Amended Statement of Beneficial Ownership (sc 13d/a)

February 09 2021 - 4:16PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE

13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT

TO RULE 13d-2(a)

(Amendment No. 6)

AGEX THERAPEUTICS, INC.

(Name of

Issuer)

Common Stock, par value $0.0001 per share

(Title of

Class of Securities)

00848H108

(CUSIP number)

David Ellam

c/o Juvenescence Limited

18 Athol Street

Douglas

Isle of Man IM1 1JA

+441624639393

(Name, Address

and Telephone Number of Person Authorized to Receive Notices and Communications)

February 5, 2021

(Date of

Event Which Requires Filing of this Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because

of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ¨.

Note: Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties

to whom copies are to be sent.

The information required on the remainder

of this cover page shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

or otherwise subject to the liabilities of that section of the Act by shall be subject to all other provisions of the Act (however,

see the Notes).

|

1.

|

NAME OF REPORTING PERSON

Juvenescence Limited

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS

WC

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

¨

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Isle of Man

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

23,531,027

|

|

8.

|

SHARED VOTING POWER

0

|

|

9.

|

SOLE DISPOSITIVE POWER

23,531,027

|

|

10.

|

SHARED DISPOSITIVE POWER

0

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

23,531,027

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

¨

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

52.6%

|

|

14.

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

SCHEDULE 13D

This amendment (the “Amendment”) amends and supplements

the beneficial ownership statement on Schedule 13D filed with the Securities and Exchange Commission on August 16, 2019 (as amended

by Amendment No. 1 filed April 6, 2020, Amendment No. 2 filed July 31, 2020, Amendment No. 3 filed October 7, 2020, Amendment No.

4 filed November 11, 2020 and Amendment No. 5 filed January 12, 2021, the “Original Statement”). The Original Statement,

as amended by this Amendment (the “Statement”) is filed on behalf of Juvenescence Limited, an Isle of Man company (the

“Reporting Person”), and relates to the shares of Common Stock of AgeX Therapeutics, Inc., par value $0.0001 per share

(the “Common Stock”).

Capitalized terms used but not defined in this Amendment have

the meanings ascribed to them in the Original Statement. This Amendment amends the Original Statement as specifically set forth

herein. Except as set forth below, all previous Items in the Original Statement remain unchanged.

|

Item 5.

|

Interest in Securities of the Issuer.

|

Item 5 of the Original Statement is hereby amended and restated

in its entirety to read as follows:

(a) The Reporting Person

beneficially owns an aggregate of 23,531,027 shares of Common Stock, representing (i) 16,447,500 shares of Common Stock held directly,

(ii) 150,000 shares of Common Stock that may be acquired on exercise of the Warrant issued in August 2019 under the Loan Agreement,

(iii) 3,362,098 shares of common stock that may be acquired on exercise of Warrants issued or to be issued in connection with advances

under the New Facility (as defined under Item 6) and (iv) an additional 3,571,429 shares of Common Stock that may be issued upon

conversion of outstanding amounts under the New Facility at the closing price of the Common Stock on February 5, 2021 and assuming

exercise of all Warrants. This aggregate amount represents approximately 52.6% of the Issuer’s outstanding common stock,

based upon 37,691,047 shares outstanding as of January 22, 2021, as reported on the Issuer’s Registration Statement filed

on Form S-3/A on January 26, 2021, and giving effect to the exercise of the Warrants and conversion of amounts outstanding under

the New Facility. Such Registration Statement registers 16,447,500 shares of Common Stock and 3,248,246 shares underlying certain

Warrants held by Reporting Person for resale and was declared effective by the SEC on January 29, 2021.

(b) The information

in Items 7 through 10 of each cover page is incorporated by reference into this Item 5(b).

(c) Except for the

information set forth in Item 6, which is incorporated by reference into this Item 5(c), the Reporting Persons have effected no

transactions relating to the Common Stock during the past 60 days.

(d) - (e) Not applicable.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Item 6 of the Original Statement is hereby supplemented as follows:

On January 25, 2021, the Reporting Person funded an additional

advance to the Issuer, representing the Seventh Advance under the New Facility, in the principal amount of $1,000,000. On February

5, 2021, following notification by NYSE American that the Issuer’s supplemental listing application for the additional Warrant

shares had been approved, the Issuer issued to the Reporting Person a Warrant to purchase 263,852 shares of Common Stock at an

exercise price of $1.895 per share, representing the last closing price of the Common Stock on the NYSE American market prior to

the drawdown notice, issuable under Clause 3.6 of the New Facility.

SIGNATURES

After reasonable inquiry and to the best of their knowledge

and belief, the undersigned certify that the information set forth in this Statement is true, complete and correct.

Date: February 8, 2021

|

JUVENESCENCE LIMITED

|

|

|

|

|

|

|

By:

|

/s/ Gregory H. Bailey

|

|

|

Name:

|

Gregory H. Bailey

|

|

|

Title:

|

President

|

|

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

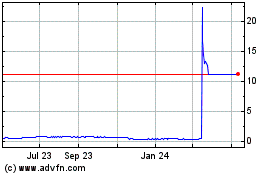

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Apr 2023 to Apr 2024