Securities Registration Statement (s-1/a)

September 21 2021 - 4:20PM

Edgar (US Regulatory)

As

filed with the U.S. Securities and Exchange Commission on September 21, 2021

Registration

No. 333-259465

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT NO. 1 TO

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Harbor

Custom Development, Inc.

(Exact

Name of Registrant as Specified in Its Charter)

|

Washington

|

|

1531

|

|

46-4827436

|

|

(State

or Other Jurisdiction of

Incorporation

or Organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

(I.R.S.

Employer

Identification

Number)

|

11505

Burnham Dr., Suite 301

Gig

Harbor, Washington 98332

(253)

649-0636

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Sterling

Griffin, Chief Executive Officer and President

Harbor

Custom Development, Inc.

11505

Burnham Dr., Suite 301

Gig

Harbor, Washington 98332

(253)

649-0636

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

|

Lynne

Bolduc, Esq.

|

|

Anthony

Marsico, Esq.

|

|

Fitzgerald

Yap Kreditor, LLP

|

|

Dorsey

& Whitney LLP

|

|

2

Park Plaza, Suite 850

|

|

51

West 52nd Street

|

|

Irvine,

California 92614

|

|

New

York, NY 10019

|

|

Tel:

(949) 788-8900

|

|

Tel:

(212) 415-9214

|

|

Fax:

(949) 788-8980

|

|

Fax:

(212) 953-7201

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

|

☐

|

|

Accelerated

filer

|

|

☐

|

|

Non-accelerated filer

|

|

☐

|

|

Smaller

reporting company

|

|

☒

|

|

|

|

|

|

Emerging

growth company

|

|

☒

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

|

|

CALCULATION OF REGISTRATION FEE

|

|

|

Title

of Each Class of Securities to be Registered(1)

|

|

Proposed

Maximum

Aggregate Offering

Price(2)

|

|

|

Amount of

Registration

Fees

|

|

|

Series A Cumulative Convertible Preferred Stock(3)

|

|

$

|

34,500,000

|

|

|

$

|

3,764

|

|

|

Representative’s Warrants to purchase Common Stock(4)

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Common Stock underlying Series A Cumulative Convertible Preferred Stock and Representative Warrants(5)(6)

|

|

$

|

36,400,260

|

|

|

$

|

3,972

|

|

|

TOTAL

|

|

$

|

70,900,260

|

|

|

$

|

7,736

|

(7)

|

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares of Common Stock registered

hereby also include an indeterminate number of additional shares of Common Stock as may from time to time become issuable by reason

of stock splits, stock dividends, recapitalizations, or other similar transactions.

|

|

|

(2)

|

Calculated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act.

|

|

|

(3)

|

Includes

additional Series A Preferred Shares issuable as part of the over-allotment option.

|

|

|

(4)

|

In

accordance with Rule 457(i) under the Securities Act, no separate registration fee is required with respect to the Warrants registered

hereby.

|

|

|

(5)

|

Calculated

in accordance with Rule 457(g) of the Securities Act, based upon the initial exercise price of the Warrants.

|

|

|

(6)

|

Includes

additional shares of Common Stock issuable upon conversion of the Series A Preferred

Shares at a price of $4.50 per share and additional shares of Common Stock issuable

upon exercise of the Representative’s Warrants.

|

|

|

(7)

|

Previously

paid.

|

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Act or until the registration statement shall become effective on such date as the Commission,

acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Harbor Custom Development, Inc. is filing this

Amendment No. 1 to its Registration Statement on Form S-1 (File No. 333-259465) as an exhibits-only filing. Accordingly, this amendment

consists only of the facing page, this explanatory note, Item 16(a) of Part II of the Registration Statement, the signature page to the

Registration Statement, and the filed exhibits. The remainder of the Registration Statement is unchanged and has therefore been omitted.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

16. Exhibits and Financial Statement Schedules.

(a)

The following exhibits are filed as part of this Registration Statement and are numbered in accordance with Item 601 of Regulation S-K:

EXHIBIT

INDEX

|

Exhibit

Number

|

|

Description

|

|

Form

|

|

Exhibit

|

|

Filing

Date

|

|

Filed

Herewith

|

|

1.1

|

|

Form of Underwriting Agreement (including Form of Underwriter’s Representative’s Warrant Agreement) between the Registrant and ThinkEquity

|

|

|

|

|

|

|

|

X

|

|

3.1

|

|

Certificate of Conversion and Articles of Incorporation of the Registrant filed with the Washington Secretary of State on October 1, 2018

|

|

S-1

|

|

3.1

|

|

03/31/2020

|

|

|

|

3.2

|

|

Amended and Restated Articles of Incorporation of the Registrant filed with the Washington Secretary of State on December 7, 2018

|

|

S-1

|

|

3.2

|

|

03/31/2020

|

|

|

|

3.3

|

|

Amended and Restated Articles of Incorporation of the Registrant filed with the Washington Secretary of State on August 1, 2019

|

|

S-1

|

|

3.3

|

|

03/31/2020

|

|

|

|

3.4

|

|

2nd Amended and Restated Bylaws of the Registrant, dated January 15, 2020

|

|

S-1

|

|

3.4

|

|

03/31/2020

|

|

|

|

3.5

|

|

Amended Articles of Incorporation of the Registrant filed with the Washington Secretary of State on April 16, 2020

|

|

S-1/A

|

|

3.5

|

|

04/28/2020

|

|

|

|

3.6

|

|

Certificate of Designation of 8.0% Series A Cumulative Convertible Preferred Stock, filed on June 8, 2021

|

|

8-K

|

|

3.1

|

|

06/08/2021

|

|

|

|

3.7

|

|

Certificate of Amendment of Certificate of Designation of 8.0% Series A Cumulative Convertible Preferred Stock, filed on June 8, 2021

|

|

S-1

|

|

3.7

|

|

09/10/2021

|

|

|

|

4.1

|

|

2018 Incentive and Non-Statutory Stock Option Plan to Employees, Directors, and Consultants of Harbor Custom Homes, Inc., dated November 19, 2018

|

|

S-1

|

|

4.1

|

|

03/31/2020

|

|

|

|

4.2

|

|

2020 Restricted Stock Plan, dated October 13, 2020

|

|

10-Q

|

|

10.1

|

|

11/16/2020

|

|

|

|

4.3

|

|

Form of Warrant Agency Agreement

|

|

S-1

|

|

4.4

|

|

04/14/2021

|

|

|

|

4.4

|

|

Form of Representative’s Warrant (included in Exhibit 1.1)

|

|

|

|

|

|

|

|

X

|

|

5.1

|

|

Opinion of FitzGerald Yap Kreditor, LLP

|

|

|

|

|

|

|

|

X

|

|

10.1

|

|

Service Agreement between Registrant and Hanover International, Inc., dated May 1, 2018 and Addendum to Service Agreement between Registrant and Hanover International, Inc., dated November 29, 2018

|

|

S-1

|

|

10.1

|

|

03/31/2020

|

|

|

|

10.2

|

|

Independent Contractor Agreement between Registrant and Richard Schmidtke dated, August 21, 2018 and Addendum to Independent Contractor’s Agreement between the Registrant and Richard Schmidtke, dated September 30, 2018

|

|

S-1

|

|

10.2

|

|

03/31/2020

|

|

|

|

10.3

|

|

Purchase and Sale Agreement between the Registrant and Lennar Northwest, Inc., dated August 23, 2019

|

|

S-1

|

|

10.3

|

|

03/31/2020

|

|

|

|

10.4

|

|

Director Agreement between Registrant and Richard Schmidtke, dated October 17, 2018

|

|

S-1

|

|

10.4

|

|

03/31/2020

|

|

|

|

10.5

|

|

RWC Limited Warranty Program Membership Agreement between Registrant and Residential Warranty Company, LLC and Western Pacific Mutual Insurance Company, dated October 18, 2018

|

|

S-1

|

|

10.5

|

|

03/31/2020

|

|

|

|

10.6

|

|

Independent Director Agreement between the Registrant and Robb Kenyon, dated November 1, 2018

|

|

S-1

|

|

10.6

|

|

03/31/2020

|

|

|

|

10.7

|

|

Executive Employment Agreement between the Registrant and Sterling Griffin, effective January 1, 2019

|

|

S-1

|

|

10.7

|

|

03/31/2020

|

|

|

|

10.8

|

|

Lease Agreement between Burnham Partners, LLC and Registrant, dated December 19, 2017

|

|

S-1

|

|

10.8

|

|

03/31/2020

|

|

|

|

10.9

|

|

Lease Agreement between Burnham Partners, LLC and Registrant, dated May 30, 2018

|

|

S-1

|

|

10.9

|

|

03/31/2020

|

|

|

|

10.10

|

|

Purchase and Sale Agreement between the Registrant and Burnham Partners LLC, dated March 9, 2021

|

|

10-K

|

|

10.10

|

|

03/31/2021

|

|

|

|

10.11

|

|

Independent Director Agreement with Larry Swets, dated March 22, 2020

|

|

S-1

|

|

10.11

|

|

03/31/2020

|

|

|

|

10.12

|

|

SoundEquity, Inc. Loan Package, dated November 13, 2019

|

|

S-1/A

|

|

10.12

|

|

04/28/2020

|

|

|

|

10.13

|

|

Form of Deed of Trust for PBRELF I, LLC

|

|

S-1/A

|

|

10.13

|

|

04/28/2020

|

|

|

|

10.14

|

|

Debt Conversion Agreement between Olympic Views, LLC and Registrant, dated May 15, 2020

|

|

S-1/A

|

|

10.14

|

|

06/01/2020

|

|

|

|

10.15

|

|

Vacant Lot Purchase and Sale Agreement between Olympic Views, LLC and Registrant, dated February 14, 2020

|

|

S-1/A

|

|

10.15

|

|

06/01/2020

|

|

|

|

10.16

|

|

Indemnification Agreement between Registrant and Larry Swets, dated June 1, 2020

|

|

S-1/A

|

|

10.17

|

|

06/19/2020

|

|

|

|

10.17

|

|

Agreement of Sale of Future Receivables between Registrant and Libertas Funding, LLC, dated August 12, 2020

|

|

S-1

|

|

10.17

|

|

01/07/2021

|

|

|

|

10.18

|

|

Lease/Rental Agreement between the Registrant and Olympic Views, LLC, dated January 28, 2019.

|

|

S-1

|

|

10.23

|

|

01/07/2021

|

|

|

|

10.19

|

|

Offer of Employment to Jeff Habersetzer from the Registrant dated December 18, 2019

|

|

S-1

|

|

10.24

|

|

01/07/2021

|

|

|

|

10.20

|

|

Offer Letter to Lynda Meadows, dated June 7, 2020

|

|

8-K

|

|

10.1

|

|

09/08/2020

|

|

|

|

10.21

|

|

Lease Agreement between Burnham Partners, LLC and Registrant, dated February 18, 2021

|

|

10-K

|

|

10.21

|

|

03/31/2021

|

|

|

|

10.22

|

|

Lease Agreement between Burnham Partners, LLC and Registrant dated February 18, 2021

|

|

10-K

|

|

10.22

|

|

03/31/2021

|

|

|

|

10.23

|

|

Purchase and Sale Agreement between the Registrant and Lennar Northwest, Inc., dated November 18, 2020

|

|

10-K

|

|

10.23

|

|

03/31/2021

|

|

|

|

10.24

|

|

Purchase and Sale Agreement between the Registrant and Lennar Northwest, Inc., dated February 16, 2021

|

|

10-K

|

|

10.24

|

|

03/31/2021

|

|

|

|

10.25

|

|

SoundEquity, Inc. Loan Package, dated October 4-5, 2021

|

|

10-K

|

|

10.25

|

|

03/31/2021

|

|

|

|

10.26

|

|

Promissory Note between Registrant and Sound Equity, Inc., dated January 22, 2021

|

|

10-K

|

|

10.26

|

|

03/31/2021

|

|

|

|

21.1

|

|

Subsidiaries of Registrant

|

|

S-1

|

|

21.1

|

|

01/07/2021

|

|

|

|

23.1

|

|

Consent of Rosenberg Rich Baker Berman, P.A.

|

|

|

|

|

|

|

|

X

|

|

23.2

|

|

Consent of FitzGerald Yap Kreditor LLP (included in Exhibit 5)

|

|

|

|

|

|

|

|

|

|

24.1

|

|

Power of Attorney (see signature page of Registration Statement on Form S-1)

|

|

S-1

|

|

24.1

|

|

04/14/2021

|

|

|

|

101.INS

|

|

Inline

XBRL Instance Document — the instance document does not appear in the Interactive Data File because its XBRL tags are embedded

within the Inline XBRL document

|

|

|

|

|

|

|

|

|

|

101.SCH

|

|

Inline

XBRL Taxonomy Extension Schema Document

|

|

|

|

|

|

|

|

X

|

|

101.CAL

|

|

Inline

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

|

|

|

|

|

|

X

|

|

101.LAB

|

|

Inline

XBRL Taxonomy Extension Label Linkbase Document

|

|

|

|

|

|

|

|

X

|

|

101.PRE

|

|

Inline

XBRL Taxonomy Extension Presentation Linkbase Document

|

|

|

|

|

|

|

|

X

|

|

101.DEF

|

|

Inline

XBRL Taxonomy Extension Definition Linkbase Document

|

|

|

|

|

|

|

|

X

|

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant has duly caused this Registration Statement to be signed on its behalf

by the undersigned, thereunto duly authorized, in the City of Gig Harbor, State of Washington, on September 21, 2021.

|

|

Harbor

Custom Development, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Sterling Griffin

|

|

|

|

Sterling

Griffin

|

|

|

|

Chief

Executive Officer, President, and Chairman of the Board of Directors

|

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement on Form S-1 has been signed by the following

persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Sterling Griffin

|

|

Chief

Executive Officer, President, and Chairman of the Board of Directors

|

|

September

21, 2021

|

|

Sterling

Griffin

|

|

(Principal

Executive Officer)

|

|

|

|

|

|

|

|

|

|

*

|

|

Interim

Chief Financial Officer

|

|

September

21, 2021

|

|

Tim

O’Sullivan

|

|

(Principal

Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September

21, 2021

|

|

Karen

Bryant

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September

21, 2021

|

|

Dennis

Wong

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September

21, 2021

|

|

Larry

Swets

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September

21, 2021

|

|

Wally

Walker

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September

21, 2021

|

|

Richard

Schmidtke

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September

21, 2021

|

|

Chris

Corr

|

|

|

|

|

|

* By:

|

/s/ Sterling

Griffin

|

|

|

|

Sterling Griffin

|

|

|

|

Attorney-in-Fact

|

|

Harbor Custom Development (NASDAQ:HCDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

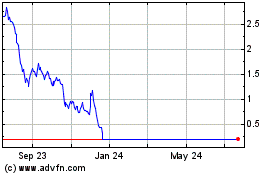

Harbor Custom Development (NASDAQ:HCDI)

Historical Stock Chart

From Apr 2023 to Apr 2024