Current Report Filing (8-k)

September 23 2021 - 8:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 22, 2021

FLUX

POWER HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

001-31543

|

|

86-0931332

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

2685

S. Melrose Drive, Vista, California

|

|

92081

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

877-505-3589

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.001 par value

|

|

FLUX

|

|

Nasdaq

Capital Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item

2.02

|

Results

of Operations and Financial Condition.

|

On

September 22, 2021, the Company issued a press release announcing, among other things, limited financial and operational information

for its fourth quarter and full fiscal year ended June 30, 2021 and provided certain forward-looking performance estimates. The full

text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The projections constituting the performance

estimates included in the release involve risks and uncertainties, the outcome of which cannot be foreseen at this time and, therefore,

actual results may vary materially from these forecasts. In this regard, see the information included in the release under the caption

“Forward-Looking Statements.”

|

Item

7.01

|

Regulation

FD Disclosure.

|

The

information under Item 2.02 above is incorporated herein by reference. On September 23, 2021, the Company issued a press release announcing

a Registered Direct Offering. A copy of the press release is attached as Exhibit 99.2 hereto.

The

information reported under Items 2.02 and 7.01 in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2,

are being “furnished” and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general

incorporation language in such filing.

Forward-Looking

Statements

The

statements in this Report on Form 8-K related to the completion of the Registered Direct Offering are “forward-looking” statements.

These forward-looking statements are based upon the Company’s current expectations. Forward-looking statements involve risks and

uncertainties. The Company’s actual results and the timing of events could differ materially from those anticipated in such forward-looking

statements as a result of these risks and uncertainties, which include, without limitation, risks related to market conditions and the

satisfaction of customary closing conditions related to the Registered Direct Offering. There can be no assurance that the Company will

be able to complete the Registered Direct Offering on the anticipated terms, or at all.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

Flux

Power Holdings, Inc.

|

|

|

a

Nevada corporation

|

|

|

|

|

|

|

By:

|

/s/

Chuck Scheiwe

|

|

|

|

Chuck

Scheiwe, Chief Financial Officer

|

Dated:

September 23, 2021

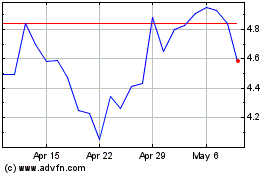

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

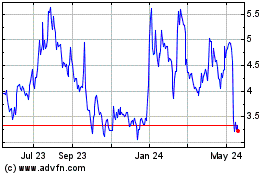

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Apr 2023 to Apr 2024