Hall of Fame Resort & Entertainment Company (NASDAQ: HOFV,

HOFVW) (the “Company”), the only resort, entertainment and media

company centered around the power of professional football,

announced its second quarter fiscal 2021 results for the period

ended June 30, 2021.

“There have been many key events achieved during the second

quarter and continuing into the third quarter, highlighting the

strength of the ecosystem that we are creating,” stated Michael

Crawford, President and CEO of HOFV. “The foundation that has been

laid has created momentum across all business verticals. The last

months have been exciting and show the strength of the team to

achieve all these accomplishments. We, together with the Pro

Football Hall of Fame, hosted Enshrinement Week last week with

thousands of people coming to the Hall of Fame Village powered by

Johnson Controls to celebrate two Enshrinements (2020 and 2021),

the NFL Hall of Fame Game, and concert. Within our Hall of Fame

Village Media subsidiary, we co-produced World Chase Tag (“WCT”)

2021 Championships and launched a set of NFTs for six football

legends. Finally, within our gaming vertical, our Hall of Fantasy

league announced the front offices for each of the teams and

launched an app.”

Key Financial Highlights

- Second quarter revenue was $2.4 million, an increase of 39%

compared to the same period of the prior year, primarily driven by

hotel revenue. Event and rental revenue also contributed to

revenue.

- Second quarter net income was $15.5 million. This was primarily

due to income of $26.3 million related to a change in fair value of

warrant liability .

- Second quarter adjusted EBITDA was a loss of $5.6 million,

compared to $1.3M in the same period of the prior year, resulting

from increased investments in operations. See page 6 for

reconciliation of net income attributable to Hall of Fame Resort

& Entertainment Company stockholders to adjusted EBITDA.

- The Company finished its second quarter with a cash balance,

including restricted cash, of $73.7 million, compared to $68.5

million as of March 31, 2021. The increased cash balance was driven

by proceeds from the Series B preferred shares and warrants issued

during the quarter.

Second Quarter Business Highlights

- Recognized with 2020 Hilton Legacy Award for our conversion and

launch of the DoubleTree by Hilton Canton Downtown Hotel.

- Announced Hall of Fame Running Back Terrell Davis as the

commissioner of the Hall of Fantasy League for the inaugural

2021-2022 season.

- Completed $15.2M raise of Series B preferred stock and warrants

in June to further strengthen the Company’s balance sheet.

- Announced collaboration with Tupelo Honey, WCT, and ESPN to

produce World Chase Tag 2021 Championships. The Company hosted the

competition with the event being televised on ESPN.

Subsequent To Quarter End Highlights

- Announced partnership with Esports Entertainment Group to

become the official esports provider and will operate a Helix

eSports entertainment center that is scheduled to open in

2022.

- Partnered with Venuetize to develop a mobile app to provide

guests with information and more convenient visits to the Hall of

Fame Village powered by Johnson Controls.

- Announced front office staff for the Hall of Fantasy League’s

inaugural 2021-2022 season with former NFL players and top fantasy

experts leading the franchises.

- Signed a multi-year sponsorship agreement with Hendrickson, a

leading global manufacturer and supplier of commercial

transportation products.

- Launched “Playbooks”, a collectible series of NFTs highlighting

memorable plays of six pro football legends.

Conference Call

The Company will host a conference call and webcast Friday,

August 13, 2021, beginning at 8:30 a.m. ET, to provide commentary

on the business. Speaking on the call will be Michael Crawford,

President and Chief Executive Officer, and Jason Krom, Chief

Financial Officer.

Investors and all other interested parties can access the live

webcast and replay at the Company’s website: ir.hofreco.com.

About Hall of Fame Resort & Entertainment Company

Hall of Fame Resort & Entertainment Company (NASDAQ: HOFV,

HOFVW) is a resort and entertainment company leveraging the power

and popularity of professional football and its legendary players

in partnership with the Pro Football Hall of Fame. Headquartered in

Canton, Ohio, the Hall of Fame Resort & Entertainment Company

is the owner of the Hall of Fame Village powered by Johnson

Controls, a multi-use sports, entertainment and media destination

centered around the Pro Football Hall of Fame’s campus. Additional

information on the Company can be found at www.HOFREco.com.

Forward-Looking Statements

Certain statements made herein are “forward-looking statements”

within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words and phrases such

as “opportunity,” “future,” “will,” “goal,” and “look forward” and

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company’s control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements. Important

factors, among others, that may affect actual results or outcomes

include the inability to recognize the anticipated benefits of the

business combination; costs related to the business combination;

the inability to maintain the listing of the Company’s shares on

Nasdaq; the Company’s ability to manage growth; the Company’s

ability to execute its business plan and meet its projections,

including refinancing its existing term loan and obtaining

financing to construct planned facilities; potential litigation

involving the Company; changes in applicable laws or regulations;

general economic and market conditions impacting demand for the

Company’s products and services, and in particular economic and

market conditions in the resort and entertainment industry; the

potential adverse effects of the ongoing global coronavirus

(COVID-19) pandemic on capital markets, general economic

conditions, unemployment and the Company’s liquidity, operations

and personnel, as well as those risks and uncertainties discussed

from time to time in our reports and other public filings with the

SEC. The Company does not undertake any obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

HALL OF FAME RESORT & ENTERTAINMENT

COMPANY AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

For the Three Months Ended June 30,

For the Six Months Ended June

30,

2021

2020

2021

2020

Revenues Sponsorships,

net of activation costs

$

1,508,402

$

1,660,928

$

2,983,838

$

3,321,856

Rents and cost recoveries

55,078

42,657

96,961

317,437

Event revenues

5,057

-

6,719

27,833

Hotel revenues

795,222

-

1,191,560

-

Total revenues

$

2,363,759

$

1,703,585

$

4,279,078

$

3,667,126

Operating expenses

Property operating expenses

6,219,781

2,428,283

12,228,780

9,112,269

Hotel operating expenses

1,596,989

-

2,363,154

-

Commission expense

260,583

607,126

427,250

1,057,980

Depreciation expense

2,972,130

2,723,303

5,893,067

5,445,423

Total operating expenses

$

11,049,483

$

5,758,712

$

20,912,251

$

15,615,672

Loss from operations

(8,685,724

)

(4,055,127

)

(16,633,173

)

(11,948,546

)

Other expense Interest

expense

(1,004,419

)

(2,199,785

)

(1,959,727

)

(4,209,795

)

Amortization of discount on note payable

(1,164,613

)

(3,443,333

)

(2,398,727

)

(6,677,746

)

Change in fair value of warrant liability

26,315,888

-

(90,035,112

)

-

Gain on extinguishment of debt

-

-

390,400

-

Total other income (expense)

$

24,146,856

$

(5,643,118

)

$

(94,003,166

)

$

(10,887,541

)

Net income (loss)

$

15,461,132

$

(9,698,245

)

$

(110,636,339

)

$

(22,836,087

)

Series B preferred stock dividends

$

(130,000

)

-

$

(130,000

)

-

Non-controlling interest

209,921

-

160,210

-

Net loss attributable to HOFRE

stockholders

$

15,541,053

$

(9,698,245

)

$

(110,606,129

)

$

(22,836,087

)

Net loss per share - basic

$

0.16

$

(1.78

)

$

(1.30

)

$

(4.20

)

Weighted average shares outstanding, basic

94,397,222

5,436,000

84,978,294

5,436,000

Net loss per share - diluted

$

-

$

(1.78

)

$

(1.30

)

$

(4.20

)

Weighted average shares outstanding, diluted

107,353,272

5,436,000

84,978,294

5,436,000

HALL OF FAME RESORT & ENTERTAINMENT

COMPANY AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS As of: June 30, 2021 December 31, 2020

(unaudited)

Assets Cash

$

61,908,208

$

7,145,661

Restricted cash

11,759,884

32,907,800

Accounts receivable, net

869,421

1,545,089

Prepaid expenses and other assets

8,954,346

6,920,851

Property and equipment, net

150,151,539

154,355,763

Project development costs

126,595,920

107,969,139

Total assets

$

360,239,318

$

310,844,303

Liabilities and stockholders' equity

Liabilities Notes payable, net

$

103,534,759

$

98,899,367

Accounts payable and accrued expenses

12,825,686

20,538,190

Due to affiliate

1,901,992

1,723,556

Warrant liability

55,805,000

19,112,000

Other liabilities

5,213,829

5,489,469

Total liabilities

179,281,266

145,762,582

Commitments and contingencies Stockholders'

equity Undesignated preferred stock, $0.0001 par value;

4,932,200 sharesauthorized; no shares issued or outstanding at June

30, 2021 andDecember 31, 2020

-

-

Series B convertible preferred stock, $0.0001 par value; 15,200

sharesdesignated; 15,200 and 0 shares issued and oustanding at June

30, 2021and December 31, 2020, respectively

2

-

Common stock, $0.0001 par value; 300,000,000 shares authorized;

94,872,068 and 64,091,266 shares issued and outstanding at June

30,2021 and December 31, 2020, respectively

9,488

6,410

Additional paid-in capital

298,752,278

172,112,688

Accumulated deficit

(117,447,000

)

(6,840,871

)

Total equity attributable to HOFRE

181,314,768

165,278,227

Non-controlling interest

(356,716

)

(196,506

)

Total equity

180,958,052

165,081,721

Total liabilities and stockholders' equity

$

360,239,318

$

310,844,303

HALL OF FAME RESORT & ENTERTAINMENT COMPANY AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (unaudited) For the Six Months Ended June

30,

2021

2020

Cash Flows From Operating Activities Net loss

$

(110,636,339

)

$

(22,836,087

)

Adjustments to reconcile net loss to cash flows used in

operating activities Depreciation expense

5,893,067

5,445,423

Amortization of note discounts

2,398,727

6,677,746

Interest paid in kind

952,012

2,199,714

Gain on forgiveness of debt

(390,400

)

-

Change in fair value of warrant liability

90,035,112

-

Stock-based compensation expense

3,006,692

-

Changes in operating assets and liabilities: Accounts

receivable

675,668

(346,185

)

Prepaid expenses and other assets

(2,033,495

)

(3,550,720

)

Accounts payable and accrued expenses

(2,060,008

)

2,121,854

Due to affiliates

178,436

(3,619,101

)

Other liabilities

(275,640

)

3,441,126

Net cash used in operating activities

(12,256,168

)

(10,466,230

)

Cash Flows From Investing Activities Additions to

project development costs and property and equipment

(26,098,120

)

(14,688,633

)

Purchase of leasehold improvements

-

(156,390

)

Net cash used in investing activities

(26,098,120

)

(14,845,023

)

Cash Flows From Financing Activities Proceeds from

notes payable

6,000,000

36,014,210

Repayments of notes payable

(4,309,947

)

(5,572,102

)

Payment of financing costs

(15,000

)

(135,268

)

Proceeds from sale of Series B preferred stock and warrants

15,200,000

-

Proceeds from equity raises, net of offering costs

31,746,996

-

Proceeds from exercise of warrants

23,346,870

-

Net cash provided by financing activities

71,968,919

30,306,840

Net increase in cash and restricted cash

33,614,631

4,995,587

Cash and restricted cash, beginning of year

40,053,461

8,614,592

Cash and restricted cash, end of year

$

73,668,092

$

13,610,179

Cash

$

61,908,208

$

2,149,500

Restricted Cash

11,759,884

11,460,679

Total cash and restricted cash

$

73,668,092

$

13,610,179

Non-GAAP Financial Measures

The Company reports its financial results in accordance with

accounting principles generally accepted in the United States

(“GAAP”) and corresponding metrics as non-GAAP financial measures.

The presentation includes references to the following non-GAAP

financial measures: EBITDA and adjusted EBITDA. These are important

financial measures used in the management of the business,

including decisions concerning the allocation of resources and

assessment of performance. Management believes that reporting these

non-GAAP financial measures is useful to investors as these

measures are representative of the company’s performance and

provide improve comparability of results. See the table below for

the definitions of the non-GAAP financial measures referred to

above and corresponding reconciliations of these non-GAAP financial

measures to the most comparable GAAP financial measures. Non-GAAP

financial measures should be viewed as additions to, and not as

alternatives for HOFV’s results prepared in accordance with GAAP.

In additional, the non-GAAP measures HOFV uses may differ from

non-GAAP measures used by other companies, and other companies may

not define the non-GAAP measures the company uses in the same

way.

For the Three Months Ended June 30,

2021

2020

Adjusted EBITDA Reconciliation Net income (loss)

attributable to HOFRE stockholders

$

15,541,053

$

(9,698,245

)

(Benefit from) provision for income taxes

-

-

Interest expense

1,004,419

2,199,785

Depreciation expense

2,972,130

2,723,303

Amortization of note discounts

1,164,613

3,443,333

EBITDA

20,682,215

(1,331,824

)

Change in fair value of warrant liability

(26,315,888

)

-

Adjusted EBITDA

$

(5,633,673

)

$

(1,331,824

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210812005869/en/

Media/Investor Contacts: Media Inquiries:

public.relations@hofreco.com Investor Inquiries:

investor.relations@hofreco.com

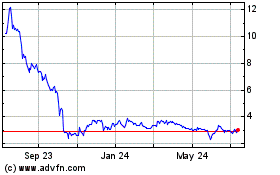

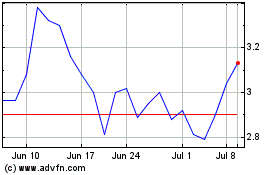

Hall of Fame Resort and ... (NASDAQ:HOFV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hall of Fame Resort and ... (NASDAQ:HOFV)

Historical Stock Chart

From Apr 2023 to Apr 2024