The Joint Corp. (NASDAQ: JYNT), a national operator, manager, and

franchisor of chiropractic clinics, reported its financial results

for the quarter ended June 30, 2021.

Financial Highlights: Q2 2021 Compared to Q2

2020

- Grew revenue 61% to $20.2 million.

- Increased system-wide sales1 by 64%, to $87.8 million.

- Reported system-wide comp sales2 of 53%.

- Posted operating income of $2.0 million, compared to

$259,000.

- Reported Adjusted EBITDA of $3.8 million, compared to $1.1

million.

Q2 2021 Operating Highlights

- Sold 63 franchise licenses, compared to 11 in Q2 2020.

- Increased total clinics to 633 at June 30, 2021, 555 franchised

and 78 company-owned or managed, up from 592 at March 31, 2021.

- Opened 36 new franchised clinics, compared to 12 in Q2

2020.

- Opened 5 greenfield clinics, compared to 1 in Q2 2020.

- Acquired 8 previously franchised clinics, compared to no

activity in Q2 2020.

“Our business model continues to deliver strong financial

results,” said Peter D. Holt, President and Chief Executive Officer

of The Joint Corp. “In the second quarter, we broke records in

franchise license sales, clinic openings, and system-wide sales

driving all-time highs for the first half of the year. The

six-month total for franchise license sales rose to 89, up from 35

and 75 for 2020 and 2019, respectively. The clinic openings for the

first six months of the year increased to 54, up from 30 and 29 in

2020 and 2019, respectively. Additionally, system-wide sales

reached 64% year-over-year, up from 2% and 34% in the second

quarters of 2020 and 2019, respectively.”

“More importantly, our future is even brighter. These trends

support long-term growth, which we expect to continue to accelerate

and build upon our financial foundation. Already, we have opened 6

greenfield clinics in 2021, and we anticipate a faster pace in the

latter half of the year. Based on performance and activity, we

raised every element of our guidance. We continue to march toward

our goal of 1,000 open clinics by the end of 2023, which we expect

to be a tipping point for national brand recognition to drive

growth at an even faster pace. Combined with the large and

expanding chiropractic care market opportunity, we believe in our

long-term ability to increase stakeholder value.”

1 System-wide sales include sales at all clinics, whether

operated or managed by the company or by franchisees. While

franchised sales are not recorded as revenues by the company,

management believes the information is important in understanding

the company’s financial performance, because these sales are the

basis on which the company calculates and records royalty fees and

are indicative of the financial health of the franchisee

base. 2 Comp sales include the sales from both company-owned

or managed clinics and franchised clinics that in each case have

been open at least 13 full months and exclude any clinics that have

closed.

Financial Results for the Three Months Ended June 30:

2021 Compared to 2020

Revenue was $20.2 million in the second quarter of 2021,

compared to $12.6 million in the second quarter of 2020, reflecting

a greater number of clinics, continued organic growth and the

favorable comparison to revenues during the beginning of the

pandemic in the prior year period. Cost of revenue was $2.0

million, compared to $1.4 million in the second quarter of 2020,

reflecting the increase in franchised clinics and the associated

higher regional developer royalties and commissions.

Selling and marketing expenses were $3.1 million, up 76%, driven

by an increase in advertising fund expenditures from a larger

franchise base and the timing of the national marketing fund spend

as well as an increase in local marketing expenditures by the

company-owned or managed clinics. General and administrative

expenses were $11.6 million, compared to $8.5 million in the second

quarter of 2020, primarily due to an increase in payroll and

related expenses to support revenue growth and a greater number of

clinics. As a percentage of revenue, general and administrative

expenses during the second quarter of 2021 and 2020 were 57% and

68%, respectively, reflecting improved leverage in the operating

model. The improvement is not expected to continue at that level in

following quarters due to the opening of four greenfields at the

end of June, the anticipated pace of more greenfields openings in

the latter half of the year, and the related up-front expense of

those openings.

Operating income was $2.0 million, compared to $259,000 in the

second quarter of 2020. Income tax benefit was $666,000, compared

to an expense of $118,000 in the second quarter of 2020. The income

tax benefit was primarily driven by excess tax benefits from the

exercise of stock options. Net income was $2.7 million, or $0.18

per diluted share, compared to $116,000, or $0.01 per diluted

share, in the second quarter of 2020.

Adjusted EBITDA was $3.8 million, compared to $1.1 million in

the second quarter of 2020. The company defines Adjusted EBITDA, a

non-GAAP measure, as EBITDA before acquisition-related expenses,

bargain purchase gain, net (gain)/loss on disposition or

impairment, and stock-based compensation expenses. The company

defines EBITDA as net income before net interest, tax expense,

depreciation, and amortization expenses.

Financial Results for the Six Months Ended June 30: 2021

Compared to 2020

Revenue was $37.8 million for the first half of 2021, compared

to $26.2 million in the same prior year period. Operating income

and net income were $4.0 million and $5.0 million, compared to $1.0

million and $931,000 in the first half of 2020, respectively.

Adjusted EBITDA was $7.2 million, compared to $2.8 million in the

same prior year period.

Balance Sheet Liquidity

Unrestricted cash was $18.5 million at June 30, 2021, compared

to $20.6 million at December 31, 2020. The change reflects net cash

provided by operating activities of $9.0 million offset by $8.9

million of investing activities consisting of acquisitions,

greenfield developments, and IT capital expenditures, as well as

the $2.7 million repayment of the Paycheck Protection Program loan

in March 2021.

Raised 2021 Guidance

Due to strong second quarter 2021 revenues, as well as increased

franchise openings and greenfield activity, management raised all

elements of its 2021 financial guidance.

- Revenue is now expected to be between $77.0 million and $79.0

million, up from the May 6, 2021 guidance of between $73.5 million

and $77.5 million. The updated mid-point reflects a 33% increase

compared to $58.7 million in 2020.

- Adjusted EBITDA - which includes the impact of a greater number

of greenfields that will be more heavily weighted in the second

half of the year - is expected to be between $12.5 million and

$13.5 million, up from prior guidance of between $11.0 million and

$12.5 million. The updated mid-point reflects a 43% increase

compared to $9.1 million in 2020.

- The expected number of franchised clinic openings has increased

to be between 90 and 110, up from 80 to 100. The updated mid-point

reflects a 57% increase compared to 70 in 2020.

- The expected number of company-owned or managed clinic

increases, through a combination of both greenfields and buybacks,

has increased to be between 25 and 35, up from 20 to 30 clinics.

The updated mid-point is 7.5 times greater than 4 opened in

2020.

Conference Call The Joint Corp. management will

host a conference call at 5 p.m. ET on Thursday, August 5, 2021, to

discuss the second quarter 2021 results. Shareholders and

interested participants may listen to a live broadcast of the

conference call by dialing 765-507-2604 or 844-464-3931 and

referencing code 5959205 approximately 15 minutes prior to the

start time. The accompanying slide presentation will be in the IR

section of the website under Presentations and in Events. A live

webcast of the conference call will also be available on the IR

section of the company’s website at https://ir.thejoint.com/events.

An audio replay will be available two hours after the conclusion of

the call through August 13, 2021. The replay can be accessed by

dialing 404-537-3406 or 855-859-2056. The passcode for the replay

is 5959205.

Non-GAAP Financial Information This release

includes a presentation of non-GAAP financial measures. System-wide

sales include sales at all clinics, whether operated by the company

or by franchisees. While franchised sales are not recorded as

revenues by the company, management believes the information is

important in understanding the company’s financial performance,

because these sales are the basis on which the company calculates

and records royalty fees and are indicative of the financial health

of the franchisee base. Comp sales include the sales from both

company-owned or managed clinics and franchised clinics that in

each case have been open at least 13 full months and exclude any

clinics that have closed.

EBITDA and Adjusted EBITDA are presented because they are

important measures used by management to assess financial

performance, as management believes they provide a more transparent

view of the company’s underlying operating performance and

operating trends. Reconciliation of net income/(loss) to EBITDA and

Adjusted EBITDA is presented in the table below. The company

defines Adjusted EBITDA as EBITDA before acquisition-related

expenses, bargain purchase gain, net (gain)/loss on disposition or

impairment, and stock-based compensation expenses. The company

defines EBITDA as net income before net interest, tax expense,

depreciation, and amortization expenses.

EBITDA and Adjusted EBITDA do not represent and should not be

considered alternatives to net income or cash flows from

operations, as determined by accounting principles generally

accepted in the United States, or GAAP. While EBITDA and Adjusted

EBITDA are used as measures of financial performance and the

ability to meet debt service requirements, they are not necessarily

comparable to other similarly titled captions of other companies

due to potential inconsistencies in the methods of calculation.

EBITDA and Adjusted EBITDA should be reviewed in conjunction with

the company’s financial statements filed with the SEC.

Forward-Looking StatementsThis press release

contains statements about future events and expectations that

constitute forward-looking statements. Forward-looking statements

are based on our beliefs, assumptions and expectations of industry

trends, our future financial and operating performance and our

growth plans, taking into account the information currently

available to us. These statements are not statements of historical

fact. Forward-looking statements involve risks and uncertainties

that may cause our actual results to differ materially from the

expectations of future results we express or imply in any

forward-looking statements, and you should not place undue reliance

on such statements. Factors that could contribute to these

differences include, but are not limited to, the continuing impact

of the COVID-19 outbreak on the economy and our operations

(including temporary clinic closures, shortened business hours and

reduced patient demand), our failure to develop or acquire

company-owned or managed clinics as rapidly as we intend, our

failure to profitably operate company-owned or managed clinics, and

the other factors described in “Risk Factors” in our Annual Report

on Form 10-K as filed with the SEC for the year ended December 31,

2020, as updated or revised for any material changes described in

any subsequently-filed Quarterly Reports on Form 10-Q or other SEC

filings. Words such as, "anticipates," "believes," "continues,"

"estimates," "expects," "goal," "objectives," "intends," "may,"

"opportunity," "plans," "potential," "near-term," "long-term,"

"projections," "assumptions," "projects," "guidance," "forecasts,"

"outlook," "target," "trends," "should," "could," "would," "will,"

and similar expressions are intended to identify such

forward-looking statements. We qualify any forward-looking

statements entirely by these cautionary factors. We assume no

obligation to update or revise any forward-looking statements for

any reason or to update the reasons actual results could differ

materially from those anticipated in these forward-looking

statements, even if new information becomes available in the

future. Comparisons of results for current and any prior periods

are not intended to express any future trends or indications of

future performance, unless expressed as such, and should only be

viewed as historical data.

About The Joint Corp. (NASDAQ: JYNT) The Joint

Corp. (NASDAQ: JYNT) revolutionized access to chiropractic care

when it introduced its retail healthcare business model in 2010.

Today, the company is making quality care convenient and

affordable, while eliminating the need for insurance, for millions

of patients seeking pain relief and ongoing wellness. With more

than 600 locations nationwide and over eight million patient visits

annually, The Joint is a key leader in the chiropractic industry.

Named on Franchise Times “Top 200+ Franchises” and Entrepreneur’s

“Franchise 500®” lists, The Joint Chiropractic is an innovative

force, where healthcare meets retail. For more information, visit

www.thejoint.com. To learn about franchise opportunities, visit

www.thejointfranchise.com.

Business StructureThe Joint Corp. is a

franchisor of clinics and an operator of clinics in certain states.

In Arkansas, California, Colorado, District of Columbia, Florida,

Illinois, Kansas, Kentucky, Maryland, Michigan, Minnesota, New

Jersey, New York, North Carolina, Oregon, Pennsylvania, Rhode

Island, South Dakota, Tennessee, Washington, West Virginia and

Wyoming, The Joint Corp. and its franchisees provide management

services to affiliated professional chiropractic practices.

Media Contact: Margie Wojciechowski, The Joint

Corp., margie.wojciechowski@thejoint.comInvestor

Contact: Kirsten Chapman, LHA Investor Relations,

415-433-3777, thejoint@lhai.com

– Financial Tables Follow –

THE JOINT CORP. AND SUBSIDIARY AND

AFFILIATESCONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited)

| |

June 30,2021 |

|

December 31,2020 |

|

ASSETS |

(unaudited) |

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

18,521,042 |

|

|

|

$ |

20,554,258 |

|

|

|

Restricted cash |

313,303 |

|

|

|

265,371 |

|

|

|

Accounts receivable, net |

2,805,387 |

|

|

|

1,850,499 |

|

|

|

Deferred franchise and regional development costs, current

portion |

973,224 |

|

|

|

897,551 |

|

|

|

Prepaid expenses and other current assets |

1,590,448 |

|

|

|

1,566,025 |

|

|

|

Total current assets |

24,203,404 |

|

|

|

25,133,704 |

|

|

| Property and equipment,

net |

12,418,496 |

|

|

|

8,747,369 |

|

|

| Operating lease right-of-use

asset |

15,232,136 |

|

|

|

11,581,435 |

|

|

| Deferred franchise and

regional development costs, net of current portion |

5,042,889 |

|

|

|

4,340,756 |

|

|

| Intangible assets, net |

6,176,429 |

|

|

|

2,865,006 |

|

|

| Goodwill |

5,128,302 |

|

|

|

4,625,604 |

|

|

| Deferred tax assets |

9,388,264 |

|

|

|

8,007,633 |

|

|

| Deposits and other assets |

474,782 |

|

|

|

431,336 |

|

|

|

Total assets |

$ |

78,064,702 |

|

|

|

$ |

65,732,843 |

|

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

2,160,642 |

|

|

|

$ |

1,561,648 |

|

|

|

Accrued expenses |

1,143,858 |

|

|

|

770,221 |

|

|

|

Co-op funds liability |

313,304 |

|

|

|

248,468 |

|

|

|

Payroll liabilities |

4,624,414 |

|

|

|

2,776,036 |

|

|

|

Debt under the Credit Agreement |

2,000,000 |

|

|

|

— |

|

|

|

Operating lease liability, current portion |

3,605,458 |

|

|

|

2,918,140 |

|

|

|

Finance lease liability, current portion |

79,752 |

|

|

|

70,507 |

|

|

|

Deferred franchise and regional developer fee revenue, current

portion |

3,162,710 |

|

|

|

3,000,369 |

|

|

|

Deferred revenue from company clinics ($2.9 million and $2.6

million attributable to VIEs) |

4,366,186 |

|

|

|

3,905,200 |

|

|

|

Debt under the Paycheck Protection Program |

— |

|

|

|

2,727,970 |

|

|

|

Other current liabilities |

551,035 |

|

|

|

707,085 |

|

|

|

Total current liabilities |

22,007,359 |

|

|

|

18,685,644 |

|

|

| Operating lease liability, net

of current portion |

14,297,918 |

|

|

|

10,632,672 |

|

|

| Finance lease liability, net

of current portion |

99,772 |

|

|

|

132,469 |

|

|

| Debt under the Credit

Agreement |

— |

|

|

|

2,000,000 |

|

|

| Deferred franchise and

regional developer fee revenue, net of current portion |

14,708,216 |

|

|

|

13,503,745 |

|

|

| Other liabilities |

27,230 |

|

|

|

27,230 |

|

|

|

Total liabilities |

51,140,495 |

|

|

|

44,981,760 |

|

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity: |

|

|

|

| Series A preferred stock,

$0.001 par value; 50,000 shares authorized, 0 issued and

outstanding, as of June 30, 2021 and December 31,

2020 |

— |

|

|

|

— |

|

|

| Common stock, $0.001 par

value; 20,000,000 shares authorized, 14,406,148 shares issued and

14,375,362 shares outstanding as of June 30, 2021 and

14,174,237 shares issued and 14,157,070 outstanding as of

December 31, 2020 |

14,405 |

|

|

|

14,174 |

|

|

| Additional paid-in

capital |

43,142,391 |

|

|

|

41,350,001 |

|

|

|

Treasury stock 30,786 shares as of June 30, 2021 and 17,167

shares as of December 31, 2020, at cost |

(761,265 |

) |

|

|

(143,111 |

) |

|

| Accumulated deficit |

(15,471,424 |

) |

|

|

(20,470,081 |

) |

|

|

Total The Joint Corp. stockholders' equity |

26,924,107 |

|

|

|

20,750,983 |

|

|

| Non-controlling Interest |

100 |

|

|

|

100 |

|

|

| Total equity |

26,924,207 |

|

|

|

20,751,083 |

|

|

|

Total liabilities and stockholders' equity |

$ |

78,064,702 |

|

|

|

$ |

65,732,843 |

|

|

THE JOINT CORP. AND SUBSIDIARY AND

AFFILIATESCONDENSED CONSOLIDATED INCOME

STATEMENTS(unaudited)

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Revenues: |

|

|

|

|

|

|

|

|

Revenues from company-owned or managed clinics |

$ |

11,433,072 |

|

|

|

$ |

6,856,807 |

|

|

|

$ |

20,903,933 |

|

|

|

$ |

14,151,102 |

|

|

|

Royalty fees |

5,332,618 |

|

|

|

3,268,653 |

|

|

|

10,101,862 |

|

|

|

6,986,883 |

|

|

|

Franchise fees |

623,655 |

|

|

|

523,964 |

|

|

|

1,319,082 |

|

|

|

1,036,716 |

|

|

|

Advertising fund revenue |

1,518,908 |

|

|

|

930,795 |

|

|

|

2,893,650 |

|

|

|

1,988,413 |

|

|

|

Software fees |

786,037 |

|

|

|

631,198 |

|

|

|

1,546,574 |

|

|

|

1,276,922 |

|

|

|

Regional developer fees |

214,434 |

|

|

|

213,424 |

|

|

|

432,390 |

|

|

|

421,066 |

|

|

|

Other revenues |

310,074 |

|

|

|

164,952 |

|

|

|

569,271 |

|

|

|

373,177 |

|

|

|

Total revenues |

20,218,798 |

|

|

|

12,589,793 |

|

|

|

37,766,762 |

|

|

|

26,234,279 |

|

|

| Cost of revenues: |

|

|

|

|

|

|

|

|

Franchise and regional development cost of revenues |

1,786,833 |

|

|

|

1,275,191 |

|

|

|

3,411,404 |

|

|

|

2,692,682 |

|

|

|

IT cost of revenues |

251,705 |

|

|

|

92,450 |

|

|

|

392,450 |

|

|

|

161,115 |

|

|

|

Total cost of revenues |

2,038,538 |

|

|

|

1,367,641 |

|

|

|

3,803,854 |

|

|

|

2,853,797 |

|

|

| Selling and marketing

expenses |

3,132,715 |

|

|

|

1,783,666 |

|

|

|

5,622,043 |

|

|

|

3,838,954 |

|

|

| Depreciation and

amortization |

1,443,018 |

|

|

|

693,400 |

|

|

|

2,612,884 |

|

|

|

1,347,649 |

|

|

| General and administrative

expenses |

11,614,444 |

|

|

|

8,541,108 |

|

|

|

21,701,047 |

|

|

|

17,235,358 |

|

|

|

Total selling, general and administrative expenses |

16,190,177 |

|

|

|

11,018,174 |

|

|

|

29,935,974 |

|

|

|

22,421,961 |

|

|

| Net (gain) loss on disposition

or impairment |

(44,260 |

) |

|

|

(54,606 |

) |

|

|

20,508 |

|

|

|

(53,413 |

) |

|

| Income from operations |

2,034,343 |

|

|

|

258,584 |

|

|

|

4,006,426 |

|

|

|

1,011,934 |

|

|

| Other expense, net |

(16,373 |

) |

|

|

(25,243 |

) |

|

|

(37,909 |

) |

|

|

(29,581 |

) |

|

|

Income before income tax (benefit) expense |

2,017,970 |

|

|

|

233,341 |

|

|

|

3,968,517 |

|

|

|

982,353 |

|

|

| Income tax (benefit)

expense |

(665,992 |

) |

|

|

117,756 |

|

|

|

(1,030,140 |

) |

|

|

51,821 |

|

|

| Net income |

$ |

2,683,962 |

|

|

|

$ |

115,585 |

|

|

|

$ |

4,998,657 |

|

|

|

$ |

930,532 |

|

|

| Earnings per share: |

|

|

|

|

|

|

|

| Basic earnings per share |

$ |

0.19 |

|

|

|

$ |

0.01 |

|

|

|

$ |

0.35 |

|

|

|

$ |

0.07 |

|

|

| Diluted earnings per

share |

$ |

0.18 |

|

|

|

$ |

0.01 |

|

|

|

$ |

0.34 |

|

|

|

$ |

0.06 |

|

|

| Basic weighted average

shares |

14,290,697 |

|

|

|

13,980,984 |

|

|

|

14,234,929 |

|

|

|

13,935,829 |

|

|

| Diluted weighted average

shares |

14,927,451 |

|

|

|

14,491,639 |

|

|

|

14,901,863 |

|

|

|

14,487,083 |

|

|

THE JOINT CORP. AND SUBSIDIARY AND

AFFILIATESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(unaudited)

| |

Six Months EndedJune 30, |

| |

2021 |

|

2020 |

| Cash flows from operating

activities: |

|

|

|

|

Net income |

$ |

4,998,657 |

|

|

|

$ |

930,532 |

|

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

| Depreciation and

amortization |

2,612,884 |

|

|

|

1,347,649 |

|

|

| Net loss on disposition or

impairment (non-cash portion) |

109,519 |

|

|

|

1,193 |

|

|

| Net franchise fees recognized

upon termination of franchise agreements |

(81,196 |

) |

|

|

(50,312 |

) |

|

| Deferred income taxes |

(1,380,631 |

) |

|

|

(2,756 |

) |

|

| Stock based compensation

expense |

530,058 |

|

|

|

466,473 |

|

|

| Changes in operating assets

and liabilities: |

|

|

|

|

Accounts receivable |

(954,888 |

) |

|

|

635,605 |

|

|

|

Prepaid expenses and other current assets |

(24,423 |

) |

|

|

(35,789 |

) |

|

|

Deferred franchise costs |

(881,891 |

) |

|

|

2,498 |

|

|

|

Deposits and other assets |

(53,096 |

) |

|

|

4,406 |

|

|

|

Accounts payable |

(162,524 |

) |

|

|

(141,327 |

) |

|

|

Accrued expenses |

130,609 |

|

|

|

406,986 |

|

|

|

Payroll liabilities |

1,848,378 |

|

|

|

(784,505 |

) |

|

|

Deferred revenue |

1,757,294 |

|

|

|

(317,053 |

) |

|

|

Other liabilities |

565,779 |

|

|

|

572,795 |

|

|

| Net cash provided by operating

activities |

9,014,529 |

|

|

|

3,036,395 |

|

|

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

Acquisition of AZ clinics |

(1,925,000 |

) |

|

|

— |

|

|

|

Acquisition of NC clinics |

(2,325,000 |

) |

|

|

— |

|

|

|

Purchase of property and equipment |

(3,238,959 |

) |

|

|

(1,986,367 |

) |

|

|

Reacquisition and termination of regional developer rights |

(1,388,700 |

) |

|

|

— |

|

|

|

Payments received on notes receivable |

— |

|

|

|

80,441 |

|

|

| Net cash used in investing

activities |

(8,877,659 |

) |

|

|

(1,905,926 |

) |

|

| |

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

Payments of finance lease obligation |

(38,593 |

) |

|

|

(23,509 |

) |

|

|

Purchases of treasury stock under employee stock plans |

(618,154 |

) |

|

|

(3,774 |

) |

|

|

Proceeds from exercise of stock options |

1,262,563 |

|

|

|

387,920 |

|

|

|

Proceeds from the Credit Agreement, net of related fees |

— |

|

|

|

1,947,352 |

|

|

|

Proceeds from the Paycheck Protection Program |

— |

|

|

|

2,727,970 |

|

|

|

Repayment of debt under the Paycheck Protection Program |

(2,727,970 |

) |

|

|

— |

|

|

| Net cash (used in) provided by

financing activities |

(2,122,154 |

) |

|

|

5,035,959 |

|

|

| |

|

|

|

| (Decrease) increase in cash,

cash equivalents and restricted cash |

(1,985,284 |

) |

|

|

6,166,428 |

|

|

| Cash, cash equivalents and

restricted cash, beginning of period |

20,819,629 |

|

|

|

8,641,877 |

|

|

| Cash, cash equivalents and

restricted cash, end of period |

$ |

18,834,345 |

|

|

|

$ |

14,808,305 |

|

|

| |

|

|

|

| Reconciliation of cash, cash

equivalents and restricted cash: |

June 30,2021 |

|

June 30,2020 |

| Cash and cash equivalents |

$ |

18,521,042 |

|

|

|

$ |

14,573,266 |

|

|

| Restricted cash |

313,303 |

|

|

|

235,039 |

|

|

| |

$ |

18,834,345 |

|

|

|

$ |

14,808,305 |

|

|

Non-GAAP Financial Measures

The table below reconciles net income to Adjusted EBITDA for the

three and six months ended June 30, 2021 and 2020.

| (unaudited) |

Three Months Ended June 30, |

|

Six Months EndedJune 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Non-GAAP Financial

Data: |

|

|

|

|

|

|

|

|

Net income |

$ |

2,683,962 |

|

|

|

$ |

115,585 |

|

|

|

$ |

4,998,657 |

|

|

|

$ |

930,532 |

|

|

|

Net interest expense |

16,373 |

|

|

|

25,243 |

|

|

|

37,909 |

|

|

|

29,580 |

|

|

|

Depreciation and amortization expense |

1,443,018 |

|

|

|

693,400 |

|

|

|

2,612,884 |

|

|

|

1,347,649 |

|

|

|

Income tax (benefit) expense |

(665,992 |

) |

|

|

117,756 |

|

|

|

(1,030,140 |

) |

|

|

51,821 |

|

|

|

EBITDA |

3,477,361 |

|

|

|

951,984 |

|

|

|

6,619,310 |

|

|

|

2,359,582 |

|

|

|

Stock compensation expense |

283,564 |

|

|

|

216,080 |

|

|

|

530,058 |

|

|

|

466,473 |

|

|

|

Acquisition related expenses |

39,373 |

|

|

|

— |

|

|

|

45,346 |

|

|

|

— |

|

|

|

(Gain) loss on disposition or impairment |

(44,260 |

) |

|

|

(54,606 |

) |

|

|

20,508 |

|

|

|

(53,413 |

) |

|

|

Adjusted EBITDA |

$ |

3,756,038 |

|

|

|

$ |

1,113,458 |

|

|

|

$ |

7,215,222 |

|

|

|

$ |

2,772,642 |

|

|

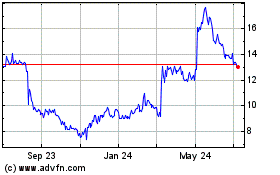

Joint (NASDAQ:JYNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

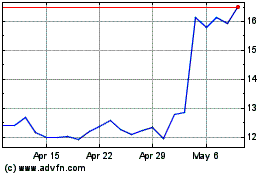

Joint (NASDAQ:JYNT)

Historical Stock Chart

From Apr 2023 to Apr 2024