Annaly Capital Management, Inc. Announces 4th Quarter Dividend of $0.50 per Share

December 18 2008 - 4:14PM

Business Wire

The Board of Directors of Annaly Capital Management, Inc. (NYSE:

NLY) declared the fourth quarter 2008 common stock cash dividend of

$0.50 per common share. This dividend is payable January 29, 2009

to common shareholders of record on December 30, 2008. The

ex-dividend date is December 26, 2008. The Company distributes

dividends based on its current estimate of taxable earnings per

common share, not GAAP earnings. Taxable and GAAP earnings will

differ because of non-taxable unrealized and realized losses,

differences in premium amortization, and non-deductible general and

administrative expenses. Beginning in the fourth quarter of 2008,

the Company will no longer apply hedge accounting to its interest

rate swaps under Statement of Financial Accounting Standards No.

133 Accounting for Derivative Instruments and Hedging Activities.

As a result, unrealized gains and losses on interest rate swaps

will be reported in earnings for GAAP net income. The Company

designates its interest rate swaps as tax hedges and any unrealized

gains or losses should not affect its distributable net income.

Dividends may be reinvested through Annaly's Dividend Reinvestment

Plan. Plan information may be obtained from the Plan Administrator,

Mellon Investor Services at 1-800-301-5234, at www.annaly.com, or

by contacting the Company. Annaly manages assets on behalf of

institutional and individual investors worldwide. The Company�s

principal business objective is to generate net income for

distribution to investors from its investment securities and from

its subsidiaries. Annaly is a Maryland corporation that has elected

to be taxed as a real estate investment trust (�REIT�), and

currently has 541,472,181 shares of common stock outstanding. This

news release and our public documents to which we refer contain or

incorporate by reference certain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements which are based on various

assumptions (some of which are beyond our control) may be

identified by reference to a future period or periods or by the use

of forward-looking terminology, such as "may," "will," "believe,"

"expect," "anticipate," "continue," or similar terms or variations

on those terms or the negative of those terms. Actual results could

differ materially from those set forth in forward-looking

statements due to a variety of factors, including, but not limited

to, changes in interest rates, changes in the yield curve, changes

in prepayment rates, the availability of mortgage-backed securities

for purchase, the availability of financing and, if available, the

terms of any financing, changes in the market value of our assets,

changes in business conditions and the general economy, changes in

government regulations affecting our business, our ability to

maintain our qualification as a REIT for federal income tax

purposes, as well as risks associated with the investment advisory

business of our subsidiaries, including the removal by clients of

assets they manage, their regulatory requirements and competition

in the investment advisory business. For a discussion of the risks

and uncertainties which could cause actual results to differ from

those contained in the forward-looking statements, see "Risk

Factors" in our most recent Annual Report on Form 10-K and any

subsequent Quarterly Reports on Form 10-Q. We do not undertake, and

specifically disclaim any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements.

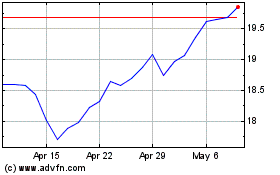

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

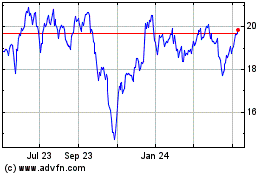

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024