As

filed with the Securities and Exchange Commission on July 29, 2021

Registration

Statement No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMMO,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

83-1950534

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S.

Employer

Identification

Number)

|

7681

East Gray Road

Scottsdale,

Arizona 85260

(480)

947-0001

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Fred

W. Wagenhals

President

and Chief Executive Officer

7681

East Gray Road

Scottsdale,

Arizona 85260

(480)

947-0001

(Address,

including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Joseph

M. Lucosky, Esq.

Adele

Hogan, Esq.

Lucosky

Brookman LLP

101

Wood Avenue South, 5th Floor

Woodbridge,

NJ 08830

(732)

395-4400

APPROXIMATE

DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. [ ]

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. [ ]

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”

and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

|

[ ]

|

|

Accelerated

filer

|

[ ]

|

|

Non-accelerated

filer

|

[X]

|

|

Smaller

reporting company

|

[X]

|

|

|

|

|

Emerging

growth company

|

[ ]

|

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount of Shares to be

Registered (1)

|

|

|

Proposed

Maximum

Offering

Price per

Share (2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount of

Registration

Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.001 per share

|

|

|

12,390,411

|

|

|

$

|

7.06

|

|

|

$

|

87,476,301.70

|

|

|

$

|

9,543.67

|

|

|

Common Stock, $0.001 par value per share, issuable upon exercise of the Warrants

|

|

|

1,337,830

|

(3)

|

|

$

|

7.06

|

|

|

$

|

9,445,079.80

|

|

|

$

|

1,030.46

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

13,728,241

|

|

|

|

-

|

|

|

$

|

96,921,381.50

|

|

|

$

|

10,574.13

|

(4)

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended, the shares of Common Stock (as defined on the cover page of the prospectus)

being registered hereunder include such indeterminate number of shares of Common Stock as may be issuable with respect to the shares

of Common Stock being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and 457(g) under the Securities Act of 1933, as

amended, using the average high ($7.25) and low prices ($6.87) of the common stock on the Nasdaq Capital Market on

July 27, 2021. Shares offered hereunder may be sold by the Selling Shareholders from time to time in the open market, through

privately negotiated transactions, or a combination of these methods at market prices prevailing at the time of sale or at negotiated

prices.

|

|

|

|

|

(3)

|

Represents

the maximum number of shares of Common Stock that the Company expects could be issuable upon the exercise of the Warrants (as defined

below), all of which were acquired by the Selling Shareholders.

|

|

(4)

|

Paid

herewith. The fee is calculated by multiplying the aggregate offering amount by 0.0001091 pursuant to Section 6(b) of the Securities

Act

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. The Selling Shareholders may not sell these securities

until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an

offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale

is not permitted.

Subject

to Completion, dated July 29, 2021.

PROSPECTUS

AMMO,

INC.

13,728,241

Shares of Common Stock

Pursuant to this prospectus, the selling shareholders

identified herein (each a “Selling Shareholder” and, collectively, the “Selling Shareholders”) are offering on

a resale basis, up to 13,728,241 shares (the “Shares”) of our common stock, par value $0.001 per share (the

“Common Stock”), by the selling stockholders identified in this prospectus under “Selling Shareholders” (the

“Offering”). This amount consists of: (i) 10,000,000 shares of Common Stock issued to one (1) Selling Shareholder pursuant

to the Merger Agreement (as defined below) dated as of April 30, 2021; (ii) 1,228,000 shares of Common Stock issued to thirty-six (36)

selling Shareholders pursuant to those certain Subscription Agreements entered into in connection with a 2017 friends and family financing;

(iii) 408,411 shares of Common Stock issued to five (5) Selling Shareholders pursuant to the Company’s Registration Statement on

filed with the Securities and Exchange Commission (“SEC”) on February 17, 2021; (iv) 500,000 shares of Common Stock issued

to one (1) Selling Shareholder pursuant to a Services Agreement between the Company and Trending Equities Corp., dated as of May 16,

2021; (v) 250,000 shares of Common Stock issued to one (1) Selling Shareholder pursuant to a Consulting Agreement between the Company

and White Bear Group LLC, dated as of May 1, 2021; (vi) 162,830 shares of Common Stock underlying warrants issued to two (2) Selling

Shareholders pursuant to the Company’s Registration Statement on Form S-3 filed with the SEC on February 17, 2021 (the “February

2021 Warrants”); and (vii) 1,175,000 shares of Common Stock underlying warrants issued to one (1) Selling Shareholder pursuant

to a Soliciting Agent Agreement between the Company and Paulson Investment Company, LLC, dated as of December 21, 2020 (the “December

2020 Warrants,” and together with the February 2021 Warrants, the “Warrants”). We are not selling any shares of our

Common Stock under this prospectus and will not receive any proceeds from the sale of the Shares. We will, however, receive proceeds

from any warrants that are exercised through the payment of the exercise price in cash. The Selling Shareholders will bear all commissions

and discounts, if any, attributable to the sale of the Shares. We will bear all costs, expenses and fees in connection with the registration

of the Shares.

Pursuant to the terms and conditions set forth in

that certain Investors Rights Agreement dated as of April 30, 2021, and entered into in connection with the Merger Agreement, we agreed

to file with the SEC a shelf registration statement covering resales of certain of the shares issued pursuant to the Merger Agreement,

which shares were issued to the applicable Selling Shareholder in a private transaction. This prospectus forms a part of a registration

statement filed by us as required by the Investors Rights Agreement.

The

Selling Shareholders may sell the Shares from time to time on terms to be determined at the time of sale through ordinary brokerage transactions

or through any other means described in this prospectus under “Plan of Distribution.” The prices at which the Selling Shareholders

may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. No securities may

be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering

of such securities.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 6 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED

IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

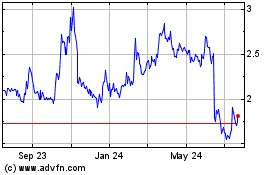

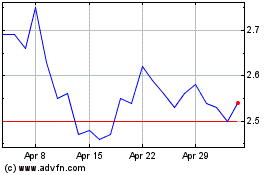

Our

Common Stock is listed on the Nasdaq Capital Market under the symbol “POWW”. On July 28, 2021, the last reported sale

price of our Common Stock on the Nasdaq Capital Market was $7.08 per share.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 in this prospectus for a discussion

of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is July , 2021.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”)

on behalf of the Selling Shareholders to permit the Selling Shareholders to sell the shares described in this prospectus in one or more

transactions. You should read this prospectus and the information and documents incorporated by reference carefully. Such documents contain

important information you should consider when making your investment decision. See “Where You Can Find More Information”

and “Incorporation of Certain Information by Reference” in this prospectus.

This

prospectus may be supplemented from time to time to add, to update or change information in this prospectus. Any statement contained

in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained

in a prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this

prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You may only

rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with

different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other

than the securities offered by this prospectus. This prospectus and any future prospectus supplement do not constitute an offer to sell

or a solicitation of an offer to buy any securities in any circumstances in which such offer or solicitation is unlawful. Neither the

delivery of this prospectus or any prospectus supplement nor any sale made hereunder shall, under any circumstances, create any implication

that there has been no change in our affairs since the date of this prospectus or such prospectus supplement or that the information

contained by reference to this prospectus or any prospectus supplement is correct as of any time after its date.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You

Can Find More Information.”

The

Selling Shareholders are offering the Shares only in jurisdictions where such offer is permitted. The distribution of this prospectus

and the sale of the Shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the distribution of this prospectus and the

sale of the Shares outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to

sell, or a solicitation of an offer to buy, the Shares by any person in any jurisdiction in which it is unlawful for such person to make

such an offer or solicitation. If there is any inconsistency between the information in this prospectus and the applicable prospectus

supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus

and the applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find

More Information; Incorporation by Reference.”

We

have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this

prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as

of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations

and prospects may have changed since those dates.

When

we refer to “Ammo,” “we,” “our,” “us” and the “Company” in this prospectus,

we mean Ammo, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

SPECIAL

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. These forward-looking statements contain information about our expectations, beliefs

or intentions regarding our product development and commercialization efforts, business, financial condition, results of operations,

strategies or prospects, and other similar matters. These forward-looking statements are based on management’s current expectations

and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult

to predict. These statements may be identified by words such as “expects,” “plans,” “projects,” “will,”

“may,” “anticipates,” “believes,” “should,” “intends,” “estimates,”

and other words of similar meaning.

These

statements relate to future events or our future operational or financial performance, and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance or achievements to be materially different from any future results,

performance or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ

materially from current expectations include, among other things, those listed under the section titled “Risk Factors” and

elsewhere in this prospectus, in any related prospectus supplement and in any related free writing prospectus.

Any

forward-looking statement in this prospectus, in any related prospectus supplement and in any related free writing prospectus reflects

our current view with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our

business, results of operations, industry and future growth. Given these uncertainties, you should not place undue reliance on these

forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this prospectus, any related

prospectus supplement and any related free writing prospectus and the documents that we reference herein and therein and have filed as

exhibits hereto and thereto completely and with the understanding that our actual future results may be materially different from any

future results expressed or implied by these forward-looking statements. Except as required by law, we assume no obligation to update

or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This

prospectus, any related prospectus supplement and any related free writing prospectus also contain or may contain estimates, projections

and other information concerning our industry, our business and the markets for our products, including data regarding the estimated

size of those markets and their projected growth rates. Information that is based on estimates, forecasts, projections or similar methodologies

is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected

in this information. Unless otherwise expressly stated, we obtained these industry, business, market and other data from reports, research

surveys, studies and similar data prepared by third parties, industry and general publications, government data and similar sources.

In some cases, we do not expressly refer to the sources from which these data are derived.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus and in the documents

we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before

investing in our securities. To fully understand this offering and its consequences to you, you should read this entire prospectus carefully,

including the information referred to under the heading “Risk Factors” in this prospectus beginning on page 6, the financial

statements and other information incorporated by reference in this prospectus when making an investment decision. This is only a summary

and may not contain all the information that is important to you. You should carefully read this prospectus, including the information

incorporated by reference therein, and any other offering materials, together with the additional information described under the heading

“Where You Can Find More Information.”

THE

COMPANY

Our

Business

We

are a designer, producer, and marketer of performance-driven, high-quality ammunition and ammunition component products for sale to a

variety of consumers, including sport and recreational shooters, hunters, individuals seeking home or personal protection, manufacturers

and law enforcement and military agencies. We also own an online auction site supporting the lawful sale of firearms, ammunition and

hunting/shooting accessories. To enhance the strength of our brands and drive product demand, we emphasize product innovation and technology

to improve the performance, quality, and affordability of our products while providing support to our distribution channel and consumers.

We seek to sell products at competitive prices that compete with high-end, custom, hand-loaded ammunition at competitive prices. Additionally,

through our ammunition casing manufacturing and sales operations (“Jagemann Munition Components” or “JMC”) we

sell ammunition casings products of various types. We emphasize an American heritage by using predominantly American-made components

and raw materials in our products that are produced, inspected, and packaged at our facilities in Payson, Arizona and Manitowoc, Wisconsin.

Our

production processes focus on safety, consistency, precision, and cleanliness. Each round is developed for a specific purpose with a

focus on a proper mix of consistency, velocity, accuracy, and recoil. Each round is chamber gauged and inspected with redundant seven-step

quality control processes.

GunBroker.com

is our online auction site. In its role as our auction site, GunBroker.com serves as the listing service and provides for the exchange

of information in a secure manner supporting the third-party listing, sale and lawful purchase of firearms, ammunition and accessories

connecting over 6.6 million registered users.

Competition

The

ammunition and ammunition casing industry is dominated by a small number of companies, a number of which are divisions of large public

companies. We compete primarily on the quality, reliability, features, performance, brand awareness, and price of our products. Our primary

competitors include Federal Premium Ammunition, Remington Arms, the Winchester Ammunition division of Olin Corporation, and various smaller

manufacturers and suppliers, including Black-Hills Ammunition, CBC Group, Fiocchi Ammunition, Hornady Manufacturing Company, PMC, Rio

Ammunition, and Wolf.

Our

Growth Strategy

Our

goal is to enhance our position as a designer, producer, and marketer of ammunition products via our manufacturing and related sales

operations, while simultaneously enhancing the GunBroker.com brand and leverage the information technologies platform to develop additional

complimentary sales channels. Key elements of our strategy to achieve this goal are as follows:

Design,

Produce, and Market Innovative, Distinctive, Performance-Driven, High-Quality Ammunition and Ammunition Components

We

are focused on designing, producing, and marketing innovative, distinctive, performance-driven, high-quality products that appeal to

retailers, manufacturers, and consumers that will enhance our users’ shooting experiences. Our ongoing research and development

activities; our safe, consistent, precision, and clean production processes; and our multi-faceted marketing programs are critical to

our success.

Continue

to Strengthen Relationships with Channel Partners and Retailers

We

continue to strive to strengthen our relationships with our current distributors, dealers, manufactures, and mass market and specialty

retailers and to attract additional distributors, dealers, retailers, and manufacturers. The success of our efforts depends on the innovation,

distinctive features, quality, and performance of our products; the attractiveness of our packaging; the effectiveness of our marketing

and merchandising programs; and the effectiveness of our customer support.

Emphasis

on Customer Satisfaction and Loyalty

We

plan to continue to emphasize customer satisfaction and loyalty by offering innovative, distinctive, high-quality products on a timely

and cost-attractive basis and by offering effective customer service. We regard the features, quality, and performance of our products

as the most important components of our customer satisfaction and loyalty efforts, but we also rely on customer service and support.

Continuously

Improving Operations

We

plan to continue to emphasize customer satisfaction and loyalty by offering innovative, distinctive, high-quality products on a timely

and cost- attractive basis and by offering effective customer service, training, and support. We regard the features, quality, and performance

of our products as the most important components of our customer satisfaction and loyalty efforts, but we also rely on customer service

and support.

Enhance

Market Share, Brand Recognition, and Customer Loyalty

We

strive to enhance our market share, brand recognition, and customer loyalty. Industry sources estimate that 70 to 80 million people in

the United States own more than approximately 393 million firearms creating a large installed base for our ammunition products. We are

focusing on the premium segment of the market through the quality, distinctiveness, and performance of our products; the effectiveness

of our marketing and merchandising efforts; and the attractiveness of our competitive pricing strategies.

Pursue

Synergetic Strategic Acquisitions and Relationships

We

intend to pursue strategic acquisitions and develop strategic relationships designed to enable us to expand our technology and knowhow,

expand our product offerings, strengthen and expand our supply chain, enhance our production process, expand our marketing and distribution,

and attract new customers.

Our

Offices

We

maintain our principal executive offices at 7681 East Gray Road, Scottsdale, Arizona 85260. Our telephone number is (480) 947-0001. Our

website is www.ammoinc.com. The information contained on our website as that can be assessed through our website does not constitute

part of this prospectus.

Recent

Developments

On

March 16, 2021, we announced the closing of an underwritten public offering of 23 million newly-issued shares of Common Stock at a price

to the public of $5.00 per share. The closing included the full exercise of the underwriters’ over-allotment option to purchase

3 million shares of Common Stock at the public offering price, for gross proceeds to the Company of $115 million, prior to deducting

offering expenses, commissions and underwriting discounts.

On

May 21, 2021, we closed an underwritten public offering of 1,097,200 newly issued shares of our 8.75% Series A Cumulative Redeemable

Perpetual Preferred Stock (the “Series A Preferred Stock”) at a price to the public of $25.00 per share. The offering resulted

in gross proceeds to the Company of $27,430,000, prior to deducting offering expenses, commissions and underwriting discounts. On May

25, 2021, the underwriter exercised its previously announced over-allotment option to purchase 164,580 shares of Series A Preferred Stock

pursuant to that certain Underwriting Agreement dated May 19, 2021, by and between us and Alexander Capital, L.P., as representative

of the several underwriters identified therein. We closed the exercise of the over-allotment on May 27, 2021. The gross proceeds from

the exercise of the over-allotment option were $4,114,500, before deducting underwriting discounts and commissions.

On

May 25, 2021, we entered into an underwriting agreement with Alexander Capital, L.P. relating to a firm commitment public offering of

138,220 newly issued shares of our Series A Preferred Stock at a public offering price of $25.00 per share. The closing of the offering

took place on May 27, 2021. The gross proceeds to use from the sale of 138,220 shares of Series A Preferred Stock, before deducting underwriting

discounts and commissions and estimated offering expenses payable by us, were $3,455,500. The total net proceeds from the two Series

A Preferred Stock offerings in May 2021 was $32,940,000.

Acquisitions

On

April 30, 2021 (the “Effective Date”), the Company entered into an agreement and plan of merger (the “Merger Agreement”),

by and among the Company, SpeedLight Group I, LLC, a Delaware limited liability company and a wholly owned subsidiary of the Company

(“Sub”), Gemini Direct Investments, LLC, a Nevada limited liability company (“Gemini”), and Steven F. Urvan,

an individual (the “Seller”), whereby Sub merged with and into Gemini, with Sub surviving the merger as a wholly owned subsidiary

of the Company (the “Merger”). At the time of the Merger, Gemini had nine (9) subsidiaries, all of which are related to Genimi’s

ownership of the gunbroker.com business. Gunbroker.com is a large on-line auction marketplace dedicated to firearms, hunting, shooting

and related products. The Merger was completed on the Effective Date.

In

consideration of the Merger, on the terms and subject to the conditions set forth in the Merger Agreement, on the Effective Date, (i)

the company assumed an aggregate amount of indebtedness of Gemini and its subsidiaries equal to $50,000,000 (the “Assumed Indebtedness”)

and (ii) the issued and outstanding membership interests in Gemini (the “Membership Interests”), held by the Seller, automatically

converted into the right to receive (A) $50,000,000 (the “Cash Consideration”) and (B) 20,000,000 shares of the Company’s

common stock (the “Stock Consideration”).

In

connection with the Merger Agreement, the Company and the Seller agreed that the Stock Consideration consisted of: (a) 14,500,000 shares

issued without being held in escrow or requiring prior stockholder approval, (b) 4,000,000 shares issued subject to that certain Pledge

and Escrow Agreement entered into pursuant to the Merger Agreement (the “Pledged Securities”), and (c) 1,500,000 shares

that will not be issued prior to the Company obtaining stockholder approval for the issuance (the “Additional Issuance”).

On

the Effective Date, in connection with the Merger Agreement, the company and the Seller entered into a Lock-Up Agreement, pursuant to

which the Pledged Securities shall not be sold or transferred by the Seller without the prior written consent of the Company until the

Pledged Securities are released pursuant to the terms of the Pledge and Escrow Agreement.

On

the Effective Date, in connection with the Merger Agreement, the Company and the Seller entered into a Voting Rights Agreement (the “Voting

Rights Agreement”), whereby for a period of six months following the Effective Date, the Seller: (i) agreed to vote in favor of

approving the implementation of a staggered board of directors at the next annual meeting of the Company; (ii) will not vote any securities

in favor of, or consent to, and will vote his 18.5 million shares of the Company’s common stock to which he has voting rights,

to vote against and not consent to, the approval of a proxy fight either individually or as part of a group for Schedule 13D or 13G purposes

that would result in one-third of the current officers and one-third of the current directors being replaced; and (iii) appointed the

Company as his attorney-in-fact and proxy with full power of substitution, for and in his name, to vote in the manner contemplated by

the Voting Rights Agreement.

On

the Effective Date, in connection with the Merger Agreement, the Company and the Seller entered into a Standstill Agreement (the “Standstill

Agreement”), whereby during the period beginning on the Effective Date and ending on the one (1) year anniversary of the Effective

Date (the “Standstill Period”), the Seller will not, among other things, make, effect, initiate, cause or participate in

(i) any acquisition of any securities of the Company or any securities of any subsidiary or other affiliate or associate of the Company

if such acquisition would result in the Seller and his affiliates and associates collectively beneficially owning twenty-five percent

(25%) or more of the then issued and outstanding shares of common stock of the Company, (ii) any Company Acquisition Transaction (as

this term is defined in the Standstill Agreement), or (iii) any “solicitation” of “proxies” (as those terms are

defined in Rule 14a-1 of the General Rules and Regulations under the Exchange Act) or consents with respect to any securities of the

Company.

On

the Effective Date, in connection with the Merger Agreement, the Company and the Seller entered into an Investor Rights Agreement (the

“Investor Rights Agreement”). The Investor Rights Agreement requires the Company to use its commercially reasonable efforts

to register 10 million shares of the Stock Consideration for resale on a registration statement to be filed with the Securities and Exchange

Commission (the “SEC”), under the Securities Act of 1933, as amended (the “Securities Act”), within ninety (90)

days following the Effective Date. The Company also agreed in the Investor Rights Agreement to provide the Seller with demand registration

rights in connection with the other shares received by the Seller as part of the Stock Consideration, including the Pledged Securities

(to the extent released and delivered to the Seller in accordance with the terms of the Merger Agreement) and the Additional Securities

(if issued in accordance with the terms of the Merger Agreement).

Appointment

of New Director and Officer

On

April 30, 2021, in connection with the closing of the Merger, Steven F. Urvan was appointed to the Company’s Board of Directors

and elected to serve as the Company’s Chief Strategy Officer.

THE

OFFERING

|

Issuer

|

|

Ammo,

Inc.

|

|

|

|

|

|

Shares

of Common Stock offered by us

|

|

None

|

|

|

|

|

|

Shares

of Common Stock offered by the Selling Shareholders

|

|

13,728,241

Shares (1)

|

|

|

|

|

|

Shares

of Common Stock outstanding before the Offering

|

|

113,132,110

shares (2)

|

|

|

|

|

|

Shares

of Common Stock outstanding after completion of this offering, assuming the sale of all shares offered hereby

|

|

114,469,940

shares

|

|

|

|

|

|

Use

of proceeds

|

|

We

will not receive any proceeds from the resale of the Shares by the Selling Shareholders. All proceeds from the sale of our common

stock pursuant to this prospectus will be for ethe accounts of the Selling Shareholders. We cannot precisely estimate the allocation

of the net proceeds from any exercise of the warrants for cash. Accordingly, in the event the Warrants are exercised for cash, our

management will have broad discretion in the application of the net proceeds of such exercises, which is anticipated to be for general

corporate purposes.

|

|

|

|

|

|

Market

for Common Stock

|

|

Our

Common Stock is listed on The Nasdaq Capital Market under the symbol “POWW.”

|

|

|

|

|

|

Risk

Factors

|

|

Investing

in our securities involves a high degree of risk. See the “Risk Factors” section of this prospectus on page 6 and in

the documents we incorporate by reference in this prospectus for a discussion of factors you should consider carefully before deciding

to invest in our securities.

|

|

(1)

|

This

amount consists of: (i) 10,000,000 shares of Common Stock issued to one (1) Selling Shareholder pursuant to the Merger Agreement

dated as of April 30, 2021; (ii) 1,228,000 shares of Common Stock issued to thirty-six (36) selling Shareholders pursuant to those

certain Subscription Agreements entered into in connection with a 2017 friends and family financing; (iii) 408,411 shares of Common

Stock issued to five (5) Selling Shareholders pursuant to the Company’s Registration Statement on filed with the SEC on February

17, 2021; (iv) 500,000 shares of Common Stock issued to one (1) Selling Shareholder pursuant to a Services Agreement between the

Company and Trending Equities Corp., dated as of May 16, 2021; (v) 250,000 shares of Common Stock issued to one (1) Selling Shareholder

pursuant to a Consulting Agreement between the Company and White Bear Group LLC, dated as of May 1, 2021; (vi) 162,830 shares

of Common Stock underlying warrants issued to two (2) Selling Shareholders pursuant to the Company’s Registration Statement

on Form S-3 filed with the SEC on February 17, 2021 (the “February 2021 Warrants”); and (vii) 1,175,000 shares

of Common Stock underlying warrants issued to one (1) Selling Shareholder pursuant to a Soliciting Agent Agreement between the Company

and Paulson Investment Company, LLC, dated as of December 21, 2020 (the “December 2020 Warrants,” and together with the

February 2021 Warrants, the “Warrants”).

|

|

|

|

|

(2)

|

The

number of shares of Common Stock outstanding before and after the Offering is based on 112,382,110 shares outstanding as of July

23, 2021 and excludes the following:

|

|

|

●

|

3,350,676

shares of Common Stock issuable upon the exercise of outstanding warrants having a weighted average exercise price of $2.32 per share;

and

|

|

|

|

|

|

|

●

|

3,311,920

shares of Common Stock reserved for future issuance under the Company’s Ammo, Inc. 2017 Equity Incentive Plan, as amended.

|

RISK

FACTORS

Investment

in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider

the risk factors incorporated by reference to our Registration Statement on Form S-3, filed with the SEC on February 17, 2021, as amended,

our most recent Annual Report on Form 10-K for the fiscal year ended March 31, 2021 filed with the SEC on June 29, 2021 and any subsequent

Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained

or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors

and other information contained in the applicable prospectus supplement before acquiring any of such securities. The occurrence of any

of these risks might cause you to lose all or part of your investment in the offered securities.

Risks

Relating to the Offering

You

may lose all of your investment.

Investing

in our Common Stock involves a high degree of risk. As an investor, you might never recoup all, or even part of, your investment and

you may never realize any return on your investment. You must be prepared to lose all your investment.

The

market price of our Common Stock may be highly volatile, you may not be able to resell your shares at or above the public offering price

and you could lose all or part of your investment.

The

trading price of our Common Stock may be volatile. Our stock price could be subject to wide fluctuations in response to a variety of

factors, including the following:

|

|

●

|

actual

or anticipated fluctuations in our revenue and other operating results;

|

|

|

|

|

|

|

●

|

actions

of securities analysts who initiate or maintain coverage of us, changes in financial estimates by any securities analysts who follow

our company, or our failure to meet these estimates or the expectations of investors;

|

|

|

|

|

|

|

●

|

issuance

of our equity or debt securities, or disclosure or announcements relating thereto;

|

|

|

|

|

|

|

●

|

the

lack of a meaningful, consistent and liquid trading market for our Common Stock;

|

|

|

|

|

|

|

●

|

additional

shares of our Common Stock being sold into the market by us or our stockholders or the anticipation of such sales;

|

|

|

|

|

|

|

●

|

announcements

by us or our competitors of significant events or features, technical innovations, acquisitions,

strategic

partnerships, joint ventures or capital commitments;

|

|

|

|

|

|

|

●

|

changes

in operating performance and stock market valuations of companies in our industry;

|

|

|

|

|

|

|

●

|

price

and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole;

|

|

|

|

|

|

|

●

|

lawsuits

threatened or filed against us;

|

|

|

|

|

|

|

●

|

regulatory

developments in the United States and foreign countries; and

|

|

|

●

|

other

events or factors, including those resulting from the impact of COVID-19 pandemic, war or incidents of terrorism, or

responses to these events.

|

In

addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate

to the operating performance of these companies. Broad market and industry factors may negatively affect the market price of our Common

Stock, regardless of our actual operating performance.

We

do not intend to pay dividends on our Common Stock so any returns will be limited to the value of our stock.

We

have never declared or paid any cash dividend on our Common Stock. We currently anticipate that we will retain future earnings for the

development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends for the foreseeable

future. Additionally, any credit and security agreement that we may enter into in the future will likely contain covenants that will

restrict our ability to pay dividends. Any return to stockholders will therefore be limited to the appreciation of their stock.

Sales

of a substantial number of shares of our Common Stock in the public market by certain of our stockholders could cause our stock price

to fall.

Sales

of a substantial number of shares of our Common Stock in the public market or the perception that these sales might occur, could depress

the market price of our Common Stock and could impair our ability to raise capital through the sale of additional equity securities.

We are unable to predict the effect that sales may have on the prevailing market price of our Common Stock.

An

active trading market for our Common Stock may not be maintained.

Our

Common Stock is currently traded on The Nasdaq Capital Market, but we can provide no assurance that we will be able to maintain an active

trading market on this or any other exchange in the future. If an active market for our Common Stock is not maintained, it may be difficult

for our stockholders to sell or purchase shares. An inactive market may also impair our ability to raise capital to continue to fund

operations by selling shares and impair our ability to acquire other companies or technologies using our shares as consideration.

USE

OF PROCEEDS

All

proceeds from the resale of the Shares offered by this prospectus will belong to the Selling Shareholders. We will not receive any proceeds

from the resale of the Shares by the Selling Shareholders.

We

will receive proceeds from any cash exercise of the Warrants. If all such Warrants are fully exercised on a cash basis, we will receive

gross cash proceeds of approximately $2,618,669. We expect to use the proceeds from the exercise of such Warrants, if any, for general

corporate purposes. General corporate purposes may include providing working capital, funding capital expenditures, or paying for acquisitions.

We currently do not have any arrangements or agreements for any acquisitions. We cannot precisely estimate the allocation of the net

proceeds from any exercise of the warrants for cash. Accordingly, in the event the Warrants are exercised for cash, our management will

have broad discretion in the application of the net proceeds of such exercises. There is no assurance that the January Warrants will

ever be exercised for cash.

SELLING

STOCKHOLDERS

This prospectus relates to the resale, from time

to time, of up to 13,728,241 shares (the “Shares”) of our common stock, par value $0.001 per share (“Common

Stock”), by the Selling Shareholders identified in this prospectus under “Selling Shareholders” (the “Offering”).

This amount consists of: (i) 10,000,000 shares of Common Stock issued to one (1) Selling Shareholder pursuant to the Merger Agreement

dated as of April 30, 2021; (ii) 1,228,000 shares of Common Stock issued to thirty-six (36) selling Shareholders pursuant to those certain

Subscription Agreements entered into in connection with a 2017 friends and family financing; (iii) 408,411 shares of Common Stock issued

to five (5) Selling Shareholders pursuant to the Company’s Registration Statement on filed with the SEC on February 17, 2021; (iv)

500,000 shares of Common Stock issued to one (1) Selling Shareholder pursuant to a Services Agreement between the Company and Trending

Equities Corp., dated as of May 16, 2021; (v) 250,000 shares of Common Stock issued to one (1) Selling Shareholder pursuant to a Consulting

Agreement between the Company and White Bear Group LLC, dated as of May 1, 2021; (vi) 162,830 shares of Common Stock underlying warrants

issued to two (2) Selling Shareholders pursuant to the Company’s Registration Statement on Form S-3 filed with the SEC on February

17, 2021 (the “February 2021 Warrants”); and (vii) 1,175,000 shares of Common Stock underlying warrants issued to

one (1) Selling Shareholder pursuant to a Soliciting Agent Agreement between the Company and Paulson Investment Company, LLC, dated as

of December 21, 2020 (the “December 2020 Warrants,” and together with the February 2021 Warrants, the “Warrants”).

All

expenses incurred with respect to the registration of the Common Stock will be borne by us, but we will not be obligated to pay any underwriting

fees, discounts, commission or other expenses incurred by the Selling Shareholders in connection with the sale of such shares.

Except

for Steven F. Urvan, who is currently serving as our Chief Strategy Officer and is a member of the Company’s Board of Directors,

neither the Selling Shareholders nor any of their associates or affiliates has held any position, office, or other material relationship

with us in the past three years.

The

following table sets forth the names of the Selling Shareholders, the number of shares of Common Stock beneficially owned by the Selling

Shareholders as of the date hereof and the number of shares of Common Stock being offered by the Selling Shareholders. The shares being

offered hereby are being registered to permit public secondary trading, and the Selling Shareholders may offer all or part of the shares

for resale from time to time. However, the Selling Shareholders are under no obligation to sell all or any portion of such shares. All

information with respect to share ownership has been furnished by the Selling Shareholders. The “Number of Shares Beneficially

Owned After the Offering” column assumes the sale of all shares offered.

The

common stock being offered by the Selling Shareholders are those owned by the Selling Shareholders and those issuable to the Selling

Shareholders, upon exercise of the Warrants. We are registering the shares of common stock in order to permit the Selling Shareholders

to offer these shares for resale from time to time. Except for the investment in the shares of Common Stock the Selling Shareholders

other than Mr. Urvan have not had any material relationship with us within the past three years.

The

table below lists the Selling Shareholders and other information regarding the beneficial ownership of the shares of Common Stock by

each of the Selling Shareholders. The second column lists the number of shares of Common Stock beneficially owned by each Selling Shareholder,

based on its ownership of the shares of Common Stock and warrants, as of the date hereof. The third column lists the shares of Common

Stock being offered by this prospectus by the Selling Shareholders. The fourth column lists the number of shares of Common Stock underlying

the Warrants to be sold pursuant to this prospectus and the fifth column lists the number of shares of Common Stock owned by each Selling

Shareholder after the offering pursuant to this prospectus, assuming the sale of all shares of Common Stock offered hereby.

|

Name of Selling Shareholder

|

|

Number of

Shares of

Common

Stock Owned

Prior to

Offering

|

|

|

% of

Shares

of

Common

Stock

Owned

Prior to

Offering

|

|

Maximum

Number

of shares

of

Common

Stock to

be Sold

Pursuant

to this

Prospectus

|

|

|

Maximum

Number of

shares of

Common

Stock

underlying

Warrants to

be Sold

Pursuant

to this

Prospectus

|

|

|

Number

of

shares of

Common

Stock

Owned

After the

Offering

|

|

|

Steven F. Urvan

|

|

|

18,500,000

|

(1)

|

|

|

|

|

10,000,000

|

|

|

|

|

|

|

|

8,500,000

|

|

|

Mill City Ventures III LTD

|

|

|

140,000

|

|

|

*

|

|

|

140,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Brandon Glickstein and Charles K Bortz

|

|

|

42,858

|

|

|

*

|

|

|

42,858

|

|

|

|

-

|

|

|

|

-

|

|

|

Ron Wiley

|

|

|

20,000

|

|

|

*

|

|

|

20,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Evan Williams

|

|

|

57,140

|

|

|

*

|

|

|

57,140

|

|

|

|

-

|

|

|

|

-

|

|

|

Pinnacle Family Office Investment L.P.

|

|

|

148,413

|

|

|

*

|

|

|

148,413

|

|

|

|

-

|

|

|

|

-

|

|

|

Richard W. Baskerville Lvg Trust

|

|

|

-

|

|

|

*

|

|

|

-

|

|

|

|

103,306

|

|

|

|

-

|

|

|

Porter Partners, L.P.

|

|

|

-

|

|

|

*

|

|

|

-

|

|

|

|

59,524

|

|

|

|

-

|

|

|

James L. Adams

|

|

|

16,000

|

|

|

*

|

|

|

16,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Adam Bloom

|

|

|

5,000

|

|

|

*

|

|

|

5,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Robert Cerrito

|

|

|

30,000

|

|

|

*

|

|

|

30,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Maninder Chatha

|

|

|

20,000

|

|

|

*

|

|

|

20,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Anthony Robert D’Amico

|

|

|

11,000

|

|

|

*

|

|

|

11,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Jimmie D Dixon Jr

|

|

|

100,000

|

|

|

*

|

|

|

100,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Michael Jackson Follmer

|

|

|

2,000

|

|

|

*

|

|

|

2,000

|

|

|

|

-

|

|

|

|

-

|

|

|

William L or Kathryn L Hallas

|

|

|

1,000

|

|

|

*

|

|

|

1,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Roy L Hill

|

|

|

165,000

|

|

|

*

|

|

|

165,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Kastner Family Trust

|

|

|

3,000

|

|

|

*

|

|

|

3,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Ryan Kaulback

|

|

|

2,000

|

|

|

*

|

|

|

2,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Paul Ray King

|

|

|

4,400

|

|

|

*

|

|

|

4,400

|

|

|

|

-

|

|

|

|

-

|

|

|

Taylor Kuehl

|

|

|

800

|

|

|

*

|

|

|

800

|

|

|

|

-

|

|

|

|

-

|

|

|

Austin Kuehl

|

|

|

800

|

|

|

*

|

|

|

800

|

|

|

|

-

|

|

|

|

-

|

|

|

Louis Laskis Irrevocable Trust

|

|

|

215,000

|

|

|

*

|

|

|

215,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Michael A Lechter & Sharon L Lechter Jtten

|

|

|

40,000

|

|

|

*

|

|

|

40,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Michael and Sharon Lechter Revocable Trust

|

|

|

40,000

|

|

|

*

|

|

|

40,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Emily Friel Lopez

|

|

|

2,000

|

|

|

*

|

|

|

2,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Randy Luth

|

|

|

40,000

|

|

|

*

|

|

|

40,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Randy E Luth Revocable Trust

|

|

|

175,000

|

|

|

*

|

|

|

175,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Sherilyn J. Madden

|

|

|

8,000

|

|

|

*

|

|

|

8,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Michael Austin Martin

|

|

|

80,000

|

|

|

*

|

|

|

80,000

|

|

|

|

-

|

|

|

|

-

|

|

|

William Murphy

|

|

|

60,000

|

|

|

*

|

|

|

60,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Joseph Pennella

|

|

|

20,000

|

|

|

*

|

|

|

20,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Louis Piccerillo

|

|

|

30,000

|

|

|

*

|

|

|

30,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Phillip and Kristen Risk

|

|

|

11,000

|

|

|

*

|

|

|

11,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Philip and Nancy Rosenblatt

|

|

|

40,000

|

|

|

*

|

|

|

40,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Frank and Marilyn Santorelli

|

|

|

32,000

|

|

|

*

|

|

|

32,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Arthur F Smith and Cheryl D Smith

|

|

|

10,000

|

|

|

*

|

|

|

10,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Barry Stowe

|

|

|

2,000

|

|

|

*

|

|

|

2,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Brittany Van Horn

|

|

|

4,000

|

|

|

*

|

|

|

4,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Douglas F Walton

|

|

|

20,000

|

|

|

*

|

|

|

20,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Ralph L Westberg Revocable Trust

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Michael Wormell

|

|

|

8,000

|

|

|

*

|

|

|

8,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Lawrence Wormell

|

|

|

5,000

|

|

|

*

|

|

|

5,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Shawn Patrick Zelek

|

|

|

4,000

|

|

|

*

|

|

|

4,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Eugene Webb

|

|

|

-

|

|

|

*

|

|

|

-

|

|

|

|

1,175,000

|

|

|

|

-

|

|

|

Trending Equities

|

|

|

500,000

|

|

|

*

|

|

|

500,000

|

|

|

|

-

|

|

|

|

-

|

|

|

White Bear Group LLC

|

|

|

250,000

|

|

|

*

|

|

|

250,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

|

20,890,411

|

|

|

|

|

|

12,390,411

|

|

|

|

1,337,830

|

|

|

|

8,500,000

|

|

(1)

The shares beneficially owned by Mr. Urvan include 14,000,000 shares issued at the closing of the Merger not subject to pledge restriction

and 4,500,000 shares (the “Pledged Securities”) subject to a Pledge and Escrow Agreement entered into in connection with

the Merger (the “Pledge Agreement”) in order to secure the fulfilment of Mr. Urvan’s indemnification obligations set

forth in the Merger Agreement. Pursuant to the Pledge Agreement, Mr. Urvan agreed to irrevocably pledge and grant the Company a continuing

lien and security interest in and to the Pledged Securities. Mr. Urvan retained his voting rights with regard to the Pledged Securities.

*

Less than 1%

PLAN

OF DISTRIBUTION

The

Selling Shareholders may, from time to time, sell, transfer, or otherwise dispose of any or all of their shares of common stock on any

stock exchange, market, or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed

prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined

at the time of sale, or at negotiated prices. The Seller Shareholders may use any one or more of the following methods when disposing

of shares:

|

|

●

|

on

any national securities exchange or quotation service on which the shares may be listed or quoted at the time of sale;

|

|

|

|

|

|

|

●

|

in

the over-the-counter market;

|

|

|

|

|

|

|

●

|

in

transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

|

|

|

|

●

|

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

|

|

|

|

●

|

block

trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as

principal to facilitate the transaction;

|

|

|

|

|

|

|

●

|

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

|

|

|

|

●

|

an

exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

|

|

●

|

privately

negotiated transactions;

|

|

|

|

|

|

|

●

|

short

sales;

|

|

|

|

|

|

|

●

|

through

the listing or settlement of options or other hedging transactions, whether such options are listed on an options exchange or otherwise;

|

|

|

|

|

|

|

●

|

broker-dealers

may agree with the Selling Shareholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

|

|

|

|

●

|

a

combination of any such methods of sale; and

|

|

|

|

|

|

|

●

|

any

other method permitted pursuant to applicable law.

|

The

Selling Shareholders may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

If

the Selling Shareholders effect such transactions by selling shares of Common Stock to or through underwriters, broker-dealers or agents,

such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions, or commissions from the Seller

Stockholders or commissions from purchasers of the shares of Common Stock for whom they may act as agent or to whom they may sell as

principal (which discounts, concessions, or commissions as to particular underwriters, broker-dealers or agents may be in excess of those

customary in the types of transactions involved). In connection with sales of the shares of Common Stock or otherwise, the Selling Shareholders

may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the shares of Common Stock in the

course of hedging in positions they assume. The Selling Shareholders may also sell shares of Common Stock short and deliver shares of

Common Stock covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales.

The Selling Shareholders may also loan or pledge shares of Common Stock to broker-dealers that in turn may sell such shares.

The

Selling Shareholders may from time to time pledge or grant a security interest in some or all of the shares of Common Stock owned by

them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares

of Common Stock from time to time under this prospectus after we have filed a supplement to this prospectus under Rule 424(b)(3) or other

applicable provision of the Securities Act supplementing or amending the list of Selling Shareholders to include the pledgee, transferee

or other successors in interest as Selling Shareholders under this prospectus. The Selling Shareholders also may transfer or donate the

shares of Common Stock in other circumstances, in which case the transferees, donees, pledgees, or other successors in interest will

be the selling beneficial owners for purposes of this prospectus.

Under

the securities laws of some states, the shares of Common Stock may be sold in such states only through registered or licensed brokers

or dealers. In addition, in some states the shares of Common Stock may not be sold unless such shares have been registered or qualified

for sale in such state or an exemption from registration or qualification is available and is complied with.

There

can be no assurance that any Selling Shareholder will sell any or all of the shares of Common Stock registered pursuant to the registration

statement of which this prospectus forms a part.

The

Selling Shareholders and any other person participating in such distribution will be subject to applicable provisions of the Securities

Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, the anti-manipulation rules

of Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the Common Stock by the Selling Shareholders

and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares

of Common Stock to engage in market-making activities with respect to the shares of common stock.

In

addition, to the extent applicable we will make copies of this prospectus (as it may be supplemented or amended from time to time) available

to the Selling Shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Seller Stockholders

may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including

liabilities arising under the Securities Act.

We

are required to pay all expenses of the registration of the shares of Common Stock, including SEC filing fees and expenses of compliance

with state securities or “blue sky” laws; provided, however, that the Selling Shareholders will pay all underwriting discounts

and selling commissions, if any, and all fees and expenses of their respective legal counsel. We have agreed to indemnify the Selling

Shareholders against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration

of the shares offered by this prospectus. We may be indemnified by the Selling Shareholders against liabilities, including liabilities

under the Securities Act, and state security laws, that may arise from any written information furnished to us by the Selling Shareholders

specifically for use in this prospectus.

DESCRIPTION

OF CAPITAL STOCK

The

following description of our capital stock is not complete and may not contain all the information you should consider before investing

in our capital stock. This description is summarized from, and qualified in its entirety by reference to, our Certificate of Incorporation

and Bylaws, which have been publicly filed with the SEC. See “Where You Can Find More Information; Incorporation by Reference.”

Our

authorized capital stock consists of 200,000,000 shares of common stock, par value of $0.001 per share, and 10,000,000 shares of preferred

stock, par value of $0.001 per share. As of July 23, 2021, there were 112,382,110 shares of our Common Stock issued and

outstanding held by approximately 313 holders of record.

Common

Stock

Each

share of our common stock entitles its holder to one vote in the election of each director and on all other matters voted on generally

by our stockholders. No share of our common stock affords any cumulative voting rights. This means that the holders of a majority of

the voting power of the shares voting for the election of directors can elect all directors to be elected if they choose to do so.

Holders

of our common stock will be entitled to dividends in such amounts and at such times as our Board of Directors in its discretion may declare

out of funds legally available for the payment of dividends. We currently do not anticipate paying any cash dividends on the common stock

in the foreseeable future. Any future dividends will be paid at the discretion of our Board of Directors after taking into account various

factors, including:

|

|

●

|

general

business conditions;

|

|

|

|

|

|

|

●

|

industry

practice;

|

|

|

|

|

|

|

●

|

our

financial condition and performance;

|

|

|

|

|

|

|

●

|

our

future prospects;

|

|

|

|

|

|

|

●

|

our

cash needs and capital investment plans;

|

|

|

|

|

|

|

●

|

our

obligations to holders of any preferred stock we may issue;

|

|

|

|

|

|

|

●

|

income

tax consequences; and

|

|

|

|

|

|

|

●

|

the

restrictions Delaware and other applicable laws and our credit arrangements may impose, from time to time.

|

If

we liquidate or dissolve our business, the holders of our common stock will share ratably in all our assets that are available for distribution

to our stockholders after our creditors are paid in full and the holders of all series of our outstanding preferred stock, if any, receive

their liquidation preferences in full.

Our

common stock has no preemptive rights and is not convertible or redeemable or entitled to the benefits of any sinking or repurchase fund.

Preferred

Stock

The

Company has 10,000,000 authorized shares of preferred stock par value $0.001 per share. As of July 23, 2021, there were 1,400,000

shares of Series A Preferred Stock outstanding.

Our

Board has the authority, within the limitations and restrictions in our certificate of incorporation, to issue shares of preferred stock

in one or more series and to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, dividend rates,

conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences and the number of shares constituting

any series or the designation of any series, without further vote or action by the stockholders. The issuance of shares of preferred

stock may have the effect of delaying, deferring or preventing a change in our control without further action by the stockholders. The