Current Report Filing (8-k)

August 04 2021 - 7:36AM

Edgar (US Regulatory)

0000832988falsefalse00008329882021-07-292021-07-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2021

SIGNET JEWELERS LIMITED

(Exact name of registrant as specified in its charter)

Commission File Number: 1-32349

|

|

|

|

|

|

|

|

Bermuda

|

Not Applicable

|

|

(State or other jurisdiction of incorporation)

|

(IRS Employer Identification No.)

|

Clarendon House

2 Church Street

Hamilton

HM11

Bermuda

(Address of principal executive offices, including zip code)

(441) 296 5872

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Shares of $0.18 each

|

|

SIG

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Matters

On July 29, 2021, Signet Group Limited (“SGL”), a wholly-owned subsidiary of Signet Jewelers Limited (the “Company”), entered into an agreement (the “Agreement”) with Signet Pension Trustee Limited (the “Trustee”), as trustee of the Signet Group Pension Scheme (the “Pension Scheme”), to facilitate the Trustee entering into a bulk purchase annuity policy ("BPA") securing accrued liabilities under the Pension Scheme with Rothesay Life Plc ("Rothesay") and subsequently, to wind up the Pension Scheme. The BPA will be held by the Trustee as an asset of the Scheme (the "buy-in") in anticipation of Rothesay subsequently (and in accordance with the terms of the BPA) issuing individual annuity contracts to each of the approximately 1,909 Pension Scheme members (or their eligible beneficiaries) ("Transferred Participants") covering their accrued benefits (a full “buy-out”), following which the BPA will terminate and the Trustee will wind up the Pension Scheme (collectively, the “Transactions”).

Under the terms of the Agreement, SGL is expected to contribute up to £16.85 million (approximately $23.4 million) (the “Total Expected Contribution”) to the Pension Scheme to enable the Trustee to pay for any and all costs incurred by the Trustee as part of the Transactions, including an initial contribution of £7 million (approximately $9.7 million) (the “Initial Installment”) to enable the Trustee to enter into the BPA with Rothesay. Subsequent installments of the Total Expected Contribution shall be reviewed and agreed by SGL and the Trustee at such times as the Trustee reasonably requires additional monies to be contributed to the Pension Scheme in furtherance of the Transactions.

From the point of buy-out, Rothesay shall be liable to pay the insured benefits to the Transferred Participants and shall be responsible for the administration of those benefits. Once all Pension Scheme members (or their eligible beneficiaries) have become Transferred Participants, the Trustee will wind up the Pension Scheme. By irrevocably transferring these obligations to Rothesay, the Company will eliminate its projected benefit obligation under the Pension Scheme.

Upon completion of the Transactions contemplated by the Agreement, the Company expects to recognize non-cash, non-operating pre-tax settlement charges totaling approximately $125 million to $150 million, subject to finalization of any applicable adjustments, true up costs, and the impact of foreign currency. The timing of such settlement charges is subject to the expected completion of the Transactions, and will be recognized in the periods when the buy-outs are finalized with the Transferred Participants.

This Current Report on Form 8-K contains statements which are or may be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These statements, based upon management’s beliefs and expectations as well as on assumptions made by and data currently available to management, appear in this document and include statements regarding the financial and other impacts and future benefits of the Transactions contemplated by the Agreement. These forward-looking statements are not guarantees of future performance and are subject to a number of risks and uncertainties that could cause actual outcomes to differ materially from the Company’s present expectations. Undue reliance should not be placed on such forward-looking statements, as such statements speak only as of the date on which they are made. For a discussion of risks and uncertainties which could cause actual results to differ materially from those expressed in any forward looking statement, see the “Risk Factors” and “Forward-Looking Statements” sections of Signet’s Fiscal 2021 Annual Report on Form 10-K filed with the SEC on March 19, 2021 and quarterly reports on Form 10-Q and the “Safe Harbor Statements” in current reports on Form 8-K filed with the SEC. Signet undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNET JEWELERS LIMITED

|

|

|

|

|

|

|

|

|

|

Date:

|

|

August 4, 2021

|

|

By:

|

|

/s/ Joan Hilson

|

|

|

|

|

|

Name:

|

|

Joan Hilson

|

|

|

|

|

|

Title:

|

|

Chief Financial and Strategy Officer

|

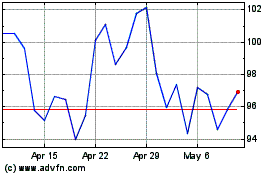

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

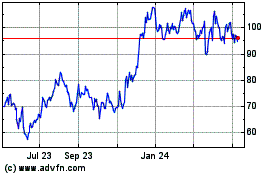

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Apr 2023 to Apr 2024