Filed Pursuant to Rule 424(b)(2) of the Securities Act of 1933

Registration No. 333-162556

PROSPECTUS SUPPLEMENT

(TO PROSPECTUS DATED OCTOBER 28, 2009)

ICOP DIGITAL, INC.

Up to

3,500,000 Shares of Common Stock

Series 1 Warrants to Purchase 3,500,000 Shares of Common Stock

Series 2 Warrants to Purchase 1,232,580 Shares of Common Stock

$0.3833 per combination of one share of common stock, Series 1 Warrant to purchase one share of common stock, Series 2 Warrant to purchase 0.3521 shares of common stock

We are offering for sale: 3,500,000 shares of our common stock, no par value;

Series 1 Warrants to purchase up to 3,500,000 shares of common stock; and Series 2 Warrants to purchase up to 1,232,580 shares of common stock. The securities will be sold in multiples of a fixed combination consisting of one share of common stock,

a Series 1 Warrant to purchase one share of common stock and a Series 2 Warrant to purchase 0.3521 shares of common stock. The exercise price of the Series 1 Warrants is $0.42 per share, and the Series 1 Warrants may be exercised beginning six

months and one day after the date of issuance (the “Series 1 Initial Exercise Date”) until the fifth anniversary of the Series 1 Initial Exercise Date. The exercise price of the Series 2 Warrants is $0.3833 per share, and each Series 2

Warrant may be exercised beginning on the date of issuance until the ninetieth (90

th

) business day after the date of issuance.

We have

retained Chardan Capital Markets, LLC as our placement agent to use its reasonable efforts to solicit offers to purchase our common stock and warrants in this offering. The placement agent has no obligation to buy any of the securities from us or to

arrange for the purchase or sale of any specific number or dollar amount of the securities.

These are speculative

securities. Investing in these securities involves significant risks. You should purchase these securities only if you can afford a complete loss of your investment. See “

Risk Factors

” beginning on page S5

of this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

Per Fixed Combination of:

one share of common stock, a Series 1

Warrant to purchase one share of common stock,

and a Series 2 Warrant to purchase 0.3521

shares of common stock

|

|

Total

(1)

|

|

Public offering price

|

|

$

|

0.383300

|

|

$

|

1,341,550

|

|

Placement agent fee

|

|

$

|

0.026831

|

|

$

|

93,909

|

|

Proceeds to us, before expenses

|

|

$

|

0.356469

|

|

$

|

1,247,641

|

|

(1)

|

Assumes that all securities offered under this prospectus supplement and accompanying prospectus are sold.

|

This is a best efforts offering by us, and the actual offering amount,

placement agent fee and net proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above. We intend to deliver the securities in one closing, which we expect to occur on or before

February 3, 2010. The investor funds will not be deposited into an escrow account and instead will be paid directly to us at each closing. The shares of common stock will be delivered in book-entry form through The Depository Trust Company.

As of January 25, 2010, there were 23,217,142 shares of our outstanding common stock held by

non-affiliates. Based on the $0.50 per share closing price of our common stock on January 7, 2010, the aggregate market value of our common stock held by non-affiliates was $11,608,571. The value of all securities we have offered

pursuant to Instruction I.B.6. of Form S-3, calculated in accordance with that Instruction, in the last 12 calendar months (including those offered hereby) is $3,329,234.

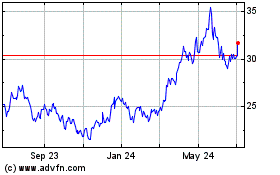

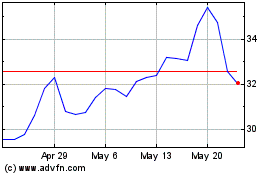

Our common stock is traded on the Nasdaq Capital Market under the symbol “ICOP.” On January 28, 2010, the last reported sale price of our common stock on the Nasdaq

Capital Market was $0.43 per share.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE

SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

CHARDAN CAPITAL MARKETS, LLC

The date of this

prospectus supplement is January 29, 2010

TABLE OF CONTENTS

In this

prospectus supplement, references to “we,” “us,” “our,” “ICOP” or the “Company” mean ICOP Digital, Inc.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus dated October 28, 2009 are part of a “shelf” registration

statement on Form S-3 that we initially filed with the Securities and Exchange Commission on October 16, 2009. By using a “shelf” registration statement, we may sell shares of common stock, preferred stock, warrants and debt

securities as described in the accompanying prospectus from time to time in one or more offerings for an aggregate dollar amount of up to $25 million.

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the securities we are offering and certain other matters relating to us and our financial

condition. The second part, the accompanying prospectus, gives more general information about securities we may offer from time to time, some of which may not apply to the securities we are offering. Generally, when we refer to “this

prospectus,” we are referring to both parts of this document combined. You should read this prospectus supplement along with the accompanying prospectus. If the description of the offering varies between this prospectus supplement and the

accompanying prospectus, you should rely on the information in this prospectus supplement.

We further note that the

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement,

including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you unless you are a party to such agreement. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, unless you are a party to such agreement, such representations, warranties and covenants should not be relied on as accurately representing the current state of our

affairs.

You should rely only on the information contained or incorporated by reference in this prospectus. We have not

authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should not assume that the information appearing in this prospectus, any

prospectus supplement or any document incorporated by reference is accurate as of any date other than its date, regardless of the time of delivery of the prospectus or prospectus supplement or any sale of securities. Our business, financial

condition, results of operations and prospects may have changed since those dates.

Our trademarks

include:

ICOP

®

, ICOP DIGITAL

®

, ICOP Model 20/20

®

, ICOP

Model 20/20

®

-W, ICOP Model 4000™, ICOP LIVE™, ICOP iVAULT™, ICOP iVAULT MMS™, ICOP

EXTREME™ Wireless Mic, ICOP Solution™, ICOP Guardian™, ICOP LIVE Platform™, ICOP DVMS™, ICOP Model 20/20 LIVE™, ICOP Guardian LIVE™, ICOP PC Viewer™, ICOP IN-FOCUS™, ICOP BodyCam™, BUSCOP™,

IBUS™, BikeCam™, TransitCop™, ICOP Digital Video Management System™, ICOP 20/20 VISION™, Advancing Surveillance Technology™

and

A Veil of Protection™

. The trademarks, service marks or trade names of any

other company appearing in this prospectus belong to its owner. Use or display by us of trademarks, service marks or trade names owned by others is not intended to and does not imply a relationship between us and, or endorsement or sponsorship by,

the owners of the trademarks, service marks or trade names.

S1

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information about us, this offering and information appearing elsewhere in this prospectus supplement

and in the accompanying prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before investing in the securities offered pursuant to this

prospectus. After you read this summary, to fully understand this offering and its consequences to you, you should read and consider carefully the more detailed information and financial statements and related notes that we include in and/or

incorporate by reference into this prospectus supplement and the accompanying prospectus, especially the section entitled “Risk Factors.” If you invest in our securities, you are assuming a high degree of risk.

ICOP Digital, Inc.

We

design, engineer and market video surveillance products for public safety. Our flagship product, the

ICOP Model 20/20-W,

is a digital in-car video and audio recorder designed for the rugged demands of law enforcement agencies, which provides

a secure chain of custody and integrity of the recorded information. Since our first commercial sale in June 2005, we have sold the

ICOP Model 20/20-W

and its predecessor, the

ICOP Model 20/20

, to law enforcement customers in 49

states. The

ICOP Model 20/20-W

technology also has applications in other markets where video surveillance is critical in the safety of people and security of property, including the military and other public safety installations. Our product

is installed in the dashboard of the vehicle; therefore, there are no parts in the trunk, under the seat, or overhead, which is critical in considering officer safety and space limitations within patrol cars. An AM/FM radio is built into the

ICOP

Model 20/20-W

to replace the AM/FM radio in the dashboard. The

ICOP Model 20/20-W

provides wireless (“W”) upload of the recorded video to the backend server where the video evidence is stored and managed.

Law enforcement has long recognized the value of gathering intelligence and documenting critical events by means of recorded video. Video

and audio evidence collected by in-car systems has been used successfully in cases such as driving under the influence, various traffic violations, vehicular pursuits, narcotic enforcement actions, assaults-on-officer incidents and civil litigation

involving law enforcement agencies. Information collected by in-car VHS (analog) video systems has also been used to assist agencies in identifying potential threats to homeland security.

The majority of in-car police video systems currently employed, however, rely on outdated analog technology that suffers from inferior

quality video and audio, lack of dependability in extreme temperatures, storage and retrieval difficulties and officer safety concerns. The law enforcement industry is currently transitioning from analog to digital technologies for in-car video, and

we believe that we are well-positioned to exploit this market. The

ICOP Model 20/20-W

is priced competitively to comparable units, yet we believe it offers superior video and audio quality, officer safety due to secure and convenient

placement in the dashboard, and security for the integrity of the recorded evidence.

We are incorporated under the laws of

Colorado. Our principal business office is located at 16801 W. 116th Street, Lenexa, Kansas 66219, and our telephone number is (913) 338-5550. Our website address is

www.icop.com

. Information contained on our website or any other website

does not constitute part of this prospectus supplement summary.

S2

This Offering

|

|

|

|

|

Securities offered by us in this offering

|

|

3,500,000 shares of common stock, Series 1 Warrants to purchase up to 3,500,000 shares of common stock and Series 2 Warrants to purchase up to 1,232,580 shares of common stock.

|

|

|

|

|

Series 1 Warrants

|

|

The Series 1 Warrants may be exercised for $0.42 per share, subject to adjustment for certain anti-dilution protections. Each warrant may be exercised beginning six months and

one day after the date of issuance until the fifth anniversary of the Series 1 Initial Exercise Date.

|

|

|

|

|

Series 2 Warrants

|

|

The Series 2 Warrants may be exercised for $0.3833 per share, subject to adjustment for certain anti-dilution protections. Each warrant may be exercised beginning on the date of

issuance until the 90

th

business day after the date of

issuance.

|

|

|

|

|

Common stock outstanding after this offering if all securities are sold

|

|

27,162,944 shares, or 31,895,524 shares if the Series 1 Warrants and Series 2 Warrants sold in this offering are exercised in full.

|

|

|

|

|

Best efforts

|

|

This is a best efforts offering by us, and there is no minimum offering amount; we may not sell all of the securities offered.

|

|

|

|

|

Listing

|

|

Our common stock is listed on the Nasdaq Capital Market under the symbol “ICOP.” The warrants being offered in this offering are not listed on any securities exchange,

and there currently is no public market for the Series 1 Warrants or Series 2 Warrants.

|

|

|

|

|

Use of proceeds

|

|

Inventory purchases and general corporate purposes, provided that no proceeds shall be used to pay any indebtedness or trade payables (other than trade payables incurred after

the date hereof in connection with such inventory purchases after the date hereof).

|

|

|

|

|

Risk factors

|

|

Investing in our securities involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page S5

of this prospectus supplement.

|

As of January 25, 2010, we had 23,662,944 shares of common stock issued and

outstanding. Unless the context indicated otherwise, all share and per-share common stock information in this prospectus supplement assumes 23,662,944 shares of common stock outstanding before this offering and:

|

|

•

|

|

assumes a public offering price of $0.3833 per combination of one share of common stock, a Series 1 Warrant to purchase one share of common stock and a

Series 2 Warrant to purchase 0.3521 shares of common stock;

|

|

|

•

|

|

assumes no exercise of outstanding publicly traded warrants, under trading symbol “ICOPW,” to purchase 4,208,025 shares of common stock;

|

|

|

•

|

|

assumes no exercise of warrants, issued in March 2005 in connection with a bridge financing, to purchase 360,002 shares of common stock;

|

|

|

•

|

|

assumes no exercise of warrants, issued to certain consultants, to purchase 235,000 shares of common stock;

|

|

|

•

|

|

assumes no exercise of warrants, issued in December 2005 to the placement agent of a private placement, to purchase 47,125 shares of common stock and

warrants to purchase 16,494 shares of common stock;

|

S3

|

|

•

|

|

assumes no exercise of warrants, issued in July 2005 to the underwriters of a secondary public offering, to purchase 46,800 shares of common stock and

warrants to purchase 46,800 shares of common stock; and

|

|

|

•

|

|

excludes 3,340,000 shares reserved for issuance upon exercise of outstanding options as of January 25, 2010 under our 2002 Stock Option Plan, as

amended.

|

S4

RISK FACTORS

An investment in our securities involves a number of risks. Before making a decision to purchase our securities, you should carefully

consider all of the risks described in this prospectus summary and our annual, quarterly or current reports filed with the Securities and Exchange Commission. If any of the risks discussed in this prospectus summary or in reports actually occurs,

our business, financial condition and results of operations could be materially adversely affected. If this were to occur, the trading price of our securities could decline significantly and you may lose all or part of your investment.

Our securities may be delisted from the NASDAQ Capital Market, which could affect their market price and liquidity.

We are required to meet NASDAQ’s continued listing requirements (including a minimum bid price for our common stock of $1.00 per share)

to maintain the listing of our common stock and warrants on the NASDAQ Capital Market. On September 25, 2008, we received a deficiency letter from the NASDAQ Stock Market indicating that for 30 consecutive trading days our common stock had a

closing bid price below the $1.00 per share minimum closing bid price required for continued listing. On January 13, 2010, we received a NASDAQ Staff Determination letter indicating that because we had not regained compliance with the $1.00

minimum bid price requirement, our securities would be subject to delisting from the NASDAQ Capital Market unless we requested a hearing before a NASDAQ Listing Qualifications Panel (the “Panel”) by January 20, 2010. We timely

requested a hearing before the Panel, and the Panel hearing is scheduled for February 25, 2010. As a result, our securities will remain listed on the NASDAQ Capital Market until the Panel renders its final determination following the hearing.

Under NASDAQ’s Listing Rules, the Panel may, in its discretion, determine to continue the our listing pursuant to an exception to the listing rules for a maximum of 180 calendar days from the date of the Staff’s notification. However,

there can be no assurances that the Panel will do so or that our stock price will recover within the exception period.

If our

common stock is delisted, it could be more difficult to buy or sell our common stock and to obtain accurate quotations, and the price of our stock could suffer a material decline. Delisting may also impair our ability to raise capital, and also

likely would adversely impact the value and price of the warrants offered hereunder. Furthermore, if our common stock is delisted, we would apply to have our common stock quoted on the OTC Bulletin Board, and our common stock would become subject to

the SEC’s penny stock regulations. A penny stock, as defined by the Penny Stock Reform Act, is any equity security not traded on a national securities exchange that has a market price of less than $5.00 per share. The penny stock regulations

generally require that a disclosure schedule explaining the penny stock market and the risks associated therewith be delivered to purchasers of penny stocks and impose various sales practice requirements on broker-dealers who sell penny stocks to

persons other than established customers and accredited investors. The broker-dealer must make a suitability determination for each purchaser and receive the purchaser’s written agreement prior to the sale. In addition, the broker-dealer must

make certain mandated disclosures, including the actual sale or purchase price and actual bid offer quotations, as well as the compensation to be received by the broker-dealer and certain associated persons. The regulations applicable to penny

stocks may severely affect the market liquidity for our common stock and could limit your ability to sell your securities in the secondary market.

If our common stock is delisted, our Class A warrants will also be delisted. The NASDAQ Capital Market’s continued listing requirements for warrants require that the security underlying the

warrant be listed on NASDAQ. If our Class A warrants are delisted, it could be more difficult to exercise or otherwise liquidate our Class A warrants and to obtain accurate quotations, and the price of our Class A warrants could

suffer a material decline.

We have a history of losses, and we expect to continue to operate at a loss at least for the near term and

may never be profitable.

Since the inception of our current business in 2002, we have incurred net losses every year.

We have had limited revenues to date and may never become profitable. If we are unable to generate sufficient revenue to achieve profitability and positive cash flows, we might be unable to satisfy our commitments and may have to discontinue

operations. We cannot assure you that we will be successful in establishing ourselves as a profitable enterprise.

S5

Our limited operating history makes evaluation of our business difficult.

We have a limited operating history and have encountered, and expect to continue to encounter, many of the difficulties and uncertainties

often faced by early stage companies. We commenced our current business operations in May 2002 and initiated the national roll-out of the

ICOP Model 20/20

in June 2005. Accordingly, we have only a limited operating history by which you can

evaluate our business and prospects. An investor must consider our business and prospects in light of the risks, uncertainties and difficulties frequently encountered by early stage companies, including limited capital, delays in product

development, possible marketing and sales obstacles and delays, inability to gain customer acceptance or to achieve significant distribution of our products to customers and significant competition. We may not be able to successfully address these

risks. If we are unable to address these risks, our business may not grow, our stock price may suffer, and we may be unable to stay in business.

Recession, sustained downturns or sluggishness in the U.S. economy, as well as large budget deficits, could adversely affect the demand for our product.

Recession, sustained downturns or sluggishness in the U.S. economy, as well as large budget deficits, generally affect the markets in which

we operate. Most government agencies, on the local, state and federal levels, have been impacted by the current downturn in the economy, with budgetary cuts hitting some agencies particularly hard and many agencies operating at a deficit. As a

result, agencies that would otherwise have considered purchasing in-car digital video systems in some cases have decided or may in the future decide to defer the decision for an unknown period of time and may not have the financial resources to

purchase our products at any time in the foreseeable future. Were this situation to continue and/or become more widespread, our internal estimates of our projected growth and our actual results of operations could be severely and negatively

impacted, particularly while we remain almost entirely dependent on sales of the

ICOP Model 20/20-W

to law enforcement agencies.

We currently have a limited product offering, so a failure to generate significant revenues from our current product line would negatively impact our business.

We anticipate that sales of the

ICOP Model 20/20-W

will account for a substantial portion of our revenues in the near-term. Our

long-term success will depend, in significant part, on our ability to achieve greater market acceptance of the

ICOP Model 20/20-W

and the

ICOP iVAULT MMS

in the law enforcement and other first responder markets, and on our success in

deploying new products into the market, such as the

ICOP Model 4000

and

ICOP LIVE.

The failure to achieve either of these objectives would have a material adverse effect on our business, financial condition and results of operations.

The ICOP Model 20/20-W is technologically complex, and our inability to improve the product and develop new products in the video

surveillance market would adversely impact our ability to compete in our market.

To be competitive in our markets, we

must continually improve and expand our product line. Our success depends on our ability to anticipate advances in digital video technologies, enhance our existing products and develop and introduce new products and product line extensions to meet

customer requirements and achieve market acceptance. This involves highly complex processes and will include components for which we have not yet demonstrated technical feasibility. Difficulty in the development of new products or improvements to

our existing products could delay or prevent the creation and release of such products, which would materially harm our business, operating results, financial condition and future growth. In addition, the introduction by others of new technologies

could materially affect our ability to compete.

S6

If we are unable to compete in our markets, you may lose all or part of your investment.

Our markets are highly competitive and highly fragmented. Most major in-car video manufacturers are in the

process of developing, or have developed, new products that, like our

ICOP Model 20/20-W

, use digital video recording technology. Many of these competitors have significant advantages over us, including greater financial, technical, marketing

and manufacturing resources, more extensive distribution channels, larger customer bases and faster response times to adapt new or emerging technologies and changes in customer requirements. As a result, our competitors may develop superior products

or beat us to market with products similar to ours. If we are not successful in competing against our current and future competitors, you could lose your entire investment.

We may lose potential sales because of our inability to fulfill orders on a timely basis.

We use third-party manufacturers to produce the

ICOP Model 20/20-W

and the

ICOP Model 4000.

The manufacturers make their production and purchasing decisions based on information we provide

regarding our projected needs. However, many customers will not provide us with forecasts of their requirements for our products. If those customers place significant orders, we may not be able to increase our production quickly enough to fulfill

their orders. The inability to fulfill orders could damage our relationships with customers and reduce our sales, which could have a material adverse effect on the value of your investment.

We may need to raise additional capital.

We are currently operating at a loss and expect our expenses to continue to increase as we expand our geographic presence throughout the United States and internationally. To date, we have relied almost

exclusively on financing transactions to fund operations. In the future, new sources of capital may not be available to us when we need it or may be available only on terms we would find unacceptable. If such capital is not available on satisfactory

terms or is not available at all, we may be unable to continue to fully develop our business, and our operations and financial condition may be materially and adversely affected. Debt financing, if obtained, could increase our expenses and would be

required to be repaid regardless of operating results. Equity financing, if obtained, could result in dilution to our existing stockholders. Since November 2008, we have had access to a factoring arrangement in which we have agreed to sell all of

our accounts receivable at a discount of 0.75% of the face value of each accepted receivable for every 30 days the invoice is outstanding. However, our ability to obtain sufficient advances under this credit line is dependent on generating increased

accounts receivable through higher sales volume, which cannot be assumed.

If we are unable to satisfy the financial net worth covenant

of our financing agreement, we may be declared in default.

We are required to maintain a tangible net worth of at

least $2.5 million at all times during the term of an amended purchasing agreement we have with a financing company. If we fail to meet the net worth requirement in the future, we could be declared in default under the purchasing agreement, which

would materially and adversely affect our business because we may be unable to draw down on this line of credit when we need working capital.

We depend on third parties to manufacture our products, and those third parties may not perform satisfactorily.

We do not have the resources, facilities or experience to manufacture our products, and therefore depend on third-party manufacturers. We rely on offshore companies for the development and exclusive manufacturing of our

ICOP Model

20/20-W

and

ICOP Model 4000

. Our manufacturing strategy presents the following risks:

|

|

•

|

|

we have limited control over the manufacturing processes;

|

|

|

•

|

|

all of our

ICOP Model 20/20-W

units and its predecessor have been purchased from one supplier; if this supplier were no longer available to us,

an alternate supplier may not be immediately available.

|

|

|

•

|

|

if we have to change to new manufacturers, they would have to be educated in the processes necessary for the production of our products, which could be

time consuming;

|

|

|

•

|

|

the manufacturer of the

ICOP 20/20-W

has certain rights related to an important process used in operating that product; if this method were no

longer available to us, we would have to redesign the product, which could delay production; and

|

S7

|

|

•

|

|

we may not have intellectual property rights, or may have to share intellectual property rights, to any improvements in the manufacturing processes or

new manufacturing processes for our products.

|

In addition, we may in some cases have to reimburse or incur

other charges from third-party contract manufacturing partners for excess inventory resulting from changes in product design or demand. If we accumulate excess or obsolete inventory, price reductions and inventory write-downs may result, which could

adversely affect our results of operations and financial condition.

Our use of manufacturers outside the United States may subject us

to a number of risks that could disrupt the supply of our products and adversely impact sales, earnings and customer relationships.

Our

ICOP Model 20/20-W

and

ICOP Model 4000

are manufactured outside of the United States. In addition to foreign currency risks, foreign manufacturing subjects us to a number of additional

risks, including:

|

|

•

|

|

changes in trade policy and regulatory requirements;

|

|

|

•

|

|

uncertain economic conditions in the countries in which the manufacturing occurs;

|

|

|

•

|

|

duties, tariffs and other trade barriers and restrictions; and

|

|

|

•

|

|

political and transportation risks.

|

Any of the above factors could disrupt the supply of products and adversely impact sales, earnings and customer relationships.

Because a significant portion of our expenses is incurred in a foreign currency, our results of operations may be harmed by inflation and currency fluctuations.

We generate our revenues in U.S. dollars, but we currently incur a significant portion of our expenses in the currencies of Japan and Taiwan,

where the manufacturers of our

ICOP Model 20/20-W

and

ICOP Model 4000

, respectively, are located. If the Japanese Yen or Taiwan Dollar appreciates relative to the dollar, we may experience an increase in our expenses without a

corresponding increase in our revenues. If our manufacturing dollar costs increase, our dollar-measured results of operations would be harmed.

Our operations could be harmed if we are unable to protect ourselves against currency fluctuations in the future. As of January 25, 2010, we were not engaged in any currency hedging transactions to

decrease the risk of financial exposure fluctuations in the exchange rate of the dollar against the Japanese Yen, Taiwan Dollar or any other foreign currency. If we do elect to enter into hedging transactions in the future, the costs of such

transactions may exceed any resulting benefits.

Our expansion into international markets may be subject to uncertainties that could

increase our costs to comply with regulatory requirements in foreign jurisdictions, disrupt our operations, and require increased focus from our management.

We are beginning to expand sales into the Middle East, and we eventually expect to enter into other international markets. The expansion of our sales into international markets is subject to numerous

additional risks, including: economic and political risks in foreign jurisdictions in which we sell products or seek to sell products; difficulty of enforcing contracts and collecting receivables through some foreign legal systems; differences in

foreign laws and regulations, including foreign tax, intellectual property, labor and contract law, as well as unexpected changes in legal and regulatory requirements; differing technology standards and pace of adoption; import and export

restrictions on encryption and other technologies; fluctuations in currency exchange rates and any imposition of currency exchange controls; and increased competition by local, regional, or global companies. If we continue to expand our sales

globally, our success will depend, in large part, on our ability to anticipate and effectively manage these and other risks associated with our international sales. However, any of these factors could adversely affect our international sales and,

consequently, our operating results.

S8

The loss of our key management personnel could result in a material adverse effect on our business.

Our future success depends in large part upon the continued service of key members of our senior management team,

including David C. Owen, our Chairman and Chief Executive Officer, and Laura E. Owen, our President, Chief Operating Officer and Corporate Secretary. We maintain a key-person life insurance policy on Laura E. Owen, but not for David C. Owen. The

loss of the services of either of these officers could seriously harm our business and our future prospects.

If we are unable to manage

rapid growth effectively, our operating results could be adversely affected.

Our business strategy anticipates rapid

growth for the foreseeable future. This growth will place significant strain on our administrative, operational and financial resources and increase demands on our systems and controls. To manage our future growth, we will need to attract, hire and

retain highly skilled and motivated officers and employees and improve existing systems and/or implement new systems for information processing, operational and financial management and training, integrating and managing our growing employee base.

If we are unable to manage growth effectively, our operating results could be adversely affected.

If we fail to maintain an effective

system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, investors could lose confidence in our financial reporting, which would harm our business and the trading price of our

securities.

Effective internal controls are necessary for us to provide reliable financial reports. If we cannot

provide reliable financial reports, our brand and operating results could be harmed. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to

fail to meet our reporting obligations. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could negatively affect the trading price of our stock.

Compliance with the requirements imposed by Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our operating results.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”), we were required to

furnish a report by our management on our internal control over financial reporting. Beginning with our Annual Report on Form 10-K for the year ending December 31, 2010, our independent auditor will also be required to furnish an attestation on

our management’s assessment of our internal control over financial reporting.

We can provide no assurance as to our or

our independent auditors’ conclusions with respect to the effectiveness of our internal controls over financial reporting under Section 404 of Sarbanes-Oxley. There is a risk that our independent auditors will not be able to conclude that

our internal controls over financial reporting are effective as required by Section 404 of Sarbanes-Oxley. Moreover, the costs to comply with Section 404 of Sarbanes-Oxley, as currently in effect, could have a material adverse effect on

our operating results.

Defects in our products could impair our ability to sell our products and could result in litigation and other

significant costs.

Detection of any significant defects in our products may result in, among other things, delay in

time-to-market, loss of market acceptance and sales of our products, diversion of development resources, injury to our reputation, or increased warranty costs. Because our products are complex, they may contain defects that cannot be detected prior

to shipment. These defects could harm our reputation and impair our ability to sell our products. The costs we may incur in correcting any product defects may be substantial and could decrease our profit margins. Additionally, errors, defects or

other performance problems could result in financial or other damages to our customers, which could result in litigation. Product liability litigation, even if we prevail, would be time consuming and costly to defend. Our product liability insurance

may not be adequate to cover claims.

S9

Our operating results may fluctuate, which makes our results difficult to predict and could cause our

results to fall short of expectations.

Our operating results may fluctuate as a result of a number of factors, many of

which are outside of our control. For these reasons, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly and annual

expenses as a percentage of our revenues may be significantly different from our historical or projected rates. Our operating results in future quarters may fall below expectations. Any of these events could cause our stock price to fall. Each of

the risk factors listed in this “Risk Factors” section, as well as others including general economic conditions, political events such as war, threat of war and terrorist actions, and natural disasters, may adversely affect our operating

results and the prices of our securities.

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents we incorporate herein and therein by reference may contain

statements which constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements that set forth anticipated results based on management’s plans and assumptions. From time to

time, we also provide forward-looking statements in other materials we release to the public as well as oral forward-looking statements. Such statements discuss future events and developments, including our future business strategy and our ability

to generate revenue, income and cash flow. In some cases, you can identify forward-looking statements by words or phrases such as “may,” “should,” “expects,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” “continue,” “our future success depends,” “seek to continue,” or the negative of these words or phrases, or comparable words or

phrases. These statements are only predictions that are based, in part, on assumptions involving judgments about future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond our control. Actual events or results may differ materially. In evaluating these statements, you should specifically consider various facts, including the risks referenced in the “Risk Factors”

section. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date on which they are made. We do not undertake to update any of the forward-looking statements after the date of this prospectus supplement to conform these statements to actual results.

S10

USE OF PROCEEDS

If all of the shares of common stock, Series 1 Warrants and Series 2 Warrants on the cover of this prospectus supplement are sold, we

estimate that the net proceeds to us from this offering will be approximately $1,187,640 (or approximately $3,130,000 if all of the offered warrants are exercised) after payment of placement agent fees of approximately $93,910 and expenses that we

estimate to be approximately $60,000. There is no minimum offering amount required to close, so the actual net proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above. We intend to use the

net proceeds from this offering for inventory purchases and general corporate purposes, and no portion of the net proceeds will be used to pay indebtedness or trade payables (other than trade payables incurred after the date hereof in connection

with such inventory purchases after the date hereof). We also may use a portion of the proceeds for the acquisition of companies, products or technology, although there are no current agreements with respect to any acquisitions.

PLAN OF DISTRIBUTION

We are directly selling to one or more purchasers up to 3,500,000 shares of common stock, Series 1 Warrants to purchase up to 3,500,000 shares of common stock and Series 2 Warrants to purchase up to

1,232,580 shares of common stock. The securities will be sold in multiples of a fixed combination consisting of one share of common stock, a Series 1 Warrant to purchase one share of common stock and a Series 2 Warrant to purchase 0.3521 shares of

common stock. There is no minimum offering amount. Accordingly, we may not sell all of the securities offered.

We have

retained Chardan Capital Markets, LLC (“Chardan”) as our placement agent in connection with the offer and sale of the aforementioned securities. We will pay the placement agent a fee equal to 7.0% of the gross proceeds from this offering.

Chardan also will receive warrants to purchase a number of shares equal to 3.0% of the shares sold by us in this offering and warrants (substantially similar to the Series 1 Warrants) to purchase a number of shares equal to 3.0% of shares issuable

under the Series 1 Warrants and Series 2 Warrants sold by us in this offering (subject to reduction in number as necessary to comply with the overall 8% compensation limit pursuant to applicable guidelines of the Financial Industry Regulatory

Authority, or FINRA, described below). Chardan’s warrants will entitle Chardan to purchase, for $0.42, one share of common stock, and a warrant to purchase approximately 1.3521 shares of common stock. Chardan’s warrant will be exercisable

for five years beginning six months and one day after the closing date of this offering.

Further, Chardan’s warrants

will otherwise comply with FINRA Rule 5110(g)(1) in that for a period of six months after the issuance date of the compensation warrants (which shall not be earlier than the closing date of the offering pursuant to which the compensation warrants

are being issued), neither the compensation warrants nor any warrant shares issued upon exercise of the compensation warrants shall be sold, transferred, assigned, pledged, or hypothecated, or be the subject of any hedging, short sale, derivative,

put, or call transaction that would result in the effective economic disposition of the securities by any person for a period of 180 days immediately following the date of effectiveness or commencement of sales of the offering pursuant to which the

compensation warrants are being issued, except the transfer of any security:

|

|

i.

|

by operation of law or by reason of reorganization of the Company;

|

|

|

ii.

|

to any FINRA member firm participating in this offering and the officers or partners thereof, if all securities so transferred remain subject to the lock-up restriction

described above for the remainder of the time period;

|

|

|

iii.

|

if the aggregate amount of securities of the Company held by the placement agent or related person do not exceed 1% of the securities being offered;

|

|

|

iv.

|

that is beneficially owned on a pro-rata basis by all equity owners of an investment fund, provided that no participating member manages or otherwise directs

investments by the fund, and participating members in the aggregate do not own more than 10% of the equity in the fund; or

|

S11

|

|

v.

|

the exercise or conversion of any security, if all securities received remain subject to the lock-up restriction set forth above for the remainder of the time period.

|

Under no circumstances will the fee or commission received by the placement agent or any other member of the

Financial Industry Regulatory Authority, or FINRA, or independent broker-dealer exceed 8% of the gross proceeds to us in this offering or any other offering in the United States pursuant to this prospectus supplement and the accompanying prospectus.

Assuming that we sell all of the securities being offered hereunder, gross proceeds from the offering would be approximately

$1,341,550, and net proceeds from the offering, before expenses, would be approximately $1,247,641 after deducting estimated placement agent fees payable by us associated with the offering. We will make sales directly to purchasers, and not through

an underwriter. We expect that we will effect the sale of the securities in one closing, which we expect will occur on or before February 3, 2010.

None of the purchaser funds will be deposited in an escrow account.

Our common

stock is traded on the NASDAQ Capital Market under the symbol “ICOP.” The transfer agent for our common stock is Computershare Investor Services, 350 Indiana Street, Suite 800, Golden, Colorado 80401.

We have agreed in a placement agent agreement to indemnify Chardan against certain liabilities, including liabilities under the Securities

Act of 1933, and liabilities arising from breaches of representations and warranties contained in the agreement, or to contribute to payments that Chardan may be required to make in respect of such liabilities.

DESCRIPTION OF SECURITIES

Our authorized capital stock consists of 50,000,000 shares of no par value common stock, and 5,000,000 shares of no par value preferred stock. As of January 25, 2010, we had 23,662,944 shares of

common stock and no shares of preferred stock outstanding.

Common Stock

The following is a description of our common stock, and is qualified in its entirety by the provisions of our articles of incorporation and

our bylaws, both as amended (our “Articles of Incorporation” and “Bylaws,” respectively).

Holders of our

common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders. Subject to the preference in dividend rights of any series of preferred stock that we may issue in the future, the holders of common stock

are entitled to receive such cash dividends, if any, as may be declared by our Board of Directors out of legally available funds. Upon liquidation, dissolution or winding up, after payment of all debts and liabilities and after payment of the

liquidation preferences of any shares of preferred stock then outstanding, the holders of the common stock will be entitled to participate

pro rata

in all assets that are legally available for distribution.

Other than the rights described above, the holders of common stock have no preemptive subscription, redemption, sinking fund or conversion

rights and are not subject to further calls or assessments. The rights and preferences of holders of common stock will be subject to the rights of any series of preferred stock that we may issue in the future.

S12

Series 1 Warrants

The material terms and provisions of the Series 1 Warrants being offered pursuant to this prospectus supplement are summarized below. This summary is subject to, and qualified in its entirety by, the form

of Series 1 Warrant, which will be provided to each purchaser in this offering and will be filed on a Current Report on Form 8-K in connection with this offering.

Each Series 1 Warrants will be exercisable at any time, in whole or in part, beginning six months and one day after the date of issuance and until five years after such Series 1 Initial Exercise Date. The

initial exercise price of the Series 1 Warrants is $0.42 per share. The Series 1 Warrants will be exercisable, at the option of each holder, upon delivery of an executed notice of exercise and payment to us of the exercise price. If at the time of

exercise, the registration statement relating to the shares underlying the Series 1 Warrants is not effective, or if the related prospectus is not available for use, then a holder of Series 1 Warrants may elect to exercise its Series 1 Warrants

using a net exercise (i.e., cashless exercise) mechanism.

Subject to certain customary exceptions, in the event of an

issuance or deemed issuance by us of common stock or securities convertible into our common stock at a per share price less than the then applicable Series 1 Warrant exercise price, the Series 1 Warrant exercise price shall be reduced to that new

issuance price; provided, however, that the exercise price shall not be reduced below $0.42 per share, as adjusted for stock splits and the like (the “Floor Price”) without prior shareholder approval. We will seek approval of our

shareholders at our next annual meeting to permit adjustment of the Series 1 Warrant exercise price below the Floor Price. The exercise price of the Series 1 Warrants also will be adjusted in the event of stock splits, reverse stock splits and the

like. In the event the Series 1 Warrant exercise price is adjusted, then the number of shares issuable upon exercise also will be adjusted, such that the aggregate exercise price payable for the adjusted number of underlying shares shall be the same

as the aggregate exercise price in effect immediately prior to the adjustment.

If we do not deliver the shares underlying a

Series 1 Warrant within three trading days after exercise of that Series 1 Warrant, and if on or after such third trading day, the warrant holder purchases shares of common stock to deliver in satisfaction of a sale of the underlying shares by the

warrant holder, then we maybe required to either: pay to the warrant holder the amount it paid for shares of common stock to cover its sale (the “Buy-In Price”); or deliver a stock certificate representing the underlying shares and pay to

the warrant holder an amount equal to the difference between the Buy-In Price and the product of (a) the number of shares deliverable upon exercise and (b) the closing sale price of our common stock immediately preceding our receipt of the

exercise notice.

The Series 1 Warrants are not listed on any securities exchange and there currently is no public market for

the warrants.

If we grant, issue or sell any options, convertible securities or rights to purchase stock, warrants,

securities or other property pro rata to the record holders of any class of the shares of common stock (the “purchase rights”), the holder of the Series 1 Warrants is entitled to acquire such purchase rights which the holder could have

acquired if the holder had held the number of shares of common stock acquirable upon the complete exercise of the holder’s Series 1 Warrants.

We may not enter into certain fundamental transactions, including a merger or sale of all or substantially all of our assets, unless the successor entity assumes in writing all of our obligations under

the Series 1 Warrants. If certain fundamental transactions occur (such as a merger, consolidation, sale of substantially all of our assets, tender offer or exchange offer with respect to our common stock or reclassification of our common stock), at

the holder’s request, we or the successor entity shall purchase the Series 1 Warrants from the holder for an amount equal to the value of the unexercised portion of the Series 1 Warrants that remain as of the time of such fundamental

transaction based on the Black Scholes Option Pricing Model obtained from the “OV” function on Bloomberg, L.P.

The

Series 1 Warrants are not exercisable to the extent that the holder or any of its affiliates would beneficially own in excess of 4.9% of the common stock.

S13

Series 2 Warrants

The material terms and provisions of the Series 2 Warrants being offered pursuant to this prospectus supplement are summarized below. This summary is subject to, and qualified in its entirety by, the form

of Series 2 Warrant, which will be provided to each purchaser in this offering and will be filed on a Current Report on Form 8-K in connection with this offering.

Each Series 2 Warrants will be exercisable at any time beginning upon the date of issuance until ninety (90) days after the date of issuance. The initial exercise price of the Series 2 Warrants is

$0.3833 per share. The Series 2 Warrants will be exercisable, at the option of each holder, upon delivery of an executed notice of exercise and payment to us of the exercise price. If at the time of exercise, the registration statement relating to

the shares underlying the Series 2 Warrants is not effective, or if the related prospectus is not available for use, then a holder of Series 2 Warrants may elect to exercise its Series 2 Warrants using a net exercise (i.e., cashless exercise)

mechanism.

Subject to certain customary exceptions, in the event of an issuance or deemed issuance by us of common stock or

securities convertible into our common stock at a per share price less than the then applicable Series 2 Warrant exercise price, the Series 2 Warrant exercise price shall be reduced to that new issuance price; provided, however, that the exercise

price shall not be reduced below $0.3833 per share, as adjusted for stock splits and the like (the “Series 2 Floor Price”) without prior shareholder approval. We will seek approval of our shareholders at our next annual meeting to permit

adjustment of the Series 2 Warrant exercise price below the Series 2 Floor Price. The exercise price of the Series 2 Warrants also will be adjusted in the event of stock splits, reverse stock splits and the like. In the event the Series 2 Warrant

exercise price is adjusted, then the number of shares issuable upon exercise also will be adjusted, such that the aggregate exercise price payable for the adjusted number of underlying shares shall be the same as the aggregate exercise price in

effect immediately prior to the adjustment.

If we do not deliver the shares underlying a Series 2 warrant within three

trading days after exercise of that warrant, and if on or after such third trading day, the warrant holder purchases shares of common stock to deliver in satisfaction of a sale of the underlying shares by the warrant holder, then we maybe required

to either: pay to the warrant holder the amount it paid for shares of common stock to cover its sale; or deliver a stock certificate representing the underlying shares and pay to the warrant holder an amount equal to the difference between the

Buy-In Price and the product of (a) the number of shares deliverable upon exercise and (b) the closing sale price of our common stock immediately preceding our receipt of the exercise notice.

The Series 2 Warrants are not listed on any securities exchange and there currently is no public market for the warrants.

If we grant, issue or sell any options, convertible securities or rights to purchase stock, warrants, securities or other property pro rata

to the record holders of any class of the shares of common stock (the “purchase rights”), the holder of the Series 2 Warrants is entitled to acquire such purchase rights which the holder could have acquired if the holder had held the

number of shares of common stock acquirable upon the complete exercise of the holder’s Series 2 Warrants.

We may not

enter into certain fundamental transactions, including a merger or sale of all or substantially all of our assets, unless the successor entity assumes in writing all of our obligations under the Series 2 Warrants. If certain fundamental transactions

occur (such as a merger, consolidation, sale of substantially all of our assets, tender offer or exchange offer with respect to our common stock or reclassification of our common stock), at the holder’s request, we or the successor entity shall

purchase the Series 2 Warrants from the holder for an amount equal to the value of the unexercised portion of the Series 2 Warrants that remain as of the time of such fundamental transaction based on the Black Scholes Option Pricing Model obtained

from the “OV” function on Bloomberg, L.P.

The Series 2 Warrants are not exercisable to the extent that the holder

or any of its affiliates would beneficially own in excess of 4.9% of the common stock.

S14

LEGAL MATTERS

The validity of the securities offered hereby will be passed on by Holland & Knight LLP, Portland, Oregon.

INFORMATION INCORPORATED BY REFERENCE

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3. The SEC allows these

filings to “incorporate by reference” information that the Company previously has filed with the SEC. This means the Company can disclose important information to you by referring you to other documents that it has filed with the SEC. The

information that is incorporated by reference is considered part of this prospectus supplement, and information that the Company files later will automatically update and may supersede this information. For further information about the Company and

the securities being offered, you should refer to the registration statement and the following documents that are incorporated by reference:

|

|

•

|

|

Our annual report on Form 10-K filed on March 20, 2009, which contains audited financial statements for the fiscal year ended

December 31, 2008;

|

|

|

•

|

|

Our definitive proxy statement on Schedule 14A filed on July 2, 2009;

|

|

|

•

|

|

Our quarterly reports on Forms 10-Q filed on May 15, 2009, August 7, 2009 and November 12, 2009;

|

|

|

•

|

|

Our current reports on Forms 8-K filed on February 4, 2009, March 18, 2009, March 24, 2009, May 15,

2009, May 20, 2009, June 17, 2009, July 21, 2009 and August 6, 2009;

|

|

|

•

|

|

All other reports filed by us pursuant to Section 13(a) or 15(d) of the Securities Exchange Act (the “Exchange

Act”) since the end of the fiscal year covered by the annual report referred to above; and

|

|

|

•

|

|

The description of our common stock contained in Forms 8-A filed on July 6, 2005 and May 28, 2009, and any amendments or reports filed for

the purpose of updating such description.

|

All documents filed by the Company subsequent to those listed

above with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offering, shall be deemed to be incorporated by reference into this prospectus supplement and to be a part hereof from

the date of filing of such documents. Any statement contained in a document incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained herein or

in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to

constitute a part of this prospectus supplement.

You may request a copy of all documents that are incorporated by reference

in this prospectus supplement or the accompanying prospectus by writing or telephoning us at the following address and number: ICOP Digital, Inc., Attention: Secretary, 16801 W. 116th Street, Lenexa, Kansas 66219, (913) 338-5550. We will

provide copies of all documents requested (not including exhibits to those documents, unless the exhibits are specifically incorporated by reference into those documents or this prospectus supplement or accompanying prospectus) without charge.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 filed with the SEC under

the Securities Act. This prospectus supplement and the accompanying prospectus do not contain all the information set forth in the registration statement because certain information has been incorporated into the registration statement by reference

in accordance with the rules and regulations of the SEC. Please review the documents incorporated by reference for a more complete description of the matters to which such documents relate.

S15

We are subject to the informational reporting requirements of the Exchange Act. In

accordance with the Exchange Act, we file reports, proxy statements, and other information with the SEC. You can inspect and copy these reports, proxy statements, and other information at the Public Reference Room of the SEC, 100 F Street,

N.E., Washington, D.C. 20549, at prescribed rates. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference rooms. Our SEC filings are also available on the SEC’s web site. The

address of this site is http://www.sec.gov.

S16

PROSPECTUS

ICOP DIGITAL, INC.

Up to $25,000,000

COMMON STOCK

PREFERRED STOCK

WARRANTS

DEBT SECURITIES

UNITS

We may sell from time to time the securities

offered by this prospectus at prices and on terms to be determined at or prior to the time of each sale. We will describe the specific terms and amounts of the securities offered in a prospectus supplement for each sale. You should carefully read

this prospectus and any prospectus supplement before you invest. This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

Our common stock is traded on the Nasdaq Capital market under the symbol “ICOP.” On October 15, 2009, the last reported sale price of our common stock on the Nasdaq

Capital market was $0.66 per share.

Our principal executive offices are located at 16801 W. 116th Street,

Lenexa, Kansas 66219.

These are speculative securities. Investing in these securities involves significant risks. You

should purchase these securities only if you can afford a complete loss of your investment. See “

Risk Factors

” beginning on page 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE

SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is October 28, 2009

TABLE OF CONTENTS

In this

prospectus, references to “we,” “us,” “our,” “ICOP” or the “Company” mean ICOP Digital, Inc.

ABOUT THIS PROSPECTUS

This prospectus is part of a Registration Statement on Form S-3 that we filed with the Securities and Exchange Commission (“SEC”)

using a “shelf” registration process. Under this shelf process, we may sell any combination of securities described in this prospectus in one or more offerings, up to the total dollar amounts appearing on the cover of this prospectus. This

prospectus provides you with a general description of the securities we may offer. Each time we offer the securities, a prospectus supplement will be provided that will contain specific information about the terms of the offering, including the

type(s), amount(s) and price(s) of the securities being offered and the plan of distribution. The prospectus supplement for a particular offering may also add, update or change information contained in this prospectus. In addition, any prospectus

supplement relating to a particular offering may be updated or supplemented. You should read carefully both this prospectus and any applicable prospectus supplement together with the additional information about us to which we refer you in the

section of this prospectus entitled “Where You Can Find More Information.”

You should rely only on the information

contained or incorporated by reference in this prospectus or a prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. You should not assume that the information appearing in this prospectus, any prospectus supplement or any document incorporated by reference is accurate as of any date other than its date, regardless of the time of delivery of the

prospectus or prospectus supplement or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since those dates.

Our trademarks include:

ICOP

®

, ICOP DIGITAL

®

, ICOP Model

20/20

®

, ICOP Model 20/20

®

-W, ICOP Model 4000™, ICOP LIVE™, ICOP iVAULT™, ICOP iVAULT MMS™, ICOP EXTREME™ Wireless Mic, ICOP Solution™, ICOP Guardian™, ICOP

LIVE Platform™, ICOP DVMS™, ICOP Model 20/20 LIVE™, ICOP Guardian LIVE™, ICOP PC Viewer™, ICOP IN-FOCUS™, ICOP BodyCam™, BUSCOP™, IBUS™, BikeCam™, TransitCop™, ICOP Digital Video Management

System™, ICOP 20/20 VISION™, Advancing Surveillance Technology™

and

A Veil of Protection™

. The trademarks, service marks or trade names of any other company appearing in this prospectus belong to its owner. Use or

display by us of trademarks, service marks or trade names owned by others is not intended to and does not imply a relationship between us and, or endorsement or sponsorship by, the owners of the trademarks, service marks or trade names.

1

PROSPECTUS SUMMARY

This summary highlights information contained in this prospectus. While we believe that this summary highlights some of the most

important information about ICOP Digital, Inc. and this offering, you should read this entire prospectus and the documents incorporated by reference carefully, including “Risk Factors,” before deciding to invest in our securities.

Business Overview

We design, engineer and market video surveillance products for public safety. Our flagship product, the

ICOP Model 20/20-W,

is a digital in-car video and audio recorder designed for the rugged

demands of law enforcement agencies, which provides a secure chain of custody and integrity of the recorded information. Since our first commercial sale in June 2005, we have sold the

ICOP Model 20/20-W

and its predecessor, the

ICOP Model

20/20

, to law enforcement customers in 49 states. The

ICOP Model 20/20-W

technology also has applications in other markets where video surveillance is critical in the safety of people and security of property, including the military and

other public safety installations. Our product is installed in the dashboard of the vehicle; therefore, there are no parts in the trunk, under the seat, or overhead, which is critical in considering officer safety and space limitations within patrol

cars. An AM/FM radio is built into the

ICOP Model 20/20-W

to replace the AM/FM radio in the dashboard. The

ICOP Model 20/20-W

provides wireless (“W”) upload of the recorded video to the backend server where the video evidence

is stored and managed.

Law enforcement has long recognized the value of gathering intelligence and documenting critical

events by means of recorded video. Video and audio evidence collected by in-car systems has been used successfully in cases such as driving under the influence, various traffic violations, vehicular pursuits, narcotic enforcement actions,

assaults-on-officer incidents and civil litigation involving law enforcement agencies. Information collected by in-car VHS (analog) video systems has also been used to assist agencies in identifying potential threats to homeland security.

The majority of in-car police video systems currently employed, however, rely on outdated analog technology that suffers from

inferior quality video and audio, lack of dependability in extreme temperatures, storage and retrieval difficulties and officer safety concerns. The law enforcement industry is currently transitioning from analog to digital technologies for in-car

video, and we believe that we are well-positioned to exploit this market. The

ICOP Model 20/20-W

is priced competitively to comparable units, yet we believe it offers superior video and audio quality, officer safety due to secure and

convenient placement in the dashboard, and security for the integrity of the recorded evidence.

The

ICOP DVMS

(Digital

Video Management System) is the original backend video management system for the

ICOP Model 20/20-W

. In late 2007, we began selling the

ICOP iVAULT MMS

(Media Management System), an enterprise-level software management product, which

was developed to serve as a digital evidence locker for law enforcement, enabling storage of multiple file formats. This software is web-enabled, allowing files to be shared within precincts, among precincts or across the nation, using high levels

of security.

The

ICOP 20/20 VISION

brings the functionality of the

ICOP Model 20/20-W

to laptops in police

cars, allowing the digital video recorder (DVR) to be controlled by an officer’s laptop computer anywhere in the vehicle. This product was developed in response to industry demand, which grew out of the dramatic growth of laptops in police

vehicles. We began shipping the

ICOP 20/20 VISION

in March 2009.

During the second quarter of 2008, we began selling

ICOP LIVE

, a product that delivers live streaming audio and video.

ICOP LIVE

works in conjunction with the

ICOP Model 20/20-W,

enabling live streaming audio and video to and from a first responder vehicle over wireless networks,

including cellular networks, mesh networks, etc., from the

ICOP Model 20/20-W

to police headquarters, personnel on the scene and web-enabled mobile devices such as smart phones and PDAs in the field. Early marketing efforts are focused on our

existing customer base of first responders. The audio and video live streams to a virtually unlimited number of simultaneous viewers, using secure protocols. To further leverage the marketing of

ICOP LIVE

, ICOP has entered into co-marketing

agreements with Sprint Nextel (“Sprint”), using the implementation of

ICOP LIVE

over the Sprint Mobile Broadband Network, and with Strix Systems (“Strix”), one of the worldwide leaders in wireless mesh networking, using

the implementation of

ICOP LIVE

over Strix mesh networks.

2

During the fourth quarter of 2008, the Company introduced the

ICOP Model 4000,

which

is a digital video product designed for school buses, cash transit vehicles, commercial and transit vehicles, including buses and trains. The

ICOP Model 4000

records up to eight cameras simultaneously for surveillance of events aboard the

vehicles and is capable of live streaming video to first responders and dispatch.

In the first quarter of 2009, we were

awarded a contract to outfit security force vehicles in Saudi Arabia with the

ICOP 20/20-W

. We believe we are well-positioned to begin our international expansion plans by first taking advantage of opportunities in the Middle East.

We are incorporated under the laws of Colorado. Our principal business office is located at 16801 W. 116th Street, Lenexa,

Kansas 66219, and our telephone number is (913) 338-5550. Our website address is

www.icop.com

. Information contained on our website or any other website does not constitute part of this prospectus.

This Offering

Through this

prospectus, we may from time to time offer and sell shares of our common stock, shares of our preferred stock, warrants, debt securities and units, and the securities issuable upon exercise or conversion of any of those securities. We may offer and

sell these securities separately or together, but the aggregate initial offering price will not to exceed $25,000,000 or the equivalent amount denominated in one or more foreign currencies. Each time we offer and sell the securities, a

prospectus supplement will be provided that will contain specific information about the terms of the offering, including the type(s), amount(s) and price(s) of the securities being offered and the plan of distribution employed.

3

RISK FACTORS

An investment in our securities involves a high degree of risk and many uncertainties discussed in the section entitled “Risk

Factors” in our annual report on Form 10-K for the year ended December 31, 2008, which is incorporated by reference into this prospectus. You should carefully consider the risk factors before purchasing our securities. If one or more

of the possibilities described as risks actually occurs, our operating results and financial condition would likely suffer and the trading price of our securities could fall, causing you to lose some or all of your investment in the securities we

are offering.

FORWARD-LOOKING STATEMENTS

We make forward-looking statements in this prospectus that are subject to risks and uncertainties. These forward-looking statements include

information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. In some cases, you may identify forward-looking statements by words such as “may,”

“should,” “plan,” “intend,” “potential,” “continue,” “believe,” “expect,” “predict,” “anticipate” and “estimate,” the negative of these words or

other comparable words. These statements are only predictions. One should not place undue reliance on these forward-looking statements. The forward-looking statements are qualified by their terms and/or important factors, many of which are outside

our control, involve a number of risks, uncertainties and other factors that could cause actual results and events to differ materially from the statements made. Such factors include, among other things, those described elsewhere in this prospectus

and the following:

|

|

•

|

|

the

ICOP Model 20/20-W

and the

ICOP Model 4000

not being accepted by the marketplace;

|

|

|

•

|

|

difficulty meeting demand for in-car video technologies at a price that results in a profit;

|

|

|

•

|

|

our ability to improve our products and to develop other products necessary to compete in the industry;

|

|

|

•

|

|

our ability to bring future products to market;

|

|

|

•

|

|

the

ICOP Model 20/20-W

and the

ICOP Model 4000

being replaced by more advanced technologies and thereby becoming obsolete;

|

|

|

•