Current Report Filing (8-k)

October 05 2021 - 5:32PM

Edgar (US Regulatory)

0001454742

false

0001454742

2021-09-30

2021-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 30, 2021

GOOD

GAMING, INC.

(Exact

name of registrant as specified in charter)

|

Nevada

|

|

000-53949

|

|

46-3917807

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

415

McFarlan Road, Suite 108

Kennett

Square, PA 19348

(Address

of Principal Executive Offices) (Zip Code)

(888)

295-7279

(Registrant’s

Telephone Number, Including Area Code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.001 par value per share

|

|

GMER

|

|

OTC

Markets

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Agreement.

Employee

Services Agreement with ViaOne Services, LLC

On

September 30, 2021, Good Gaming, Inc. (the “Registrant”) entered into an Employee Services Agreement (the “Services

Agreement”) with ViaOne Services, LLC (“ViaOne”) effective as of September 1, 2021 (the “Effective Date”).

Pursuant to the Services Agreement, ViaOne shall provide to the Registrant services relating to the Registrant’s human resources,

payroll, marketing, advertising, accounting and financing (the “Services”) for a monthly management fee of $42,000 (the “Monthly

Management Fee”) for a period of one year commencing from the Effective Date and automatically renewing for successive terms of

one (1) year each unless either party provides the other party with at least ninety (90) days advance written notice of its intent not

to renew the Services Agreement. In accordance with the terms of the Services Agreement, ViaOne shall have the right to convert part

or all of the Monthly Management Fee into shares of the Registrant’s common stock, par value $0.001 per share (the “Common

Stock”) at the Conversion Rate equal to 125% of the Conversion Amount, divided by the Conversion Price, as those terms are defined

in the Services Agreement.

The

foregoing description of the terms of the Services Agreement is not complete and is qualified in its entirety by reference to the full

text of the Services Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

Unless specified in this Current Report, capitalized terms have the meanings defined in the Services Agreement.

Revolving

Convertible Promissory Note with ViaOne Services, LLC

On

September 30, 2021, the Registrant entered into a revolving convertible promissory note (the “Revolving Note”) with ViaOne.

Under the terms of the Revolving Note, the Registrant promises to pay to ViaOne the principal sum of $1,000,000 or such lesser amount

as may be advanced to the Registrant by ViaOne from time to time, pursuant to the Revolving Note. In consideration for extending the

Revolving Note to the Registrant, the Registrant granted ViaOne warrants to purchase 1,000,000 shares of Common Stock at an exercise

price of $0.42, a premium of 20% to the closing bid price of the Common Stock the trading day prior to the execution of the Revolving

Note. Payment of all obligations under the Revolving Note is secured by a security interested granted to ViaOne by the Registrant in

all of the right, title and interest of the Registrant in all of the assets of the Registrant currently owned or acquired hereafter.

The

Revolving Note (and any unpaid interest or liquidated damages amount) may be converted into shares of Common Stock at a conversion price

of eighty-five percent (85%) of the VWAP for the five (5) trading days immediately prior to the date of the notice of conversion. The

Revolving Note contains customary events of default, including, among others, the failure by the Registrant to make a payment of principal

or interest when due. Following an event of default, ViaOne is entitled to accelerate the entire indebtedness under the Revolving Note.

The restrictions are also subject to certain additional qualifications and carveouts, as set forth in the Revolving Note.

The

foregoing description of the terms of the Revolving Note is not complete and is qualified in its entirety by reference to the full text

of the Revolving Note, which is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated by reference herein. Unless

specified in this Current Report, capitalized terms have the meanings defined in the Revolving Note.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

October 5, 2021

|

|

GOOD

GAMING, INC.

|

|

|

|

|

|

|

By:

|

/s/

David B. Dorwart

|

|

|

Title:

|

David

B. Dorwart

|

|

|

Name:

|

Chief

Executive Officer

|

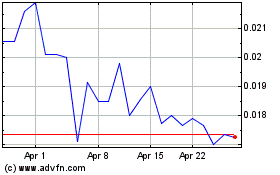

Good Gaming (QB) (USOTC:GMER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Good Gaming (QB) (USOTC:GMER)

Historical Stock Chart

From Apr 2023 to Apr 2024