Table of Contents

|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule 424(b)(5)

|

|

(To Prospectus dated July 12, 2021)

|

Registration No. 333-257826

|

27,297,995 Shares of Common Stock

DARKPULSE, INC.

We are offering 27,297,995 shares of common stock

at a price per share, net of discount, of $0.120888 pursuant to this prospectus supplement and the accompanying prospectus. The shares

of Common Stock are being bought by GHS Investments LLC (“GHS”), an accredited investor.

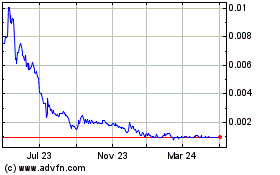

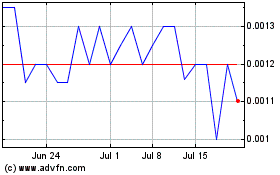

Our common stock, par value $0.0001 per share

(the “Common Stock”), is currently quoted on the OTCPink Marketplace operated by OTC Markets Group Inc. (the “OTCPink”)

under the trading symbol “DPLS”. On August 30, 2021, the last reported sale price of our Common Stock on the OTCPink was $0.1304

per share.

Investing in our securities involves a high

degree of risk. Before buying any of our securities, you should carefully read the discussion of material risks of investing in our securities

under the heading “Risk Factors” beginning on page S-7 of this prospectus supplement and the documents incorporated by reference

herein and page 5 of the accompanying prospectus.

We have engaged J.H. Darbie & Co. as a placement

agent (“Placement Agent”) in connection with this offering.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public Offering Price

|

|

$

|

0.131400

|

|

|

$

|

3,586,956.53

|

|

|

Discounts

|

|

$

|

0.010512

|

|

|

$

|

286,956.53

|

|

|

Proceeds, before expenses, to us

|

|

$

|

0.120888

|

|

|

$

|

3,300,000.00

|

|

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of Common Stock is expected

to be made on or about September 2, 2021, subject to customary closing conditions.

The date of this prospectus supplement is August

31, 2021.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

No dealer, salesperson or other person is authorized

to give any information or to represent anything not contained in this prospectus supplement or the accompanying prospectus. You must

not rely on any unauthorized information or representations. This prospectus supplement and the accompanying prospectus are an offer to

sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information

contained in this prospectus supplement and the accompanying prospectus is current only as of their respective dates.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus are part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or SEC, utilizing a “shelf”

registration process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms

of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference

herein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus,

we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this

prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference therein filed

prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any

statement in one of these documents is inconsistent with a statement in another document having a later date-for example, a document incorporated

by reference in the accompanying prospectus-the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made

solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties

to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties

or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied

on as accurately representing the current state of our affairs.

You should rely only on the information contained

in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein. We have not authorized, and the Placement

Agent has not authorized, anyone to provide you with information that is different. The information contained in this prospectus supplement

or the accompanying prospectus, or incorporated by reference herein or therein is accurate only as of the respective dates thereof, regardless

of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our Common Stock. It is important

for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents

incorporated by reference herein and therein, in making your investment decision. You should also read and consider the information in

the documents to which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus supplement and in the accompanying prospectus, respectively.

We are offering to sell, and seeking offers to

buy, the securities offered by this prospectus supplement only in jurisdictions where offers and sales are permitted. The distribution

of this prospectus supplement and the accompanying prospectus and the offering of the securities offered by this prospectus supplement

in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement

and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Common Stock

and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement

and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer

to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which

it is unlawful for such person to make such an offer or solicitation

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus supplement. This summary does not contain all the information that you should

consider before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated by reference

herein. In particular, attention should be directed to our “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and the financial statements and related notes thereto contained herein or otherwise

incorporated by reference hereto, before making an investment decision.

When we refer to “DarkPulse,” “we,”

“our,” “us” and the “Company” in this prospectus, we mean, DarkPulse, Inc., unless otherwise specified.

When we refer to “you,” we mean the holders of the applicable series of securities.

THE COMPANY

Organization

DarkPulse, Inc. ("DPI", “DarkPulse”

or the "Company") is a technology-security company incorporated in 1989 as Klever Marketing, Inc ("Klever"). Its principal

wholly-owned subsidiary, DarkPulse Technologies Inc. ("DPTI"), originally started as a technology spinout from the University

of New Brunswick, Fredericton, Canada. DPI is comprised of two security platforms: Fiber and Ultra-High Sensitivity Sensors ("UHSS").

On April 27, 2018, Klever entered into an Agreement

and Plan of Merger (the “Merger Agreement” or the “Merger”) involving Klever as the surviving parent corporation

and acquiring DPTI as its wholly-owned subsidiary. On July 18, 2018, the parties closed the Merger Agreement, as amended on July 7, 2018,

and the name of the Company was subsequently changed to DarkPulse, Inc. With the change of control of the Company, the Merger was accounted

for as a recapitalization in a manner similar to a reverse acquisition.

On July 20, 2018, the Company filed a Certificate

of Amendment to its Certificate of Incorporation with the State of Delaware, changing the name of the Company to “DarkPulse, Inc.”

The Company filed a corporate action notification with the Financial Industry Regulatory Authority (FINRA), and the Company's ticker symbol

was changed to “DPLS.”

The Company’s security and monitoring systems

will be delivered in applications for critical infrastructure/ key resources such as but not limited to border security, pipelines, the

oil and gas industry and mine safety. Current uses of fiber optic distributed sensor technology have been limited to quasi-static, long-term

structural health monitoring due to the time required to obtain the data and its poor precision. The Company’s patented BOTDA dark-pulse

sensor technology allows for the monitoring of highly dynamic environments due to its greater resolution and accuracy.

In December 2010 DPTI entered into an Assignment

Agreement with the University of New Brunswick, Canada (the “University”), pursuant to which the University sold, transferred,

and assigned to the Company certain patents related to the University’s BOTDA dark-pulse technology (the "Patents") in

exchange for the issuance of a debenture to the University in the amount of C$1,500,000 (Canadian dollars). In April 2017, DPTI

issued a replacement debenture to the University in the amount of US$1,491,923 (the “Debenture”). The Patents and the

Debenture were initially recorded in the Company’s accounts at $1,491,923, based upon the exchange rate between the US dollar and

the Canadian dollar on December 16, 2010, the date of the original debenture. In addition to the repayment of principal and interest,

the Debenture requires DPTI to pay the University a two percent royalty on sales of any and all products or services which incorporate

the Patents for a period of five years commencing on April 24, 2018, as well as to reimburse the University for its patent-related costs.

Our Business

The Company offers a full suite of engineering,

installation and security management solutions to industries and governments. Coupled with our patented BOTDA dark-pulse technology (the

“DarkPulse Technology”), DarkPulse provides its customers a comprehensive data stream of critical metrics for assessing the

health and security of their infrastructure. Our comprehensive system provides for rapid, precise analysis and responsive activities predetermined

by the end-user customer.

Historically, distributed sensor systems have

been too costly, slow and limited in their capabilities to attain widespread use. In addition, Brillouin-based sensors have been plagued

with temperature and strain cross-sensitivity, i.e. the inability to distinguish between temperature and strain change along the same

fiber. The loss of spatial resolution with an increase in fiber length has also limited the use of distributed sensor systems. Due to

these shortcomings, existing technologies are unable to succeed within today’s dynamic environments, and needs for more advanced

sensor technologies have remained unsatisfied.

By contrast to existing technologies, the DarkPulse

Technology is a distributed-fiber sensing system, based on dark-pulse Brillouin scattering, which reports in real-time on conditions

such as temperature, stress, strain corrosion and structural health monitoring of Critical Infrastructure/Key Resources including Bridges,

Buildings, Roadways pipelines and mining installations.

DarkPulse Technology’s differentiators from

and advantages over existing technologies:

|

|

·

|

Real-time Reporting: Higher data acquisition speeds allowing for structural monitoring of dynamic systems

|

|

|

·

|

Cost to Customer: Significantly lower acquisition and operating costs

|

|

|

·

|

Precision: A greater magnitude of precision and spatial resolution than other systems currently available

|

|

|

·

|

Applications: Wider range of capabilities than other systems currently available

|

|

|

·

|

Power consumption: Lower power consumption than existing systems allowing for off-grid installations

|

|

|

·

|

Integration: Capable of integrating with existing systems

|

|

|

·

|

Central station monitoring/cloud based GUI

|

We believe that these key advantages should allow

the Company not only to enter existing markets, but more importantly, to open new market opportunities with new applications. The Company

intends to leverage new applications to target clients that have been unable to make use of distributed fiber optic technology to date.

Recent Developments

Acquisitions

On August 9, 2021, the Company entered into a

Share Purchase Agreement with Optilan Guernsey Limited and Optilan Holdco 2 Limited (the “Sellers”), pursuant to which the

Company purchased from the Sellers all of the issued and outstanding equity interests of Optilan HoldCo 3 Limited, a private company incorporated

in England and Wales (“Optilan”) for £1.00 and also a commitment to enter into the Subscription (as defined below).

As of August 9, 2021, the Company owns all of the equity interests of Optilan.

On August 9, 2021, the Company entered into a

Subscription Agreement (the “Subscription”) with Optilan, pursuant to which the Company agreed to purchase an aggregate of

4,000,000 Ordinary Shares of Optilan (the “Shares”) for an aggregate purchase price of £4,000,000.

On August 30, 2021 (the “Closing Date”),

the Company closed two separate Membership Interest Purchase Agreements (the “MPAs”) with Remote Intelligence, Limited Liability

Company, a Pennsylvania limited liability company (“RI”) and Wildlife Specialists, LLC, a Pennsylvania limited liability company

(“WS”) pursuant to which the Company agreed to pay to the majority shareholder of each of RI and WS an aggregate of 15,000,000

shares of the Company’s Common Stock, $500,000 to be paid on the Closing Date, and an additional $500,000 to be paid 12 weeks from

Closing Date in exchange for 60% ownership of each of RI and WS. RI and WS are now subsidiaries of the Company.

Financings

On January 4, 2021, we entered into a securities

purchase agreement with Geneva Roth Remark Holdings, Inc. (“Geneva”) issuing to Geneva a convertible promissory note

in the aggregate principal amount of $42,350 with a $3,850 original issue discount and $3,500 in transactional expenses due to Geneva

and its counsel. The note bears interest at 8% per annum and may be converted into common shares of the Company's common stock at a conversion

price equal to 70% of the lowest trading price of our common stock during the 20 prior trading days. We received $35,000 net cash.

On February 3, 2021, we entered into a securities

purchase agreement with Geneva issuing to Geneva a convertible promissory note in the aggregate principal amount of $94,200 with a $15,700

original issue discount and $3,500 in transactional expenses due to Geneva and its counsel. The note bears interest at 4.5% per annum

and may be converted into common shares of our common stock at a conversion price equal to 81% of the lowest two trading prices of our

common stock during the 10 prior trading days. We received $75,000 net cash.

On February 18, 2021, we entered into a securities

purchase agreement with Geneva issuing to Geneva a convertible promissory note in the aggregate principal amount of $76,200 with a $12,700

original issue discount and $3,500 in transactional expenses due to Geneva and its counsel. The note bears interest at 4.5% per annum

and may be converted into common shares of our common stock at a conversion price equal to 81% of the lowest two trading prices of our

common stock during the 10 prior trading days. We received $60,000 net cash.

On April 5, 2021, the Company entered into a securities

purchase agreement with Geneva Roth issuing to Geneva a convertible promissory note in the aggregate principal amount of $64,200 with

a $10,700 original issue discount and $3,500 in transactional expenses due to Geneva and its counsel. The note bears interest at 4.5%

per annum and may be converted into common shares of the Company's common stock at a conversion price equal to 81% of the lowest 2 trading

prices of the Company's common stock during the 10 prior trading days. The Company received $50,000 net cash.

On April 26, 2021, we entered a Securities Purchase

Agreement (the “SPA”) and Registration Rights Agreement (the “Registration Rights Agreement”) with FIRSTFIRE GLOBAL

OPPORTUNITIES FUND, LLC, a Delaware limited liability company (the “FirstFire”), pursuant to which we issued to FirstFire

a Convertible Promissory Note in the principal amount of $825,000 (the “FirstFire Note”). The purchase price of the FirstFire

Note is $750,000. The FirstFire Note matures on January 26, 2022 upon which time all accrued and unpaid interest will be due and payable.

Interest accrues on the FirstFire Note at 10% per annum guaranteed until the FirstFire Note becomes due and payable, whether at maturity

or upon acceleration or by prepayment or otherwise. The FirstFire Note is convertible at any time after 180 days from issuance, upon the

election of the FirstFire, into shares of our Common Stock at $0.015 per share. The FirstFire Note is subject to various “Events

of Default,” which are disclosed in the FirstFire Note. Upon the occurrence of an “Event of Default,” the conversion

price will become $0.005. In the event of a DTC “chill” on our shares, an additional discount of 10% will apply to the conversion

price while the “chill” is in effect. Upon the issuance of the FirstFire Note, we have initially agreed to reserve 550,000,000

shares of Common Stock.

The Registration Rights Agreement provides that

we shall (i) use our best efforts to file with the Commission an S-1 Registration Statement within 90 days of the date of the Registration

Rights Agreement to register the shares into which the FirstFire Note is convertible; and (ii) have the Registration Statement declared

effective by the Commission within 180 days after the date the Registration Statement is filed with the Commission.

On July 14, 2021, the Company entered a Securities

Purchase Agreement with GS Capital Partners, LLC (the “Lender”), pursuant to which the Company issued to the Lender a 6% Redeemable

Note in the principal amount of $2,000,000 (the “Note”). The purchase price of the Note is $1,980,000. The Note matures on

July 14, 2022 upon which time all accrued and unpaid interest will be due and payable. Interest accrues on the Note at 6% per annum until

the Note becomes due and payable. The Note is subject to various “Events of Default,” which are disclosed in the Note. Upon

the occurrence of an “Event of Default,” the interest rate on the Note will be 18%. The Note is not convertible into shares

of the Company’s Common Stock and is not dilutive to existing or future shareholders and the Company plans on using a portion of

the proceeds of the Note to retire existing convertible debt.

On August 19, 2021, the Company entered into a

securities purchase agreement (the “Purchase Agreement”) with an accredited investor (the “Purchaser”), for the

offering of up to $45,000,000 worth of Common Stock. Pursuant to the Purchase Agreement, on August 19, 2021, the Company and the Purchaser

agreed that the Company would issue and sell to the Purchaser, and the Purchaser would purchase from the Company, 31,799,260 shares of

Common Stock for total proceeds to the Company, net of discounts, of $3,300,000, at an effective price of $0.1038 per share (the “Closing”).

The Company received approximately $2,790,000 in net proceeds from the Closing after deducting the fees and other estimated offering expenses

payable by the Company. The Company used the net proceeds from the Closing for working capital and for general corporate purposes. The

Shares were issued to the Purchaser in a registered direct offering, pursuant to a prospectus supplement to the Company’s currently

effective registration statement on Form S-3 (File No. 333-257826), which was initially filed with the SEC on July 12, 2021, and was declared

effective on August 18, 2021.

Partnerships

We have entered into a consulting agreement with

the Bachner Group to assist in the successful transformation from an R&D focused company to a sales-focused company, and assist us

with federal contract opportunities.

We have entered into a partnership with Remote

Intelligence to expand our service offerings to include “eye in the sky” drone capabilities.

We have entered into a partnership with Unleash

Live to expand our service offerings to include AI enhanced image evaluation and secure private networking capabilities.

Other Events

On August 3, 2021, the Company entered into an

Engagement Agreement and Terms and Conditions (the “Agreement”) with Energy & Industrial Advisory Partners, LLC ( “EIAP”).

Pursuant to the Agreement, the Company has engaged EIAP to serve as an advisor to the Company in the proposed transaction for agreed target

company or any of its subsidiaries and/or the whole or any part of its or their business or assets (the “Transaction”). EIAP

will receive a monthly retainer of $10,000 per month payable upon receipt of an invoice. EIAP will also receive a consulting bonus fee

of $350,000 payable upon completion of the Transaction. In the event of successful completion of the Transaction as a result of EIAP’s

involvement, EIAP agrees to deduct the total retainer fee from the consulting bonus fee. The Agreement may be terminated, with or without

cause, by either party upon ten days’ written prior notice thereof to the other party. If (a) during the term of the Agreement,

or (b) within two years following the date of the Agreement’s termination by the Company (provided that such two-year period shall

be extended by the same period of time that the Company takes to settle in full all fees, expenses and/or outlays due or to become due

to EIAP as at the date of the Agreement’s termination), the Company completes a transaction with the target company or a similar

transaction to the Transaction, then the Company shall pay the consulting bonus fee at the completion of the transaction.

Available Information

All reports of the Company filed with the SEC

are available free of charge through the SEC’s website at www.sec.gov. In addition, the public may read and copy materials

filed by the Company at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. The public may also

obtain additional information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

THE OFFERING

|

Shares of Common Stock offered by us in this offering

|

|

We are offering 27,297,995 shares of Common Stock

|

|

|

|

|

|

Offering price per share, net of discount

|

|

$0.120888

|

|

|

|

|

|

Shares of Common Stock outstanding immediately before this offering

|

|

4,851,846,094

|

|

|

|

|

|

Common Stock outstanding immediately after this offering

|

|

4,879,144,089

|

|

|

|

|

|

Use of proceeds

|

|

We estimate that our net proceeds from this offering

will be approximately $3,300,000 after deducting estimated offering expenses payable by us.

We plan to use the net proceeds of this offering

for working capital and general corporate purposes. See “Use of Proceeds.”

|

The number of shares of our Common Stock to be

outstanding after this offering is based on 4,879,144,089 shares of our Common Stock outstanding as of August 31, 2021, and excludes as

of such date:

|

|

●

|

any shares of Common Stock issuable pursuant to shares Series D Preferred Stock outstanding as of August 30, 2021 which includes 27,493,794,500 shares of Common Stock issuable pursuant to the conversion of Series D Preferred Stock.

|

RISK FACTORS

An investment in our securities involves a

high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks described below and

discussed under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December

31, 2020, which is incorporated by reference in this prospectus supplement and the accompanying prospectus in its entirety, together with

other information in this prospectus supplement, the accompanying prospectus, the information and documents incorporated herein and therein

by reference, and in any free writing prospectus that we have authorized for use in connection with this offering. If any of these risks

actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the

trading price of our Common Stock to decline, resulting in a loss of all or part of your investment.

Risks Related to This Offering

MANAGEMENT WILL HAVE BROAD DISCRETION AS TO THE

USE OF THE PROCEEDS FROM THIS OFFERING, AND WE MAY NOT USE THE PROCEEDS EFFECTIVELY.

Our management will have broad discretion in the

application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations

or enhance the value of our Common Stock. Our failure to apply these funds effectively could have a material adverse effect on our business

and cause the price of our Common Stock to decline.

YOU WILL EXPERIENCE IMMEDIATE AND SUBSTANTIAL

DILUTION IN THE NET TANGIBLE BOOK VALUE PER SHARE OF THE COMMON STOCK YOU PURCHASE.

Since the price per share of our Common Stock

being offered is substantially higher than the net tangible book value per share of our Common Stock, you will suffer immediate and substantial

dilution in the net tangible book value of the Common Stock you purchase in this offering. Based on a public offering price, net of discount,

of $0.120888 per share, if you purchase shares of Common Stock in this offering, you will suffer immediate and substantial dilution of

$0.120588 per share with respect to the net tangible book value of the Common Stock. See the section entitled “Dilution” below

for a more detailed discussion of the dilution you will incur if you purchase Common Stock in this offering.

YOU MAY EXPERIENCE FUTURE DILUTION AS A RESULT

OF FUTURE EQUITY OFFERINGS AND OTHER ISSUANCES OF OUR COMMON STOCK OR OTHER SECURITIES. IN ADDITION, THIS OFFERING AND FUTURE EQUITY OFFERINGS

AND OTHER ISSUANCES OF OUR COMMON STOCK OR OTHER SECURITIES MAY ADVERSELY AFFECT OUR COMMON STOCK PRICE.

In order to raise additional capital, we may in

the future offer additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock at prices

that may not be the same as the price per share in this offering. We may not be able to sell shares or other securities in any other offering

at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing

shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional

shares of our Common Stock or securities convertible into Common Stock in future transactions may be higher or lower than the price per

share in this offering. In addition, the sale of shares in this offering and any future sales of a substantial number of shares of our

Common Stock in the public market, or the perception that such sales may occur, could adversely affect the price of our Common Stock.

We cannot predict the effect, if any, that market sales of those shares of Common Stock or the availability of those shares of Common

Stock for sale will have on the market price of our Common Stock.

SPECIAL NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements

that involve risks and uncertainties, principally in the sections entitled “Risk Factors.” All statements other than statements

of historical fact contained in this prospectus, including statements regarding future events, our future financial performance, business

strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking

statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although

we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined

under “Risk Factors” or elsewhere in this prospectus, which may cause our or our industry’s actual results, levels of

activity, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements should not be read

as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, that performance

or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s

good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance

or results to differ materially from what is expressed in or suggested by the forward-looking statements.

Forward-looking statements speak only as of the

date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking

statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except

to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn

that we will make additional updates with respect to those or other forward-looking statements.

USE OF PROCEEDS

Based upon the offering price, net of discount,

of $0.120888 per share of Common Stock, we estimate that the net proceeds from the sale of the shares of Common Stock offered under this

prospectus supplement, after deducting estimated offering expenses payable by us will be approximately $2,885,000.

We estimate that the net proceeds to us from this

offering will be approximately $2.885 million after deducting the estimated discounts and commissions and estimated offering expenses

payable by us. We intend to use the net proceeds from this offering to fund the payments due to our Optilan division and for working capital

and general corporate purposes.

|

Proceeds:

|

|

|

|

|

Gross Proceeds

|

|

$

|

3,586,956.53

|

|

|

Discounts

|

|

|

286,956.53

|

|

|

Fees and Expenses

|

|

|

415,000.00

|

|

|

Net Proceeds

|

|

$

|

2,885,000.00

|

|

|

|

|

|

|

|

|

Uses:

|

|

|

|

|

|

Optilan Division

|

|

|

2,293,548.84

|

|

|

Working Capital

|

|

|

591,451.16

|

|

|

Total Uses

|

|

$

|

2,885,000.00

|

|

Our management will have broad discretion to allocate

the net proceeds to us from this offering and investors will be relying on the judgment of our management regarding the application of

the proceeds from this offering. We reserve the right to change the use of these proceeds as a result of certain contingencies such as

competitive developments, the results of our marketing efforts, acquisition and investment opportunities and other factors. An investor

will not have the opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use the

proceeds.

CAPITALIZATION

The following table sets forth

our cash and cash equivalents and capitalization as of June 30, 2021:

|

|

●

|

on an actual basis, and

|

|

|

●

|

on a proforma as adjusted basis to give effect to the sale of 27,297,995 shares in this offering assuming an offering price, net of discount, of $0.120888 per share, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, and

|

The information in this table

is illustrative only and our capitalization following the closing of the offering will be adjusted based upon the actual public offering

price and other terms of this offering determined at pricing.

|

|

|

As of June 30, 2021

|

|

|

|

|

Actual

|

|

|

Pro forma as

adjusted

|

|

|

Cash and cash equivalents

|

|

$

|

148,562

|

|

|

$

|

3,033,562

|

|

|

Capitalization

|

|

|

|

|

|

|

|

|

|

Current debt:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$

|

934,234

|

|

|

$

|

934,234

|

|

|

Convertible notes payable– current portion

|

|

|

1,240,153

|

|

|

|

1,240,153

|

|

|

Total Current debt

|

|

|

2,174,387

|

|

|

|

2,174,387

|

|

|

|

|

|

|

|

|

|

|

|

|

Long term debt

|

|

|

|

|

|

|

|

|

|

Secured debenture

|

|

|

1,210,155

|

|

|

|

1,210,155

|

|

|

Total long-term debt

|

|

|

1,210,155

|

|

|

|

1,210,155

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Common stock (par value $0.0001), 20,000,000,000 shares authorized, 4,770,327,191 and 4,797,625,186 shares issued and outstanding respectively

|

|

|

477,033

|

|

|

|

479,763

|

|

|

Treasury stock, 100,000 shares

|

|

|

(1,000

|

)

|

|

|

(1,000

|

)

|

|

Convertible preferred stock, Series D (par value $0.01) 100,000 shares authorized, 88,235 shares issued and outstanding respectively

|

|

|

883

|

|

|

|

883

|

|

|

Additional paid-in capital

|

|

|

2,363,848

|

|

|

|

5,661,120

|

|

|

Accumulated deficit

|

|

|

(6,687,651

|

)

|

|

|

(7,484,609

|

)

|

|

Accumulated other comprehensive income

|

|

|

281,769

|

|

|

|

281,769

|

|

|

Non-controlling interest in a variable interest entity and subsidiary

|

|

|

(12,439

|

)

|

|

|

(12,439

|

)

|

|

Total stockholders’ deficit

|

|

|

(3,577,557

|

)

|

|

|

(1,074,513

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

(193,015

|

)

|

|

$

|

2,310,029

|

|

The

number of shares of our common stock to be outstanding following this offering is based on 4,770,327,191 shares of common stock issued

and outstanding as of June 30, 2021, and excludes:

|

|

●

|

49,719,643 shares of Common Stock issued pursuant to conversions of convertible notes

|

|

|

●

|

31,799,260 shares of Common Stock issued pursuant to offering dated August 23, 2021

|

|

|

●

|

any shares of Common Stock issuable pursuant to shares Series D Preferred Stock outstanding as of August 30, 2021 which includes 27,493,794,500 shares of Common Stock issuable pursuant to the conversion of Series D Preferred Stock.

|

Unless

otherwise noted, the information in this prospectus assumes no exercise of outstanding options.

A 100,000 increase or decrease

in the number of shares offered by us, based on the assumed offering price, net of discount, of $0.120888 per share, would increase or

decrease our cash and cash equivalents, additional paid-in capital, total stockholders’ equity and total capitalization by approximately

$11,122, after deducting the estimated discounts and commissions and estimated offering expenses payable by us.

DILUTION

If you invest in our shares

in this offering, your ownership interest will be immediately diluted to the extent of the difference between the assumed public offering

price per share of our common stock that is part of the share and the pro forma net tangible book value per share of our common stock

immediately after the closing of this offering. Our net tangible book value is the amount of our total tangible assets less our total

liabilities. Net tangible book value per share is our net tangible book value divided by the number of shares of common stock outstanding

as of June 30, 2021. Our net tangible book value as of June 30, 2021 was ($3,052,652) or ($0.00) per share, based on 4,770,327,191 shares

of our common stock outstanding as of June 30, 2021.

After giving effect to the

sale and issuance by us of the shares in this offering at the assumed public offering price, net of discount, of $0.120888 per share,

and the receipt and application of the net proceeds, and after deducting estimated underwriting discounts and commissions and estimated

offering expenses payable by us, our pro forma net tangible book value as of June 30, 2021 would have been approximately $1,508,165 or

$0.00 per share of common stock. This represents an immediate increase in pro forma net tangible book value of $0.00 per share to our

existing stockholders and an immediate dilution of $0.120588 per share to investors purchasing common stock as part of the shares in this

offering.

The following table illustrates

this per share dilution:

|

Assumed public offering price per share, net of discount

|

|

$

|

0.120888

|

|

|

Net tangible book value per share at June 30, 2021

|

|

$

|

(0.0006

|

)

|

|

Increase to net tangible book value per share attributable to investors purchasing our common stock in this offering

|

|

$

|

0.121488

|

|

|

|

|

|

|

|

|

Pro forma net tangible book value per share as of June 30, 2021 after giving effect to this offering

|

|

$

|

0.0003

|

|

|

Pro forma as adjusted net tangible book value per share

|

|

$

|

0.0003

|

|

|

Dilution of pro forma net tangible book value per share to investors purchasing our common stock in this offering

|

|

$

|

0.120588

|

|

Each $1.00 increase (decrease)

in the assumed public offering price, net of discount, of $0.120888 per share would increase (decrease) pro forma as adjusted net tangible

book value per share to new investors by $25,114,155, and would increase (decrease) dilution per share to new investors in this offering

by $0.01, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after

deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase or

decrease of 1.0 million in the number of shares of common stock as part of the shares offered by us would increase (decrease) our pro

forma as adjusted net tangible book value by approximately $0.00 per share and increase (decrease) the dilution to new investors by $0.120588

per share, assuming the assumed public offering price remains the same, and after deducting the estimated underwriting discounts and commissions

and estimated offering expenses payable by us.

The

number of shares of our common stock to be outstanding following this offering is based 4,770,327,191 shares of common stock issued and

outstanding as of June 30, 2021, and excludes:

|

|

●

|

49,719,643 shares of Common Stock issued pursuant to conversions of convertible notes

|

|

|

●

|

31,799,260 shares of Common Stock issued pursuant to offering dated August 23, 2021

|

|

|

●

|

any shares of Common Stock issuable pursuant to shares Series D Preferred Stock outstanding as of August 30, 2021 which includes 27,493,794,500 shares of Common Stock issuable pursuant to the conversion of Series D Preferred Stock.

|

Unless

otherwise noted, the information in this prospectus assumes no exercise of outstanding options.

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

Common Stock

Each share of our common stock entitles its holder

to one vote in the election of each director and on all other matters voted on generally by our stockholders. No share of our common stock

affords any cumulative voting rights. This means that the holders of a majority of the voting power of the shares voting for the election

of directors can elect all directors to be elected if they choose to do so.

Holders of our common stock will be entitled to

dividends in such amounts and at such times as our Board of Directors in its discretion may declare out of funds legally available for

the payment of dividends. We currently do not anticipate paying any cash dividends on the common stock in the foreseeable future. Any

future dividends will be paid at the discretion of our Board of Directors after taking into account various factors, including:

|

|

●

|

general business conditions;

|

|

|

|

|

|

|

●

|

industry practice;

|

|

|

|

|

|

|

●

|

our financial condition and performance;

|

|

|

|

|

|

|

●

|

our future prospects;

|

|

|

|

|

|

|

●

|

our cash needs and capital investment plans;

|

|

|

|

|

|

|

●

|

our obligations to holders of any preferred stock we may issue;

|

|

|

|

|

|

|

●

|

income tax consequences; and

|

|

|

|

|

|

|

●

|

the restrictions Delaware and other applicable laws and our credit arrangements may impose, from time to time.

|

If we liquidate or dissolve our business, the

holders of our common stock will share ratably in all our assets that are available for distribution to our stockholders after our creditors

are paid in full and the holders of all series of our outstanding preferred stock, if any, receive their liquidation preferences in full.

Our common stock has no preemptive rights and

is not convertible or redeemable or entitled to the benefits of any sinking or repurchase fund.

Anti-Takeover Law and Certain Charter and Bylaw

Provisions

Provisions of our articles of incorporation and

bylaws may delay or prevent a takeover which may not be in the best interests of our stockholders. Provisions of our articles of incorporation

and bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings of our stockholders may be called,

and may delay, defer, or prevent a takeover attempt. In addition, certain provisions of Delaware law also may be deemed to have certain

anti-takeover effects which include that control of shares acquired in excess of certain specified thresholds will not possess any voting

rights unless these voting rights are approved by a majority of a corporation’s disinterested stockholders. Our articles of incorporation

and bylaws:

|

|

●

|

authorize the issuance of “blank check” preferred stock that could be issued by our board of directors to thwart a takeover attempt;

|

|

|

|

|

|

|

●

|

provide that vacancies on our board of directors, may be filled by a majority vote of directors then in office;

|

|

|

|

|

|

|

●

|

place restrictive requirements on how special meetings of stockholders may be called by our stockholders; do not provide stockholders with the ability to cumulate their votes; and

|

|

|

|

|

|

|

●

|

provide that our board of directors or a majority of our stockholders may amend our bylaws.

|

Delaware Anti-takeover Law

We are subject to Section 203 of Delaware Law,

an anti-takeover law. In general, Section 203 prohibits a publicly held Delaware corporation from engaging in a “business combination”

with an “interested stockholder” for a period of three years following the date the person became an interested stockholder,

unless:

|

|

●

|

the board of directors approves the transaction in which the stockholder became an interested stockholder prior to the date the interested stockholder attained that status;

|

|

|

|

|

|

|

●

|

when the stockholder became an interested stockholder, he or she owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding shares owned by persons who are directors and also officers and certain shares owned by employee benefits plans; or

|

|

|

|

|

|

|

●

|

on or subsequent to the date the business combination is approved by the board of directors, the business combination is authorized by the affirmative vote of at least 66 2/3% of the voting stock of the corporation at an annual or special meeting of stockholders.

|

Generally, a “business combination”

includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. Generally,

an “interested stockholder” is a person who, together with affiliates and associates, owns, or is an affiliate or associate

of the corporation and within three years prior to the determination of interested stockholder status did own, 15% or more of a corporation’s

voting stock.

The existence of Section 203 of Delaware Law would

be expected to have an anti-takeover effect with respect to transactions not approved in advance by our board of directors, including

discouraging attempts that might result in a premium over the market price for the shares of our common stock.

OTCPink Quotation

Our common stock is currently quoted on the OTCPink

under the symbol “DPLS”.

Transfer Agent

The transfer agent and registrar for our common

stock is Standard Registrar & Transfer Co., Inc. (“Standard Registrar”). The principal office of Standard Registrar is

located at 440 East 400 South, Suite 200, Salt Lake City, UT 84111 and its telephone number is 801-571-8844.

PLAN OF DISTRIBUTION

The shares of Common Stock being offered pursuant

to this prospectus supplement and the accompanying prospectus are being bought by GHS, an accredited investor. On August 19, 2021 we entered

into a securities purchase agreement directly with GHS in connection with an offering in an amount of up to $45 million.

The terms of this offering were subject to market

conditions and negotiations between us and GHS.

We expect to deliver the shares of Common Stock

being offered pursuant to this prospectus supplement on or about September 2, 2021.

We estimate that, the total expenses of this offering

payable by us will be approximately $711,957.

This prospectus supplement and the accompanying

prospectus may be made available in electronic format on the Company’s website. Other than this prospectus supplement and the accompanying

prospectus, the information on the Company’s website is not part of this prospectus supplement and the accompanying prospectus or

the registration statement of which this prospectus supplement and the accompanying prospectus form a part and should not be relied upon

by investors.

The foregoing does not purport to be a complete

statement of the terms and conditions of the securities purchase agreement. A copy of the securities purchase agreement with the purchasers

is included as an exhibit to our Current Report on Form 8-K that will be filed with the SEC and incorporated by reference into the registration

statement of which this prospectus supplement and the accompanying prospectus form a part. See “Information Incorporated by Reference”

and “Where You Can Find More Information.”

No action has been or will be taken in any jurisdiction

(except in the United States) that would permit a public offering of the securities offered by this prospectus supplement and accompanying

prospectus, or the possession, circulation or distribution of this prospectus supplement and accompanying prospectus or any other material

relating to us or the securities offered hereby in any jurisdiction where action for that purpose is required. Accordingly, the securities

offered hereby may not be offered or sold, directly or indirectly, and neither of this prospectus supplement and accompanying prospectus

nor any other offering material or advertisements in connection with the securities offered hereby may be distributed or published, in

or from any country or jurisdiction except in compliance with any applicable rules and regulations of any such country or jurisdiction.

The Placement Agent may arrange to sell securities offered by this prospectus supplement and accompanying prospectus in certain jurisdictions

outside the United States, either directly or through affiliates, where they are permitted to do so.

LEGAL MATTERS

The validity of the shares of Common Stock offered

by this prospectus supplement has been passed upon for us by Business Legal Advisors, LLC. Pryor Cashman LLP is acting as counsel for

GHS in connection with the shares of Common Stock offered hereby.

EXPERTS

Our consolidated balance sheets as of December

31, 2020 and 2019, and the related consolidated statements of operations, stockholders’ deficit, and cash flows for each of those

two years have been audited by Boyle, CPA, LLC, an independent registered public accounting firm, as set forth in its report incorporated

by reference and are included in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION

BY REFERENCE

Available Information

We file reports, proxy statements and other information

with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers,

such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our website address is https://www.darkpulse.com.

The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement

are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement.

The full registration statement may be obtained from the SEC or us, as provided below. Forms of the documents establishing the terms of

the offered securities are or may be filed as exhibits to the registration statement. Statements in this prospectus or any prospectus

supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it

refers. You should refer to the actual documents for a more complete description of the relevant matters. You may view a copy of the registration

statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate

by reference” information into this prospectus, which means that we can disclose important information to you by referring you to

another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and

subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in

a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the

extent that a statement contained in this prospectus modifies or replaces that statement.

We incorporate by reference our documents listed

below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended, which we refer to as the “Exchange Act” in this prospectus, between the date of this prospectus and the termination

of the offering of the securities described in this prospectus. We are not, however, incorporating by reference any documents or portions

thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC, including any

information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

This prospectus and any accompanying prospectus

supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

|

●

|

Our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on April 15, 2021.

|

|

|

|

|

●

|

Our Quarterly Reports on Form 10-Q for the quarters ended June 30, 2021 and March 31, 2021 filed with the SEC on August 16, 2021 and May 17, 2021, respectively.

|

|

|

|

|

●

|

Our Current Reports on Form 8-K and/or amendments on Form 8-K/A filed with the SEC on August 30, 2021, August 24, 2021, August 13, 2021, August 5, 2021, August 4, 2021, July 29, 2021, July 28, 2021, July 14, 2021, June 30, 2021, June 28, 2021, June 23, 2021, June 8, 2021, June 4, 2021, May 20, 2021, May 13, 2021, May 5, 2021, February 18, 2021, and January 14, 2021, respectively.

|

All reports and other documents we subsequently

file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this Offering, including all such documents

we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement,

but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus

and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents

incorporated by reference in this prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents)

by writing or telephoning us at the following address:

DARKPULSE, INC.

1345 Avenue of the Americas

2nd Floor

New York, NY 10105

(800) 436-1436

Exhibits to the filings will not be sent, however,

unless those exhibits have specifically been incorporated by reference in this prospectus and any accompanying prospectus supplement.

PROSPECTUS

DARKPULSE, INC.

$50,000,000.00

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We may offer and sell up to $50 million in the

aggregate of the securities identified above from time to time in one or more offerings. This prospectus provides you with a general description

of the securities.

The securities offered by this prospectus may

be sold from time to time in the open market, through privately negotiated transactions or a combination of these methods, at a fixed

price to be set forth in the applicable pricing supplement until our common stock is quoted on the OTCQB or OTCQX Market of OTCMarkets,

Inc., or a national securities exchange (of which there can be no assurance), and thereafter at market prices prevailing at the time of

sale or at negotiated prices.

Each time we offer and sell securities, we will

provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the

securities. The supplement may also add, update or change information contained in this prospectus with respect to that offering. You

should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

We may offer and sell the securities described

in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers,

or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their

names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable

from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus

and the applicable prospectus supplement describing the method and terms of the offering of such securities.

INVESTING IN OUR SECURITIES INVOLVES RISKS.

SEE THE “RISK FACTORS” ON PAGE 5 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT

CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Our common stock is currently quoted on the OTCPink

Marketplace operated by OTC Markets Group Inc. (the “OTCPink”) under the symbol “DPLS”. On July 8, 2021, the last

reported sales price for our common stock was $0.15 per share. The prospectus supplement will contain information, where applicable, as

to any other listing of the securities on the OTCPink or any other securities market or exchange covered by the prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. By using

a shelf registration statement, we may sell securities from time to time and in one or more offerings up to a total dollar amount of $50

million as described in this prospectus. Each time that we offer and sell securities, we will provide a prospectus supplement to this

prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. The

prospectus supplement may also add, update or change information contained in this prospectus with respect to that offering. If there

is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the prospectus

supplement. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement,

together with the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference.”

We have not authorized any other person to provide

you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will

not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information

appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on its respective

cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless

we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

When we refer to “DarkPulse,” “we,”

“our,” “us” and the “Company” in this prospectus, we mean, DarkPulse, Inc., unless otherwise specified.

When we refer to “you,” we mean the holders of the applicable series of securities.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION

BY REFERENCE

Available Information

We file reports, proxy statements and other information

with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers,

such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our website address is https://www.darkpulse.com.

The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement

are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement.

The full registration statement may be obtained from the SEC or us, as provided below. Forms of the documents establishing the terms of

the offered securities are or may be filed as exhibits to the registration statement. Statements in this prospectus or any prospectus

supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it

refers. You should refer to the actual documents for a more complete description of the relevant matters. You may view a copy of the registration

statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate

by reference” information into this prospectus, which means that we can disclose important information to you by referring you to

another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and

subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in

a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the

extent that a statement contained in this prospectus modifies or replaces that statement.

We incorporate by reference our documents listed

below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended, which we refer to as the “Exchange Act” in this prospectus, between the date of this prospectus and the termination

of the offering of the securities described in this prospectus. We are not, however, incorporating by reference any documents or portions

thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC, including any

information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

This prospectus and any accompanying prospectus

supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

|

●

|

Our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on April 15, 2021.

|

|

|

|

|

●

|

Our Quarterly Reports on Form 10-Q for the quarter March

31, 2021, filed with the SEC on May 17, 2021.

|

|

|

|

|

●

|

Our Current Reports on Form 8-K and/or amendments on Form 8-K/A filed

with the SEC on June 30, 2021, June

28, 2021, June 23, 2021, June

8, 2021, June 4, 2021, May

20, 2021, May 13, 2021, May

5, 2021, February 18, 2021, and

January 14, 2021, respectively.

|

All reports and other documents we subsequently

file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this Offering, including all such documents

we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement,

but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus

and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents

incorporated by reference in this prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents)

by writing or telephoning us at the following address:

DARKPULSE, INC.

1345 Avenue of the Americas

2nd Floor

New York, NY 10105

(800) 436-1436

Exhibits to the filings will not be sent, however,

unless those exhibits have specifically been incorporated by reference in this prospectus and any accompanying prospectus supplement.

THE COMPANY

Organization

DarkPulse, Inc. ("DPI", “DarkPulse”

or the "Company") is a technology-security company incorporated in 1989 as Klever Marketing, Inc ("Klever"). Its principal

wholly-owned subsidiary, DarkPulse Technologies Inc. ("DPTI"), originally started as a technology spinout from the University

of New Brunswick, Fredericton, Canada. DPI is comprised of two security platforms: Fiber and Ultra-High Sensitivity Sensors ("UHSS").

On April 27, 2018, Klever entered into an Agreement

and Plan of Merger (the “Merger Agreement” or the “Merger”) involving Klever as the surviving parent corporation

and acquiring DPTI as its wholly-owned subsidiary. On July 18, 2018, the parties closed the Merger Agreement, as amended on July 7, 2018,

and the name of the Company was subsequently changed to DarkPulse, Inc. With the change of control of the Company, the Merger was accounted

for as a recapitalization in a manner similar to a reverse acquisition.

On July 20, 2018, the Company filed a Certificate

of Amendment to its Certificate of Incorporation with the State of Delaware, changing the name of the Company to “DarkPulse, Inc.”

The Company filed a corporate action notification with the Financial Industry Regulatory Authority (FINRA), and the Company's ticker symbol

was changed to “DPLS.”

The Company’s security and monitoring systems

will be delivered in applications for critical infrastructure/ key resources such as but not limited to border security, pipelines, the

oil and gas industry and mine safety. Current uses of fiber optic distributed sensor technology have been limited to quasi-static, long-term

structural health monitoring due to the time required to obtain the data and its poor precision. The Company’s patented BOTDA dark-pulse

sensor technology allows for the monitoring of highly dynamic environments due to its greater resolution and accuracy.

In December 2010 DPTI entered into an Assignment

Agreement with the University of New Brunswick, Canada (the “University”), pursuant to which the University sold, transferred,

and assigned to the Company certain patents related to the University’s BOTDA dark-pulse technology (the "Patents") in

exchange for the issuance of a debenture to the University in the amount of C$1,500,000 (Canadian dollars). In April 2017, DPTI

issued a replacement debenture to the University in the amount of US$1,491,923 (the “Debenture”). The Patents and the

Debenture were initially recorded in the Company’s accounts at $1,491,923, based upon the exchange rate between the US dollar and

the Canadian dollar on December 16, 2010, the date of the original debenture. In addition to the repayment of principal and interest,

the Debenture requires DPTI to pay the University a two percent royalty on sales of any and all products or services which incorporate

the Patents for a period of five years commencing on April 24, 2018, as well as to reimburse the University for its patent-related costs.

Our Business

The Company offers a full suite of engineering,

installation and security management solutions to industries and governments. Coupled with our patented BOTDA dark-pulse technology (the

“DarkPulse Technology”), DarkPulse provides its customers a comprehensive data stream of critical metrics for assessing the

health and security of their infrastructure. Our comprehensive system provides for rapid, precise analysis and responsive activities predetermined

by the end-user customer.

Historically, distributed sensor systems have

been too costly, slow and limited in their capabilities to attain widespread use. In addition, Brillouin-based sensors have been plagued

with temperature and strain cross-sensitivity, i.e. the inability to distinguish between temperature and strain change along the same

fiber. The loss of spatial resolution with an increase in fiber length has also limited the use of distributed sensor systems. Due to

these shortcomings, existing technologies are unable to succeed within today’s dynamic environments, and needs for more advanced

sensor technologies have remained unsatisfied.

By contrast to existing technologies, the DarkPulse

Technology is a distributed-fiber sensing system, based on dark-pulse Brillouin scattering, which reports in real-time on conditions

such as temperature, stress, strain corrosion and structural health monitoring of Critical Infrastructure/Key Resources including Bridges,

Buildings, Roadways pipelines and mining installations.

DarkPulse Technology’s differentiators from

and advantages over existing technologies:

|

|

·

|

Real-time Reporting: Higher data acquisition speeds allowing for structural monitoring of dynamic systems

|

|

|

·

|

Cost to Customer: Significantly lower acquisition and operating costs

|

|

|

·

|

Precision: A greater magnitude of precision and spatial resolution than other systems currently available

|

|

|

·

|

Applications: Wider range of capabilities than other systems currently available

|

|

|

·

|

Power consumption: Lower power consumption than existing systems allowing for off-grid installations

|

|

|

·

|

Integration: Capable of integrating with existing systems

|

|

|

·

|

Central station monitoring/cloud based GUI

|

We believe that these key advantages should allow

the Company not only to enter existing markets, but more importantly, to open new market opportunities with new applications. The Company

intends to leverage new applications to target clients that have been unable to make use of distributed fiber optic technology to date.

Available Information

All reports of the Company filed with the SEC

are available free of charge through the SEC’s website at www.sec.gov. In addition, the public may read and copy materials

filed by the Company at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. The public may also

obtain additional information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

RISK FACTORS

Investment in any securities offered pursuant

to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated

by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form

8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus,

as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus

supplement before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or part of your investment

in the offered securities.

You should carefully consider the factors discussed

under the heading “Risk Factors” in our Annual Report on Form 10-K filed on April 15, 2021, which could materially affect

our business operations, financial condition, or future results. Additional risks and uncertainties not currently known to us or that

we currently deem to be immaterial also may materially adversely affect our business operations and/or financial condition. There have

been no material changes to our risk factors since the filing of our Form 10-K.

SPECIAL NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements

that involve risks and uncertainties, principally in the sections entitled “Risk Factors.” All statements other than statements