferred stock been fully converted prior to closing; (c) make other amendments throughout the Original

Merger Agreement to provide for the concept of the exchange of Viking preferred stock for Company preferred stock; (d) remove the

closing conditions related to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, which the parties have determined

will not apply to the Merger; (e) provide for Viking’s consent to the Company’s payment of the consideration to each

non-executive member of the Board of Directors and each executive officer of the Company, as described below in connection with

the Merger Compensation Agreements (which had previously been approved in concept by Viking pursuant to the Merger Amendments);

(f) provide for the Company’s consent to an amendment to the designation of the terms of Viking’s Series C Preferred

Stock, subject to applicable law and the approval of the holder thereof; (g) remove certain closing conditions to the Merger which

have already occurred to date; (h) include as a closing condition that Viking must receive an opinion, from legal counsel or an

independent public or certified accountant, in form and substance reasonably satisfactory to Viking, dated as of the closing date

of the Merger, to the effect that, on the basis of facts, representations and assumptions set forth or referred to in such opinion,

for U.S. federal income tax purposes, the Merger will be treated as a “reorganization” within the meaning of

Section 368(a) of the Internal Revenue Code; (i) provide that Viking shall not have more than 28,092 shares of Series C Preferred

Stock issued and outstanding at the time the Merger closes; (j) confirm that if the merger is not completed because Camber’s

shareholders do not approve the merger, that Camber would retain 15% of Elysium; and (k) make certain other clarifying changes

and updates to the Original Merger Agreement.

In connection with

the entry into the A&R Merger Agreement, on August 31, 2020, the Company’s Board of Directors entered into Past Service

Payment and Success Bonus Agreements with each non-executive member of the Board of Directors, and each of Louis G. Schott, our

Interim Chief Executive Officer and Robert Schleizer, our Chief Financial Officer (collectively, the “Merger Compensation

Agreements”). Pursuant to such agreements: each non-executive director, and each officer, of the Company, is to receive,

contingent upon closing the Merger, a payment of $100,000 in consideration for past services provided to the Company through the

date of the Merger as a member of the Board of Directors/officer, and $50,000 as a success bonus for the Company’s successful

completion of the Merger, contingent on such non-executive director/officer’s, continued service to the Company at the same

level of service he is currently performing, through the effective date of the Merger.

Additionally

on August 31, 2020, the Company entered into first amendments to the letter agreements the Company had previously entered into

with Fides Energy LLC, an entity owned and controlled by Mr. Schott (“Fides”) and BlackBriar Advisors LLC, an

entity owned and controlled by Mr. Schleizer (“BlackBriar”), to provide that (a) Mr. Schott, through Fides,

will continue to provide services to the Company for a period of six months following the closing of the Merger, on similar terms

as set forth in such original letter agreement, except in a non-executive capacity and that the Company will reimburse Mr. Schott

for the costs of his and his family’s health insurance through such six month term; and (b) Mr. Schleizer, through BlackBriar,

will continue to provide services to the Company for a period of three months following the closing of the Merger, on similar terms

as set forth in such original letter agreement, except in a non-executive capacity and for total consideration of $30,000 per month

(compared to $40,000 per month currently).

The foregoing description

of the A&R Merger Agreement, the Merger Compensation Agreements, the 1st amendment to the Fides letter agreement

and 1st amendment to the BlackBriar letter agreement above, is subject to, and qualified in its entirety by, the A&R

Merger Agreement, the Merger Compensation Agreements, the 1st amendment to the Fides letter agreement and 1st

amendment to the BlackBriar letter agreement, attached as Exhibits 2.1, 10.4 through 10.7, 10.9 and

10.11, respectively, which are incorporated in this Item 1.01 by reference in their entirety.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information disclosed

in Item 1.01 of this Current Report on Form 8-K relating to the shares issuable to SylvaCap is incorporated by

reference into this Item 3.02. We plan to claim an exemption from registration pursuant to Section 4(a)(2) and/or Rule

506 of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), since the foregoing issuance

of 75,000 shares to SylvaCap will not involve a public offering, the recipient is (a) an “accredited investor”;

and/or (b) had access to similar documentation and information as would be required in a Registration Statement under the Securities

Act, and the recipient will acquire the securities for investment only and not with a view towards, or for resale in connection

with, the public sale or distribution thereof. The securities will be subject to transfer restrictions, and the certificates evidencing

the securities will contain an appropriate legend stating that such securities have not been registered under the Securities Act

and may not be offered or sold absent registration or pursuant to an exemption therefrom.

|

Item 3.03.

|

Material Modification to Rights

of Security Holders.

|

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form

8-K is incorporated herein by reference.

|

Item 5.03.

|

Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

|

On August 31, 2020, the

Board of Directors approved the designation of 28,092 shares of Series A Convertible Preferred Stock (the “Series A Preferred

Stock”), which were designated with the Secretary of State of Nevada on August 31, 2020 (the “Series A Designation”).

The Series A Preferred

Stock has substantially similar rights as the Series C Preferred Stock of Viking (as amended), as adjusted for the exchange ratio

of the Merger. Specifically, each outstanding share of Series A Preferred Stock will vote an aggregate of (a) 4,900 voting shares,

multiplied by (b) the exchange ratio of the Merger, on all stockholder matters, voting together with the Company’s common

stock as a single class (which voting rights will equal the same voting rights that would have applied had the Series C Preferred

Stock of Viking been fully converted into Viking common stock immediately prior to the effective time of the Merger)(described

herein as the “voting shares”); will receive, upon the occurrence of a liquidation of the Company, the same

amount of consideration that would have been due if such shares of Series A Preferred Stock had been converted into common stock

of the Company immediately prior to such liquidation; and provide rights for such shares of Series A Preferred Stock to convert,

at the option of the holder thereof, into a number of shares of Company common stock equal to (a) 4,900 shares, multiplied by (b)

the exchange ratio of the Merger (which will equal the number of shares of Company common stock which would have been issuable

to the holders of the Series C Preferred Stock of Viking in the Merger, had such Series C Preferred Stock been converted into common

stock of Viking immediately prior to the effective time of the Merger)(described herein as the “conversion shares”).

Such Series A Preferred

Stock does not have any redemption rights and shares equally in any dividends authorized by the Board of Directors for distribution

to common stock holders, on an as-converted basis.

The Series A Designation

also provides that such number of voting shares and conversion shares as calculated as discussed above, shall be updated by the

Company following the Merger, without any required approval of the holders of such Series A Preferred Stock, to include the actual

numerical value of such voting shares and conversion shares, upon closing of the Merger.

No shares of Series A Preferred

Stock will be issued by the Company until or unless the Merger closes, at which time it is contemplated that all 28,092 designated

shares of Series A Preferred Stock of the Company will be issued to the holders of Viking’s 28,092 shares of Series C Preferred

Stock, which shares are currently solely held by James A. Doris, the Chief Executive Officer and director of Viking.

The foregoing description

of the Series A Designation is subject to, and qualified in its entirety by, the full text of the Series A Designation, attached

as Exhibit 3.1, which is incorporated in this Item 5.03 by reference in its entirety.

As of September 3,

2020, the Company had 22,872,484 shares of common stock issued and outstanding. The increase in our outstanding shares of common

stock from the date of the Company’s April 16, 2020 increase in authorized shares of common stock (from 5 million shares,

to 25 million shares, pursuant to the approval of the stockholders of the Company at the annual meeting of stockholders held on

the same day), is almost solely entirely due to conversions of shares of Series C Preferred Stock of the Company into common stock,

and conversion premiums due thereon, which are payable in shares of common stock, pursuant to the designation of such Series C

Preferred Stock. The conversions are in the sole discretion of the Series C Preferred Stockholder. The number of shares of common

stock due to the Series C Preferred Stockholder are subject to increase and adjustment as the price of the Company’s common

stock declines in value.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

(d) Exhibits.

Exhibit

Number

|

|

Description of Exhibit

|

|

2.1*#

|

|

Amended and Restated Agreement and Plan of Merger, dated as of August 31, 2020, by and between Viking Energy Group, Inc. and Camber Energy, Inc.

|

|

3.1*

|

|

Certificate of Designations of Preferences, Rights and Limitations of Series A Convertible Preferred Stock of Camber Energy, Inc., filed with the Secretary of State of Nevada on August 31, 2020

|

|

10.1

|

|

February 15, 2020 Letter Agreement with Sylva International LLC dba SylvaCap Media (Filed as Exhibit 10.1 to the Company’s Report on Form 8-K, filed with the Commission on May 13, 2020 and incorporated herein by reference) (File No. 001-32508)

|

|

10.2*

|

|

May 19, 2020, First Amendment to Letter Agreement with Sylva International LLC dba SylvaCap Media

|

|

10.3*

|

|

August 30, 2020, Second Amendment to Letter Agreement with Sylva International LLC dba SylvaCap Media

|

|

10.4*

|

|

Past Service Payment and Success Bonus Agreement dated August 31, 2020, with Louis G. Schott

|

|

10.5*

|

|

Past Service Payment and Success Bonus Agreement dated August 31, 2020, with Robert Schleizer

|

|

10.6*

|

|

Past Service Payment and Success Bonus Agreement dated August 31, 2020, with Fred Zeidman

|

|

10.7*

|

|

Past Service Payment and Success Bonus Agreement dated August 31, 2020, with James G. Miller

|

|

10.8

|

|

Engagement Letter with Fides Energy LLC/Louis G. Schott dated May 25, 2018 (Filed as Exhibit 10.3 to the Company’s Report on Form 8-K, filed with the Commission on May 25, 2018 and incorporated herein by reference) (File No. 001-32508)

|

|

10.9*

|

|

First Amendment to May 25, 2018 Engagement Letter with Fides Energy LLC/Louis G. Schott dated August 31, 2020

|

|

10.10

|

|

December 1, 2017 Letter Agreement between Camber Energy, Inc. and BlackBriar Advisors LLC (Filed as Exhibit 10.41 to the Company’s Annual Report on Form 10-K, filed with the Commission on July 1, 2019, and incorporated herein by reference)(File No. 001-32508)

|

|

10.11*

|

|

First Amendment to December 1, 2017 Letter Agreement between Camber Energy, Inc. and BlackBriar Advisors LLC dated August 31, 2020

|

|

#

|

Certain schedules and exhibits have been omitted pursuant

to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule or Exhibit will be furnished supplementally to the Securities

and Exchange Commission upon request; provided, however that Camber Energy, Inc. may request confidential treatment pursuant to

Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or Exhibit so furnished.

|

Forward-Looking

Statements

Certain

of the matters discussed in this communication which are not statements of historical fact constitute forward-looking statements

that involve a number of risks and uncertainties and are made pursuant to the Safe Harbor Provisions of the Private Securities

Litigation Reform Act of 1995. Words such as “strategy,” “expects,” “continues,”

“plans,” “anticipates,” “believes,” “would,” “will,”

“estimates,” “intends,” “projects,” “goals,” “targets”

and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying

these statements.

Important

factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements

include, without limitation, the occurrence of any event, change or other circumstances that could give rise to the parties failing

to complete the merger on the terms disclosed, if at all, the right of one or both of Viking or Camber to terminate the merger

agreement and the result of such termination; the outcome of any legal proceedings that may be instituted against Viking, Camber

or their respective directors; the ability to obtain regulatory approvals and other consents, and meet other closing conditions

to the merger on a timely basis or at all, including the risk that regulatory approvals or other consents required for the merger

are not obtained on a timely basis or at all, or which are obtained subject to conditions that are not anticipated or that could

adversely affect the combined company or the expected benefits of the transaction; the ability to obtain approval by Viking stockholders

and Camber stockholders on the expected schedule; required closing conditions which may not be able to be met and/or consents

which may not be able to be obtained; difficulties and delays in integrating Viking’s and Camber’s businesses; prevailing

economic, market, regulatory or business conditions, or changes in such conditions, negatively affecting the parties, including,

but not limited to, as a result of the recent volatility in oil and gas prices and the status of the economy (both US and global)

due to the Covid-19 pandemic and actions taken to slow the spread of Covid-19; risks that the transaction disrupts Viking’s

or Camber’s current plans and operations; failing to fully realize anticipated cost savings and other anticipated benefits

of the merger when expected or at all; potential adverse reactions or changes to business relationships resulting from the announcement

or completion of the merger; the ability of Camber to obtain the approval of its Series C Preferred Stock holder to close the

merger (to the extent required); the ability of Viking or Camber to retain and hire key personnel; the diversion of management’s

attention from ongoing business operations; uncertainty as to the long-term value of the common stock of the combined company

following the merger; the continued availability of capital and financing, prior to, and following, the merger; the business,

economic and political conditions in the markets in which Viking and Camber operate; and the fact that Viking’s and Camber’s

reported earnings and financial position may be adversely affected by tax and other factors.

Other

important factors that may cause actual results and outcomes to differ materially from those contained in the forward-looking

statements included in this communication are described in the Form S-4 (defined below), and Viking’s and Camber’s

publicly filed reports, including Viking’s Annual Report on Form 10-K for the year ended December 31, 2019 and subsequently

filed Quarterly Reports on Form 10-Q and Camber’s Annual Report on Form 10-K for the year ended March 31, 2020.

Viking

and Camber caution that the foregoing list of important factors is not complete, and they do not undertake to update any forward-looking

statements that either party may make except as required by applicable law. All subsequent written and oral forward-looking statements

attributable to Viking, Camber or any person acting on behalf of either party are expressly qualified in their entirety by the

cautionary statements referenced above.

Additional

Information and Where to Find It

In

connection with the planned merger, on June 4, 2020, Camber filed with the Securities and Exchange Commission (SEC), a preliminary

draft of a registration statement on Form S-4 to register the shares of Camber’s common stock to be issued in connection

with the merger (the “Form S-4”). The registration statement includes a preliminary joint proxy statement/prospectus

which, when finalized, will be sent to the respective stockholders of Viking and Camber seeking their approval of their respective

transaction-related proposals. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE FINAL REGISTRATION STATEMENT ON FORM S-4 AND

THE RELATED JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE FINAL REGISTRATION STATEMENT ON FORM S-4, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PLANNED

MERGER, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VIKING, CAMBER AND THE PLANNED MERGER.

Investors

and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or

from Viking at its website, www.vikingenergygroup.com, or from Camber at its website, www.camber.energy.

Documents filed with the SEC by Viking will be available free of charge by accessing Viking’s website at www.vikingenergygroup.com under

the heading “Investors” – “SEC Filings”, or, alternatively, by directing a request

by telephone or mail to Viking Energy Group, Inc. at 15915 Katy Freeway, Suite 450, Houston, Texas, 77094, (281) 404-4387, and

documents filed with the SEC by Camber will be available free of charge by accessing Camber’s website at www.camber.energy under

the heading “Investors” – “SEC Filings” or, alternatively, by directing a request

by telephone or mail to Camber Energy, Inc. at 1415 Louisiana, Suite 3500, Houston, Texas, 77002, (210) 998-4035.

Participants

in the Solicitation

Viking,

Camber and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of

proxies from the respective stockholders of Viking and Camber in respect of the planned merger under the rules of the SEC.

Information about Viking’s directors and executive officers is available in Viking’s Annual Report on Form 10-K for

the year ended December 31, 2019. Information about Camber’s directors and executive officers is available in Camber’s

Annual Report on Form 10-K for the year ended March 31, 2020. Other information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the final joint

proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available.

Investors should read the final joint proxy statement/prospectus carefully when it becomes available before making any voting

or investment decisions. You may obtain free copies of these documents from Viking or Camber using the sources indicated above.

No

Offer or Solicitation

This

communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be

any sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of

a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

CAMBER ENERGY, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Robert Schleizer

|

|

|

|

Name:

|

Robert Schleizer

|

|

|

Title:

|

Chief Financial Officer

|

Date: September 3, 2020

EXHIBIT INDEX

Exhibit

Number

|

|

Description of Exhibit

|

|

2.1*#

|

|

Amended and Restated Agreement and Plan of Merger, dated as of August 31, 2020, by and between Viking Energy Group, Inc. and Camber Energy, Inc.

|

|

3.1*

|

|

Certificate of Designations of Preferences, Rights and Limitations of Series A Convertible Preferred Stock of Camber Energy, Inc., filed with the Secretary of State of Nevada on August 31, 2020

|

|

10.1

|

|

February 15, 2020 Letter Agreement with Sylva International LLC dba SylvaCap Media (Filed as Exhibit 10.1 to the Company’s Report on Form 8-K, filed with the Commission on May 13, 2020 and incorporated herein by reference) (File No. 001-32508)

|

|

10.2*

|

|

May 19, 2020, First Amendment to Letter Agreement with Sylva International LLC dba SylvaCap Media

|

|

10.3*

|

|

August 30, 2020, Second Amendment to Letter Agreement with Sylva International LLC dba SylvaCap Media

|

|

10.4*

|

|

Past Service Payment and Success Bonus Agreement dated August 31, 2020, with Louis G. Schott

|

|

10.5*

|

|

Past Service Payment and Success Bonus Agreement dated August 31, 2020, with Robert Schleizer

|

|

10.6*

|

|

Past Service Payment and Success Bonus Agreement dated August 31, 2020, with Fred Zeidman

|

|

10.7*

|

|

Past Service Payment and Success Bonus Agreement dated August 31, 2020, with James G. Miller

|

|

10.8

|

|

Engagement Letter with Fides Energy LLC/Louis G. Schott dated May 25, 2018 (Filed as Exhibit 10.3 to the Company’s Report on Form 8-K, filed with the Commission on May 25, 2018 and incorporated herein by reference) (File No. 001-32508)

|

|

10.9*

|

|

First Amendment to May 25, 2018 Engagement Letter with Fides Energy LLC/Louis G. Schott dated August 31, 2020

|

|

10.10

|

|

December 1, 2017 Letter Agreement between Camber Energy, Inc. and BlackBriar Advisors LLC (Filed as Exhibit 10.41 to the Company’s Annual Report on Form 10-K, filed with the Commission on July 1, 2019, and incorporated herein by reference)(File No. 001-32508)

|

|

10.11*

|

|

First Amendment to December 1, 2017 Letter Agreement between Camber Energy, Inc. and BlackBriar Advisors LLC dated August 31, 2020

|

|

#

|

Certain schedules and exhibits have been omitted pursuant

to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule or Exhibit will be furnished supplementally to the Securities

and Exchange Commission upon request; provided, however that Camber Energy, Inc. may request confidential treatment pursuant to

Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or Exhibit so furnished.

|

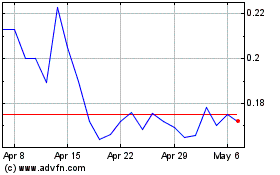

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024