Current Report Filing (8-k)

September 27 2021 - 7:56AM

Edgar (US Regulatory)

LSB INDUSTRIES INC false 0000060714 0000060714 2021-09-22 2021-09-22 0000060714 us-gaap:CommonStockMember 2021-09-22 2021-09-22 0000060714 us-gaap:PreferredStockMember 2021-09-22 2021-09-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): September 27, 2021 (September 22, 2021)

LSB INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-7677

|

|

73-1015226

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

3503 NW 63rd Street, Suite 500, Oklahoma City, Oklahoma

|

|

73116

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (405) 235-4546

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, Par Value $.10

|

|

LXU

|

|

New York Stock Exchange

|

|

Preferred Stock Purchase Rights

|

|

N/A

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Revolver Amendment

On September 22, 2021, LSB Industries, Inc. (the “Company”) and each of the Company’s subsidiaries signatory thereto entered into the Consent and Fourth Amendment to the Third Amended and Restated Loan and Security Agreement (the “Revolver Amendment”), with the lender identified on the signature pages thereto and Wells Fargo Capital Finance, LLC (“Wells Fargo”), as the arranger and administrative agent. The Revolver Amendment amends the Company’s existing Working Capital Revolver to expressly permit the indebtedness contemplated to be incurred under the senior notes described in Item 7.01 below and the liens related thereto, among other things. In addition, the Revolver Amendment provides for the consent of the agent and the required lenders thereunder to (i) the consummation of the Company’s previously announced exchange of its existing Series E-1 and Series F-1 Redeemable Preferred Stock into shares of the Company’s common stock and (ii) the payment of a dividend to holders of the Company’s Series B 12% Cumulative Convertible Preferred Stock and Series D 6% Cumulative Convertible Preferred Stock, in an aggregate amount not to exceed $2,000,000.

A copy of the Revolver Amendment is attached hereto as Exhibit 10.1 and is incorporated herein by reference. The above summary of the Revolver Amendment does not purport to be complete and is qualified in its entirety by reference to the complete text of the Revolver Amendment.

Securities Exchange Agreement Waiver

On September 22, 2021, the Company received a written consent (the “Written Consent”) from LSB Funding LLC (“LSB Funding”) under the Securities Exchange Agreement, dated as of July 19, 2021, by and between the Company and LSB Funding. Under the terms of the Written Consent, LSB Funding consented to the incurrence by the Company and its subsidiaries of up to $500,000,000 of indebtedness in the form of secured bonds and related liens to refinance the Company’s existing 9.625% Senior Secured Notes due 2023, subject to certain conditions.

A copy of the Written Consent will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarterly period ending September 30, 2021.

|

Item 7.01

|

Regulation FD Disclosures

|

On September 27, 2021, the Company issued a press release announcing that it intends to offer, pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended (the “Securities Act”), up to $500 million aggregate principal amount of Senior Secured Notes due 2028, subject to market and other conditions (the “144A Offering”). Copies of the press release announcing the 144A Offering is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In connection with the 144A Offering, the Company disclosed certain information to prospective investors in a preliminary offering circular, dated September 27, 2021. The preliminary offering circular included information that supplements or updates certain prior disclosures of the Company. Such information is attached hereto as Exhibit 99.2 and is being furnished under Item 7.01 of this Current Report on Form 8-K.

The information contained in this Current Report on Form 8-K, including the Exhibits hereto, is neither an offer to sell nor a solicitation of an offer to purchase any of the securities to be offered. The securities to be offered will not be registered under the Securities Act or applicable state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state securities laws.

Forward-Looking Statements

This Current Report on Form 8-K, including the Exhibits attached hereto, includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company makes these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical fact, included in this Current Report on Form 8-K, including the Exhibits hereto, may constitute forward-looking statements. Forward-looking statements include statements about the Company’s expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause actual results to differ include, but are not limited to, (i) the Company’s business plans may change as circumstances warrant and the 144A Offering may not ultimately be completed because of general market conditions or other factors or (ii) any of the risk factors discussed from time to time in each of our documents and reports filed with the Securities and Exchange Commission. Unless required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statement to reflect circumstances or events after the date of this Current Report on Form 8-K.

The information contained in this Item 7.01 and Item 9.01 of this Current Report on Form 8-K and the Exhibits attached hereto is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of such section, nor shall it be deemed incorporated by reference into any filing under the Securities Act, regardless of any incorporation by reference language in any such filing, except as shall be expressly set forth by specific reference to this Item 7.01 or Item 9.01 in such filing.

(d) Exhibits.

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

10.1

|

|

Consent and Fourth Amendment to Third Amended and Restated Loan and Security Agreement, dated as of September 22, 2021, by and among Wells Fargo Capital Finance, LLC, as the arranger and administrative agent, the lenders party thereto, LSB Industries, Inc. and its subsidiaries identified on the signature pages thereto as borrowers and the Company’s subsidiaries identified on the signature pages thereto as guarantors.

|

|

|

|

|

99.1

|

|

Press Release, dated September 27, 2021, announcing the 144A Offering.

|

|

|

|

|

99.2

|

|

Excerpts from preliminary offering circular for the 144A Offering, dated September 27, 2021.

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the XBRL document)

|

Exhibit Index

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

10.1

|

|

Consent and Fourth Amendment to Third Amended and Restated Loan and Security Agreement, dated as of September 22, 2021, by and among Wells Fargo Capital Finance, LLC, as the arranger and administrative agent, the lenders party thereto, LSB Industries, Inc. and its subsidiaries identified on the signature pages thereto as borrowers and the Company’s subsidiaries identified on the signature pages thereto as guarantors.

|

|

|

|

|

99.1

|

|

Press Release, dated September 27, 2021, announcing the 144A Offering.

|

|

|

|

|

99.2

|

|

Excerpts from preliminary offering circular for the 144A Offering, dated September 27, 2021.

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 27, 2021

|

|

|

|

|

LSB INDUSTRIES, INC.

|

|

|

|

|

By:

|

|

/s/ Michael J. Foster

|

|

Name: Michael J. Foster

|

|

Title: Executive Vice President and General Counsel

|

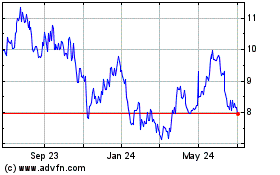

LSB Industries (NYSE:LXU)

Historical Stock Chart

From Mar 2024 to Apr 2024

LSB Industries (NYSE:LXU)

Historical Stock Chart

From Apr 2023 to Apr 2024