Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-252073 and 333-249558

PROSPECTUS SUPPLEMENT NOS. 7 AND 6

(to Prospectuses dated June 25, 2021 and June 25, 2021)

Clover Health Investments, Corp.

________________________________

This prospectus supplement updates and supplements the prospectuses dated June 25, 2021 and June 25, 2021 (the "Prospectuses"), which form a part of our registration statements on Form S-1 (No. 333-252073 and 333-249558, respectively) (the “Registration Statements”). This prospectus supplement is being filed to update and supplement the information in the Prospectuses with the information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission on September 14, 2021 (the “Report”). Accordingly, we have attached the Report to this prospectus supplement.

Our Class A common stock is listed on the Nasdaq Global Select Market under the symbol “CLOV.” On September 13, 2021, the last reported sales price of our Class A common stock was $8.37 per share.

This prospectus supplement should be read in conjunction with the Prospectuses. This prospectus supplement updates and supplements the information in the Prospectuses. If there is any inconsistency between the information in either of the Prospectuses and this prospectus supplement, you should rely on the information in this prospectus supplement.

This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectuses.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and, as such, have elected to comply with certain reduced disclosure and regulatory requirements.

________________________________

Investing in our securities involves risks. See the section entitled “Risk Factors” in each of the Prospectuses, and under similar headings in any further amendments or supplements to the Prospectuses, to read about factors you should consider before buying our securities.

________________________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectuses is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is September 14, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 14, 2021

CLOVER HEALTH INVESTMENTS, CORP.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-39252

|

98-1515192

|

|

(State or Other Jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of Incorporation)

|

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

725 Cool Springs Boulevard, Suite 320

|

|

|

|

Franklin, Tennessee

|

|

37607

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (201) 432-2133

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading

|

|

|

|

Title of each class

|

|

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.0001 per share

|

|

CLOV

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On September 14, 2021, Clover Health Investments, Corp. (the “Company”) issued a press release announcing the results of the completed redemption of all of its outstanding public and private warrants to purchase shares of the Company's common stock, par value $0.0001 per share, that were issued under the Warrant Agreement, dated as of April 21, 2020, by and between the Company (f/k/a Social Capital Hedosophia Holdings Corp. III) and Continental Stock Transfer & Trust Company, as warrant agent. A copy of the press release is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) List of Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

|

99.1

|

Press release, dated September 14, 2021

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clover Health Investments, Corp.

|

|

|

|

|

|

|

|

Date:

|

September 14, 2021

|

|

By:

|

/s/ Gia Lee

|

|

|

|

|

Name:

|

Gia Lee

|

|

|

|

|

Title:

|

General Counsel and Corporate Secretary

|

|

|

|

|

|

|

Clover Health Investments, Corp. Announces the Results of the

Completed Redemption of All Outstanding Warrants

NASHVILLE, Tenn., September 14, 2021 (GLOBE NEWSWIRE) -- Clover Health Investments, Corp. (Nasdaq: CLOV), ("Clover Health" or the "Company"), a technology company committed to improving health equity for America’s underserved seniors, today announced the results of the completed redemption of all of its outstanding warrants (the "Public Warrants") to purchase shares of the Company's common stock, par value $0.0001 per share (the "Common Stock"), that were issued under the Warrant Agreement, dated April 21, 2020, by and between the Company (f/k/a Social Capital Hedosophia Holdings Corp. III) and Continental Transfer & Trust Company (the "Warrant Agent"), as warrant agent (the "Warrant Agreement"), as part of the units sold in the Company's initial public offering (the "IPO"), and all of the Company's outstanding warrants to purchase Common Stock that were issued under the Warrant Agreement in a private placement simultaneously with the IPO (the "Private Warrants and, together with the Public Warrants, the "Warrants").

On July 22, 2021, the Company issued a press release stating that it would redeem all of its outstanding Warrants that remained outstanding on the redemption date for a redemption price of $0.10 per Warrant. On August 25, 2021, the Company announced that it was extending the period during which the holders of the Public Warrants could exercise such warrants to 5:00 p.m. New York City time on September 9, 2021.

In connection with the redemption, 33,535 Public Warrants were exercised for cash at an exercise price of $11.50 per share of Common Stock, and 26,716,041 were exercised on a cashless basis in exchange for an aggregate of 6,651,933 shares of Common Stock, in each case in accordance with the terms of the Warrant Agreement, representing approximately 97% of the Public Warrants. In addition, all of the Private Warrants were exercised on a cashless basis in exchange for an aggregate of 2,722,399 shares of Common Stock, in accordance with the terms of the Warrant Agreement. Total cash proceeds generated from exercises of the Warrants were $385,653. As of September 13, 2021, the Company had no Warrants and 253,096,849 shares of Class A Common Stock outstanding.

In connection with the redemption, the Public Warrants stopped trading on the Nasdaq Global Select Market and were delisted. The redemption had no effect on the trading of the Company's Class A Common Stock, which continues to trade on the Nasdaq Global Select Market under the symbol "CLOV."

About Clover Health

Clover Health (Nasdaq: CLOV) is a next-generation risk-bearing organization aiming to achieve health equity for all Americans. While our mission is to improve every life, we particularly focus on seniors who have historically lacked access to affordable high quality healthcare.

Contact Information

Investor Relations:

Derrick Nueman

investors@cloverhealth.com

Press Contact:

Andrew Still-Baxter

press@cloverhealth.com

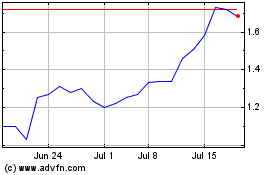

Clover Health Investments (NASDAQ:CLOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

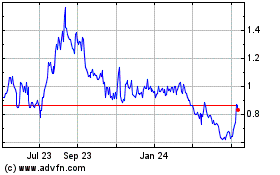

Clover Health Investments (NASDAQ:CLOV)

Historical Stock Chart

From Apr 2023 to Apr 2024