Current Report Filing (8-k)

October 04 2021 - 7:16AM

Edgar (US Regulatory)

0000908259

false

0000908259

2021-09-30

2021-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported)

September

30, 2021

ONCOTELIC

THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-21990

|

|

13-3679168

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

29397

Agoura Road, Suite 107

Agoura

Hills, CA 91301

(Address

of principal executive offices and Zip Code)

Registrant’s

telephone number, including area code

(650)

635-7000

Not

applicable.

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of class

|

|

Trading

Symbols

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

OTLC

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item

1.01

|

Entry

into a Material Definitive Agreement.

|

On

September 30, 2021, Oncotelic Therapeutics, Inc. (the “Company”) entered into an exclusive License Agreement (the

“Agreement”) with Autotelic, Inc. (“Autotelic”), pursuant to which Autotelic granted Oncotelic, among

other things: (i) the exclusive right and license to certain Autotelic Patents (as defined in the Agreement) and Autotelic Know-How (as

defined in the Agreement); and (ii) a right of first refusal to acquire at least a majority of the outstanding capital stock of Autotelic

prior to Autotelic entering into any transaction that is a financing collaboration, distribution revenues, earn-outs, sales, out-licensing,

purchases, debt, royalties, merger acquisition, change of control, transfer of cash or non-cash assets, disposition of capital stock

by way of tender or exchange offer, partnership or any other joint or collaborative venture, research collaboration, material transfer,

sponsored research or similar transaction or agreements. In exchange for the rights granted to Oncotelic, Autotelic will be entitled

to earn the following milestone payments (collectively, the “Milestone Payments”).

|

Milestones

|

|

Transaction Value

|

|

|

Actions

|

|

|

|

|

|

|

|

|

Tranche 1

|

|

$

|

1,000,000

|

|

|

Upon the earlier to occur of: (i) the Company receiving an investment of at least $20 million, and (ii) the uplisting of the Company’s common stock to any NASDAQ market or the New York Stock Exchange.

|

|

|

|

|

|

|

|

|

|

Tranche 2

|

|

$

|

2,000,000

|

|

|

Upon approval by the United States Food and Drug Administration of the Company’s 505(b)2 application for purposes of treating PD.

|

|

|

|

|

|

|

|

|

|

Tranche 3

|

|

$

|

2,000,000

|

|

|

Upon first patient in (“FPI”) for any clinical trial supporting the use of AL-101 for the treatment of PD or ED.

|

|

|

|

|

|

|

|

|

|

Tranche 4

|

|

$

|

2,500,000

|

|

|

Upon FPI for phase 2 clinical trials supporting the use of AL-101 to treat FSD.

|

|

|

|

|

|

|

|

|

|

Tranche 5

|

|

$

|

2,500,000

|

|

|

Upon FPI for phase 3 clinical trials supporting the use of AL-101 to treat FSD

|

|

|

|

|

|

|

|

|

|

Tranche 6

|

|

$

|

10,000,000

|

|

|

Upon Marketing approval for the use of AL-101 to treat PD.

|

|

|

|

|

|

|

|

|

|

Tranche 7

|

|

$

|

10,000,000

|

|

|

Upon Marketing approval for the use of AL-101 to treat ED.

|

|

|

|

|

|

|

|

|

|

Tranche 8

|

|

$

|

10,000,000

|

|

|

Upon Marketing approval for the use of AL-101 to treat FSD

|

|

|

|

|

|

|

|

|

|

Tranche 9

|

|

$

|

10,000,000

|

|

|

Upon the earlier of: (i) the Company entering into a licensing agreement with a third party for the use of AL-101 for the treatment of PD, ED or FSD with an aggregate licensing value of at least $50 million; and (ii) the Company’s gross revenue derived from sales of AL-101 for the treatment of PD, ED or FSD reaches at least $50.0 million.

|

In

addition to the Milestone Payments, Autotelic will be entitled to royalties equal to 15% of the net sales of any products that incorporate

the Autotelic Patents or Autotelic Know-How.

The

Agreement contains representations, warranties and indemnification provisions of each of the parties thereto that are customary for transactions

of this type.

The

Company’s Chief Executive Officer, Mr. Vuong Trieu, is the majority owner of Autotelic.

The

foregoing description of the Agreement is subject to and qualified in its entirety by reference to the full text of the form of the Agreement,

a copy of which is included as Exhibit 10.1 hereto, and the terms of which are incorporated herein by reference.

|

Item

7.01

|

Regulation

FD Disclosure

|

On

October 4, 2021, the Company released a press release announcing the entry into the Agreement. A copy of the press release is attached

hereto as Exhibit 99.1.

Disclaimer.

The

information in Section 7.01 of this Current Report on Form 8-K, including the information set forth in Exhibit 99.1, is being furnished

and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), nor shall Exhibit 99.1 filed herewith be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

Oncotelic

Therapeutics, Inc.

|

|

|

|

|

|

Date:

October 4, 2021

|

|

/s/

Vuong Trieu

|

|

|

By:

|

Vuong

Trieu

|

|

|

|

Chief

Executive Officer

|

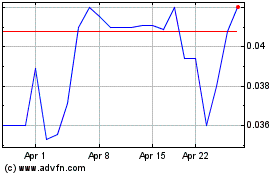

Oncotelic Therapeutics (QB) (USOTC:OTLC)

Historical Stock Chart

From Mar 2024 to Apr 2024

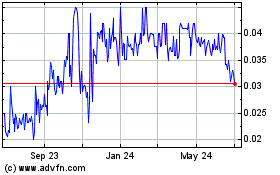

Oncotelic Therapeutics (QB) (USOTC:OTLC)

Historical Stock Chart

From Apr 2023 to Apr 2024