Current Report Filing (8-k)

September 02 2021 - 3:41PM

Edgar (US Regulatory)

false000182928000018292802021-09-012021-09-01

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 1, 2021

FORIAN INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-40146

|

|

85-3467693

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

41 University Drive,

Suite 400, Newtown,

PA

|

|

18940

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (267) 757-8707

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

FORA

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On September 1, 2021, Forian Inc. (the “

Company”) entered into a convertible note purchase

agreement (the “

Note Purchase Agreement”) with certain accredited investors and a director of the Company (the “

Investors”), pursuant to which the Company will issue at 100% of par value $24,000,000 in aggregate principal balance of

3.5% Convertible Promissory Notes due 2025 (the “

Notes”), convertible into (i) shares of the Company’s common stock, par value $0.001 per share (“

Common Stock”), and (ii) warrants to purchase shares of Common Stock equal to 20% of

the principal amount of the Notes (the “

Warrants”). The Notes will mature on the fourth-year anniversary of the date of issuance, at which time the Warrants will also terminate. The conversion price of the Notes and the exercise price of

the Warrants is $11.98 per share, which was the consolidated closing bid price of the Common Stock as reported by Nasdaq on the most recently completed trading day preceding the Company entering into the Note Purchase Agreement with investors

with respect to the Notes (the “

Note Offering”).

The Investors may, at any time, convert all or a portion of the Notes (subject to a minimum principal amount of $100,000) at

the conversion price. The Company may redeem all or a portion of any Notes then outstanding at any time after the first anniversary of issuance at a price of 112.5% of par value plus accrued interest. In the event of a change of control of the

Company, the Company may redeem all Notes then outstanding at a price of 108% of par value plus accrued interest. The Notes contain customary events of default and become due and payable upon the occurrence thereof.

The Company has agreed to use reasonable commercial efforts to file a Registration Statement on Form S-3 covering the Notes, the

Warrants and the resale of the shares of Common Stock issuable upon conversion of the Notes and exercise of the Warrants as soon as practicable after the later of (i) the date on which the Company becomes eligible to use a Registration Statement

on Form S-3 and (ii) six (6) months from the date of issuance of the Notes, subject to the terms of the Note Purchase Agreement, including an exception to the extent such securities may be sold pursuant to Rule 144 without being subject to any

volume limit or manner of sale limitations.

The Notes were offered and sold to the Investors in reliance on the exemption from registration provided by Section 4(a)(2) of

the Securities Act and Regulation D under the Securities Act.

The foregoing description of the Note Purchase Agreement is qualified in its entirety by reference to the text of the Note

Purchase Agreement. The form of the Note Purchase Agreement is attached as Exhibit 10.1 hereto and incorporated herein by reference.

|

Item 2.03

|

Unregistered Sales of Equity Securities

|

The disclosure set forth in Item 1.01 above is incorporated by reference into this Item 2.03.

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

The disclosure set forth in Item 1.01 above is incorporated by reference into this Item 3.02.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

Appointment of Chief Financial Officer

On September 1, 2021, the Company appointed Michael Vesey to the position of Chief Financial Officer, effective September 2, 2021 (the “Effective Date”).

Mr. Vesey (age 59) previously served as the Chief Financial Officer of Wayside Technology (Nadaq:WSTG), an international technology

solutions provider/distributor of cyber security, software and technology products, from 2016-2021. Prior to joining Wayside Technology, Mr. Vesey was the Chief Financial Officer of Majesco Entertainment Company, an international publisher and

marketer of digital entertainment software products, from 2011 to 2016 and was the Chief Accounting Officer from 2006 to 2011 prior to his appointment to Chief Financial Officer. Mr. Vesey holds a B.B.A. from Pace University and earned a Master

of Finance from Penn State University. Mr. Vesey is a Certified Public Accountant.

Pursuant to Mr. Vesey’s employment agreement, dated as of September 2, 2021 (the “Employment Agreement”), Mr. Vesey is entitled to an annual base salary of $300,000,

which amount is subject to annual review by and at the sole discretion of the Company’s Board or the compensation committee. Mr. Vesey is eligible to receive an annual cash bonus equal to or exceeding 50% of his base salary, provided that he

achieves performance targets determined by the Board or the compensation committee, which shall be prorated for the fiscal year ending December 31, 2021. Under the Employment Agreement, Mr. Vesey is also entitled to receive a grant of 40,000

restricted stock units, which vest in four equal annual installments beginning on September 2, 2022, and 350,000 non-qualified stock options to purchase common stock of the Company, which vest twenty-five percent (25%) on September 2, 2022, and

seventy-five percent (75%) in 12 equal quarterly installments thereafter.

The Employment Agreement has a term commencing on the Effective Date and continuing until terminated (i) upon death of the

employee; (ii) upon disability; (iii) for cause; (iv) with good reason or without cause; or (v) voluntarily. The Employment Agreement also contains, among other things, the following material provisions: (i) reimbursement for all reasonable

travel and other out-of-pocket expenses incurred in connection with his employment; (ii) paid vacation leave; (iii) health benefits; and (iv) a severance payment equal to twelve (12) months of base salary and any cash bonus earned but unpaid upon

termination by Mr. Vesey for Good Reason or by the Company without Cause (each term as defined in the Employment Agreement), with restrictive covenants applicable for a corresponding period after termination.

There are no transactions between the Company and Mr. Vesey that would require disclosure under Item 404(a) of Regulation S-K

and there is no family relationship between Mr. Vesey and any director or officer of the Company.

The foregoing description of the Employment Agreement is qualified in its entirety by reference to the text of the Employment

Agreement. The form of the Employment Agreement is attached as Exhibit 10.2 hereto and incorporated herein by reference.

Transition of Current Chief Financial Officer

In connection with the appointment of Mr. Vesey as Chief Financial Officer, effective as of the Effective Date, Clifford Farren

will transition from Chief Financial Officer to Special Advisor. Mr. Farren and the Company entered into a Transition and Release Agreement, dated as of September 2, 2021 (the “Transition Agreement”), pursuant to which Mr. Farren will

continue to receive his current employment benefits until January 3, 2022 at which time his employment with the Company will cease. Beginning January 4, 2022, Mr. Farren will act as a consultant to the Company until March 31, 2022 (the “Consulting

Period”). During the Consulting Period, Mr. Farren will be entitled to receive a consulting fee of $13,000 per month and will be entitled to reimbursement of pre-approved out-of-pocket expenses.

The foregoing description of the Transition Agreement is qualified in its entirety by reference to the text of the Transition

Agreement. The form of the Transition Agreement is attached as Exhibit 10.3 hereto and incorporated herein by reference.

On September 1, 2021, the Company issued a press release announcing the Note Offering and the appointment of Mr. Vesey as Chief Financial Officer. A copy of the press release is

attached as Exhibit 99.1 hereto and is incorporated by reference into this Item 8.01.

|

Item

9.01

|

Financial Statements and Exhibits

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

Form of Note Purchase Agreement, dated September 1, 2021, by and between the Company and the Investors.

|

|

|

|

|

|

|

|

Employment Agreement, dated as of September 2, 2021, by and between the Company and Michael Vesey.

|

|

|

|

|

|

|

|

Transition and Release Agreement, dated as of September 2, 2021, by and between the Company and Clifford Farren.

|

|

|

|

|

|

|

|

Press Release, dated September 1, 2021.

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

FORIAN INC.

|

|

|

|

|

|

Dated: September 2, 2021

|

By:

|

/s/ Edward Spaniel, Jr.

|

|

|

Name:

|

Edward Spaniel, Jr.

|

|

|

Title:

|

Executive Vice President and General Counsel

|

5

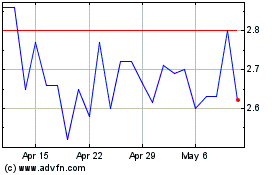

Forian (NASDAQ:FORA)

Historical Stock Chart

From Mar 2024 to Apr 2024

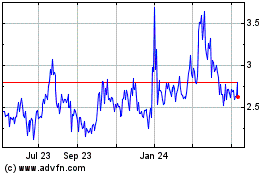

Forian (NASDAQ:FORA)

Historical Stock Chart

From Apr 2023 to Apr 2024