Inari Medical Reports Second Quarter 2021 Financial Results

August 10 2021 - 4:01PM

Inari Medical, Inc. (NASDAQ: NARI) (“Inari”) a commercial-stage

medical device company focused on developing products to treat and

transform the lives of patients suffering from venous diseases,

today reported financial results for its second quarter ended June

30, 2021.

Second Quarter Revenue and Business

Highlights:

- Treated a record number of patients,

with revenue of $63.5 million for the second quarter of 2021, up

11% sequentially and 150% year-over-year.

- Announced FDA clearance of

FlowSaver, enabling bloodless thrombectomy with the use of Triever

Catheters.

- Presented interim results of the

CLOUT DVT registry at New Cardiovascular Horizons, confirming best

in class safety, clot removal, and clinical results for patients

treated with ClotTriever.

- Ended the quarter with $176.1

million in cash, cash equivalents and short-term investments.

“Our second quarter was highly successful, especially in ways

most important to our mission to treat and transform the lives of

our patients,” said Bill Hoffman, CEO of Inari Medical. “We treated

a record number of patients, reported best in class data from our

CLOUT registry, and announced FDA clearance of FlowSaver, making

bloodless thrombectomy a reality across the entire Inari portfolio.

We continue to invest aggressively to expand our capabilities to

treat even more patients and address more unmet needs. We love

every second of this work, and we are so thankful to all of you for

believing and committing along with us in this mission.”

Second Quarter 2021 Financial

Results

Revenue was $63.5 million for the second quarter of 2021,

compared to $57.4 million for the prior quarter and $25.4 million

for the second quarter of 2020. The increase over prior year was

driven by continued U.S. commercial expansion and new product

introductions.

Gross profit was $58.6 million for the second quarter of 2021,

compared to $21.9 million for the same period of 2020. Gross margin

was 92.4% for the second quarter of 2021, up from 86.3% for the

same period in the prior year, due primarily to the impact of an

idle capacity charge in the second quarter of 2020 of $1.1 million,

combined with current quarter product mix and manufacturing

efficiencies.

Operating expenses for the second quarter of 2021 were $54.5

million, compared to $22.5 million for the second quarter of 2020.

The increase was mainly driven by an increase in personnel-related

expenses to fund the expansion of the commercial, research and

development, clinical and support organization.

Net income was $4.1 million for the second quarter of 2021 and

net income per share was $0.08 on a weighted-average basic share

count of 49.7 million and $0.07 on a diluted share count of 55.6

million, compared to a net loss of $3.8 million and a net loss per

share of $0.16 on a weighted-average basic and diluted share count

of 24.3 million in the same period of the prior year.

Our cash, cash equivalents and short-term investments were

$176.1 million as of June 30, 2021.

COVID-19 and Guidance

Despite ongoing challenges and uncertainties in its operating

environment, Inari Medical is updating financial guidance as

follows:

- For the full-year 2021, revenue guidance is increased to $250

to $255 million from the previous guidance of $240 to $250

million.

Webcast and Conference Call Information

Inari Medical will host a conference call to discuss the second

quarter 2021 financial results after market close on Tuesday,

August 10, 2021 at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time.

The conference call can be accessed live over the phone (833)

519-1265 for U.S. callers or (914) 800-3838 for international

callers, using conference ID: 1160795. The live webinar can be

accessed at https://ir.inarimedical.com.

About Inari Medical, Inc.

Inari Medical, Inc. is a commercial-stage medical device company

focused on developing products to treat and transform the lives of

patients suffering from venous diseases. Inari has developed two

minimally-invasive, novel catheter-based mechanical thrombectomy

devices that are designed to remove large clots from large vessels

and eliminate the need for thrombolytic drugs. The company

purpose-built its products for the specific characteristics of the

venous system and the treatment of the two distinct manifestations

of venous thromboembolism, or VTE: deep vein thrombosis and

pulmonary embolism. The ClotTriever system is 510(k)-cleared by the

FDA and CE Mark approved for the treatment of deep vein thrombosis.

The FlowTriever system is 510(k)-cleared by the FDA and CE Mark

approved for the treatment of pulmonary embolism and clot in

transit in the right atrium.

Forward Looking Statements

Statements in this press release may contain “forward-looking

statements” that are subject to substantial risks and

uncertainties. Forward-looking statements contained in this press

release may be identified by the use of words such as “may,”

“will,” “should,” “expect,” “plan,” “anticipate,” “could,”

“intend,” “target,” “project,” “contemplate,” “believe,”

“estimate,” “predict,” “potential” or “continue” or the negative of

these terms or other similar expressions. Forward-looking

statements include financial guidance regarding second quarter and

full year 2021 revenue and the potential impact of COVID-19 on the

business, and are based on Inari’s current expectations, forecasts

and assumptions, are subject to inherent uncertainties, risks and

assumptions that are difficult to predict, and actual outcomes and

results could differ materially due to a number of factors. These

and other risks and uncertainties include those described more

fully in the section titled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operation” and elsewhere in its Annual Report on Form 10-K for the

period ended December 31, 2020 and in its other reports filed with

the U.S. Securities and Exchange Commission. Forward-looking

statements contained in this announcement are based on information

available to Inari as of the date hereof and are made only as of

the date of this release. Inari undertakes no obligation to update

such information except as required under applicable law. These

forward-looking statements should not be relied upon as

representing Inari’s views as of any date subsequent to the date of

this press release. In light of the foregoing, investors are urged

not to rely on any forward-looking statement in reaching any

conclusion or making any investment decision about any securities

of Inari.

Investor Contact:

Westwicke PartnersCaroline CornerPhone

+1-415-202-5678caroline.corner@westwicke.com

INARI MEDICAL,

INC.Condensed Consolidated Statements of

Operations and Comprehensive Income (Loss)(in

thousands, except share and per share

data)(unaudited)

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Revenue |

$ |

63,453 |

|

|

$ |

25,392 |

|

|

$ |

120,850 |

|

|

$ |

52,345 |

|

| Cost of goods sold |

|

4,814 |

|

|

|

3,487 |

|

|

|

9,437 |

|

|

|

6,193 |

|

| Gross profit |

|

58,639 |

|

|

|

21,905 |

|

|

|

111,413 |

|

|

|

46,152 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

11,630 |

|

|

|

3,628 |

|

|

|

19,793 |

|

|

|

6,646 |

|

|

Selling, general and administrative |

|

42,897 |

|

|

|

18,880 |

|

|

|

79,795 |

|

|

|

35,273 |

|

|

Total operating expenses |

|

54,527 |

|

|

|

22,508 |

|

|

|

99,588 |

|

|

|

41,919 |

|

| Income (loss) from

operations |

|

4,112 |

|

|

|

(603 |

) |

|

|

11,825 |

|

|

|

4,233 |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

35 |

|

|

|

146 |

|

|

|

103 |

|

|

|

201 |

|

|

Interest expense |

|

(74 |

) |

|

|

(463 |

) |

|

|

(147 |

) |

|

|

(809 |

) |

|

Change in fair value of warrant liabilities |

|

— |

|

|

|

(2,884 |

) |

|

|

— |

|

|

|

(3,317 |

) |

|

Other income (expense) |

|

7 |

|

|

|

— |

|

|

|

(34 |

) |

|

|

— |

|

|

Total other expenses |

|

(32 |

) |

|

|

(3,201 |

) |

|

|

(78 |

) |

|

|

(3,925 |

) |

| Income (loss) before income

taxes |

|

4,080 |

|

|

|

(3,804 |

) |

|

|

11,747 |

|

|

|

308 |

|

| Provision for income taxes |

|

12 |

|

|

|

— |

|

|

|

210 |

|

|

|

— |

|

| Net income (loss) |

$ |

4,068 |

|

|

$ |

(3,804 |

) |

|

$ |

11,537 |

|

|

$ |

308 |

|

| Other comprehensive income

(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

57 |

|

|

|

— |

|

|

|

(123 |

) |

|

|

— |

|

|

Unrealized (loss) gain on available-for-sale securities |

|

(6 |

) |

|

|

— |

|

|

|

12 |

|

|

|

— |

|

| Total other comprehensive income

(loss) |

|

51 |

|

|

|

— |

|

|

|

(111 |

) |

|

|

— |

|

| Comprehensive income (loss) |

$ |

4,119 |

|

|

$ |

(3,804 |

) |

|

$ |

11,426 |

|

|

$ |

308 |

|

| Net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.08 |

|

|

$ |

(0.16 |

) |

|

$ |

0.23 |

|

|

$ |

0.02 |

|

|

Diluted |

$ |

0.07 |

|

|

$ |

(0.16 |

) |

|

$ |

0.21 |

|

|

$ |

0.01 |

|

| Weighted average common shares

used to compute net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

49,669,652 |

|

|

|

24,295,900 |

|

|

|

49,512,800 |

|

|

|

15,339,755 |

|

|

Diluted |

|

55,595,016 |

|

|

|

24,295,900 |

|

|

|

55,665,193 |

|

|

|

47,362,292 |

|

INARI MEDICAL,

INC.Condensed Consolidated Balance

Sheets(in thousands, except share data and par

value)(unaudited)

|

|

June 30,2021 |

|

|

December 31,2020 |

|

| Assets |

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

91,322 |

|

|

$ |

114,229 |

|

|

Restricted cash |

|

— |

|

|

|

50 |

|

|

Short-term investments |

|

84,744 |

|

|

|

49,981 |

|

|

Accounts receivable, net |

|

31,497 |

|

|

|

28,008 |

|

|

Inventories |

|

18,112 |

|

|

|

10,597 |

|

|

Prepaid expenses and other current assets |

|

2,497 |

|

|

|

2,808 |

|

|

Total current assets |

|

228,172 |

|

|

|

205,673 |

|

| Property and equipment,

net |

|

10,827 |

|

|

|

7,498 |

|

| Restricted cash |

|

— |

|

|

|

338 |

|

| Operating lease right-of-use

assets |

|

868 |

|

|

|

— |

|

| Deposits and other assets |

|

13,692 |

|

|

|

583 |

|

| Total

assets |

$ |

253,559 |

|

|

$ |

214,092 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

Accounts payable |

|

10,319 |

|

|

|

3,047 |

|

|

Payroll-related accruals |

|

16,041 |

|

|

|

8,198 |

|

|

Accrued expenses and other current liabilities |

|

4,429 |

|

|

|

2,593 |

|

|

Operating lease liabilities, current portion |

|

793 |

|

|

|

— |

|

|

Total current liabilities |

|

31,582 |

|

|

|

13,838 |

|

| Operating lease liabilities,

noncurrent portion |

|

156 |

|

|

|

— |

|

| Total

liabilities |

|

31,738 |

|

|

|

13,838 |

|

| Commitments and

contingencies (Note 7) |

|

|

|

|

|

| Stockholders'

equity |

|

|

|

|

|

|

Preferred stock, $0.001 par value, 10,000,000 shares authorized, no

shares issued and outstanding as of June 30, 2021 and December

31, 2020 |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 300,000,000 shares authorized as of

June 30, 2021 and December 31, 2020; 49,828,829 and 49,251,614

shares issued and outstanding as of June 30, 2021 and December

31, 2020, respectively |

|

50 |

|

|

|

49 |

|

|

Additional paid in capital |

|

237,764 |

|

|

|

227,624 |

|

|

Accumulated other comprehensive (loss) income |

|

(107 |

) |

|

|

4 |

|

|

Accumulated deficit |

|

(15,886 |

) |

|

|

(27,423 |

) |

| Total stockholders'

equity |

|

221,821 |

|

|

|

200,254 |

|

| Total liabilities and

stockholders' equity |

$ |

253,559 |

|

|

$ |

214,092 |

|

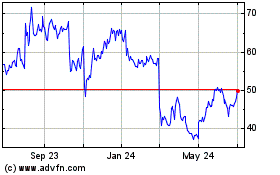

Inari Medical (NASDAQ:NARI)

Historical Stock Chart

From Mar 2024 to Apr 2024

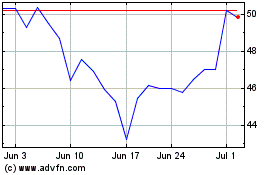

Inari Medical (NASDAQ:NARI)

Historical Stock Chart

From Apr 2023 to Apr 2024