Concerned Shareholders of Rocky Mountain Comment on the Board’s Last-Minute Attempt to Circumvent the Shareholder Franchise

September 20 2021 - 5:53PM

Business Wire

Believes Announced Board Contraction

Raises Substantial Questions About Mismanagement, Entrenchment and

Fiduciary Duties

Vote the BLUE

Card to Elect the Concerned Shareholders of Rocky Mountain’s

Director Candidates

AB Value Management LLC, collectively with its affiliates (“AB

Value”), and the other participants in this solicitation

(collectively, the “Concerned Shareholders of Rocky Mountain”)

representing approximately 14.59% of the outstanding shares of

Rocky Mountain Chocolate Factory, Inc. (NASDAQ: RMCF) (the

“Company”), today remarked on the Company’s latest entrenchment

maneuver—a reduction to the size of its Board of Directors (the

“Board”) approximately two weeks before the Company’s 2021 Annual

Meeting of Shareholders (the “2021 Annual Meeting”).

The Concerned Shareholders of Rocky Mountain were startled to

learn that the Board decided to shrink the number of Board seats up

for election from seven to six in reaction to the recent vacancy

created by Mary Kennedy Thompson’s resignation from the Board. The

group strenuously objects to the Board’s unilateral decision

approximately two weeks before the annual shareholder vote. The

Concerned Shareholders of Rocky Mountain believe that, facing a

potential loss of an incumbent majority of director seats, the

Board chose desperation over proper governance. The Board should

have waited for the shareholders, the true owners of the Company,

to vote at the 2021 Annual Meeting and decide what should happen

with the vacant seat.

“We cannot comprehend how a self-described ‘best-in-class’ Board

can justify cutting the number of director seats up for contested

election, particularly just about two weeks away from the 2021

Annual Meeting,” commented Andrew T. Berger, Managing Member of AB

Value. “We believe that despite the Board’s excuse for its

decision, shareholders know the likely real reason and motivation—

preventing the Concerned Shareholders of Rocky Mountain from

winning Board seats.”

This latest decision seems to continue the Company’s long

history of poor corporate governance practices, which include: a)

willingness to deploy extreme measures such as delaying the annual

meeting date and requiring a court order to restrict further

postponement, b) maintaining a ten-year poison pill without

shareholder approval, and then failing to include its removal on

the most recent proxy, c) administering questionable compensation

governance and oversight as evidenced by consistent low vote

support, and d) adopting a reluctant and reactionary approach to

board refreshment which has been sparingly achieved through

shareholder settlements and strategic partnership agreements. Given

this history, we believe that the incumbent Board hopes to find a

director supportive of its side and likely avoid the accountability

associated with having highly-qualified independent directors that

prioritize shareholders’ interests and resist the status quo.

Inconsistent with the Company’s claims of “good faith engagement

with AB Value,” the Company never reached out to the Concerned

Shareholders of Rocky Mountain to see if one of their nominees

would agree to serve on both slates when a vacancy was created. The

Concerned Shareholders of Rocky Mountain are perplexed as to why

the Board did not ask to include one of the group’s four

highly-qualified nominees, particularly after acknowledging that at

least one of the group’s nominees, Mark Riegel, was among the

finalists previously and “seriously considered” by the Special

Committee of the Board. The Concerned Shareholders of Rocky

Mountain believe that the only thing shareholders can know for sure

from the Company’s recent calls for “refreshment” and newfound

commitment to governance is that the Company wants the Board, and

not shareholders, to decide who leaves and who joins the Board.

Ultimately, this Board contraction tactic disenfranchises

shareholders and is a poor substitute compared to the option of

genuine, immediate change. We strongly encourage shareholders to

act now and vote FOR the Concerned Shareholders of Rocky

Mountain’s four candidates—Andrew T. Berger, Mark Riegel, Sandra

Elizabeth Taylor and Rhonda J. Parish—on the BLUE proxy card

and discard any white proxy card received from the Company.

Important Additional Information

AB Value Partners, LP and AB Value Management LLC, Andrew T.

Berger, Bradley Radoff, Rhonda J. Parish, Mark Riegel, and Sandra

Elizabeth Taylor (collectively, the “Participants”) have filed a

definitive proxy statement and an accompanying BLUE proxy

card with the SEC to solicit proxies from shareholders of the

Company for use at the 2021 Annual Meeting. THE PARTICIPANTS

STRONGLY ADVISE ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY

STATEMENT AND OTHER PROXY MATERIALS BECAUSE THEY CONTAIN IMPORTANT

INFORMATION. Such proxy materials are available at no charge on the

SEC’s website at http://www.sec.gov. In addition, the Participants

in this proxy solicitation will provide copies of the proxy

statement without charge, upon request. Requests for copies should

be directed to the Participants’ proxy solicitor.

Certain Information Regarding the Participants

The Participants in the proxy solicitation are: AB Value

Partners, LP, AB Value Management LLC, Andrew T. Berger, Bradley

Radoff, Rhonda J. Parish, Mark Riegel, and Sandra Elizabeth Taylor.

As of the date hereof, AB Value Partners, LP directly owns 224,855

shares of common stock, $0.001 par value per share of the Company

(“Common Stock”). As of the date hereof, AB Value Management LLC

directly owns 235,334 shares of Common Stock. As of the date

hereof, Mr. Radoff directly owns 433,624 shares of Common Stock. As

of the date hereof, none of Mr. Berger, Ms. Parish, Mr. Riegel, or

Ms. Taylor directly own any shares of Common Stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210920005945/en/

John Glenn Grau InvestorCom LLC (203) 295-7841

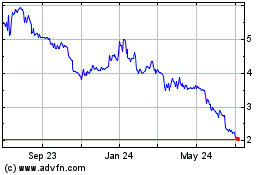

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024