Statement of Changes in Beneficial Ownership (4)

September 10 2021 - 4:53PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

SOFTBANK GROUP CORP |

2. Issuer Name and Ticker or Trading Symbol

T-Mobile US, Inc.

[

TMUS

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

TOKYO PORTCITY TAKESHIBA, 1-7-1 KAIGAN |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/8/2021 |

|

(Street)

MINATO-KU TOKYO, M0 105-7537

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Forward sale contract (obligation to sell) | (1)(2)(3)(4) | 9/8/2021 | | J/K (1)(2)(3)(4) | | 17935000 (1) | | (1)(2)(3)(4) | 6/25/2024 | Common Stock | 17935000 (1) | (1)(2)(3)(4) | 17935000 (1) | I | By: Delaware Project 6 L.L.C. |

| Explanation of Responses: |

| (1) | On September 8, 2021, Delaware Project 6 L.L.C. ("Project 6 LLC") entered into master confirmations under Rule 144 under the Securities Act of 1933, as amended, in respect of two variable prepaid forward sale contracts (the "Forward Contracts") with unaffiliated dealers covering up to a maximum of 17,935,000 shares of the Issuer's common stock (the "Subject Shares"). The Forward Contracts provide for cash settlement based on the average of the daily volume-weighted average trading prices of the Issuer's common stock over the 20 trading day period beginning on May 29, 2024 (the "Settlement Price"). Project 6 LLC has the option to elect to settle the Forward Contracts on a physical basis. |

| (2) | In exchange for entering into the Forward Contracts and assuming the obligations thereunder, Project 6 will receive a cash payment of $1,809,096,276.00. |

| (3) | The cash equivalent to the value of the Subject Shares to be delivered to the dealers on the Settlement Date is to be determined as follows: (a) if the Settlement Price is equal to or less than $116.388 per Share (the "Forward Floor Price"), Project 6 LLC will deliver to the dealers the cash equivalent value of the Subject Shares based on the Settlement Price; (b) if the Settlement Price is between the Forward Floor Price and $161.650 per Share (the "Forward Cap Price"), Project 6 LLC will deliver to the dealers the cash equivalent value of the Subject Shares based on the Settlement Price, multiplied by a fraction, (i) the numerator of which is the Forward Floor Price and (ii) the denominator of which is the Settlement Price; and (c) if the Settlement Price is greater than the Forward Cap Price, |

| (4) | (Continued from footnote 3) Project 6 LLC will deliver to the dealers the cash equivalent value of the Subject Shares based on the Settlement Price multiplied by a fraction (i) the numerator of which is the sum of (x) the Forward Floor Price and (y) the Settlement Price minus the Forward Cap Price, and (ii) the denominator of which is the Settlement Price. |

Remarks:

Marcelo Claure, an executive officer of SoftBank Group Corp. is a member of the Board of Directors of the Issuer. As a result each of the Reporting Persons may be a director by deputization for Section 16 purposes. Mr. Claure disclaims beneficial ownership of the shares of common stock reported in this filing, except to the extent of his pecuniary interest therein. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

SOFTBANK GROUP CORP

TOKYO PORTCITY TAKESHIBA

1-7-1 KAIGAN

MINATO-KU TOKYO, M0 105-7537 | X |

|

|

|

Delaware Project 6 L.L.C.

1 CIRCLE STAR WAY 4F

SAN CARLOS, CA 94070 | X |

|

|

|

Signatures

|

| /s/ Natsuko Ohga, Head of Corporate Legal Department of SOFTBANK GROUP CORP. | | 9/10/2021 |

| **Signature of Reporting Person | Date |

| /s/ Stephen Lam, Manager of DELAWARE PROJECT 6 L.L.C | | 9/10/2021 |

| **Signature of Reporting Person | Date |

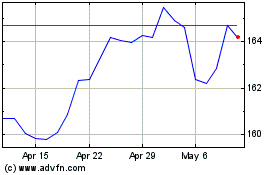

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

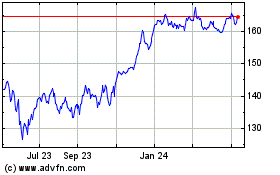

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024