Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

September 30 2021 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No.

__)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

|

Rocky Mountain Chocolate Factory, Inc.

|

(Name of Registrant as Specified In Its Charter)

AB VALUE PARTNERS, LP

AB VALUE MANAGEMENT LLC

BRADLEY RADOFF

ANDREW T. BERGER

RHONDA J. PARISH

MARK RIEGEL

SANDRA ELIZABETH TAYLOR

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

AB Value Partners, LP,

AB Value Management LLC (together with AB Value Partners, LP, “AB Value”), Bradley Radoff, Andrew T. Berger, Rhonda J. Parish,

Mark Riegel and Sandra Elizabeth Taylor filed a definitive proxy statement and accompanying BLUE proxy card with the Securities and Exchange

Commission on September 13, 2021, to be used to solicit votes for the election of their slate of highly-qualified director nominees at

the 2021 annual meeting of shareholders (including any other meeting of shareholders held in lieu thereof, and adjournments, postponements,

reschedulings or continuations thereof, the “Annual Meeting”) of Rocky Mountain Chocolate Factory, Inc., a Delaware corporation,

and for the approval of a business proposal to be presented at the Annual Meeting.

On September 29, 2021, AB Value sent a letter

to Bryan J. Merryman, Rahul Mewawalla, Franklin E. Crail, Brett P. Seabert and Jeffrey R. Geygan, with a copy to Peter R. Gleason, President

and CEO of the National Association of Corporate Directors, a copy of which is filed as Exhibit 1.

Exhibit 1

Andrew Berger

David Polonitza

AB Value Management, LLC

AB Value Partners, LP

208 Lenox Ave., #409

Westfield, NJ 07090

September 29, 2021

VIA EMAIL

|

Bryan J. Merryman

Rahul Mewawalla

Franklin E. Crail

Brett P. Seabert

Jeffrey R. Geygan

|

|

|

Re:

|

The Likely Upcoming Change in Control

|

Dear Messrs. Merryman, Mewawalla, Crail, Seabert

and Geygan:

This is not the time for you

to take drastic measures to flout the will of the stockholders of Rocky Mountain Chocolate Factory, Inc. (the “Company”) in

a transparent attempt to protect your board seats at the expense of both stockholders and the Company.

As you know, AB Value Partners,

LP and AB Value Management LLC (together, “AB Value”) and their affiliates Bradley Radoff, Andrew Berger and Sandra Elizabeth

Taylor (together with AB Value, the “Concerned Shareholders of Rocky Mountain”) have a high probability of winning control

of the Company’s board of directors (the “Board”) at the annual meeting of Company stockholders, scheduled for October

6, 2021, a week from today (the “Annual Meeting”). ISS has endorsed AB Value’s entire slate of directors, noting that

the incumbent Board’s “attempts to compromise [with AB Value] to safeguard the future of the company seem to lack sincerity[,]”

and that that the Company’s “current dysfunction appears to be the result of a mismanaged transition from a founder-led board”—a

board that has overseen “value-destroying acquisition practices, and irregular corporate governance.”

ISS’s concerns are well-founded.

In addition to unilaterally constricting the Board from seven members to six mere weeks before the Annual Meeting, the Board just yesterday

disclosed (1) its settlement of a lawsuit with Immaculate Confection, and (2) its consideration of strategic transactions with Immaculate

Confection to “expand [the Company’s] international franchise network.” As you know, you failed to inform the full Board

about any of these developments. If the Board even met to consider either the settlement or potential transactions with Immaculate Confection,

that is news to AB Value and its Board designee, Andrew Berger.

Running the Company this way

is totally unacceptable. The Annual Meeting is just one week away. Delaware law prohibits you from taking any further actions to impede

the stockholder franchise. As fiduciaries with an unremitting duty of loyalty to the stockholders, your priority should be conducting

a full and fair election free from interference, not entrenching yourselves or lining your pockets using Company resources. Among other

things, this duty requires you to:

(1) Operate the Company under

the current status quo until the stockholders decide the Board’s composition. Committing the Company to any material transactions

or obligations outside the ordinary course of business before the new Board is seated would disenfranchise the stockholders and could

deprive the new Board of its ability to act in accordance with its electoral mandate.

(2) Cease your pattern of

gamesmanship and disenfranchising tactics. Adjourning or postponing the Annual Meeting would be totally unacceptable. The Delaware Court

of Chancery has already taken you to task for this once. See Geser v. Rocky Mountain Chocolate Factory, Inc., C.A. No. 2019-0764-AGB

at *16 (Del. Ch. Nov. 1, 2019) (Transcript).

(3) Take all steps necessary

to disarm any change in control provisions that could penalize stockholders for electing candidates you oppose. Among other things, the

Board should approve AB Value’s slate of directors for purposes of the change in control provisions in the employment agreements

of Messrs. Merryman and Dudley to avoid any Termination Payment in the event of a Triggering Termination. There is absolutely no justification

for Mr. Merryman or Mr. Dudley to walk away from the Company with a windfall consolation prize if the stockholders elect AB Value’s

slate of directors at the Annual Meeting, especially pursuant to a transparently defensive provision that was modified and approved on

February 26, 2019, in the shadow of a potential proxy contest by AB Value. Indeed, the three-member Compensation Committee that approved

these compensation arrangements included Mr. Crail (Mr. Dudley’s former boss and then-CEO) and Mr. Seabert, whose extremely close

ties to Mr. Merryman remained undisclosed to stockholders until a few weeks ago.

AB Value fully intends to

hold you to account for any interference with the stockholder franchise or any disloyalty to the Company or its stockholders between now

and the Annual Meeting.

|

|

Sincerely yours,

|

|

|

|

|

|

/s/ Andrew Berger

|

|

|

Andrew Berger

|

|

|

David Polonitza

|

|

|

AB Value Management, LLC

|

|

|

AB Value Partners, LP

|

|

cc:

|

Peter R. Gleason

|

|

|

President and CEO

|

|

|

National Association of Corporate Directors

|

|

|

1515 N. Courthouse Road, Suite 1200

|

|

|

Arlington, VA 22201

|

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

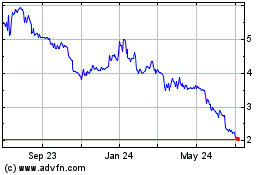

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024