Prospectus Supplement No. 2

(to Resale Prospectus dated May 25, 2021)

Registration File No. 333-252810

Prospectus Supplement No. 1

(to PIPE Resale Prospectus dated May 25, 2021)

Registration File No. 333-251390

Filed Pursuant to Rule 424(b)(3)

Rush Street

Interactive, Inc.

184,364,810 Shares

of Class A Common Stock

This Prospectus Supplement,

dated August 13, 2021, is being filed by Rush Street Interactive, Inc. (the “Company”) to update and supplement the information

contained in the Company’s (i) prospectus, dated May 25, 2021 (as amended and supplemented from time to time, the “Resale

Prospectus”), which forms a part of the Company’s Registration Statement on Form S-1 (Registration No. 333-252810), as amended

from time to time, and (ii) prospectus, dated May 25, 2021 (as amended and supplemented from time to time, the “PIPE Resale Prospectus”

and together with the Resale Prospectus, the “Prospectuses”), which forms a part of the Company’s Registration Statement

on Form S-1 (Registration No. 333-251390), as amended from time to time. This prospectus supplement is being filed to update and supplement

the information in the Prospectuses with the information contained in the Company’s Current Report on Form 8-K, filed with the Securities

and Exchange Commission (“SEC”) on August 12, 2021 (the “Current Report”). Accordingly, we have attached the Current

Report to this prospectus supplement.

The Resale Prospectus relates

to: (1) the offer and sale, from time to time, by the selling holders identified in the Resale Prospectus, or their permitted transferees,

of (i) up to 168,321,808 shares of the Company’s Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”).

The PIPE Resale Prospectus relates to the resale from time to time by the selling stockholders named in the PIPE Resale Prospectus, or

their permitted transferees, of up to 16,043,002 shares of Class A Common Stock.

This prospectus supplement

updates and supplements the information in the Prospectuses and is not complete without, and may not be delivered or utilized except in

combination with, the Prospectuses, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction

with the Prospectuses and if there is any inconsistency between the information in the Prospectuses and this prospectus supplement, you

should rely on the information in this prospectus supplement.

Our Class A Common Stock is

traded on The New York Stock Exchange under the symbol “RSI”. On August 11, 2021, the closing price of our Class A Common

Stock was $13.32 per share.

Investing in our securities

involves risks that are described in the “Risk Factors” section beginning on page 19 of the Resale Prospectus and page 18

of the PIPE Resale Prospectus, and under similar headings in any further amendments or supplements to the Prospectuses before you decide

whether to invest in the Company’s securities.

Neither the SEC nor any

state securities commission has approved or disapproved of the securities to be issued under the Prospectuses or determined if the Prospectuses

or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August

13, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 12, 2021

RUSH STREET INTERACTIVE, INC.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

|

001-39232

|

|

84-3626708

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

900 N. Michigan Avenue, Suite 950

Chicago, Illinois 60611

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (312) 915-2815

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A common stock, par value $0.0001 per share

|

|

RSI

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On August 12, 2021, Rush Street

Interactive, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the second quarter

ended June 30, 2021.

A copy of the Company’s

press release is attached hereto as Exhibit 99.1 and is hereby incorporated by reference in this Item 2.02. The information and exhibit

contained in this Item 2.02 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as

amended, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

Press Release, dated August 12, 2021,

reporting financial results for the second quarter ended June 30, 2021

|

|

104

|

|

Cover Page Interactive Data File

(embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

RUSH STREET INTERACTIVE, INC.

|

|

|

|

|

|

|

By:

|

/s/ Kyle Sauers

|

|

|

|

Name: Kyle Sauers

|

|

|

|

Title: Chief Financial Officer

|

|

|

|

|

|

Dated: August 12, 2021

|

|

|

Exhibit 99.1

RUSH STREET INTERACTIVE ANNOUNCES SECOND QUARTER

2021 RESULTS AND RAISES FULL YEAR 2021 GUIDANCE

- Second Quarter Revenue of $122.8 Million,

up 89% Year-over-Year -

- Full Year 2021 Revenue Guidance Raised to

between $465 and $495 Million -

CHICAGO – August 12, 2021 – Rush

Street Interactive, Inc. (NYSE: RSI) (“RSI”), a leading online casino and sports betting company in the United States, today

announced financial results for the second quarter ended June 30, 2021.

Second Quarter 2021

Financial Highlights

|

|

●

|

Revenue was $122.8 million during the second quarter of 2021, an increase of 89%, compared to $65.0 million

during the second quarter of 2020.

|

|

|

●

|

Net loss was $14.0 million during the second quarter of 2021, compared to a net loss of $50.6 million

during the second quarter of 2020.

|

|

|

●

|

Adjusted EBITDA[1]

loss was $6.6 million during the second quarter of 2021, compared to an Adjusted EBITDA of $3.7 million during the second quarter of 2020.

|

|

|

●

|

Adjusted advertising and promotions expense1 was $36.9 million, or 30% of revenue, during the

second quarter of 2021, compared to $7.4 million during the second quarter of 2020.

|

|

|

●

|

Real-Money Monthly Active Users (“MAUs”) in the United States for the second quarter of 2021

were up 128% year-over-year with average revenue per MAU (“ARPMAU”) of $377 during the second quarter of 2021.

|

|

|

●

|

As of June 30, 2021, RSI had $361 million of unrestricted cash and cash equivalents.

|

Richard Schwartz, Chief Executive Officer of RSI, said, “We are

very pleased with the continued execution of our business strategy and remain focused on providing a premiere user experience for our

customers. In addition to successfully growing revenues in existing markets, we have made significant progress in securing access opportunities

to new markets. Earlier today, we announced an extremely exciting partnership with the State of Connecticut, where we will be the exclusive

partner of the Connecticut Lottery offering both mobile and retail sports wagering, and be one of only three operators operating in the

state. This week, we also announced an agreement for market access opportunities in Louisiana, Mississippi, and New Mexico, with the latter

two subject to those states passing mobile gaming legislation. Earlier this week, we also submitted mobile sports betting applications

in New York and Arizona.

While new market access is a key pillar to our growth story, we also

continue to work diligently to expand our exclusive content offering for both sport betting and casino games as exemplified by new partnerships

with GTG Network for co-exclusive sports betting information and Boom Entertainment for exclusive casino content. Stay tuned for the launch

of new and exclusive offerings in coming quarters.

1

This is a non-GAAP financial measure. Please see “Non-GAAP Financial Measures” for more information about this non-GAAP financial

measure and “Reconciliations of GAAP to Non-GAAP Financial Measures” for a reconciliation of the most comparable measure calculated

in accordance with GAAP to this non-GAAP financial measure.

On the sports betting side, and as we head into the ever-important

football season, BetRivers recently entered into a partnership with the Chicago Bears and is excited to be working with several highly

recognized and well-respected former athletes as brand ambassadors. This includes our recent announcement of Chicago football legend Mike

Ditka who we are thrilled to have on our team. We look forward to creating and streaming exclusive content from these hometown heroes,

directly to the BetRivers and PlaySugarHouse apps.

Our ongoing commitment to improving the player experience by enhancing

the quality of our mobile apps and sites, coupled with solid execution on our marketing programs, has led to continued impressive paybacks,

along with strong conversion and retention rates. The strength of these metrics and efficiency of our marketing efforts supports our confidence

in the long-term success of the business.”

Increasing 2021

Revenue Guidance

RSI expects revenues

for the full year ending December 31, 2021 to be between $465 and $495 million, up from its previous guidance of between $440 and $480

million. At the midpoint of the range, revenue of $480 million represents 72% year-over-year growth when compared to $278.5 million of

revenues for 2020. This increase reflects RSI’s strong first half 2021 results and anticipated growth in recently opened and existing

markets resulting from increased marketing spend funded with cash on hand.

This range is based

on certain assumptions, including that (i) launch of operations in any new jurisdictions are not included, (ii) all professional and college

sports calendars that have been announced come to fruition, including the completion or commencement of their 2021 seasons, and (iii)

RSI continues to operate in states in which it is live today.

Recent Business

Highlights

|

|

·

|

Announced market access partnerships for five new markets, including Connecticut, Arizona, Louisiana,

Mississippi and New Mexico, with the latter two being subject to the passage of enabling mobile gaming legislation. We anticipate being

able to launch in Connecticut, Arizona, and Louisiana during the upcoming football season.

|

|

|

·

|

Crowned Casino Operator of the Year, Customer Services Operator of the Year and Social Gaming Operator

of the Year at the EGR North America Awards 2021, winning the first two awards for the 2nd year in row. The continued recognition

for customer service exemplifies how our market leading user experience drives players to remain loyal to our platform.

|

|

|

·

|

Announced a multi-year exclusive partnership with the Chicago Bears and Rivers Casino making BetRivers

the Bears’ Official Sportsbook partner.

|

|

|

·

|

Formed a brand ambassador partnership agreement with NFL legend Mike Ditka.

|

|

|

·

|

Launched Evolution Gaming’s online live dealer casino games in Michigan on July 22nd, the first

day the product was authorized to launch in the state.

|

|

|

·

|

Partnered with Scientific Games to be the first operator to premiere its proven online casino game library

in West Virginia at BetRivers.com.

|

|

|

·

|

Announced a multi-year co-exclusive partnership with GTG Network to offer GTG’s iSport Genius data

facts and insights in all states where RSI operates its online sportsbooks.

|

|

|

·

|

Made a minority investment in Boom Entertainment, a premier online gaming developer and technology provider,

and entered into a partnership with them that brings with it several potential market access opportunities in states such as Mississippi,

New Mexico and Louisiana, along with incremental high-quality online casino games, including certain exclusive games only available on

our platform.

|

|

|

·

|

Added to the Russell 2000® Index and Russell 3000® Index as part of the indexes’ annual

reconstitution that took place on June 25, 2021.

|

Technology Updates

|

|

·

|

RSI mobile sportsbook app independently rated #4 out of 31 apps in the US market in July 2021 by Eilers

& Krejcik.

|

|

|

·

|

Launched Android App on GooglePlay across our US footprint.

|

|

|

·

|

Launched new and materially improved iOS apps in Illinois, Iowa, Indiana, Colorado and Virginia.

|

|

|

·

|

Remain on track to launch an iOS app in live casino markets in 2H21.

|

|

|

·

|

Brought several exciting new sports betting features to market including betting tips, a stats center,

enhanced player search functionality, live event score and game clock updates and more live streamed content.

|

|

|

·

|

Plans to offer more advanced single game parlay bet options in time for the upcoming NFL season where

customers will be able to parlay the existing moneyline, spread and totals with player prop bets including passing yards, rushing yards,

touchdowns scored and more.

|

Earnings Conference Call and Webcast Details

RSI will host a conference call and audio webcast

today at 5:00 p.m. Eastern Time (4:00 p.m. Central Time), during which management will discuss second quarter results and provide commentary

on business performance and its current outlook for 2021. A question-and-answer session will follow the prepared remarks.

The conference call may be accessed by dialing

(844) 200-6205 for domestic callers or +44 208-0682-558 for international callers. The conference call access code is 828144.

A live audio webcast of the earnings conference

call may be accessed on RSI’s website at ir.rushstreetinteractive.com, along with a copy of this press release and an investor slide

presentation. The audio webcast and investor slide presentation will be available on RSI’s investor relations website until at least

September 12, 2021.

About Rush Street Interactive

RSI is a trusted online gaming and sports entertainment

company focused only on legal and regulated markets in the United States and Latin America. Through its brands, BetRivers.com

and PlaySugarHouse.com, RSI was an early entrant in many regulated jurisdictions and is currently

live with real-money mobile, online and/or retail operations in ten U.S. states: Pennsylvania, Illinois, New Jersey, New York, Michigan,

Indiana, Virginia, Colorado, Iowa and West Virginia. RSI is also active internationally, offering its online casino and sportsbook in

the regulated gaming market of Colombia on RushBet.co. RSI offers, through its proprietary online

gaming platform, some of the most popular online casino games and sports betting options in the United States. Founded in 2012 in Chicago

by gaming industry veterans, RSI was named the 2020 Global Gaming Awards Digital Operator of the Year and the 2021 EGR North America Awards

Casino Operator of the Year, Customer Services Operator of the Year and Social Gaming Operator of the Year. RSI is committed to industry-leading

responsible gaming practices and seeks to provide its customers with the resources and services they need to play responsibly. For more

information, visit www.rushstreetinteractive.com.

Non-GAAP Financial

Measures

In addition to providing

financial measurements based on accounting principles generally accepted in the United States (“GAAP”), this press release

includes certain financial measures that are not prepared in accordance with GAAP, including Adjusted EBITDA, Adjusted Operating Costs

and Expenses, Adjusted Net Loss Per Share, Adjusted Net Loss and Adjusted Weighted Average Common Shares Outstanding, each of which is

a non-GAAP performance measure that RSI uses to supplement its results presented in accordance with GAAP. A reconciliation of

each such non-GAAP financial measure to the most directly comparable GAAP financial measure can be found below. RSI believes that presentation

of these non-GAAP financial measures provides useful information to investors regarding RSI’s results of operations and operating

performance, as they are similar to measures reported by its public competitors and are regularly used by security analysts, institutional

investors and other interested parties in analyzing operating performance and prospects. These non-GAAP financial measures are not intended

to be considered in isolation or as a substitute for any GAAP financial measures and, as calculated, may not be comparable to other similarly

titled measures of performance of other companies in other industries or within the same industry.

RSI defines Adjusted

EBITDA as net income (loss) before interest, income taxes, depreciation and amortization, share-based compensation, adjustments for certain one-time or non-recurring items

and other adjustments. Adjusted EBITDA excludes certain expenses that are required in accordance with GAAP because certain expenses

are either non-cash (for example, depreciation and amortization, and share-based compensation) or are not related to our underlying business

performance (for example, interest income or expense).

RSI defines Adjusted

Operating Costs and Expenses as RSI’s GAAP operating costs and expenses adjusted to exclude the impacts of share-based compensation,

certain one-time or non-recurring items and other adjustments. Adjusted Operating Costs and Expenses excludes certain expenses that are

required in accordance with GAAP because certain expenses are either non-cash (for example, share-based compensation) or are not

related to our underlying business performance.

RSI defines Adjusted

Net Loss Per Share as Adjusted Net Loss divided by Adjusted Weighted Average Common Shares Outstanding. Adjusted Net Loss is defined as

net loss attributable to Rush Street Interactive, Inc. as used in the diluted net loss per share calculation, adjusted for the reallocation

of net loss attributable to noncontrolling interests, share-based compensation, certain one-time or non-recurring items and other adjustments.

Adjusted Weighted Average Common Shares Outstanding is defined as the weighted average number of common shares outstanding as used in

the diluted net loss per share calculation, adjusted for the assumed conversion of the noncontrolling interest’s Rush Street Interactive,

LP Class A units to Class A common stock of RSI on a one-to-one-basis.

RSI includes these

non-GAAP financial measures because management uses them to evaluate RSI’s core operating performance and trends and to make strategic

decisions regarding the allocation of capital and new investments. Management believes that these non-GAAP financial measures provide

investors with useful information on RSI’s past financial and operating performance, enable comparison of financial results from

period-to-period where certain items may vary independent of business performance, and allow for greater transparency with respect to

metrics used by RSI’s management in operating our business. Management also believes these non-GAAP financial measures are useful

in evaluating our operating performance compared to that of other companies in our industry, as these metrics generally eliminate the

effects of certain items that may vary from company to company for reasons unrelated to overall operating performance.

Key Metrics

RSI provides certain

key metrics, including MAUs and ARPMAU, in this press release. RSI defines MAUs as the number of unique players per month who have placed

at least one real-money bet across one or more of our online casino or online sports betting offerings, and it defines ARPMAU as average

revenue for the applicable period divided by the average MAUs for the same period.

The numbers RSI uses

to calculate MAUs and ARPMAU are based on internal RSI data. While these numbers are based on what RSI believes to be reasonable judgments

and estimates of our customer base for the applicable period of measurement, there are inherent challenges in measuring usage and engagement

with respect to our online offerings across our customer base. Such challenges and limitations may also affect RSI’s understanding

of certain details of its business. In addition, RSI’s key metrics and related estimates, including the definitions and calculations

of the same, may differ from estimates published by third parties or from similarly-titled metrics of its competitors due to differences

in operations, offerings, methodology and access to information. RSI regularly reviews, and may adjust its processes for calculating,

its internal metrics to improve their accuracy.

Forward-Looking

Statements

This press release

includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995. RSI's actual results may differ from their expectations, estimates and projections and consequently, you

should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate,"

"project," "budget," "forecast," "anticipate," "intend," "plan," "may,"

"will," "could," "should," "believes," "predicts," "potential," "continue,"

and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation,

statements regarding guidance, RSI’s future results of operations or financial condition, RSI’s strategic plans and focus,

player growth and engagement, product initiatives and the objectives of management for future operations. These forward-looking statements

involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of

these factors are outside RSI's control and are difficult to predict. Factors that may cause such differences include, without limitation:

changes in applicable laws or regulations; RSI’s ability to manage growth; RSI’s ability to execute our business plan and

meet its projections; unanticipated product or service delays; general economic and market conditions impacting the demand for RSI’s

products and services; economic and market conditions in the gaming, entertainment and leisure industry in the markets in which RSI operates;

the potential adverse effects of the COVID-19 pandemic on capital markets, general economic conditions, unemployment and RSI’s liquidity,

operations and personnel; and other risks and uncertainties indicated from time to time in RSI's filings with the SEC. RSI cautions that

the foregoing list of factors is not exclusive. RSI cautions readers not to place undue reliance upon any forward-looking statements,

which speak only as of the date made. RSI does not undertake or accept any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances

on which any such statement is based.

Media Contacts:

Jonathan Gasthalter

/ Carissa Felger / Nathaniel Garnick

(312) 319-9233 / (212)

257-4170

rsi@gasthalter.com

or

Lisa Johnson

(609) 788-8548

lisa@lisajohnsoncommunications.com

Investor Contact:

ir@rushstreetinteractive.com

Rush Street Interactive,

Inc.

Consolidated Condensed

Statements of Operations and Comprehensive Loss

(Unaudited and in

thousands, except per share data)

|

|

|

Three Months Ended

June 30,

|

|

|

Six Months Ended

June 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2021

|

|

|

2020

|

|

|

Revenue

|

|

$

|

122,800

|

|

|

$

|

65,038

|

|

|

$

|

234,620

|

|

|

$

|

100,215

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of revenue

|

|

|

84,760

|

|

|

|

49,287

|

|

|

|

164,447

|

|

|

|

71,667

|

|

|

Advertising and promotions

|

|

|

37,543

|

|

|

|

7,445

|

|

|

|

79,759

|

|

|

|

15,915

|

|

|

General administration and other

|

|

|

11,768

|

|

|

|

58,399

|

|

|

|

28,332

|

|

|

|

75,165

|

|

|

Depreciation and amortization

|

|

|

914

|

|

|

|

457

|

|

|

|

1,588

|

|

|

|

916

|

|

|

Total operating costs and expenses

|

|

|

134,985

|

|

|

|

115,588

|

|

|

|

274,126

|

|

|

|

163,663

|

|

|

Loss from operations

|

|

|

(12,185

|

)

|

|

|

(50,550

|

)

|

|

|

(39,506

|

)

|

|

|

(63,448

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(17

|

)

|

|

|

(40

|

)

|

|

|

(30

|

)

|

|

|

(85

|

)

|

|

Change in fair value of warrant liabilities

|

|

|

-

|

|

|

|

-

|

|

|

|

41,802

|

|

|

|

-

|

|

|

Change in fair value of earnout interests liability

|

|

|

-

|

|

|

|

-

|

|

|

|

(13,740

|

)

|

|

|

-

|

|

|

Total other income (expenses)

|

|

|

(17

|

)

|

|

|

(40

|

)

|

|

|

28,032

|

|

|

|

(85

|

)

|

|

Loss before income taxes

|

|

|

(12,202

|

)

|

|

|

(50,590

|

)

|

|

|

(11,474

|

)

|

|

|

(63,533

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

1,752

|

|

|

|

-

|

|

|

|

2,556

|

|

|

|

-

|

|

|

Net loss

|

|

$

|

(13,954

|

)

|

|

$

|

(50,590

|

)

|

|

$

|

(14,030

|

)

|

|

$

|

(63,533

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to non-controlling interests

|

|

|

(10,187

|

)

|

|

|

-

|

|

|

|

(10,246

|

)

|

|

|

-

|

|

|

Net loss attributable to Rush Street Interactive, Inc.

|

|

$

|

(3,767

|

)

|

|

$

|

(50,590

|

)

|

|

$

|

(3,784

|

)

|

|

$

|

(63,533

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share attributable to Rush

Street Interactive, Inc. – basic

|

|

$

|

(0.06

|

)

|

|

|

N/A

|

|

|

$

|

(0.07

|

)

|

|

|

N/A

|

|

|

Weighted average common shares outstanding – basic

|

|

|

59,163,547

|

|

|

|

N/A

|

|

|

|

53,093,129

|

|

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share attributable to Rush

Street Interactive, Inc. – diluted

|

|

$

|

(0.06

|

)

|

|

|

N/A

|

|

|

$

|

(0.24

|

)

|

|

|

N/A

|

|

|

Weighted average common shares outstanding – diluted

|

|

|

59,163,547

|

|

|

|

N/A

|

|

|

|

55,452,029

|

|

|

|

N/A

|

|

|

|

|

Three Months Ended

June 30,

|

|

|

Six Months Ended

June 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2021

|

|

|

2020

|

|

|

Net loss

|

|

$

|

(13,954

|

)

|

|

$

|

(50,590

|

)

|

|

$

|

(14,030

|

)

|

|

$

|

(63,533

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

(268

|

)

|

|

|

54

|

|

|

|

(892

|

)

|

|

|

(310

|

)

|

|

Comprehensive loss

|

|

$

|

(14,222

|

)

|

|

$

|

(50,536

|

)

|

|

$

|

(14,922

|

)

|

|

$

|

(63,843

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss attributable to non-controlling interests

|

|

|

(10,383

|

)

|

|

|

-

|

|

|

|

(10,923

|

)

|

|

|

-

|

|

|

Comprehensive loss attributable to Rush Street Interactive, Inc.

|

|

$

|

(3,839

|

)

|

|

$

|

(50,536

|

)

|

|

$

|

(3,999

|

)

|

|

$

|

(63,843

|

)

|

Rush Street Interactive,

Inc.

Reconciliations of

GAAP to Non-GAAP Financial Measures

(Unaudited and in

thousands)

Adjusted EBITDA:

|

|

|

Three Months Ended

June

30,

|

|

|

Six Months Ended

June 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2021

|

|

|

2020

|

|

|

Net loss

|

|

$

|

(13,954

|

)

|

|

$

|

(50,590

|

)

|

|

$

|

(14,030

|

)

|

|

$

|

(63,533

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

914

|

|

|

|

457

|

|

|

|

1,588

|

|

|

|

916

|

|

|

Interest expense, net

|

|

|

17

|

|

|

|

40

|

|

|

|

30

|

|

|

|

85

|

|

|

Income tax expense

|

|

|

1,752

|

|

|

|

-

|

|

|

|

2,556

|

|

|

|

-

|

|

|

Change in fair value of warrant liability

|

|

|

-

|

|

|

|

-

|

|

|

|

(41,802

|

)

|

|

|

-

|

|

|

Change in fair value of earnout interests liability

|

|

|

-

|

|

|

|

-

|

|

|

|

13,740

|

|

|

|

-

|

|

|

Share-based compensation

|

|

|

4,661

|

|

|

|

53,769

|

|

|

|

16,237

|

|

|

|

67,259

|

|

|

Adjusted EBITDA

|

|

$

|

(6,610

|

)

|

|

$

|

3,676

|

|

|

$

|

(21,681

|

)

|

|

$

|

4,727

|

|

Adjusted Operating Costs and Expenses:

|

|

|

Three Months Ended

June 30,

|

|

|

Six Months Ended

June 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2021

|

|

|

2020

|

|

|

GAAP operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of revenue

|

|

$

|

84,760

|

|

|

$

|

49,287

|

|

|

$

|

164,447

|

|

|

$

|

71,667

|

|

|

Advertising and promotions

|

|

|

37,543

|

|

|

|

7,445

|

|

|

|

79,759

|

|

|

|

15,915

|

|

|

General administration and other

|

|

|

11,768

|

|

|

|

58,399

|

|

|

|

28,332

|

|

|

|

75,165

|

|

|

Depreciation and amortization

|

|

|

914

|

|

|

|

457

|

|

|

|

1,588

|

|

|

|

916

|

|

|

Total operating costs and expenses

|

|

$

|

134,985

|

|

|

$

|

115,588

|

|

|

$

|

274,126

|

|

|

$

|

163,663

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP operating cost and expense adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of revenue1

|

|

$

|

(298

|

)

|

|

$

|

-

|

|

|

$

|

(1,213

|

)

|

|

$

|

-

|

|

|

Advertising and promotions1

|

|

|

(636

|

)

|

|

|

-

|

|

|

|

(2,334

|

)

|

|

|

-

|

|

|

General administration and other1

|

|

|

(3,727

|

)

|

|

|

(53,769

|

)

|

|

|

(12,690

|

)

|

|

|

(67,259

|

)

|

|

Depreciation and amortization

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Total non-GAAP operating cost and expense adjustments

|

|

$

|

(4,661

|

)

|

|

$

|

(53,769

|

)

|

|

$

|

(16,237

|

)

|

|

$

|

(67,259

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of revenue

|

|

$

|

84,462

|

|

|

$

|

49,287

|

|

|

$

|

163,234

|

|

|

$

|

71,667

|

|

|

Advertising and promotions

|

|

|

36,907

|

|

|

|

7,445

|

|

|

|

77,425

|

|

|

|

15,915

|

|

|

General administration and other

|

|

|

8,041

|

|

|

|

4,630

|

|

|

|

15,642

|

|

|

|

7,906

|

|

|

Depreciation and amortization

|

|

|

914

|

|

|

|

457

|

|

|

|

1,588

|

|

|

|

916

|

|

|

Total adjusted operating costs and expenses

|

|

$

|

130,324

|

|

|

$

|

61,819

|

|

|

$

|

257,889

|

|

|

$

|

96,404

|

|

1 Share-based

compensation.

Rush Street Interactive,

Inc.

Reconciliations of

GAAP to Non-GAAP Financial Measures

(Unaudited and in

thousands)

Adjusted Net Loss, Adjusted Weighted

Average Common Shares Outstanding and Adjusted Net Loss Per Share:

|

|

|

Three Months Ended

June 30, 2021

|

|

|

Six Months Ended

June 30, 2021

|

|

|

Adjusted Net Loss

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Rush Street Interactive, Inc. – diluted(1)

|

|

$

|

(3,767

|

)

|

|

$

|

(13,353

|

)

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Add: Net loss attributable to non-controlling interests

|

|

|

(10,187

|

)

|

|

|

(10,246

|

)

|

|

Less: Change in fair value of warrant liabilities attributable to noncontrolling interests

|

|

|

-

|

|

|

|

(32,233

|

)

|

|

Add: Change in fair value of earnout interests liability

|

|

|

-

|

|

|

|

13,740

|

|

|

Add: Share-based compensation expense

|

|

|

4,661

|

|

|

|

16,237

|

|

|

Adjusted Net Loss

|

|

$

|

(9,293

|

)

|

|

$

|

(25,855

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Weighted Average Common Shares Outstanding

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – diluted(2)

|

|

|

59,163,547

|

|

|

|

55,452,029

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Add: Conversion of RSILP units to Class A Common Shares

|

|

|

160,000,000

|

|

|

|

160,000,000

|

|

|

Adjusted Weighted Average Common Shares Outstanding

|

|

|

219,163,547

|

|

|

|

215,452,029

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share attributable to Rush Street Interactive, Inc. – diluted:

|

|

$

|

(0.06

|

)

|

|

$

|

(0.24

|

)

|

|

Adjusted Net Loss per Share

|

|

$

|

(0.04

|

)

|

|

$

|

(0.12

|

)

|

|

|

(1)

|

Net loss attributable to Rush Street Interactive, Inc. –

diluted for the six months ended June 30, 2021, includes the Net loss attributable to Rush Street Interactive, Inc. adjusted for the

dilutive effect of previously outstanding warrants that were redeemed in March 2021 (i.e., the portion of the change in fair value of

warrants attributed to Rush Street Interactive Inc.). There was no dilutive effect for the three months ended June 30, 2021.

|

|

|

(2)

|

Weighted average common shares outstanding – diluted for

the six months ended June 30, 2021, includes the basic number of weighted average common shares outstanding, adjusted for the dilutive

effect of previously outstanding warrants that were redeemed in March 2021 using the Treasury Stock Method. There was no dilutive effect

for the three months ended June 30, 2021.

|

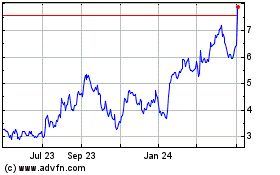

Rush Street Interactive (NYSE:RSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

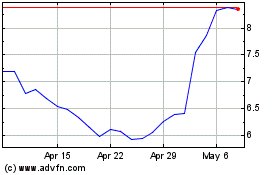

Rush Street Interactive (NYSE:RSI)

Historical Stock Chart

From Apr 2023 to Apr 2024