MRNA and More: 3 Stocks That Can Lose Up to 87% In the Next Year

July 30 2021 - 7:45AM

Finscreener.org

The markets have been on an absolute tear in the last 15 months.

Since the start of 2020, the S&P

500 has gained around 40% despite a global recession induced by

the ongoing pandemic. While the indexes are trading near record

highs, there are few stocks that remain vulnerable in the

near-term.

Here, we look at three such stocks that have significant

downside potential from current trading prices.

Moderna

One of the top-performing stocks on the NASDAQ, Moderna (NASDAQ:

MRNA), is

up a staggering 1,760% since it went public in late 2018. It has

more than tripled in 2021 and has gained 320% in the last year.

Moderna stock is currently trading at $340 valuing it a market cap

of $138 billion. Wall Street forecasts Moderna to increase sales by

2,180% to $18.32 billion in 2021. Comparatively, its earnings might

improve from a loss per share of $1.96 in 2020 to earnings of

$24.57 in 2021.

Moderna expects to produce between 800 million and 1 billion

COVID-19 doses in 2021 allowing the company to derive over $19

billion in sales this year. The company is one of the leading

COVID-19 vaccine manufacturers in the world but there is a chance

for sales to fall off a cliff once the pandemic is bought under

control.

For example, Moderna sales are estimated to fall by 16% to

$15.35 billion in 2022 while earnings might decline to $18.2 per

share as well. Analysts tracking the stock have a 12-month average

price target of $185 for MRNA stock which is 46% below its current

trading price.

Cronos Group

The second stock on my list is cannabis giant Cronos Group

(NASDAQ: CRON).

This Canada-based pot producer has severely underperformed the

broader markets in the last two years. CRON stock is trading 68%

below record highs and might lose another 20% from current

levels.

In 2021, analysts expect Cronos to increase sales by 55% to

$72.26 million. Comparatively, its also forecast to report a loss

per share of $0.62 this year. Given it has 371.66 million

outstanding shares, total losses will stand at $230 million in

2021. So, Cronos is expected to lose over $3 for every $1 in

sales.

Cronos ended Q1 with $1.24 billion in cash which means it has

enough liquidity to improve its profit margins without having to

dilute shareholder wealth. In the March quarter, its sales rose by

50% year over year to $12.6 million. However, it still reported a

negative gross margin and an operating loss of $43.5 million.

Cronos has just $9.36 million in debt and is backed by tobacco

giant Altria. The latter pumped in $1.2 billion into Cronos to

acquire a 45% stake in the company, back in 2018.

AMC Entertainment

One of the most

popular meme stocks in 2021, AMC Entertainment (NYSE:

AMC) can lose up to 87% in market value in the next year,

according to consensus price target estimates. AMC shares are up

close to 2,000% year to date primarily due to a group of retail

traders on Redditt who initiated a short-squeeze on the stock.

However, the company remains fundamentally weak as it ended Q1

with $813 million in cash and $11 billion in debt. It raised

capital in Q2 which will increase its cash balance to approximately

$2.2 billion in the June quarter. AMC also has $11 billion in debt

and is forecast to report an adjusted net loss of $3.16 per share

in 2021. It has 513 million outstanding shares so the net loss will

be over $1.6 billion.

Analysts also expect a

loss of $0.81 per share in 2022 which suggests AMC will have to

raise additional capital going forward, making it one of the

riskiest bets on Wall Street.

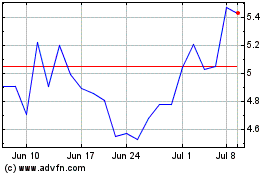

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

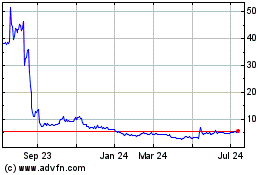

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024