Current Report Filing (8-k)

September 23 2021 - 9:22AM

Edgar (US Regulatory)

0000876883

false

--12-31

0000876883

2021-09-23

2021-09-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September

23, 2021

STAGWELL

INC.

(Exact name of Registrant as Specified in Its

Charter)

|

Delaware

|

|

001-13718

|

|

86-1390679

|

|

|

|

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

One

World Trade Center, Floor

65, New

York, NY

10007

(Address of principal

executive offices and zip code)

(646)

429-1800

(Registrant’s Telephone Number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title

of each class

|

Trading

symbol(s)

|

Name

of each exchange on which registered

|

|

Class

A Common Stock, $0.001 par value

|

STGW

|

NASDAQ

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

On September 23, 2021, Stagwell Inc. (the “Company”)

provided separate Notices of Conversion (the “Series 6 Notice” and the “Series

8 Notice,” respectively) to each holder of record of each of (i) the Company’s Series 6 Convertible Preferred Stock,

par value $0.001 per share (the “Series 6 Preferred Stock”), and (ii) the

Company’s Series 8 Convertible Preferred Stock, par value $0.001 per share (the “Series

8 Preferred Stock”). Pursuant to the Series 6 Notice, the 50,000 issued and outstanding shares of Series 6 Preferred Stock

will be converted into 12,086,700 shares of the Company’s Class A common stock, par value $0.001 per share (the “Class

A Common Stock”), in the aggregate, on October 7, 2021 (the “Conversion Date”).

Pursuant to the Series 8 Notice, the 73,849 issued and outstanding shares of Series 8 Preferred Stock will be converted into 20,948,746

shares of Class A Common Stock, in the aggregate, on the Conversion Date.

The shares of Class A Common Stock are being issued in reliance upon

the exemption set forth in Section 3(a)(9) of the Securities Act of 1933, as amended, for securities exchanged by the Company and existing

security holders where no commission or other remuneration is paid or given directly or indirectly by the Company for soliciting such

exchange.

|

Item 3.03.

|

Material Modification of Rights of Security Holders.

|

The information set forth under Items 3.02 and 5.03 of this

Current Report on Form 8-K is incorporated by reference into this Item 3.03.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws.

|

On September 22, 2021, in order to simplify the Company’s capital

structure and thereby improve the marketability of its common stock to investors, (i) the Company’s board of directors (acting

with the unanimous approval and upon the unanimous recommendation of the independent and disinterested members of the Company’s

board of directors) and the holder of all of the issued and outstanding shares of Series 6 Preferred Stock approved an amendment to the

Amended and Restated Certificate of Designation of the Series 6 Preferred Stock (the “Series

6 Amendment”), and (ii) the Company’s board of directors (acting with the unanimous approval and upon the unanimous

recommendation of the independent and disinterested members of the Company’s board of directors) and the holders of all of the

issued and outstanding shares of Series 8 Preferred Stock approved an amendment to the Certificate of Designation of the Series 8 Preferred

Stock (the “Series 8 Amendment”). The Series 6 Amendment and the Series 8

Amendment provided, among other things, for the removal of certain ownership-based limitations on the conversion of shares of Series

6 Preferred Stock and Series 8 Preferred Stock, respectively, into shares of Class A Common Stock.

On September 23, 2021, the Company filed

with the Secretary of State of the State of Delaware (i) a Certificate of Amendment to the Amended and Restated Certificate of

Designation of the Series 6 Preferred Stock (the “Series 6 Certificate”)

relating to the Series 6 Amendment and (ii) a Certificate of Amendment to the Certificate of Designation of the Series 8 Preferred

Stock (the “Series 8 Certificate”) relating to the Series 8 Amendment.

The Series 6 Certificate and the Series 8 Certificate are attached hereto as Exhibits 3.1 and 3.2, respectively, and incorporated

herein by reference.

The foregoing description of the Series 6 Amendment and the Series

8 Amendment is not complete and is qualified in its entirety by reference to the Series 6 Certificate and the Series 8 Certificate.

On September 23, 2021, the Company issued a press release announcing

the conversion of the Series 6 Preferred Stock and the Series 8 Preferred Stock. A copy of this press release is filed herewith as Exhibit

99.1 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 23, 2021

|

|

STAGWELL INC.

|

|

|

|

|

|

|

By:

|

/s/

Frank Lanuto

|

|

|

|

Frank

Lanuto

|

|

|

|

Chief

Financial Officer

|

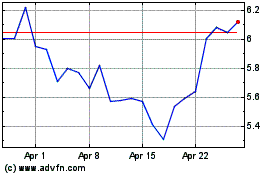

Stagwell (NASDAQ:STGW)

Historical Stock Chart

From Mar 2024 to Apr 2024

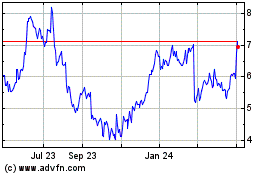

Stagwell (NASDAQ:STGW)

Historical Stock Chart

From Apr 2023 to Apr 2024