Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258109

PROSPECTUS SUPPLEMENT NO. 4

(To the Prospectus dated August 9, 2021)

Up to 136,035,264 Shares of Common Stock

Up to 17,905,000 Shares of Common Stock Issuable Upon Exercise of Warrants

Up to 405,000 Warrants to Purchase Common Stock

This prospectus supplement supplements the prospectus, dated August 9, 2021 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-258109). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission on August 24, 2021 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of an aggregate of up to 17,905,000 shares of our common stock, $0.0001 par value per share (the “Common Stock”), which consists of (i) up to 405,000 shares of Common Stock that are issuable upon the exercise of 405,000 warrants (the “Private Warrants”) originally issued in a private placement to Apex Technology Sponsor LLC (the “Sponsor”) in connection with the initial public offering of Apex Technology Acquisition Corporation (“Apex”) and (ii) up to 17,500,000 shares of Common Stock that are issuable upon the exercise of 17,500,000 warrants (the “Public Warrants” and, together with the Private Warrants, the “Warrants”) originally issued in the initial public offering of Apex.

The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus or their permitted transferees (the “selling securityholders”) of (i) up to 136,035,264 shares of Common Stock consisting of (a) up to 14,000,000 shares of Common Stock issued in a private placement pursuant to subscription agreements (“Subscription Agreements”) entered into on November 23, 2020, as amended, (b) up to 8,750,000 shares of Common Stock (which includes 2,916,700 Sponsor Earn-Out Shares) issued in a private placement to the Sponsor and Cantor Fitzgerald & Co in connection with the initial public offering of Apex, (c) up to 810,000 shares of Common Stock that were issued in connection with the separation of the Private Units, (d) up to 405,000 shares of Common Stock issuable upon exercise of the Private Warrants and (e) up to 112,070,264 shares of Common Stock (including up to 13,329,190 shares of Common Stock issuable pursuant to outstanding options and up to 1,912,155 shares of Common Stock issuable as Earnout Shares) pursuant to that certain Amended and Restated Registration Rights Agreement, dated July 1, 2021, between us and the selling securityholders granting such holders registration rights with respect to such shares and (ii) up to 405,000 Private Warrants.

The Common Stock and Public Warrants are listed on the Nasdaq Global Select Market (“Nasdaq”) under the symbols “AVPT” and “AVPTW,” respectively. On August 23, 2021, the last reported sales price of our Common Stock on Nasdaq was $9.41 per share and the last reported sales price of our Warrants was $2.02 per warrant.

This prospectus supplement should be read in conjunction with the Prospectus, including any amendments or supplements thereto, which is to be delivered with this prospectus supplement. This prospectus supplement is qualified by reference to the Prospectus, including any amendments or supplements thereto, except to the extent that the information in this prospectus supplement updates and supersedes the information contained therein.

This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus, including any amendments or supplements thereto.

We are an “emerging growth company” as defined under U.S. federal securities laws and, as such, have elected to comply with reduced public company reporting requirements. The Prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled “Risk Factors” beginning on page 10 of the Prospectus and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus supplement or the Prospectus. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated August 24, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 24, 2021 (August 19, 2021)

AvePoint, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-39048

|

83-4461709

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

525 Washington Blvd, Suite 1400

Jersey City, NJ

(Address of principal executive offices)

|

07310

(Zip Code)

|

Registrant’s telephone number, including area code: (201) 793-1111

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001

per share

|

|

AVPT

|

|

The Nasdaq Global Select Market

|

|

Warrants, each whole warrant

exercisable for one share of Common

Stock at an exercise price of $11.50

per share

|

|

AVPTW

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 4.01

|

Changes in Registrant’s Certifying Accountant.

|

AvePoint, Inc. (the "Company") has dismissed Crowe LLP (“Crowe”) as its independent registered public accounting firm, effective as of August 19, 2021. As described in Item 4.01(a) below, the change in independent registered public accounting firm is not the result of any disagreement with Crowe.

(a) Dismissal of Independent Registered Public Accounting Firm

On August 19, 2021 (the "Dismissal Date"), the Audit Committee (the "Audit Committee") of the Board of Directors of the Company approved the dismissal of Crowe as the Company’s independent registered public accounting firm. Crowe had previously been appointed as the independent registered public accounting firm for the Company's predecessor operating company, AvePoint Operations, Inc. ("Legacy AvePoint"), prior to the successful completion of Legacy's AvePoint's business combination (the "Business Combination") with Apex Technology Acquisition Corporation on July 1, 2021 (the "Merger Effective Date"). Upon completion of the Business Combination on the Merger Effective Date (the "Merger Effective Time"), the Audit Committee appointed Crowe to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

The reports of Crowe on Legacy AvePoint's consolidated financial statements for the fiscal years ended December 31, 2020 and 2019 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

In connection with the audits of Legacy AvePoint's consolidated financial statements for the fiscal years ended December 31, 2020 and 2019 and during (A) Legacy AvePoint's two most recent fiscal years and the subsequent interim period through the Merger Effective Date and ending just prior to the Merger Effective Time (during which periods Crowe served as Legacy AvePoint's independent registered public accounting firm) and (B) the subsequent interim period from the Merger Effective Time through the Dismissal Date (during which Crowe served as the Company's independent registered public accounting firm), there were no “disagreements” with Crowe on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements if not resolved to the satisfaction of Crowe would have caused Crowe to make reference thereto in its reports on the consolidated financial statement for such period. During the aforementioned periods, there have been no “reportable events” (as defined in Item 304(a)(1)(iv) and Item 304(a)(1)(v) of Regulation S-K), other than the material weaknesses in internal controls identified by management related to (i) the completeness and accuracy of financial accounting, reporting and disclosures, (ii) the identification, review and accounting for nonroutine transactions and/or events and (iii) segregation of duties with respect to the processing of financial transactions, as the foregoing were previously disclosed in the Company's Registration Statement on Form S-4 as originally filed with the Securities and Exchange Commission (the “SEC”) on February 4, 2021.

The Company provided Crowe with a copy of the disclosure it is making herein in response to Item 304(a) of Regulation S-K, and requested Crowe furnish the Company with a copy of its letter addressed to the SEC, pursuant to Item 304(a)(3) of Regulation S-K, stating whether or not Crowe agrees with the statements related to them made by the Company in this report. A copy of Crowe’s letter dated August 24, 2021 is attached as Exhibit 16.1 to this report.

(b) Newly Engaged Independent Registered Public Accounting Firm

On August 19, 2021, the Audit Committee approved the appointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s new independent registered public accounting firm as of and for the fiscal year ending December 31, 2021. Prior to engaging Deloitte, during the fiscal years ended December 31, 2020 and 2019 and through the Dismissal Date, neither the Company nor anyone on its behalf consulted Deloitte regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered with respect to the consolidated financial statements of the Company, and no written report or oral advice was provided to the Company by Deloitte that was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue; or (ii) any matter that was the subject of a "disagreement" (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a “reportable event” (as that term is defined in Item 304(a)(1)(v) of Regulation S-K).

|

Item 9.01

|

Financial Statement and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

AvePoint, Inc.

|

|

|

|

|

|

|

|

Dated: August 24, 2021

|

|

|

|

|

|

By:

|

/s/ Brian Michael Brown

|

|

|

|

|

Brian Michael Brown

|

|

|

|

|

General Counsel, Chief Legal and Compliance Officer,

and Secretary

|

|

Exhibit 16.1

August 24, 2021

Office of the Chief Accountant

Securities and Exchange Commission

100 F Street, N. E.

Washington, D.C. 20549

Ladies and Gentlemen:

We have read the comments made regarding us in Item 4.01 of Form 8-K of AvePoint, Inc. dated August 24, 2021, as contained in the first paragraph of Item 4.01, the second and third sentences of the second paragraph of Item 4.01, and the third, fourth and fifth paragraphs of Item 4.01, and are in agreement with those statements.

/s/ Crowe LLP

New York, New York

|

cc:

|

Mr. John Ho

|

|

|

Audit Committee Chairman

|

|

|

AvePoint, Inc.

|

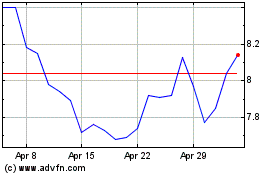

AvePoint (NASDAQ:AVPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

AvePoint (NASDAQ:AVPT)

Historical Stock Chart

From Apr 2023 to Apr 2024